Student loan forgiveness for therapists and psychologists is a topic that hits close to home for me.

Student loan forgiveness for therapists and psychologists is a topic that hits close to home for me.

My wife has a masters in counseling psychology and works as a therapist at a nonprofit counseling clinic.

A majority of therapists and psychologists, or those who have loved ones who are therapists, likely agree with me when I say that therapists do not get paid as much as they should. Yet in order to be qualified to work in the field, aspiring therapists and psychologists usually have to take out a large amount of debt for undergrad and grad programs.

Thankfully there are options for student loan forgiveness for therapists and psychologists. In fact, my wife and I are pursuing student loan forgiveness.

Before we dig into the options, let’s first examine why therapists and psychologists have so much student loan debt. Unpacking this is helpful for relatives, friends, and even therapists themselves who don’t understand how the debt adds up to such a large amount.

Why Therapists and Psychologists have so much Student Loan Debt

There are a few reasons why therapists and psychologists typically end up with a large amount of student loan debt. It starts with the fact they need to get a masters degree to work in their field. This isn’t the case with every single job in the field, but job options are and income potential will both be limited without a masters.

When we talk about student loan debt today, many of the stories focus on undergrad student loans. The median amount of undergrad student loan debt is in the $30k range, with some leaving undergrad with much more. This is before adding any grad school debt to the total.

When you enter grad school at least half-time your loans go into in-school deferment. That means any unsubsidized loans accrue interest. When you exit in-school deferment all that accrued interest gets added to the principal of your loan. Assuming it takes about three years to finish a masters in counseling psychology, there is likely a material amount of interest accruing while you are working on completing your masters.

And remember, this is before tacking on any grad school debt.

Let’s talk about the cost of grad school. My alma mater, the University of St. Thomas, has an M.A. in Counseling Psychology program. As of today it requires 48 credits at a price of $790 per a credit. This comes out to $37,920. This does not include fees, books, or other costs related to the program. Nor does it include taking additional classes to fulfill the requirements of becoming a licensed therapist (these can be taken after completing a masters degree, but they will eventually have to be completed at a university).

Let’s be generous and round the cost of undergrad to $40,000 when factoring in other costs such as books and loan origination fees. A note on student loan fees – if any GRAD PLUS loans were taken out, there was a 4% origination fee that was factored into the loan. Any non-PLUS loans have a 1% origination fee.

So we get to $40,000 of additional debt. This assumes no debt is taken out to cover living expenses, which is the case for some masters students, and it also doesn’t factor in unsubsidized loans accruing interest.

But can’t grad students just pay their way through?

This is a question many – typically baby boomers – have. The reality is that many psychology masters students do work full-time while taking classes. Typically their income is only enough to cover living expenses. If they do have any money left over it is unlikely to make much of a dent in tuition.

Practicum also causes major financial pressure for psychology grad students. The average person has no idea what practicum is. Practicum is a requirement for completing a psychology masters program. Masters students work at a clinic part-time (20 hours a week) for approximately eight months with no compensation. The benefit for the student is real-world experience.

It is very difficult to continue to work full-time during practicum. Practicum hours are typically during regular business hours, and not everyone can shift full-time work outside of those hours. Even if they could, it may not be sustainable or even possible for someone to work forty+ hours at another job in addition to practicum. Practicum also has a classroom requirement to it, not to mention, you know, other things going on in the student’s life. What all this means is that for those who are single and/or do not have someone else’s income to rely on it can be difficult to avoid taking out additional loans for regular living expenses.

Finally, there is the PsyD program that is becoming more and more popular because it opens up additional work opportunities. PsyD is also an alternative path to a PhD, as psychology PhD programs are extremely competitive. The PsyD program at my alma mater is a program that builds on the masters of counseling psychology program. It’s 82 additional credits at the cost of $1,048 per credit. It’s even more difficult to work while pursuing the PsyD than a masters because of the number of credits required and aggressive timeline of the program. Simple math tells you that, combined with undergrad and masters debt, it’s very plausible that someone would build up $200k, or more, of student loan debt if they pursued a PsyD.

All of these factors are why therapists and psychologists have so much student loan debt.

