When you think of the company SoFi you probably think of student loan refinancing. And that’s to be expected, since that is where SoFi got started (see our SoFi student loan refi review).

When you think of the company SoFi you probably think of student loan refinancing. And that’s to be expected, since that is where SoFi got started (see our SoFi student loan refi review).

But SoFi has since expanded their offerings. Not only can you refinance your student loans with SoFi, you can also open a bank account and even invest in stocks and ETFs.

SoFi Invest is their brokerage product, and there is a lot to like about it.

We’ve been testing out SoFi review for the past couple months and here are a few highlights:

- Sign up entirely online

- Sleek and simple mobile app

- Purchase fractional shares, or “bits” of a stock

- $1 minimum balance requirement

- Zero stock and ETF trading fees

Let’s go over the benefits and drawbacks of using SoFi Invest.

Sign Up Entirely Online

The process for signing up for SoFi Invest is simple and entirely online. This is how it should be, in my opinion, and COVID has definitely started to weed out the businesses that make it anything but simple to get started.

To sign up and get started on SoFi Invest you can use this link.

If you plan on depositing $1,000 or more in your initial deposit, use this link instead so you can receive a $50 bonus.

Sleek and Simple Mobile App

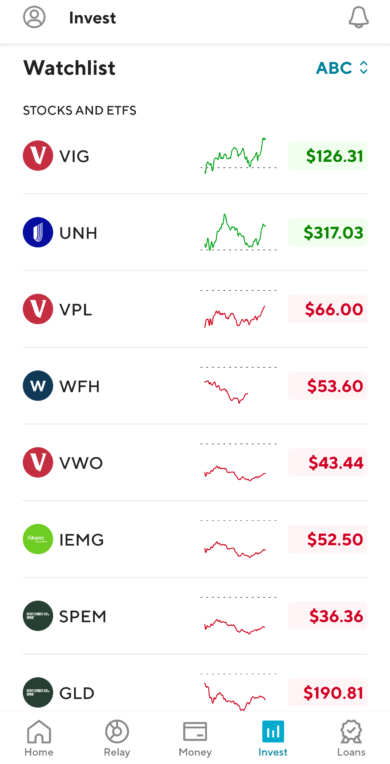

As SoFi has expanded beyond simply being a student loan refinancing company, they’ve built an app that is a one-stop-shop for all their products. Here is a screenshot of a Watchlist on SoFi Invest. The Watchlist is where you can add stocks and ETFs you want to keep track of but haven’t invested in yet (if you have invested in a stock or ETF you will see it above the Watchlist in the Invest Holdings section).

If you look closely at the bottom of that screenshot, you can see that you can navigate quickly and easily to your loans or bank account within the app, if you are using those services from SoFi.

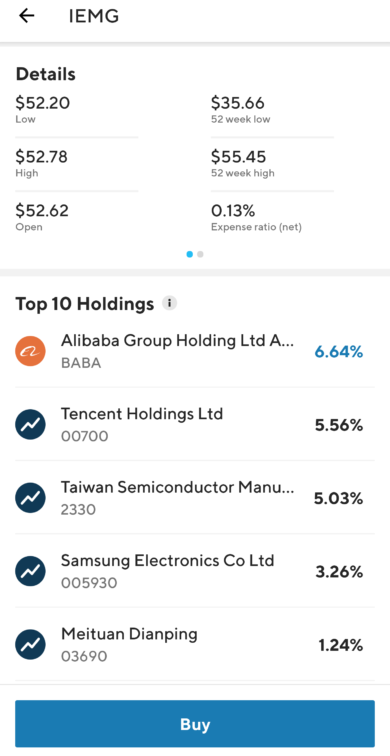

Below is an example of what an ETF looks like when you click on it for more detail:

Purchase fractional shares, or “bits” of a stock

One benefit that SoFi Invest offers is “Stock Bits.” You can essentially invest any amount of money in a stock, regardless of whether it is equal to one share or not.

For example, CVS Health is trading for around $65. I can invest just $5 into that stock. Or $10. Or $100. It doesn’t matter whether it equals the price of a full stock or not.

This is a nice feature because sometimes it seems like people don’t start investing because they don’t have much to invest. That is a totally legit concern. But with stock bits you can invest small amounts consistently over time. $20 here, $50 there…the most important part of investing – and most things in life – is just getting started.

Reminder: SoFi Invest is currently running a short-term promotion where you can receive $50 if your opening deposit is $1,000 or more. Don’t have $1,000 to deposit on the app? Use this link to sign up instead.

$1 Minimum Balance Requirement

Big benefit of this app: you can get started with SoFi Invest for just $1.

The cost to SoFi to set up, vet, and maintain your account is certainly more than $1 a year, but by offering the extremely low $1 minimum required balance they don’t shut out smaller investors or people who may be using SoFi as a secondary brokerage account (myself included).

Zero Stock and ETF Trading Fees

There has been a trend the past year in the financial space of offering zero fees for most stock, ETF, and mutual fund trades. SoFi is no exception: they don’t charge you for stock and ETF trades.

This is where we get to a drawback of SoFi: they don’t offer mutual fund trades.

If you want to buy and sell mutual funds, you will have to pick another platform.

I personally don’t see this as too big of a drawback. People will debate to the end of time which is better, mutual funds or ETFs, but the reality is that there is a massive selection of ETFs. For the average investor there are certainly more ETF options than they could possibly need, so missing out on mutual funds isn’t a huge deal. Plus, you can always open an account at Fidelity or another brokerage if you really want to be exposed to mutual funds instead of ETFs.

Additional Features

There are a few things that are worth mentioning that I haven’t hit on yet:

- Cryptocurrency Trading – Crypto isn’t the craze it was a couple years ago, but Bitcoin is up over 65% year-to-date at the time of this writing. If you are interested in trading crypto, SoFi makes it easy for you. Prior to a product like SoFi Invest, it could be quite difficult and confusing to figure out how exactly you can invest in crypto. For example, a couple years ago you had to create a CoinBase account, convert USD to Bitcoin, and then transfer to another app to actually trade in non-Bitcoin cryptocurrencies.

It’s worth noting that unlike stocks and ETFs, crypto trades do come with fees. Crypto trades require a $10 minimum value per trade and a 1.25% fee per trade.

- Retirement Accounts – You can open an IRA with SoFi, which would be a (somewhat) separate product from what we have gone over so far. The easiest way to get started is to first open a SoFi Invest account and then add a SoFi IRA through the app. The IRA comes with some cool features, letting you decide whether to take a DIY approach or allow the automated robo-adivsor technology manage it.

- Benefits for all SoFi Users – Regardless of which SoFi products you use (SoFi Invest, SoFi student loan refi, SoFi personal loan, etc.) there are some free benefits that all SoFi users receive. These change from time-to-time, but they can include live invite-only events, career coaching, will drafting, and more.

To sign up and get started on SoFi Invest you can use this link.

If you plan on depositing $1,000 or more in your initial deposit, use this link instead so you can receive a $50 bonus.