You want to work on your financial life, but you don’t know where to start.

You want to work on your financial life, but you don’t know where to start.

You’ve come to the right place if that describes you.

My goal here is to share a simple personal finance checklist. This won’t cover everything, but it will hit on some key actions to take to start managing your financial life better.

Here is the simple personal finance checklist, followed by more details on how to actually do each of these things:

- Review Your Income and Expenses from the Past 3 Months

- Create a Budget for the Next Month

- List Out your Debt

- Make a Plan to Address your Debt

- Make a Plan to Build an Emergency Fund

- Check your Credit Score

- Calculate your Net Worth

Let’s dig into each of the items on the personal finance checklist, including ideas of how to accomplish them.

Review Your Income and Expenses from the Past 3 Months

If you want to make positive changes to your finances – or confirm you are making the right ones – you need to understand where your money is going.

First you will need to track your income and expenses for at least three months. You can do this by pulling your income and spending information from your bank and credit card statements. If you use cash often you will need to capture that going forward and should estimate the past three months for the time being.

I track my income and expenses by using Tiller, which pulls all your income and spend data from your credit cards and bank accounts automatically. The key word here is automatically. I used to do it manually, but I’ve found Tiller to save me a decent amount of time each month so I’ve used it for a few years now.

When you have three months of data in front of you, it’s time to reflect on it.

Are You Spending More than You Earn? If you are spending more than you earn it could be due to a couple things. You may have too much coming out of your paycheck each month for your retirement or Health Savings account. The other reason is you are simply spending too much for your income.

If you are spending too much, take a look at each category. Are there things that stick out? Is your rent or mortgage way too high? Do you have a $500 car payment? Do you spend too much on restaurants and take-out? Or perhaps your grocery budget is too high?

You will also want to think about what you actually want to spend money on. I personally don’t think a latte a day will kill your finances, so if you enjoy spending money on it then by all means continue to do so. But your car loan or lease of $600 could be pushing your finances over the edge. It may be time to sell and purchase a more reasonably-priced vehicle.

Create a Budget for the Next Month

Using your three months of spending data you now have a good idea of how much you spend on various categories in an average month. Using this information combined with what you discovered when you reviewed your spending, you are now ready to make a budget for the next month.

I use a budget spreadsheet for my budget. Some people use apps. Test out both and use whatever is easiest for you.

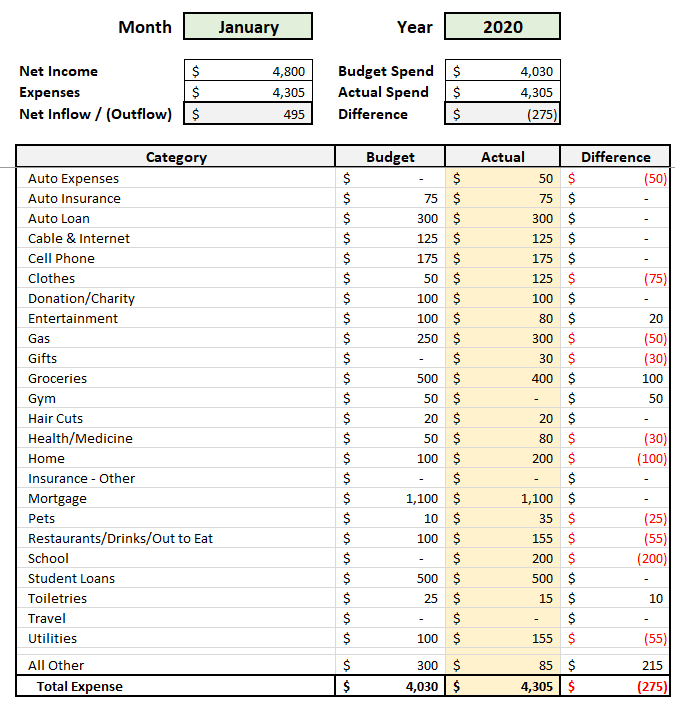

We have a free automated budget spreadsheet that you can download. This budget spreadsheet uses Tiller to populate the “actuals” data. A typical monthly budget sheet looks like this:

Setting a budget isn’t difficult when you have your past three months – or more – of expenses to help guide you. Set a reasonable budget for each category and challenge yourself in categories where you are spending more than you would like to.

