If you’ve tried budgeting in the past, you may have tried a popular app like Mint or You Need a Budget. You may even still use these apps.

If you’ve tried budgeting in the past, you may have tried a popular app like Mint or You Need a Budget. You may even still use these apps.

But budgeting apps aren’t for everyone. For some a spreadsheet is the best way to budget.

With a spreadsheet you have total control. You can move rows and columns around and add information easily.

With apps you have to work within their user interface. It can be frustrating to work with.

The biggest issue with budget spreadsheets is that you have to manually add all the information. Peter Polson, the founder of Tiller Money, saw this problem as an opportunity. Tiller Money adds automation to the budget spreadsheet process.

I’ll start this review of Tiller Money by talking about the automation that it brings to spreadsheets, which is the primary reason someone would use Tiller Money.

You can try Tiller Money out for free for 30 days using our link. After the 30-day trial, Tiller will bill you $6.58 per month to continue using their services. You can cancel at any time.

Tiller Money Makes Spreadsheet Budgeting Automated

I’ve used a budget spreadsheet for nearly a decade now, but it’s changed over time.

I used to sit down at the end of each month and drop credit card and bank data into a spreadsheet. Then I would go through the time-consuming work of editing all the data so it was uniform. This became a bit easier as I got used to how each of the credit card companies structured their data, but it still took about an hour a month.

Part of the reason it took me a while was because my wife and I both like to take advantage of credit card rewards. That means we were often signing up for new cards and moving our spend to different cards.

But even if you only use a couple credit cards and a bank account it can still take some time to pull all that monthly spend data together and get it set up in the same format.

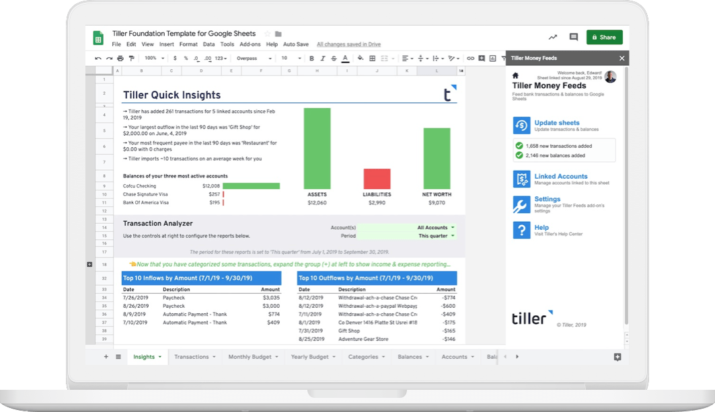

Tiller Money automates this step of the process. Tiller Money, using bank-grade security, allows you to link your accounts and have daily updates of all your transactions. Most importantly they put all this data in the exact same format and drop it in a spreadsheet. This was a big time-saver for me and something that didn’t exist prior to Tiller Money.

Tiller Money works out of Google Sheets, but they have a beta of an Excel add-in. I’ll talk about their budgeting template next, but first I want to share a little more about how I use Tiller.

I continued to use my budget spreadsheet in Excel and did not switch to Tiller Money’s Google Sheets budget template. Instead I copy and paste the transactions data into my Excel budget spreadsheet. I then have formulas that read off of that data, which in turn feeds into tabs for each month’s budget (i.e. January 2020, February 2020, etc.).