Leaving a masters program with $100k+ of student loan debt is very realistic today, if not common. Student loan debt is just one of the financial challenges therapists and psychologists face, unfortunately. The other is relatively low pay.

According to U.S. News and World Report, mental health counselors made a median salary of $44,840 in 2018. The best-paid 25 percent made $60,300 that year, while the lowest-paid 25 percent made $34,600.

For Minnesota, which is where my alma mater is located and whose program I used as an example of costs, the range of pay is approximately $35k to $55k, with many jobs in the $40k range. These jobs require a masters to be qualified, and we know that $100k+ in debt is plausible.

This is why loan forgiveness for therapists and psychologists is so important.

It is also why I have a passion for sharing loan forgiveness opportunities with therapists and psychologists. They are underpaid relative to the value they provide and the cost of their education.

They certainly aren’t the only profession. For example, there are many pharmacists making $90k-$100k a year who took on $300k or more of student loan debt.

Thankfully as long as you borrowed federal student loan debt you have opportunities for loan forgiveness. Let’s dive into those options now.

(Notice I said federal student loans. Read this post for how to address private student loans.)

Student Loan Forgiveness Opportunities for Therapists and Psychologists

For therapists and psychologists there are three major student loan forgiveness opportunities:

- Public Service Loan Forgiveness, or PSLF

- Income-Driven Loan Forgiveness

- State-specific Loan Forgiveness Programs

These three options do not cover every opportunity for student loan forgiveness, but they are the major ones. An example of one I didn’t mention is total and permanent disability (TPD) discharge of student loans. This is when you become permanently disabled and are unable to earn a material income (i.e. more than $10,000 a year).

Public Service Loan Forgiveness, or PSLF, is the holy grail of loan forgiveness. It also is very compatible with the therapist and psychology profession because it is only available to those working full-time at a 501(c)(3) nonprofit or those employed full-time by the government. This is what my wife and I are pursuing for her loans.

We’ll get to income-driven loan forgiveness and state-specific loan forgiveness shortly, but let’s start with PSLF.

Public Service Loan Forgiveness

If they work for qualifying employers, PSLF is the best student loan forgiveness opportunity for therapists and psychologists. The core requirements of PSLF include:

- Make 120 qualifying monthly payments…

- on a qualifying loan or loans…

- while working full-time for a qualifying employer

If you fulfill all the requirements the remaining balance of your student loans will be forgiven tax-free once your application is accepted.

There is no cap on the amount of debt forgiven in PSLF. You could get $5,000 or $50,000 forgiven. Or a million. There is no limit.

The qualifying monthly payments do not have to be consecutive. For example, you could make 60 qualifying payments, take a couple years off from working (and therefore, not have any qualifying payments), and then return to the workforce and start making qualifying payments again.

The qualifying repayment plans include the standard ten-year repayment plan and the four income-driven repayment plans. You can read more about the four income-driven repayment plans here.

Graduated, extended, or any other repayment plan not mentioned is not eligible for PSLF. If you make a payment plan and you are not on a qualifying repayment plan, the payment is not a qualifying payment towards PSLF.

As far as loans go, here are the types of student loans that qualify for PSLF:

- Direct Subsidized

- Direct Unsubsidized

- Direct Graduate PLUS

- Direct Parent PLUS (only if consolidated through a Direct Consolidation Loan)

- Direct Consolidation

Any Direct loan other than Parent PLUS is eligible, though Parent PLUS loans can also become eligible when they are consolidated through a Direct Consolidation Loan. Unfortunately ICR, the worst of the four income-driven repayment plans, is the only income-driven repayment plan that a direct consolidation loan that repaid a Parent PLUS loan is eligible for. Make sure you fully understand the implications before going through with student loan consolidation.

FFEL loans, which were discontinued in 2010 but many borrowers still have today, are not eligible for PSLF. FFEL loans can become eligible for PSLF if they are consolidated into a Direct Consolidation loan.

Finally, for a payment to be marked as eligible towards PSLF you must be employed full-time working for a qualified employer. These include:

- Government organizations at any level (federal, state, local, or tribal)

- Not-for-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code

- Other types of not-for-profit organizations that are not tax-exempt under Section 501(c)(3) of the Internal Revenue Code, if their primary purpose is to provide certain types of qualifying public services

I cover PSLF and many other student loan and personal finance topics in my book Student Loan Solution: 5 Steps to Take Control of Your Student Loans and Financial Life.

