Every day we hear about the impending fiscal cliff the United States is facing. President Obama said he will not accept any compromise that doesn’t tax the wealthy at higher rates; conversely the Republican leadership has said they are standing their ground and will not agree to tax increases.

What I see most likely happening is the Bush tax cuts expiring and the tax rates rising to pre-tax cut levels. This will stifle the economy and cause a bunch of finger-pointing between the Republicans and Democrats. If the Republicans stand their ground, though, I see them “winning” politically in the end because once people feel the sting of higher taxes they will be more adamant about supporting a party that stands for lower taxes.

The Democratic and Republican party are ultimately stuck with the positions they started with. Why would President Obama and the Democrats back down from their stance after an overwhelming win at the polls? They have little incentive to. The Republicans on the other hand, have little to gain by compromising. The people who would applaud a tax-increase compromise are just as likely to vote Democrat because they may see the Democratic party as the party that best promotes “reaching across the aisle.”

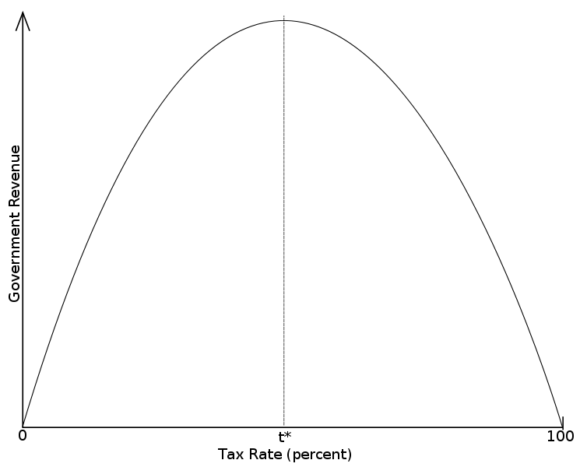

What I want to discuss today is the Laffer curve and how it ties into the fiscal cliff. The Laffer curve is an illustration of how government revenues increase or decrease based on tax rates. At 100% taxes, the government would collect $0 in revenue, while at 0% they also would collect $0 in revenue. Therefore, the “ideal” tax rate is somewhere in between 0 and 100%.

Supply-side economist Art Laffer is credited with popularizing the theory of optimal government tax rates, hence why it is referred to as the Laffer Curve. The point Laffer is trying to make with the Laffer curve is that sometimes increasing the tax rate is counterproductive and actually lowers government revenues. When the tax rate is at 10% versus 50%, the businessman has more incentive to produce because he gets to keep a bigger share of his profits.

As with most things in economics, it is difficult to move theory into practice. There are a number of unanswered (and arguably unanswerable questions) when it comes to the Laffer Curve:

- At what tax rate does the government bring in the maximum revenue?

- How do other variables factor into how much the government generates in tax revenue?

- How much do businesses and individuals factor in tax rates when they produce/consume?

Shortcomings of the theory aside, the Laffer Curve does come into play when discussing the fiscal cliff. First off, the fiscal cliff will have effects on the economy. The Congressional Budget Office (CBO) estimates that there is a risk of a recession if the US falls off the fiscal cliff for the entire year, raising unemployment to 9.1%. Because of the United State’s debt and looming trillion-plus budget deficit, government tax revenues are incredibly important. There will not be drastic cuts to the budget with the current political makeup, so it’s important that the government improve the economy while also increasing their revenue. The Laffer Curve warns that setting tax rates too high can be counterproductive to government tax revenues overall.

What can we do to fix this situation? My personal opinion is that tax rates should be kept low to drive economic growth and create incentive for investment. Will that happen? Unlikely.

____________

Photo by Mark Heard

I think a good way to fix the situation would be to kick them all out and start over fresh, but that’s not an option. :) I think it’s ineviable that our taxes will go up, rather the tax cuts be allowed to expire. I tend to agree that the tax rates should be kept lower, but I just don’t see how we can get around having to pay more so (hopefully) we can deal with the deficit and other headaches.

@FrugalRules Hey I tried that! My candidates didn’t win, though (only county commissioner won, every single other person I voted for lost). I worry that increasing the rates will further hurt the private sector and hurt jobs and government revenue. Others will disagree, and they should be happy the cuts are expiring and care less whether the Republicans compromise or not.

The obvious way to improve the economy is to increase the volume of exports, this will lead to more jobs and more tax revenue without ever needing to touch the tax rates.

Unfortunately the entire world economy is stuffed, so there is no one to export to, so I’m not really sure how to fix it any more. I think the most likely outcome is a long period of no growth (most likely negative growth)

@MonsterPiggyBank We are truly in a bad spot, both here in the US and globally.

I don’t know. I don’t think that tax rates can be kept low forever if we ever have any intention of paying down the national debt. That worries me more now than where tax rates end up at. It’s hard to pick a strategy that is entirely fair for everyone.

@Holly at ClubThrifty What if increasing the tax rates actually caused there to be less government revenue? That’s the question I pose today. Not saying I have the ultimate answer, but I question whether increasing taxes will end with higher revenues.

Now that the election is over everyone is focusing on the fiscal cliff. I hope they sort things out but I’m not counting on it. That Laffer guy is pretty smart but the tax increases we’re talking about aren’t going to 75% so while it may cut back economic activity it won’t be the end of the world.

@Money Life and More I think there would be a TON of people who disagree that 75% is the optimal rate, especially because even the Dems agree we are headed towards a fiscal cliff when the tax cuts expire, and they aren’t expiring to rates THAT high.

I don’t like taxes, but I don’t see any other way than tax increases. If they don’t offer some sort of spending cuts, though, there will be lots of mad folks when the next election comes around.

@Eyesonthedollar Even with spending cuts we would be VERY lucky to have a balanced budget, let alone debt payments! I might be in the “extreme” but I think we should drastically cut the federal budget and keep rates low to not stifle the private sector.

Isn’t it sad that the politicians play games like this at the expense of people’s lives? Oh, sure, let’s stick it to the Dems and “win” this thing! I hope it doesn’t come down to your predictions, but I fear you may be right.

@Veronica @ Pelican on Money I don’t necesarily think it’s “games.” From the sounds of it you support higher tax rates, wouldn’t you be in favor of the cuts expiring? It sounds like you would be upset if the Republicans didn’t compromise, that’s the only reason I ask.

I agree that the tax rate should be kept low… we have held ours at 0.5% in the UK – Good explanation on the Laffer curve

@SavvyScot1 There’s a lot of debate about this, but if we are headed towards a “fiscal cliff” because of tax cuts expiring, you have to wonder whether or not the low tax rates are good incentives for economic activity.

Hey I’m new to your blog. Excited about diving in and reading your stuff.

Great post! I agree that our rates need to be in just the right place. That perfect spot is exactly the debate. I had not heard of the Laffer curve before today so thanks for the education!

@TheMoneySteward Thanks for stopping by! And no problem about sharing the Laffer Curve. It looks like you have a website? What’s the url?

The problem is our system is so corrupt that I fear the only way to fix it would be a revolution. The tax system favors some companies/individuals while others are left out in the cold.

it might not be a bad thing that we can finally get some additional income to address the government, without the ‘pubs having to actually vote for a tax increase.. it will take a balanced approach to turn this ship around…

-j-

@seedebtrun Haha you’ve got a point there – if they just expire Democrats don’t have to do anything to get their tax increases, and Republicans don’t have to vote for a tax increase! I didn’t think of it that way.

Delicious economics! The only thing I will venture to add here is to ask the question – what if your tax rates are currently suboptimal, on the low side?