There are a number of expenses that are difficult to change, think housing and car payments or leases. Even though you can’t change these costs immediately, don’t let them fall off your radar. If your housing costs are way too expensive for your income make it a priority to find more affordable housing. If you have a vehicle that is keeping you in debt because the payment is $500, consider selling your vehicle and buying something more reasonable. These aren’t the easy wins, but they are the big wins that have the potential to drastically help your financial life.

List Out your Debt

Do you have debt? If you have debt you should, at minimum, know these things:

- Type of Debt (Credit Card, Student Loan, etc.)

- Amount

- Interest Rate

- Whether the Interest Rate is Fixed or Variable

- Remaining Number of Payments (for Installment Loans like a mortgage)

- Minimum Required Monthly Payment

If you’ve never done this, take a deep breathe. When my wife and I listed out our student loan debt it was more than we expected. This was especially true after my wife finished her master’s degree and we had her undergrad loans in deferment for a few years while also taking out additional student loans.

In our free Student Loan Spreadsheet we have a couple of sheets where you can drop in the details of your debt. One tab is specific to student loans while the second tab is for all debt.

Once you have your debt listed out, move on to the next step: make a plan to address your debt.

Make a Plan to Address your Debt

When it comes to debt everyone’s situation is going to be different. $30,000 of debt at 3.25% interest is different than $30,000 of debt at 23.0% interest. $10,000 of debt for someone making $125,000 a year is different than $10,000 of debt for someone making $20,000 a year.

With that in mind, there are a few strategies that may be relevant to your situation:

Make a Strategic Student Loan Plan

If you have student loan debt there are a number of paths you can take. You can refinance your student loans and pay them off as quickly as possible. You can pay them off on the standard ten-year repayment plan. Or you can strategically repay your student loans on an income-driven repayment plan and head down the path to student loan forgiveness (either income-driven loan forgiveness or Public Service Loan Forgiveness).

I go into much more detail on student loan repayment and broader personal finance in my book Student Loan Solution: 5 Steps to Take Control of Your Student Loans and Financial Life. My wife and I are going the strategic repayment route. I talk about our personal situation in my post I can afford to pay off my student loans, but I won’t: here’s why.

Lower Your Interest Rate

The reason credit card debt can feel so crushing is because of the interest rate. Credit card debt is double-digits in most cases. It can easily reach the high-teens or the low 20s.

When your interest rate is high you end up putting a lot of money towards interest before you make progress on the principal. The lower your interest rate the better. Typically the higher your credit score the lower the interest rate available to you. We’ll go over credit score in more detail soon.

One strategy is to open a 0% APR credit card. With these cards you can transfer your credit card balance and pay 0% interest for a period of time. For example with the Capital One® Quicksilver® Cash Rewards Credit Card you get 15 months of 0% interest on both purchases and balance transfers. You can use this time to make as much progress as possible towards the principal balance of your debt. You may even be able to knock it out entirely. Here’s our picks for the best 0% APR credit cards.

We already mentioned student loan refinancing, which I highly recommend for any private student loans. You can get rate quotes from multiple companies through Credible. For credit card and personal debt you can see what rates are available if you refinance through a personal loan.

Get Help

The last thing I want to mention is that it makes sense to reach out for help if you are overwhelmed. This may mean reaching out to a certified credit counselor or working with a debt attorney (I interviewed a debt lawyer about what prospective clients should expect when working with one.

Regardless of what strategy you take, the sooner you confront your debt the sooner you will have a plan for taking control of it. A couple additional posts you may find helpful are how to deal with debt on a low income and options for dealing with a large unexpected expense.

Make a Plan to Build an Emergency Fund

One of the most basic and repeated pieces of personal finance advice is “build an emergency fund.”

