If you haven’t heard of Zillow, consider yourself lucky. Once you log on for the first time you will inevitably spend countless hours on the site, browsing houses for no apparent reason. House fever will set in whether you own a house or not, and you will inevitably think about all the amazing homes you could see yourself moving into.

If you haven’t heard of Zillow, consider yourself lucky. Once you log on for the first time you will inevitably spend countless hours on the site, browsing houses for no apparent reason. House fever will set in whether you own a house or not, and you will inevitably think about all the amazing homes you could see yourself moving into.

Okay, that’s a bit extreme, and I love actually am a big fan of Zillow and think it’s a great site.

If you don’t already know, Zillow is a website that aggregates publicly available housing data such as when a home was sold, how much a home was sold for, statistics about the home such as square footage, and a lot more.

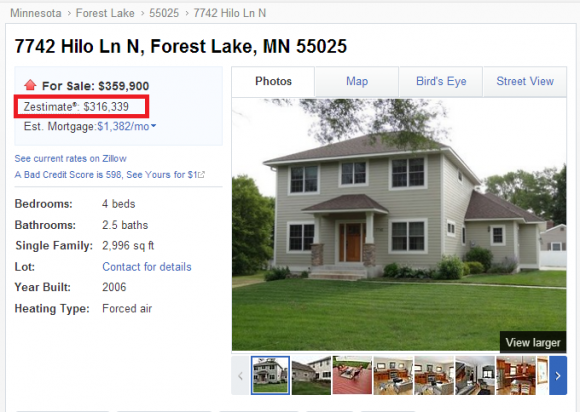

Zillow also has an interesting statistic that is called a zestimate. Zestimates are essentially Zillow’s estimate of how much a home is worth. Below is an example of where the Zestimate is located on a listing in Zillow:

While the algorithm used to quantify the Zestimate isn’t public information, it’s likely based on comparable home sales in the area. While this is a good way to get a general idea of what a home is worth, people will inevitably put a lot of weight into what Zillow deems a good estimate for a home’s worth. As expected, Zillow’s Zestimate comes with some shortcomings and can even be misleading.

Home Appraisal versus Zestimate

As you probably already know if you’ve gone through the home-buying process, when you are purchasing a home and are using a loan to finance the purchase, the bank wants to make sure that the home is worth at least as much as the loan amount. To illustrate the shortcomings of the Zestimate that Zillow presents you need to look no further than how homes are appraised.

Appraisers spend a significant amount of time evaluating a home. They take everything into consideration, from the age of the home, the location, how updated the home is (including the big things like the roof, siding, mechanicals, etc. Like Zillow’s Zestimate, they factor in comparable home sales in the area, and even point out the three or so homes they used as a baseline for comparison.

The major difference, though, is that an appraiser looks at more factors and is able to bring his own human judgement to the equation. Don’t get me wrong, big data is the way of the future, but you just don’t get that human judgement in Zillow’s algorithm.

Inaccuracies and fluctuations with Zillow

When I was in the market for a home, I always checked the Zestimate and was somewhat turned off when a home’s Zestimate was drastically lower than the list price. Ironically I ended up paying more than $30k what my home’s Zestimate was listed for.

In fact, my Dad became very concerned when I told him the address of the home I was about to put an offer on. He pointed out the low Zestimate of $160k. What he didn’t realize was that the square footage was off by about 800, the room count was off by one, and in general the listing had very few details and therefore the algorithm wasn’t factoring these details into the equation.

After closing on our current home, I made it a priority to update my Zillow listing to reflect the reality. A few weeks after making these updates, the home was much more in-line with what we had paid for it, and I was definitely happy to see this change.

If you are shopping for a home and see a low Zestimate, be sure to check out the details of the listing before writing off the home as being priced too high. There’s a chance the owner has no idea what Zillow is and the facts listed on Zillow may be inaccurate.

