My wife and I are considering getting a couple of dogs once we move into our house in October. While we are excited about getting our pups, we recognize the need to review the financial implications of owning dogs. Because we don’t have a huge cash reserve (honestly, how many young adults do?) I have started to look into pet insurance to help us avoid getting an unexpected $1,000+ medical bill.

Here’s a list of various companies that offer pet insurance:

VPI Pet Insurance

VPI Pet insurance offers the following plans:

- Economical: Covers accidents and illnesses ($19-$27 month)

- Comprehensive: Covers accidents, illnesses, and hereditary issues ($25-$35 month)

- Emergency: Covers only emergencies (Dogs only: $10 month)

- Feline Select Plan: Covers 15 common conditions (Cats only: $11 month)

- Avian & Exotic Pet Plan (Estimate depends on animal)

I first heard of VPI Pet Insurance through my employer, who offer a 5% discount on plans. While I think they have good plans, I’m not sure the 5% discount alone would convince me to go with them. Be sure to check on their site if your employer also offers a discount, as it seems they have started to partner with more companies (2012 was the first year my company offered a discount through them).

Petplan Pet Insurance

Petplan doesn’t give a quoted range for each plan like VPI Pet Insurance, but it does have a fairly easy-to-use quote calculator. I ran the numbers for a three year old golden retriever and was given a range of $40.79 – $48.13 a month. Petplan offers full coverage of hereditary issues, which partly explains the higher estimated monthly costs.

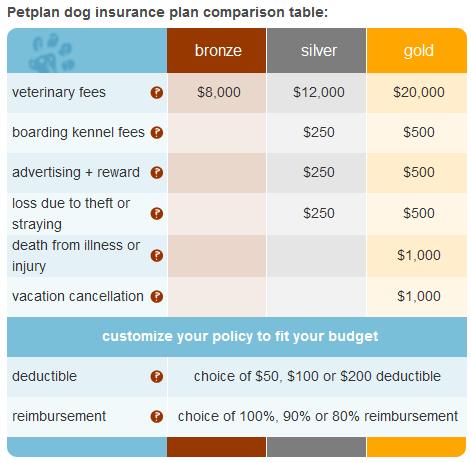

Here is their breakout of coverage for dogs:

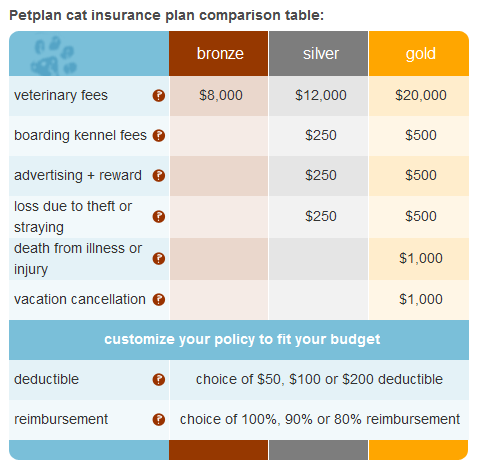

Here is their breakout of coverage for cats:

ASPCA Pet Insurance offers four levels of coverage:

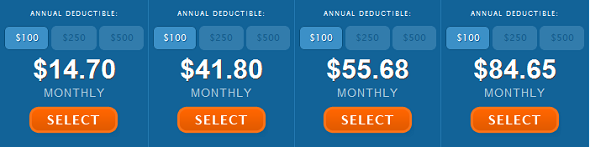

Like Petplan, ASPCA does not give a price range for each level of coverage. I ran a quote for a three year old Golden Retriever and were given the following prices:

As can be seen from running a few quotes from a few different sites, the cost of pet health insurance really depends on what you want covered. Obviously if you want the golden “all-inclusive” coverage, the cost of insurance is going to be much higher than an accidents-only plan.

The best thing to do when looking for pet health insurance is to take some time to compare the different plans and quotes before purchasing.

____________

Photo by TrainManDan

Very interesting~! I have never bought pet insurance before. My dog turns ten this month so I am probably too late on it with him!

@Holly at ClubThrifty Haha, well we have a TWENTY….yes, TWENTY year old cat. My wife has had her since she was three :0

This is something that I definitely need to do soon! My dog was just sick this past weekend.

@SenseofCents I think it just makes sense. I don’t have a huge cash reserve as it is, and even if I did I wouldn’t want something catastrophic to come along and have it drain my reserve. Glad to hear your dog is better, tho!

I have 2 dogs and aside from an illness my dog had when we got her that would have stuck the rescue with a good $3000 bill if I didn’t work at a veterinary hospital they haven’t cost me a dime illness or injury wise in the last 4 year. But I have prepared myself for it to happen by making an emergency fund specifically for them. I’m hoping to never have to use it but I prefer having the funds over purchasing pet insurance.

@Em23 Yeah that $3k bill is what I’m trying to insure against. It makes sense for some people to not have it, but I think unless you ALREADY have an emergency fund for your dog I think it makes sense to have the insurance, at least for a few years.

We’ve had dogs in the past, and we’ve never purchased pet insurance. My take is that you’re probably better off saving up a larger emergency fund, or a specific “pet emergency fund” in order to take care of any expenses that might pop up. In many cases the pet insurance can be relatively expensive for what you actually receive, and in the end sometimes you don’t actually get covered for everything you think you might be – it can be hard to collect on the insurance at times.

@moneymatters It sounds like you have looked into it before? I found these three companies to be a little more straightforward than the ones I left off. I understand your point that you might not know what is covered, but that comes with ANY insurance. I work in health insurance and honestly it’s just a little complex and most people don’t look into their full plan until something happens. I like the emergency fund idea but….I think you should insure UNTIL you have an emergency fund, since you’d be sitting with no reserve for a catastrophic event.

What a comprehensive overview! We’ve considered pet insurance in the past, but ended up going the route moneymatters alludes to – self-budgeting for an emergency fund and/or putting the amount we’d ordinarily pay for monthly pet insurance towards better preventive care (exercise, diet, etc.).

My dog has severe allergies and I bet they wouldn’t cover a lot of the treatments she’d need or the plan would be really expenses. We’re looking into potential allergy testing $200-$400 just for the test then anywhere from $100 a month in the beginning down to $25 a month toward the end for her allergy vaccine medicine…

@Money Life and More Well it’s called insurance for a reason haha. It’s to insure you against having high payments. The expensive plans essentially cover everything…

This hits home with me. I have two big dogs. When they we puppies, I opted for pet insurance through one of the plans you detailed. It ended up costing me $46 per dog, per month. Yes, $92/month. That equates to just over $1,100 per year. Needless to say, it was cancelled after the first year. I wasn’t spending anywhere near that amount at the vet’s office. And let’s not forget deductibles, co-pays and certain things that were NOT covered. Like others have already mentioned, I have set-up a “pet emergency fund” that I contribute to with each paycheck. I pray I’ll never have to use it, but it’s certainly better than paying nearly $100/month..

That’s smart to look into insurance options. Make sure the vet you use is a provider. Most of the vets where we live don’t take it, but we live in the boonies! Our dogs always do stupid things that probably wouldn’t be covered anyway.

@Eyesonthedollar Ah I see, yeah definitely would want to make sure the vets are “in-network” haha.

The Wife and I have a VPI plan which we are happy with. I pay about $50 a month but have a very good reimbursement rate (although I wonder if the reimbursement rate plus the monthly fee adds up lol).

The reason I bought it for the very simple fact that I do not want to be forced to decide on an emergency surgery or my bank account.