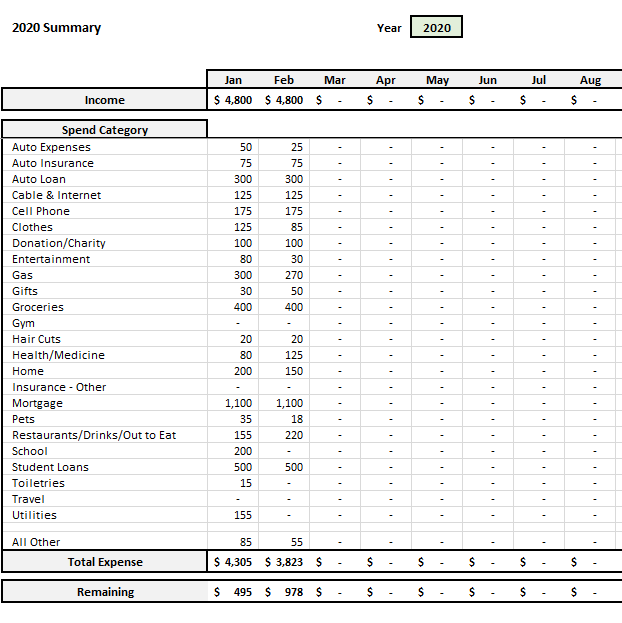

My favorite tab, though, is a tab that has a summary of income and expenses. It has the months across the top and the spend categories to the left. You can quickly and easily see the trend of your monthly spend, and going forward can correct as needed. (I actually do not budget monthly but instead use this tab to review my monthly income and expenses).

You can read more about my free automated budget spreadsheet in Excel or if you are ready to check it out you can have it sent to your inbox by filling in the box below (check your spam if you don’t see it in your inbox).

Join our Online Community to Receive your FREE Automated Budget Spreadsheet in Excel

Next let’s take a look at the Tiller Budgeting template.

Tiller Money Budgeting Templates

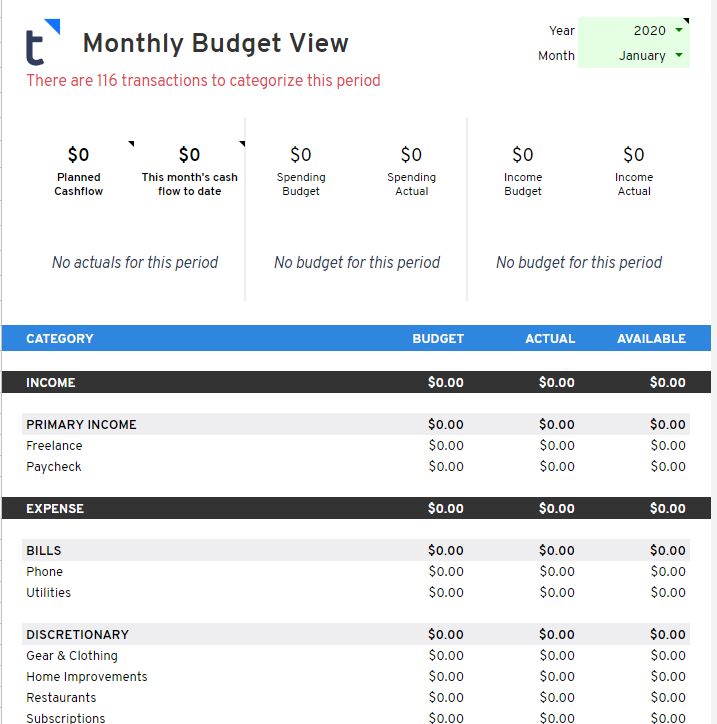

You can do all your budgeting within the Tiller Google Sheet. Here’s a few quick screenshots of what it looks like.

First, here is the monthly budget sheet. Once you set your monthly budget you are good to go. Your income and expense data will automatically flow into the tab.