I’ll go over an example illustrating the potential savings – and in some cases huge savings – under PSLF, but first let’s talk about an alternative to PSLF: income-driven loan forgiveness.

Income-Driven Loan Forgiveness

If you are not eligible for PSLF there is still another good option for loan forgiveness: income-driven loan forgiveness.

When you make payments on an income-driven repayment plan for 20-25 years (depending on the plan) you will have the remaining balance on your loans forgiven. Income-driven loan forgiveness does not have an employer requirement like PSLF. In fact, you don’t even have to be working for a payment to be counted as eligible (i.e. if your income is $0, your requiremed payment will be $0).

The length of time you will have to make payments to achieve forgiveness will depend on the income-driven repayment plan you are on. Here’s a breakdown:

- Pay As You Earn (PAYE) – 20 years

- Revised Pay As You Earn (REPAYE) – 20 years or 25 years if repaying any graduate school loans

- Income-Based Repayment (IBR) – 25 years

- Income-Based Repayment (IBR) (for new borrowers on or after July 1, 2014) – 20 years

- Income-Contingent Repayment (ICR) – 25 years

You may look at those time frames and groan. I get it, 20 or 25 years is a long time. Ultimately, though, you can still save a lot of money and you likely will benefit if your debt-to income ratio is 2 or higher (i.e. $100k of student loan debt on an income of $50k). Let’s look at a quick example.

Chad has an AGI of $30,000 (remember this is not his salary but adjusted gross income, which is adjusted for contributions to tax-deferred retirement accounts such as a Standard IRA or a 403b). Chad has $120,000 of student loan debt (half direct subsidized half direct unsubsidized) at an interest rate of 6.5%. He lives in Texas and is single.

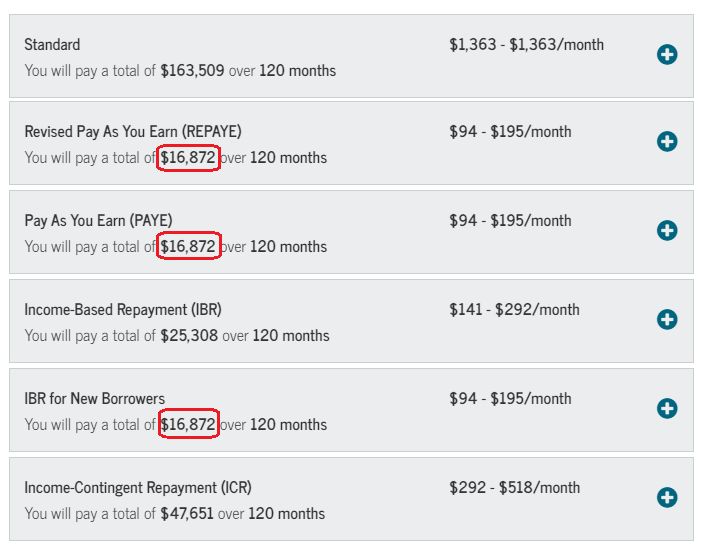

Let’s plug in Chad’s data to the StudentLoans.gov repayment calculator. This calculator assumes that Chad’s income goes up by 5% each year and that his number of dependents stays consistent.

As you can see, under the standard repayment plan Chad would have to pay nearly $1,400 a month, every month, for ten years.

It doesn’t take a mathematician to realize this is simply not going to happen on Chad’s salary.

On PAYE his monthly payments would be just $94 a month at the beginning, growing to a projected $387 a month by the end of the 20 years. Under this repayment plan Chad would pay just $51,902 over 20 years, with whatever principal and accrued interest is left at the end forgiven.

Even on REPAYE, where Chad would be making payments for 25 years (assuming he got his masters in counseling psychology), he would pay just $80,123, which is nearly $50,000 less than his original loan balance.

The one negative to this path is that interest will accrue and ultimately Chad’s debt will increase over time. There are some interest subsidies depending on the income-driven repayment plan, but ultimately the debt will rise. Unlike PSLF, forgiven debt is taxable income under income-driven loan forgiveness. Meaning a “tax bomb” awaits Chad.

