Most people associate student loan forgiveness with Public Service Loan Forgiveness, or PSLF.

Most people associate student loan forgiveness with Public Service Loan Forgiveness, or PSLF.

PSLF provides certain student loan borrowers forgiveness after 120 qualified monthly payments. PSLF is only eligible for those who work for the government or a 501(c)(3) nonprofit, though, so it won’t help everyone.

What many fail to realize is that PSLF isn’t the only way to get your student loans forgiven.

For those who are not eligible for PSLF there is income-driven student loan forgiveness. The way income-driven loan forgiveness works is you make 20- or 25-years worth of payments on an income-driven repayment plan. Once you hit the 20- or 25-year mark your remaining balance and accrued interest is forgiven by the federal government.

20-25 years can seem like a long time, and it is, but millions of borrowers would benefit from going down the path of income-driven student loan forgiveness.

But there is one thing to keep in mind with income-driven loan forgiveness: the amount forgiven is taxed.

This can have big implications for your taxes, hence the term student loan tax bomb. This contrasts with Public Service Loan Forgiveness, where student loans are forgiven with no tax implications.

Once they become aware of the student loan tax bomb, student loan borrowers naturally wonder how the tax bomb works and how to prepare for it. Before we get into those details let’s first go over the basics of income-driven loan forgiveness.

Income-Driven Loan Forgiveness and the Student Loan Tax Bomb

Income-driven student loan forgiveness hasn’t received much attention because no one has received forgiveness from this program yet. The reason why is because you couldn’t have made 20 years of eligible payments yet, since the four income-driven repayment plans haven’t been around that long.

The program is relatively straightforward: make 20- or 25-years worth of student loan payments on an income-driven repayment plan and the remaining balance of your student loans, including accrued interest, will be discharged.

How many years you have to make payments depends on the repayment plan you are on and whether you are repaying any graduate school debt.

- Pay As You Earn (PAYE): 20 years

- Revised Pay As You Earn (REPAYE): 20 years; 25 years if repaying any graduate student loan debt

- Income-Based Repayment (IBR): 25 years

- Income-Based Repayment (IBR) “New”*: 20 years

- Income-Contingent Repayment (ICR): 25 years

*New Borrowers = no outstanding balance on any federal student loans when taking out a loan on or after July 1st 2014.

I go into more detail on income-driven repayment plans here, including what loans are eligible for each type of repayment plan.

Under an income-driven repayment plan your required payment can be as low as zero dollars. Many borrowers utilizing an income-driven repayment plan, especially those who are trying to maximize the amount forgiven, will not see their loan balances go down. In fact, many will see interest accrue on the side, which essentially means the amount of money they owe is increasing.

This isn’t necessarily a bad thing, as it frees up cash flow to save and invest. Your investments will grow over time thanks to compound interest, but the interest on your student loans is simple interest. That means you aren’t paying interest on interest, which is the case with credit card debt, and explains why credit card debt can be so difficult to dig yourself out of. Instead, you are only accruing interest on the principal balance of your student loans.

For example, let’s say you have $100,000 of student loans and your required monthly payment is $0. If your loans are at 7%, you would have $7,000 of interest accrue (there are some interest subsidies depending on which income-driven repayment plan you are on that could lower this amount, but we will ignore that complexity).

For the purpose of interest in the future, that $7,000 is not added to the $100,000 principal. Meaning, the next year you do not owe interest on $107,000; you only owe interest on the $100,000. This is a big benefit of federal student loan debt, especially when we are talking timelines of 20-25 years.

When you reach the 20 or 25 year mark and your loans are discharged, you do owe taxes on it. This can create a huge – and I predict unexpected – tax liability for many borrowers. For example if you had $200,000 of student loans forgiven, you could owe $50,000 in taxes. Yes, $50,000 is better than having to repay $200,000 of loans, but it would still be a very difficult amount for most borrowers to repay.

Now that we’ve gone over income-driven loan forgiveness at a high level, let’s walk through an example.