Some things Zillow’s algorithm can’t factor in

The biggest shortfall of the Zestimate, and the reason I believe it can be misleading is the fact that it has no way of factoring in how updated or debilitated a home is. For example, my neighbor has a home that is essentially a mirror image of our home. Let’s say they put $125,000 into a home renovation, making it extremely up-to-date with modern amenities and beautiful hardwood floors. Their Zestimate likely won’t change much, unless Zillow something they did can be factored into Zillow’s algorithm (i.e. changed carpet to hardwood floor).

Even if Zillow’s algorithm did somehow pick up on the changes to their home and the value they added through their renovation, it would disproportionately benefit my home. It still would factor in the square footage and number of beds/baths disproportionately.

Even if Zillow’s algorithm did somehow pick up on the changes to their home and the value they added through their renovation, it would disproportionately benefit my home. It still would factor in the square footage and number of beds/baths disproportionately.

I’m not blaming Zillow for this shortfall and I’m saying this more as a warning that you can’t just look at “comparable” homes and assume that they should all be in line. If you bought my neighbors fully updated home there truly is more value built into the home and therefore you have to use your own judgement as a buyer and assume that your appraiser factors in his human judgement into the equation when appraising the home.

The bottom line? Use the Zestimate as a guide, but not as bible.

Should you use Zillow?

Despite all the shortcomings that Zillow has, it’s still an incredible tool. If every homeowner reviewed their home listing from time-to-time and made sure everything was accurate, the Zillow would become an even more powerful tool than it already is.

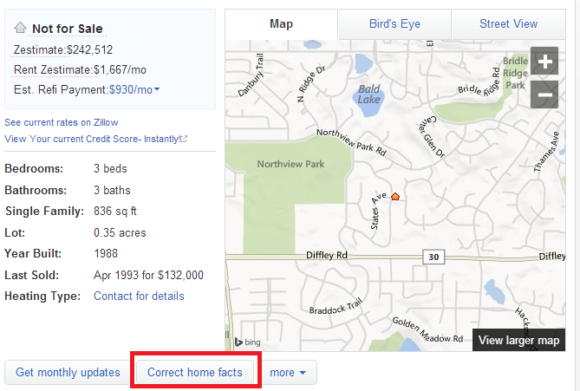

If you are a current homeowner and you don’t want potential buyers turned off by an inaccurate Zestimate, consider reviewing your home on Zillow. Zillow doesn’t have access to every piece of data on a home, so it’s up to you to go to the site and share data if you want it reflected in your home’s page and subsequently it’s Zestimate.

To add your own data to your home, click on the “Correct Home Facts” button on your listings page:

From there you have the option of sharing or correcting many facts about the home, from the square footage to the appliances included. Additionally, you can write up a description of the home (if your home is for sale this will be auto-populated with your realtor’s description of your home in the MLS), what you love about your home, as well as a neighborhood description.

______________________

Zillow has a lot going for it and fueled my real estate obsession. I like the fact that you can get a general idea of what homes are worth in a market by viewing what homes have been selling for and when the sales occurred. I think the visual interface is genius and makes for an enjoyable browsing experience.

Overall, I would recommend using Zillow but would use caution when it comes to the Zestimate.

Have you used Zillow before? Will you use it next time you buy a home? Would you recommend it? What are your thoughts on the Zestimate?

____________

Photo by Boa-Franc

Interesting stuff, DC! I didn’t know that you could work to change your Zillow estimate on your home either. Thanks for sharing some very interesting info!

Laurie TheFrugalFarmer Thanks Laurie, it sounds like you aren’t alone! I’m glad you enjoyed the post!

Very interesting DC. I spoke with a Zillow rep pretty in depth at FinCon and learned quite a bit that I did not know about what they do. I hadn’t known you could change your info, which I imagine could be very helpful given the right circumstance.

FrugalRules Dang it I did not know Zillow was at FinCon, I would have really loved to talk to a rep! I really like what they are doing despite what seems like a negative article (which I don’t think it truly is if you read it in it’s entirety). I actually also initially found out from a rep that you can provide additional details and whatnot.