Plan for the “Tax Bomb” with Income-Driven Loan Forgiveness

Let’s assume the amount of student loan debt forgiven (including accrued interest) is $210,000. Chad will have to report that as taxable income. We can’t predict what tax rates will be in 20 or 25 years, but using 2020 tax rates for a single filer, Chad would owe a little less than $50,000 in taxes.

$50k is a lot, but remember we are talking about a 20- or 25-year time frame. Throughout that time Chad can set aside money in a brokerage account and invest it in an index fund. If he plans ahead, Chad should be well-positioned to withdraw the $50k to pay off the tax bomb, as he would have years of consistent deposits and compound growth.

Assuming an 8% annual interest rate on his investments, Chad could deposit $85 a month for 20 years and have approximately $50,000 in his brokerage account. That $50,000 would be made up of $20,000 of deposits and $30,000 of interest gained.

Because the market can be unpredictable, and the more money Chad has the more comfortable he will be despite his loan balance increasing, I would recommend Chad contribute more than $85, closer to $125 a month (5% of his Adjusted Gross Income in year 1 of repayment).

The point is this: income-driven loan forgiveness can be a much better option than killing yourself trying to pay a huge amount month-after-month on the standard ten-year repayment plan. In fact it may even be impossible to pay the amount the standard ten-year repayment plan requires, making income-driven loan forgiveness attractive and beneficial.

One other view I want to share is what Chad’s situation looks like on PSLF. Here’s how the numbers fall:

Yes, you are reading that correctly.

Chad could pay just under $17k on a majority of the income-driven repayment plans, over the course of ten years, with any remaining balance (including accrued interest) being wiped out tax free. No tax bomb.

This is why PSLF is the holy grail of loan forgiveness. And it should be something therapists and psychologists take into consideration when deciding whether to work for a nonprofit employer or a for-profit employer, especially if the salary and workload is comparable.

State-specific Loan Forgiveness (through the Health Resources and Services Administration, or HSRA)

This brings us to the third major way therapists and psychologists can get student loan forgiveness: state-specific programs and opportunities.

I will spend very little time here because of how much more favorable PSLF is than any other loan forgiveness program, with income-driven repayment being a solid secondary option. The state loan forgiveness opportunities will typically be something along the lines of “work in a rural area for two years and get $10,000 a year towards your student loan debt each year.” I’m making this example up, but you get the point.

With that being said, I am a believer in looking into and understanding all the options available to you. You can browse the opportunities on the Health Resources and Services Administration website.

Next Steps to take for Student Loan Forgiveness

As you can see, there are good opportunities for federal student loan forgiveness for therapists and psychologists. In certain cases with PSLF, some may even say the opportunity is a huge one that could allow you to retire many years earlier than if you had to repay your student loans in full.

As you can see, there are good opportunities for federal student loan forgiveness for therapists and psychologists. In certain cases with PSLF, some may even say the opportunity is a huge one that could allow you to retire many years earlier than if you had to repay your student loans in full.

We went over a lot of information, and due to the complexity of student loan repayment I had to leave out a lot.

If you are ready to take control of your student loans and put a solid strategy in place, here are a few things you can do next:

Get the book Student Loan Solution: 5 Steps to Take Control of Your Student Loans and Financial Life – this book will walk you step-by-step through the process of setting a student loan repayment strategy. It puts a lot of focus on your specific situation: your finances, your goals, your job, your life – You! This is an approach that some personal finance experts don’t take, and I think it’s a travesty. I believe in empathy and a balanced approach. This book reflects that.

Download the free Student Loan Spreadsheet – If you truly want to understand your student loans, you need to have all the data in front of you. This student loan spreadsheet was originally made for my wife and me and I’ve since blown it out to include places to put your other debt, instructions on where to find your loan information, and a bunch of calculators. Get it sent to you for free by filling out the form below.

Join our Online Community to Receive your FREE Student Loan Spreadsheet

See how your situation fits with loan forgiveness opportunities – Take your student loan debt, your salary expectations, and other factors into consideration and see if working towards student loan forgiveness makes sense for you. Based on the relatively high cost of education required to become a therapist and psychologist, and the relatively low pay compared to tuition costs, student loan forgiveness will make sense for a lot of therapists and psychologists.