Example of the Student Loan Tax Bomb

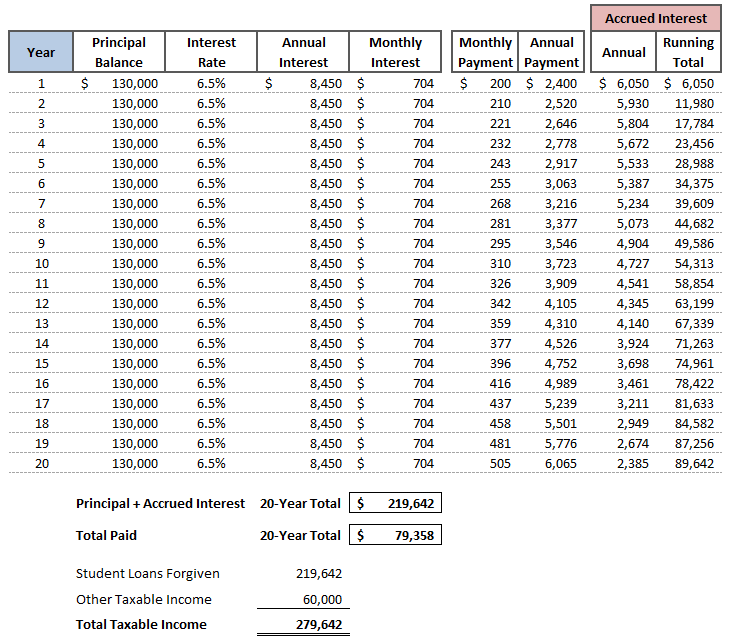

Tyler is a therapist with $130,000 in student loan debt. For simplicity’s sake, let’s assume all of his debt is federal. Let’s also assume that the interest rate on his debt is 6.5%.