Yeah I never really pay attention to Zillow. Some of the listings themselves are years old. And when it comes to pricing you are only going to get what someone is willing to pay no matter what. Great tips though! Did you decide not to get the theme changed?

YourDailyFin It’s true you are only getting what someone is willing to pay, but it would suck to have buyers influenced by the Zestimate if it wasn’t even accurate!

YourDailyFin Oh, and to answer your question I’d say the redesign is “pending.” It’s more on my end than theirs. I am doing some tweaking of the theme myself and seeing how that goes. I might use them for my second site I’m launching in early 2014 instead.

We’ve been house shopping and I use Zillow a lot to look up property taxes or room sizes….or additional pics! With that being said, their zestimate is often way off. I pretty much ignore that part!

Holly at ClubThrifty Ah yes the additional pics are great! It’s funny to look at the pics of our house when it was on the market (they aren’t on Zillow anymore thankfully), our house looks so different now.

We actually used Zillow to find our current home but with the understanding that the Zestimate was probably far lower than what we would actually be paying for the house.

myeverydaylifeblog Great way to approach it. I think in some cases it can be higher. You could easily argue ours is a bit higher than we’d realistically get if we listed it today.

Fantastic post, thanks for sharing your thoughts on this! I’ve always wondered how accurate Zillow was – especially when I looked at our home and saw the estimated value was WAY higher than I previously thought. I’ll have to look into submitting some more information to the site to get that Zestimate to be as accurate as possible, but it’s good to know that it at least is in the ballpark. Thanks again for sharing!

CSMillennial Once we upgraded our information the Zestimate was in-line with what we expected. Housing prices have increased a bit in our area this year so now I’d say the Zestimate is a bit higher than it should be. As long as the number is ballpark I think it’s useful.

What’s crazy is that during the housing crash the Zestimate listed my mine and my ex-husbands house for almost 30k more than what I thought it was worth. That is a lot when housing is so cheap in the area we live in. But I’ve been looking at it here recently on a couple of houses I had interest in and thought the Zestimate was super low. It’s kind of weird how that works out. I like Zillow but I don’t think their Zestimates are very accurate.

SingleMomIncome I think they do the best with the data they have, but unless homeowners are providing additional data points they sometimes have little to go off of. Like I said, the interior of a home isn’t really factored in (if you put in a brand new $40k kitchen it wouldn’t add value to Zillow’s Zestimate per se). I think my house is overvalued slightly right now with the Zestimate but that’s something I can live with ;)

I have never used it but I once saw a friend using it when he was searching for a home. I like seeing the price of homes so that when I get ready to buy one, I will have a small idea. And since you mentioned it, I am heading there to browse my area and see.

BorrowedCents Have fun looking around! It’s pretty addicting.

I love checking out Zillow as well, great source of information!

I’ve found Zillow to be pretty accurate in some areas, less accurate in others. For instance, at our last house that we just sold for $215,000, it listed the value as $275,000. Granted, we bought the house for that price at the height of the real estate bubble, but recent sales in our area for houses similar to ours were in the area of $190-220,000 or so. I think their system may have gotten confused because we live in a mixed development with townhomes, detached townhomes (ours) and regular single family homes with big lots. I think the single family home sales may have skewed things.

At a townhouse we sold a few years ago, the value seems to be right on. So i guess the moral of the story is to check out the values, but take them with a grain of salt.

moneymatters I think you’re right about the mixed development. It may be difficult to factor in the various real estate options in the area and treat them too similar in the algorithm.

I hope the Zestimate values continue to improve because it’s such a great way to track the worth of your home. In the end, though, it really is up to the buyer and how much they are willing to pay.

I’m not buying a home any time soon but I love “playing” on zillow. What is it about it that makes it so addictive? It’s like HGTV and Food Channel- so entertaining even though I’m not doing any of it!

brokeandbeau I watched HGTV for years before even considering buying a home. It’s pretty fun to see the possibilities and “dream” a bit about what you can do with a property down the road.

