This post is by our regular contributor, Kristi.

This post is by our regular contributor, Kristi.

Are you planning on doing your own taxes this year?

You’re in luck; you have a rare few extra days to get everything in order.

Because April 15, 2016, falls on Emancipation Day this year, a legal holiday in the District of Columbia, April 18, 2016, is the due date for taxes.

You still have a few months before taxes are officially due, but you’ll want to make you’re completely ready with all of the necessary paperwork before you actually sit down to hash out your taxes with TurboTax or any other tax program.

Don’t wait until the last minute to find everything you need.

Check out this tax checklist to help yourself prepare for taxes. You can even download a free Excel file (see bottom of the post) that has all the items on the list to help you stay organized.

Round up your files

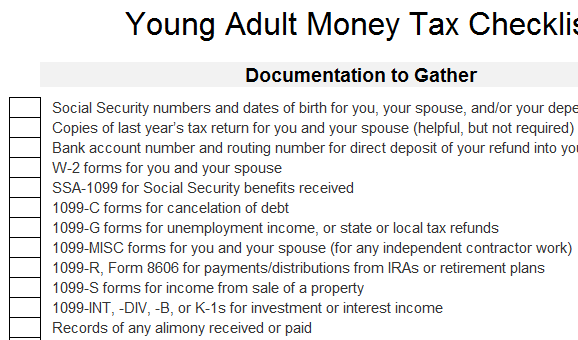

Brace yourself, because this list is intense.

Of course not all of these documents will apply to every individual, so look over the list carefully and highlight what you think you’ll need. So, round up all of the following documents and organize them by section for easy access and review when you finally sit down to do your taxes.

- Social Security numbers and dates of birth for you, your spouse, and/or your dependents

- Copies of last year’s tax return for you and your spouse (helpful, but not required)

- Bank account number and routing number for direct deposit of your refund into your account

- W-2 forms for you and your spouse

- SSA-1099 for Social Security benefits received

- 1099-C forms for cancelation of debt

- 1099-G forms for unemployment income, or state or local tax refunds

- 1099-MISC forms for you and your spouse (for any independent contractor work)

- 1099-R, Form 8606 for payments/distributions from IRAs or retirement plans

- 1099-S forms for income from sale of a property

- 1099-INT, -DIV, -B, or K-1s for investment or interest income

- Records of any alimony received or paid

- Business or farming income – profit/loss statement, capital equipment information

- Records of rental property income and expenses

- Forms 6252 for principal and interest collected during the year

- Records of miscellaneous income: jury duty, gambling winnings, Medical Savings Account, scholarships, etc.

- Records of Medical Savings Account (MSA) contributions

- Self-employed health insurance payment records

- Keogh, SEP, SIMPLE, and other self-employed pension plans

Tax deduction records

- Form 1098-E for student loan interest paid (or loan statements for student loans)

- Form 1098-T for tuition paid (or receipts/canceled checks for tuition paid for post-high school)

- Records of IRA contributions made during the year

- Receipts for eco-friendly home improvements

- Child care records (i.e. babysitter’s name, W-9, and total amount paid, etc.)

- Form 1098-T for educational costs

- Adoption records of expenses: You will need the SSN of your child and their legal records as well as records of any medical or travel costs

- Form 1098 for mortgage interest and private mortgage insurance etc.

- Records of charitable contributions (either cash or physically donated goods)

- Applicable medical or dental expense records

- Records of moving expenses

- Casualty and theft losses: amount of damage, insurance reimbursements

- Random tax deduction records (i.e. records of union dues, work expenses, travel,)

- Records of home business expenses, home size/office size, home expenses

- Rental property income/expenses: profit/loss statement, rental property suspended loss information

Records of taxes already paid

Also, be sure to round up all of your records of taxes you paid throughout the year.

- Bills from your state and local income taxes

- Vehicle license fees

- Records of any real estate or personal property taxes

- Estimated tax payments (quarterly tax payments) if you’re self-employed

You made it to the end of the list! Congratulations! Remember, it’s better to have too much prepared than not enough. You won’t want to be missing a critical piece of information when you’re filing your taxes.

