When you hear about side hustles, most of the focus is around paying off debt faster.

When you hear about side hustles, most of the focus is around paying off debt faster.

This should come as no surprise, as most Americans – especially millennials – have a lot of debt. From credit card debt to student loans to mortgages, Americans have taken on a lot of debt.

Side hustles are one way to help pay off that debt faster. My entire first book was inspired by my wife and my efforts to make an extra $1,000 a month in side hustle income to help cover our monthly student loan payments.

Contributing side hustle income towards debt is great, but I want to flip the script a bit in this post. I’ve seen a huge response to my posts about investing, especially How Much Money You Will Need to Make $1,000 in Dividends and How Much Money Would You Need to Live off Dividend Income?. It makes working hard and hustling a little easier if you have a vision of getting $1,000 a month in (truly) passive dividend income.

With that in mind I wanted to share a couple examples of how even a small side hustle income of $300 and $500 could have on your finances, specifically in terms of retirement savings. Then we’ll up the ante and see what $1,500 of side hustle income would have on your retirement savings.

Yes, many people will leverage side hustle income to pay down debt, build or pad an emergency fund, or save for something like a house, but I think looking at this in terms of retirement can be helpful. There’s a growing movement of people shooting for financial independence (having 25x your annual expenses in the stock market), and side hustles could help speed up when this target is hit.

Let’s dive into the examples.

Example: $300 of Side Hustle Income for 10 Years

For this first example let’s take a look at someone making a $300 monthly side hustle income. We’ll assume they deposit this into an index fund that gains 8% annually.

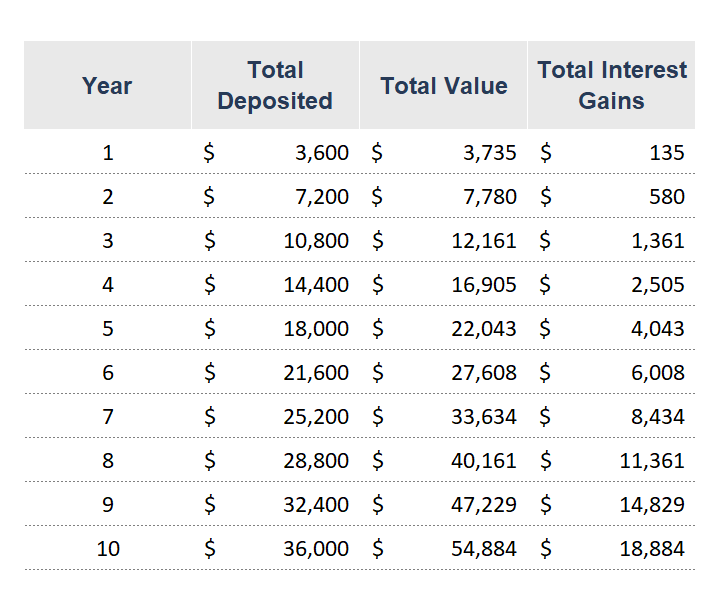

Here’s a table showing how much they’ve deposited each year and how much value their investment account is:

As you can see, if someone consistently deposits $300 a month into an index fund gaining 8%, they would have deposited $36k, but would also have gained close to $19k from interest.

Let’s assume that after a decade of side hustling you are ready to be done finding ways to make an extra $300 a month. Perhaps you are making more at your 9-5, you have children who demand your time, or you are just completely burnt out (which could happen well before ten years, realistically).

Let’s say you let your hard-earned $55k sit for another 20 years. What would that $55k become?

If you are able to restrain yourself from dipping into the funds, you would have about a quarter-million dollars after letting the balance build through compound interest over the next 20 years. This is after depositing nothing else after the first ten years.

Example: $500 of Side Hustle Income for 10 Years

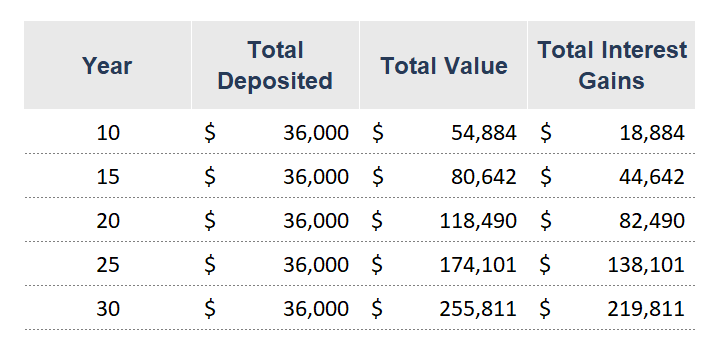

Let’s up the ante a bit and say you are committed to making an extra $500 a month in side hustle income, throwing all of it into an index fund gaining 8% annually. Then you let it sit for 20 years. Here’s what it would look like:

Over $400,000!

I don’t want to sugarcoat this. $500 a month, consistently, for ten years, would require a lot of discipline and dedication. I won’t pretend anyone and everyone can do it, but there are plenty of people who can make $500 a month in side income.

We’ll get into specific side hustle ideas soon, but first I want to go over our last example of $1,500 of monthly side hustle income.

Example: $1,500 of Side Hustle Income for 10 Years

This example is only realistic for those who are truly dedicated to a side hustle and can put a lot of time into it each month. It likely needs to be something that can be scaled, whether it’s a physical product or a blog that can make sales while you sleep (I took this route).