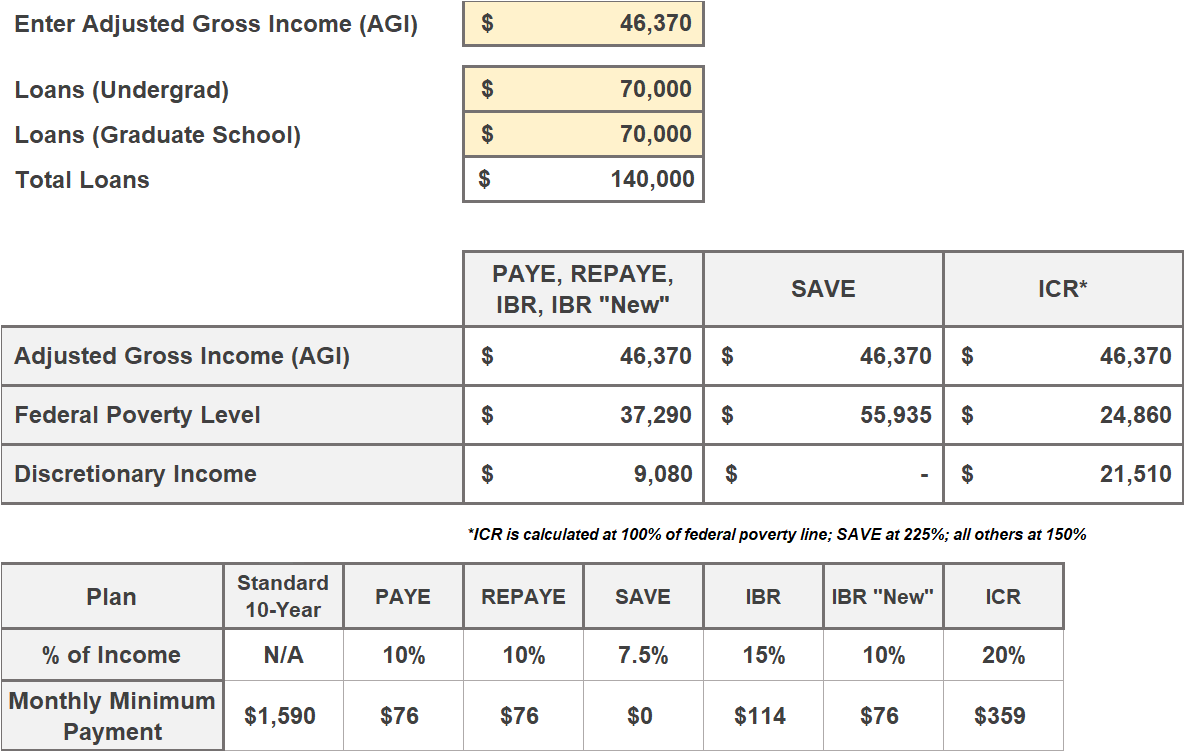

Tyler’s adjusted gross income today is $42,750 and he’s single and lives in Delaware. His required monthly payment is $200 on the PAYE, REPAYE, and IBR “New” repayment plans. (I calculated this by plugging numbers into our free student loan spreadsheet that you can download here).

Let’s assume that his required monthly payment increases by 5% every year. Life is complex and this clearly won’t be exactly how it plays out, but for this example it’s a simple way to chart out potential growth in income.

For comparison purposes, on a standard ten-year repayment plan Tyler would owe a required minimum payment of $1,476 a month. The difference between that and his calculated $200 payment on an income-driven repayment plan would be $1,276. That’s a massive difference, and something we will revisit when we get into how to prepare for the tax bomb.

With Tyler’s income-driven payment being so low, his payment won’t even cover all the interest owed on his monthly payment ($704 a month). That means interest will accrue each month. (As mentioned earlier there are some interest subsidies with the income-driven repayment plans that may benefit Tyler. I cover those in my book, Student Loan Solution).

Let’s assume Tyler will receive income-driven loan forgiveness after twenty years. Here’s what his repayment looks like over the twenty years:

At the end of the twenty years he would have made $79,358 of payments towards his $130,000 of student loans. Because his payments never fully covered the interest on his debt, Tyler’s student loans (principal of $130,000 plus any accrued interest) comes out to $219,642.

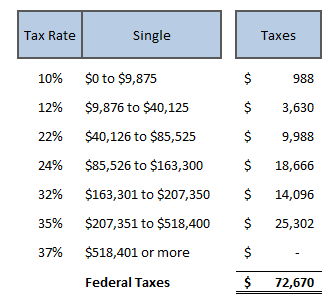

If he gets the $219,642 forgiven it will be reported as taxable income. Let’s also assume he has an additional $60,000 of taxable income that year. Here’s what he would owe come tax time. Note that I used 2020 tax rates, as it is impossible to accurately predict what the tax rate will be twenty years down the road.

Tyler would owe $72,670 in federal taxes.

That’s why we call it the tax bomb. It’s a huge amount to owe in taxes.

Taking a step back, Tyler would have paid $79,358 towards his student loans over the course of twenty years, plus an additional $72,670 in taxes at the end of year twenty, for a grand total of $152,028.

Excuse me? How is this better than paying off his $130,000 of student loans? It doesn’t seem like a good deal…

Let’s look at the alternative again. Tyler could, in theory, work a second full-time job and perhaps live at his parent’s house rent-free so he could pay the minimum required monthly payment of $1,476 a month. The negative side of this is that his standard of living would be low and it would have a negative impact on his social, mental, and physical health.

But let’s ignore that. He is set on paying back his loans so he’s fine with sinking thousands of hours into his second job.

A key point in this comparison is that there is interest on his $130,000 of student loan debt. If he paid $1,476 each month towards his debt for a full ten years he would pay $177,135, which includes interest.

$177,135 on the standard ten-year repayment plan versus $152,028 on the income-driven repayment plan (including the cost of the tax bomb).

Income-driven repayment loan forgiveness is looking a bit more attractive, isn’t it?