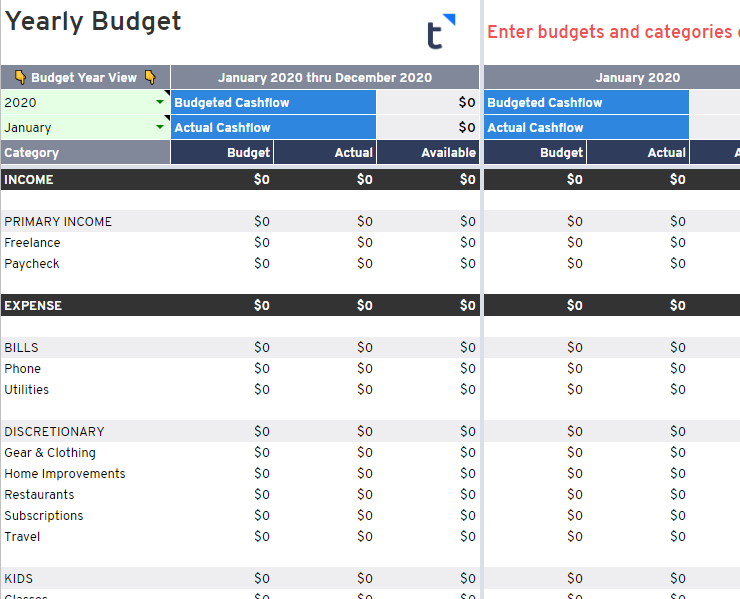

Next you have a full-year view of your income and expenses. This will automatically update as well.

Finally there is a tab where you can add additional budget categories. This will also have a monthly view of income/expense for each category.

There is also a “Transactions” tab that will pull in your data automatically. They have an add-on within Google Sheets for Tiller Money that drives the automation. Within the add-on you can select which accounts you want to pull in. One example where this is useful is with keeping personal and business transactions separate. I have one set up for my personal income and expenses and one for my business income and expenses.

Tiller Money Functionality

With new technology there is typically two questions that need to be asked:

- Does it save me time? If not, does it make me money, save me money, or enrich my life in some other way?

- How easy is it to use?

The first question is easy to answer. Tiller Money automates something that otherwise would have to be done manually. It saves you time, potentially more than an hour a month.

It also helps you improve your financial life because you can view the data on-demand. Once your accounts are set up any new transactions will flow into your Google Sheet. Whether you notice it directly or indirectly, you are likely to be more on top of your spending if you are checking your transactions daily or weekly instead of monthly. You also may be more likely to notice an increase in a recurring charge (internet, for example…) if you are checking transactions often. You can do this today by logging into your accounts individually, but Tiller pulls it into one place and automatically will compare your spend to your budget.

Ease of use is a different question that is more difficult to answer. I say that because the initial set-up process can take a little bit of time. You need to learn how Tiller’s budget spreadsheet works (and/or my free budget spreadsheet). You also need to link all your accounts.

This can take some time, but once everything is set up and you are comfortable using either the Google Sheet or the Excel spreadsheet you are essentially good to go. As I mentioned earlier I grab the transactions data out of Tiller Money and move it to my spreadsheet. Now that I have my accounts linked all I need to do is open the Google Sheet and grab the data from the “Transactions” tab. There is no other effort required for me to use Tiller Money. This should be comparable if you use their Budget spreadsheet, which also will be more or less automated once you get it set up initially.

How Much Does Tiller Cost?

You can try Tiller Money out for free for 30 days using our link. After the 30-day trial, Tiller will bill you $6.58 per month to continue using their services. You can cancel at any time.

Why isn’t Tiller Money free like Mint? Unlike Mint there are no advertisements in Tiller Money. Mint seems to constantly be trying to refer you to products and services, and it should be no surprise: they need to make money somehow.

Should You Try Tiller Money?

Given that this isn’t a free app after the 30-day free trial, it’s natural to wonder if Tiller Money is really worth the cost.

Trying it out with the free trial is really the only way to tell if Tiller Money will be worth it for you, but here is a few quick thoughts on who would likely benefit from using Tiller Money and who it likely won’t appeal to.

Tiller might be for you if:

- You prefer spreadsheets over apps

- You want an affordable way to track your money

- You like a snapshot of your entire financial situation all in one place

- You like to be able to customize your budget

Of course, Tiller isn’t for everyone. It might not be the best fit if:

- You have never used a spreadsheet before and have no desire to start

- You prefer the navigation and platform of an app

Try out Tiller Money for free: Use this link for a free 30-day trial to Tiller Money.

interesting also if I prefer old method to write everything on papaer and then control my bank account online at least once per week