Alison Paoli from Zillow here. Based off of the names I am seeing on this thread, I may have met some of you at #FINCON12 in Denver. Thank you David for your article and your Zillow enthusiasm! Like you said, we absolutely recommend that people update their home facts for the most accurate Zestimate and I appreciate you doing so for your home.

One thing I’d like to address is the issue around updated/debilitated homes. While it is true that Zillow has no insight into a home and cannot tell if a home in great or poor shape, there is one way that we are able to get to this through data, the sales price.

For example, if on Jan. 1 two homes that we believe to be very similar (attributes, taxes, location) hit the market but sell via a traditional transaction (non-distressed sale) for very different prices, our models will then assume that the homes really are not the same and the algorithm will adjust accordingly (up or down) until the homes sell again. So, if home ‘A’ was in really bad shape, the sales price would reflect that and it would be used in our model for that particular home.

Have you checked out your Rent Zestimate yet? That is the estimated amount of rent we think a particular home can fetch if it were up for rent.

Cheers!

Alison

AlisonPaoli Hi Alison, I appreciate you stopping by! I was sad when I heard Zillow was represented at FinCon because I would have loved to chat with you. Next year?

Thanks for clearing up a few things. I have checked out the Rent Zestimate, but I think that might be for another post : ) Renting our current house is something we’ve considered and the Rent Zestimate seems like it could really help homeowner’s determine approximately how much they could bring in from renting their homes, or renting a home they plan on purchasing for the purpose of rental.

DC @ Young Adult Money AlisonPaoli I wasn’t able to make it this year because I am 7 months pregnant with twins but I did send my colleague Lauren. I hope to return next year. I am glad I was able to add some clarity.

The Rent Zestimate is is very helpful for folks in your situation. I became an accidental landlord two years ago after we could not sell our home and used the Rent Zestimate as a guide. If I recall correctly, we ended up getting about 5-10% more than the Rent Zestimate but that was likely because we were one of very few homes that allowed pets (dogs, not cats) and we charged “pet rent.”

AlisonPaoli Wow congrats! Our Wednesday staff writer is also pregnant with twins.

Gotta love pet rent. I hated that as a tenant but it makes a bit more sense now that I’m on the other side of the equation. I’ll be looking at the Rent Zestimate a bit closer the next couple months and probably will write a post on it.

DC @ Young Adult Money AlisonPaoli Thanks. It should be a wild ride. Pet rent made sense to us because pet ultimately wear down the house more than if it were just people (hardwood floor/carpet/lawn). We didn’t charge a lot but it will help when we have to replace the flooring. Also, now thinking of my home as an investment, it helped me get a better return!

I am addicted to Zillow and seeing how much things were bought for and what the Zestimate is. However, I prefer older homes and the value is almost always way off. Even with my home the value is way off. I think the Zestimates are most correct when it comes to newly built homes – or at least that is how it is in my area.

SenseofCents Hmm you might have a point with the older homes. Now that I think about it, there were definitely some older homes I looked at whose list price was a lot higher than the Zestimate. I doubt it ended up selling near the Zestimate.

I browse zillow frequently. I have the app on my phone which is great and pretty easy to use. Sometimes I find myself browsing houses that are out of my state when I’m bored.

MonaSez I’ve browsed houses in Hawaii for fun. Some really expensive real estate there!

I have used Zillow in the past and I use it to see where our house is at with regards to their estimate. I do know that they really only deal with comparable sales because they don’t have much info into what your house is like. I am sure some people use this as their information to make offers and they may get a harsh reality.

DebtRoundUp A realtor I was tweeting with is not a fan of Zillow because people have gotten stuck on the Zestimate too often and it’s caused problems closing a deal. It’s hard to not think about it, though, especially if you are paying significantly more than the Zestimate for a home.

I use Zillow quite a bit but I recently stopped using it to calculate my monthly Net Worth, since (like you say) my renovations aren’t captured in the Zestimate.

fipilgrim Yeah you can’t just use their number. Our house supposedly has increased by $30k+ in less than a year, but in reality we’d need to put probably 20k or so into the house to fetch that price in my opinion.