If you haven’t started a side hustle, or your side hustle is more so focused on trading time for money such as pet sitting, a $1,500 side hustle may not add up. There is nothing wrong with delivering for Uber Eats, being a waiter, or any other number of side hustles that can’t be scaled, but I’d encourage you to keep an open mind if you have bigger goals in the range of $1,500 a month (or more).

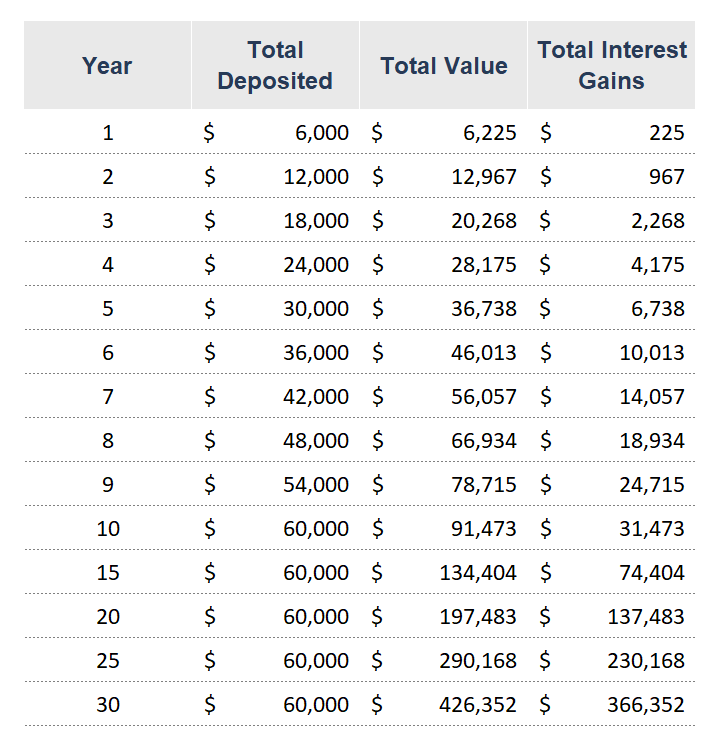

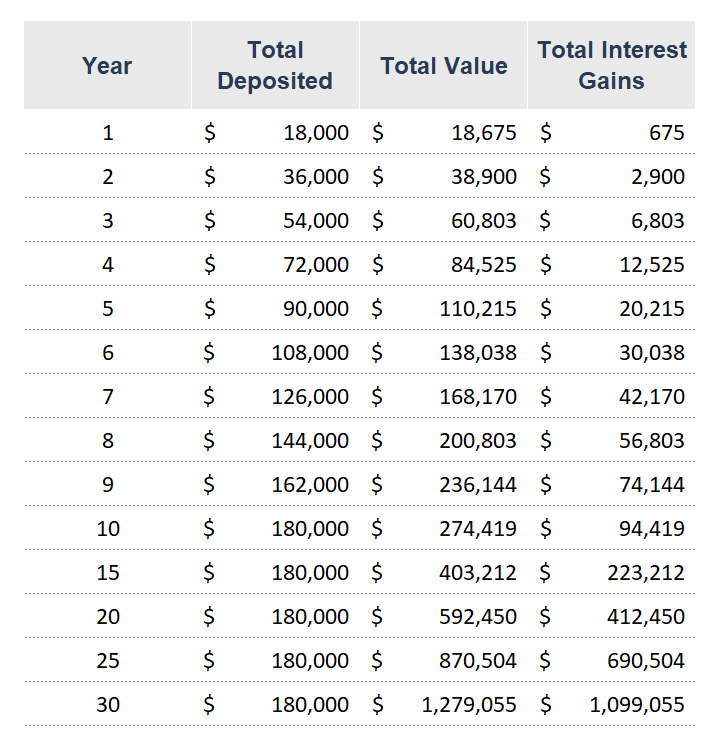

Here’s what the table looks like for $1,500 a month for ten years:

Yes, we are now talking more than $1.25M!

Does this sound ridiculous to you? If so, think about the fact that in this example the individual would be investing $1,500 into an index fund every month for ten years. That’s not a small sum of money. And at 8% interest rate we would expect the total to double approximately every nine years. That’s how you get to the $1.25M+ number.

Side Hustle Ideas

I’m obviously a big fan of side hustles, though I do realize their limitations. They can be demanding and take precious hours out of an already squeezed schedule. But I also think they come with a ton of benefits, obviously the biggest being the dollars being deposited in your account each month.

If you are considering starting a side hustle or starting a new one, here are some things you may want to check out:

- I recently shared 10+ ways I’ve made side hustle income.

- I reflected on 7 years blogging as a side hustle – should you start a blog?.

- Rachel shared the beginners guide to side hustles.

- If you want to scroll through a lot of ideas here is 50+ online and at-home side hustle ideas.

Side hustles are great, but some have opportunities to make more at their 9-5 job. I have said in the past and I will continue to say it: increasing your salary by $10k is easier than making $10k from a side hustle. With that being said, even if you do increase your salary you can still make side hustle income, you just are adding it to an even larger 9-5 salary.

With that in mind we have a few career-related articles that may be worth checking out including:

really interesting thanks for sharing!!!