Make retroactive contributions

Do you have all of your necessary paperwork ready and waiting? Great! Now you can use this time to go back and make any retroactive contributions for the prior tax year.

For example, if you regret not maxing out your retirement or college savings account for the prior year, you still have time to max out those accounts even though it’s technically the new year.

You have the ability to make retroactive contributions to your IRA, Roth IRA, 401K, HSA, 529, or Coverdell Education Savings Account as long as you attribute the contribution to the prior tax year and make sure you’re payment is received before tax day.

Make any necessary “removal of excess contributions”

You can also use this time leading up to tax day to make any necessary removal of excess contributions if you contributed too much.

For example, if you accidentally contributed the $5500 to both your Traditional IRA and your Roth IRA you will need to withdraw $5500 total from your accounts, either $2,250 from each, or any other combination you prefer, as long as your combined contributions to both accounts does not exceed the annual maximum of $5,500.

Remedying excess contributions is important, because if you have too much in those accounts on April 18, you’ll have to pay a six percent tax penalty on the extra money plus the interest it accrued. So simply get a withdrawal request form from your financial institution, and request any necessary distributions from your accounts before April 18 to avoid any tax penalties.

Remember also to report the withdrawal of excess contributions as income, because they are subject to a ten percent early withdrawal penalty.

Use the lead up to tax time to your benefit

Tax Day is still months away, so use this time leading up to get your financial ducks in a row. Getting everything ready now means you’ll have time to fix errors, make more contributions, or find any missing paperwork. Secure all of the necessary paperwork now, and you’ll save yourself a whole lot of stress down the road.

We also offer a free Excel download of this checklist. Just click the image below and the Excel file will download. Feel free to delete the rows that aren’t relevant to you and add anything else you may need. Taxes are a lot less painful when you are prepared!

Download a free copy of the Tax Checklist in Excel!

We are almost ready to do our taxes and I am already dreading it. It usually takes Greg two full days to get all of our personal and biz taxes figured out. Lots of tears and stress, too!

Excellent info here, Kristi. I love that we can make retroactive 401k and IRA contributions. What a great way to minimize tax liability at the last minute!

Great list Kristi! We hire our taxes out though it’s still a lot of work to get everything together so our CPA can do them. I’m usually on top of them, but I haven’t even started yet this year – I better get started. ;)

Great tips and advice! I still need to prepare a few documents but I’m hoping that I can file some time this month.

Jaime Donovan I’m glad you found it helpful!

holly@clubthrifty.com Taxes have that effect in our house as well.

Laurie TheFrugalFarmer It’s a shame that too many people don’t realize that there’s still time to fix mistakes!

FrugalRules As my business grows I’m thinking more and more about hiring out our taxes to a CPA. Have you had good experiences with yours? Any advice for someone looking to find a CPA for the first time?

Chonce That’s great, Chonce! The earlier the better!

A very comprehensive list of all the documents that will be needed. I prepare for tax day early if I’m getting a refund! For most of my peers who are just W-2 workers, it’s a little pet peeve of mine that they pay someone to get their taxes done. I understand if you’re a freelancer, have a business or complicated investments but if you don’t…it’s not that complicated. Plus, you still have to gather all the documents for the tax preparer anyway.

Other than rental income for the guest house, our taxes are relatively straightforward. It wouldn’t be a problem except that I’m an S-corp. So I have to get those taxes done before I can tackle ours. I need to be sure all the numbers are correct before I plug them in to our 1040.

So here’s to double-checking that all my income and expenses have already been listed. Whee.

Great list! We do our own taxes because our situation is pretty straight forward and simple!

That is a great comprehensive list. I used to be a bit unorganized about taxes, but I’ve gotten much better over the years and spreadsheets are my friends! I don’t believe you can make retroactive contributions to a 401k or 529, though, unless there is some rule I’m not aware of.

Good stuff! Download worthy for sure – and as a CPA, I don’t say that lightly :)

Thank you for this great checklist. I’m downloading it now.

Laura Beth @ How To Get Rich Slowly Thanks Laura Beth! Such kind words : )