I’ve only use zillow for fun but I agree it’s a time suck. It’s like house hunters for me. I just love seeing what my money can get in other parts of the country. Then I cry in my sushi. :)

Beachbudget Haha! House Hunters is so ridiculous. I saw one in Branson Missouri where they bought a house for about $225k that would legitimately be in the $400-$600k range here, and Minnesota isn’t too expensive of a real estate market compared to you West Coasters.

I was practically “addicted” to zillow when we were looking for condos. I just checked our condo and the zestimate is dead on for our unit, but a little high for the other units in our building.

StudentDebtSurvivor It’s probably to your advantage that the other houses are a little high, at least you are the one benefiting from that higher Zestimate.

I’ve actually never really looked at Zillow. I’m not in the market to buy, though, so that’s probably why. Good information here! I don’t think I’d ever base an offer on a Zestimate. There are probably a lot of homeowners out there that haven’t updates their home’s information. I know my parents didn’t!

JourneytoSaving I didn’t look at Zillow until I was in the market to buy. I’d say almost NO homeowners have updated their homes information, but usually if it’s on the market most of the bigger categories are correct (i.e. square footage, number of bedrooms, etc.).

Zillow zestimates our properties pretty highly. I don’t thing they would ever sell for the prices listed there, but it is a good starting point for real estate searches. You can spend way too much time if you aren’t careful, though.

Eyesonthedollar My main problem with Zillow is that I start looking at houses in a similar price range and then next thing you know I’m looking at $1M+ properties just for fun :0

This is an interesting article as I usually check Zillow to see how much other homes are selling for in my neighborhood. I also did not know you can update your home information. I will be checking that out.

Practical Cents I definitely recommend updating your home’s information. It can’t hurt!

I have not checked out Zillow in a while. It was just too much of a time suck seeing all the different houses that I could maybe get involved with. As much as I like the idea of real estate, I don’t know if I’m commited to the area where I am at. I don’t really like the idea of being a cross country landlord.

Zillow Zestimates are notoriously inaccurate and when 17% are more than 25% incorrect that is a serious problem that causes misery and potential financial damage to 20 million homeowners who are in the category of 25% erroneous Zestimates. I am in that category and when raising the matter will Zillow I was told that under NO circumstances do they correct or delete Zestimates, and “thanks to the First Amendment they have the right to publish whatever valuation they want”. How arrogant is that? So lets forget the Zillow propaganda that Zestimates are a ‘starting point’ as they are an END point as far as Zillow is concerned. Frankly the sooner that Zillow is subjected to some form of Regulation the better for all homeowners as Zillow has demonstrated that they cannot be trusted to act in a fair minded way towards homeowners.

Surbiton99 In theory your house is worth whatever people are willing to pay for it, so I’m not sure where that statistic comes from? How can you measure how far off Zillow is? It can be more or less in line, but I could put $100k into renovating the interior of my house and Zillow’s Zestimate won’t budge an inch. I wouldn’t worry too much about potential buyer’s being scared away by your Zestimate, it’s pretty easy to explain why it’s above or below what it should be.

DC @ Young Adult Money The statistic that 17% of Zestimates are more than 25% incorrect was developed by Clarity Consulting and was put to Zillow CEO Spencer Rascoff in a Bloomberg interview who didn’t dispute it. Here is the link

http://www.bloomberg.com/video/zillow-sales-model-change-boosted-results-ceo-says-0qGTD~MvSvCjZ8dqUAFetA.html?cmpid=yhoo

Our Zestimate is inflated about $27k. That’s because we have some cosmetic issues — a badly weather eaten fence, which currently stops short of our masonry wall & a back porch that isn’t properly screened in — that can’t be factored in. We also have the house painted in a way that would probably be a detractor for some buyers. Zestimate is an I there sting way to ballpark things, but definitely take it witha grain of salt.