And let’s not forget that he is paying about $79,000 over the course of twenty years, not ten. $1,000 paid today is more “expensive” than $1,000 paid in fifteen years due to inflation and the time-value of money. Which brings us to this key point:

Not only would Tyler pay less in total through income-driven loan forgiveness, he also would have $1,200+ a month in cash flow, starting at month one, that he otherwise wouldn’t have.

That is $1,200+ that can be used for:

- Emergency fund

- Health Savings Account (or medical emergency fund as I like to call it)

- Investing for Retirement

- Investing in a Brokerage

- High Interest Credit Card Debt

- Saving for a Home

- Travel

- Children and Family

If Tyler invests even a small amount of money each month in a broad-market index fund he is going to be much better off by strategically repaying his student loan debt instead of busting his ass trying to somehow make a nearly $1,500 a month payment for ten years straight.

Which brings us to the next thing I want to walk you through: how to prepare for the student loan tax bomb.

How to Prepare for the Student Loan Tax Bomb

Tyler’s tax bomb is about $72,000. He has twenty years to prepare for it.

One advantage he has is time, and with that time he can take advantage of compound interest. $100 invested today will gain value over time. After one year it may be worth $108. That $108 would then earn value on both the $100 plus the additional $8. This process of compounding interest repeats year after year after year.

Using a compound interest calculator we can estimate how much Tyler would need to set aside each month to save $72,000 after twenty years.

To be conservative let’s assume interest compounds annually. We’ll also assume 8% annual interest.

If Tyler contributes $131 a month, or $1,572 a year, he would have just under $72,000 after twenty years.

In this example Tyler would contribute $31,440 out of his own pocket towards investments, meaning over $40,000 of the $72,000 he has after twenty years would be from interest gains.

That is with just $131 a month. Remember, by choosing the income-driven repayment plan Tyler would free up nearly $1,300 of cash flow compared to the required minimum monthly contribution under the standard ten-year repayment plan.

Also, at a rate of $131 a month he is investing just 3.5% of his Adjusted Gross Income, or AGI (which is $42,750 in year 1 of our example). We also did not increase his contributions as his income increased, so as his Adjusted Gross Income increased the amount he was investing, $1,572 a year, became a lower and lower percentage of his Adjusted Gross Income.

Here’s a general rule: to be prepared for the student loan tax bomb, invest at least 5% of your Adjusted Gross Income each year.

If Adjusted Gross Income is too difficult to calculate, use the AGI number from last year’s tax return as a baseline.

The more money you save and invest, the more comfortable you will be with the fact that your student loan balance isn’t going down. You saw the math in this example. For some borrowers income-driven student loan forgiveness makes sense despite the tax bomb.

Will the Student Loan Tax Bomb actually Happen?

For some student loan borrowers the student loan tax bomb will be a huge surprise. They simply won’t have the money to pay it. Which begs the question: will the government aggressively pursue payment? Will they take student loan borrowers to court?

To be clear, you should 100% plan for the student loan tax bomb if you are headed down the path of income-driven loan forgiveness. It’s the law, and you should expect to incur the tax liability.

But what if a ton of borrowers (not you) are unprepared for the tax bomb?

One possible scenario is that there will be enough political pressure that politicians will get rid of the tax bomb. This seems even more likely when you think of how it could be seen as a compromise, or middle ground, between the politicians who want to save taxpayer money and those who want to make public college free and cancel all outstanding student loan debt.

Again, don’t plan on the law changing. Set aside the money needed, and watch your brokerage account grow as you work down the path of income-driven loan forgiveness.

But there is certainly a small chance that the law will change and the student loan tax bomb won’t happen.

Take Control of your Student Loans

Hopefully this explanation of the student loan tax bomb has peaked your interest and shown you how even a little time spent understanding your student loans, repayment options, and opportunities for loan forgiveness can greatly benefit your financial life.

Two things you can do today:

Get a copy of Student Loan Solution: 5 Steps to Take Control of Your Student Loans and Financial Life.

Download a copy of our student loan spreadsheet. You can get a copy emailed to you by filling out the box below or you can read more details about the spreadsheet here.

Join our Online Community to Receive your FREE Student Loan Spreadsheet