I know, I know, it’s easier said than done. But it is important.

As I mention in my book Student Loan Solution, a better and more inspiring name for an emergency fund is a F*** Off Fund. When you have no cash savings you are in a vulnerable position. You may put up with an abusive manager longer than you should because you need money, right? When you have an emergency fund you can say F*** off to those who need to hear it.

As far as importance, building an emergency fund is on par with making a plan for your debt. There is simply nothing more empowering than having cash in the bank.

Instead of getting fixated on a goal that may seem unattainable today, such as having three or six months of expenses in a savings account, I encourage people to focus on what they can accomplish today. $100 a month is better than $0 a month. Whatever you can manage is what you should be setting aside. For more details, read our post build an emergency fund $100 at a time.

Check your Credit Score

A credit score impacts, for better or for worse, your ability to take out a loan or open a credit card. It also can impact the interest rate you receive.

Here is a general guide to how creditors will view your credit score:

- Less than 500: Very bad

- 500-549: Bad

- 550-599: Poor

- 600-649: Average

- 650-699: Good

- 700-749: Very good

- 750 or Higher: Excellent

You can check your credit score for free with most credit cards through the online dashboard when you log in.

If you have a bad credit score, don’t panic. Nearly a third of Americans in total and 43% of millennials have a poor or bad credit score, which is defined as a credit score of 600 or below.

If you want or need to increase your credit score, read how this blogger increased their credit score 150+ points in 8 months and 5 ways to fix a bad credit score.

Calculate your Net Worth

The final item in this simple personal finance checklist is calculate your net worth. Calculating your net worth, at a high level, is really simple: you take your assets and subtract your liabilities (i.e. debt). That’s it.

In practice it’s a bit more difficult because the amount in your bank account changes often. If you have retirement savings that also moves around daily. The value of your house and the outstanding principal on your mortgage changes. The debt you have goes down (or up).

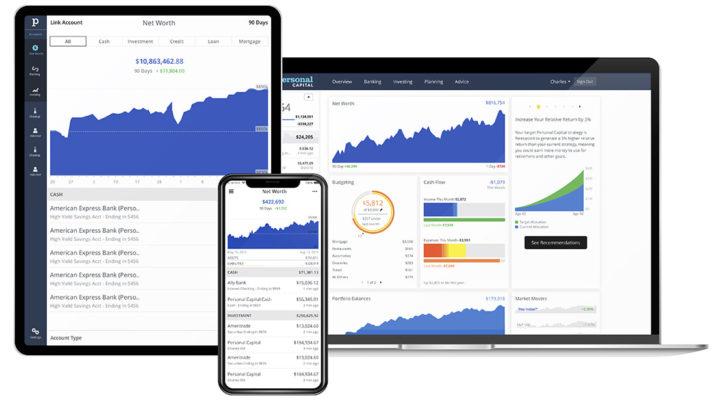

To get an accurate picture of my net worth I use Personal Capital. Personal Capital is a free tool that links to your accounts and pulls in your data real-time. Once you do the initial setup work you can get a real-time look at your net worth whenever you want.

Checking your net worth may not be the most uplifting experience. Let’s say you just finished grad school and have $225,000 of student loan debt from undergrad and grad school. You worked, but any money you made went towards your living expenses. In this case your net worth will be negative.

If you find yourself less-than-inspired by your net worth my recommendation would be to not check it that often. Instead focus on what you can control today. You can budget. You can create a strategic student loan repayment plan. You can create a plan for eliminating debt. We didn’t talk about it, but you can also focus on increasing your income at your 9-5 or through a side hustle, and you can start socking away money in an investment account.

By proactively making these money moves you can set yourself up for success. Years go by quick and before you know it all your hard work will translate into a net worth that puts a smile on your face.

By working through this simple personal finance checklist there is a chance you will drastically improve your financial life. With that being said, taking control of your financial life can take time – don’t get overwhelmed! Realize that even tracking your income and expenses is a huge step towards owning your finances.

ABSOLUTELY AGREE WITH THE ENTIRE POST