A few years back student loan refinancing wasn’t something that most people heard about.

A few years back student loan refinancing wasn’t something that most people heard about.

That’s not the case today.

The student loan refinancing industry has exploded. According to LendEDU, private student loans now total approximately $100 billion.

Driving the trend towards more and more private student loans includes:

- Cost of College – As the cost of tuition, housing, and other living expenses continues to rise, more students today are supplementing their federal student loans with private ones.

- Higher Balance of Loans – With grads leaving college with higher amounts of debt, the time it takes to repay those loans are going up. The longer it will take to repay student loans, the higher the potential interest savings.

- Advertising Budgets – There are now start-ups, banks, and credit unions all offering student loan refinancing as a product. Marketing spend on this product has been quite intense the past few years, especially compared to ten years ago.

Let’s dive into student loan refinancing, including what it is (and isn’t), the pros and cons, and who should and shouldn’t consider refinancing their student loans.

Student Loan Refinancing vs. Student Loan Consolidation

Student loan refinancing is a simple process: it takes existing loans, repays them, and creates a brand new loan. The reason why someone would do this is because the new loan would be at a lower interest rate, potentially opening them up for thousands of dollars of savings that would otherwise have gone towards interest.

When you refinance a loan, you are creating a private student loan. You can refinance private or federal student loans.

This differs from student loan consolidation. Loan consolidation only applies to federal student loans and does not give you any interest savings. Instead, it takes the weighted average interest rate of multiple federal student loans and combines them into one loan with one interest rate. The benefits of consolidation include:

- Simplifies Repayment – Student loan borrowers can have as many as ten or more federal student loans, and they can be spread across multiple servicers. That means you need to make multiple payments, which can be a hassle. Loan consolidation simplifies the process by creating one loan, with one interest rate, with one servicers.

- Exit Student Loan Default – Consolidation is one way of exiting student loan default and making your loans current.

- Make FFEL Loans Eligible for Public Service Loan Forgiveness – FFEL loans, which were made until 2010, are not eligible for Public Service Loan Forgiveness. If they are consolidated into a direct consolidation loan, though, the new consolidation loan is eligible (because it is a direct loan).

There are some drawbacks to loan consolidation, including:

- Can Reset your Loan Forgiveness Clock – Because loan consolidation creates a brand new loan, the previous loans you were making payments on no longer exist. That means any payments on those loans no longer matter for income-driven loan forgiveness or Public Service Loan Forgiveness. Your loan forgiveness “clock” resets.

- Beware of Consolidating Parent PLUS Loans – Parent PLUS loans are not eligible for any of the income-driven repayment plans. If you include a Parent PLUS loan or loans in a direct consolidation, though, that new direct loan is eligible for the Income-Contingent Repayment plan, or ICR. The problem is that the new consolidation loan is only eligible for the ICR plan, which is by far the least favorable of the four income-driven repayment plans. In almost every situation it makes sense to not consolidate Parent PLUS loans.

- No Strategic Repayment of Loans Based on Interest Rate – Because consolidation creates one loan with one interest rate, you can no longer prioritize paying off higher-interest loans before lower-interest loans.

- It Cannot be Undone – Once you go through with loan consolidation, there is no reversing it.

We haven’t even gotten to the ins and outs of student loan refinance yet, but you probably already are catching on to the fact that student loans are very complicated. While there is a lot of content on this website, if you want a step-by-step plan to create a strategic student loan repayment plan based on your unique loans and greater financial life, consider giving my book Student Loan Solution: 5 Steps to Take Control of Your Student Loans and Financial Life a read.

Before diving into the pros and cons of student loan refinance, let’s look at a simple example that illustrates the value that can be gained from refinancing.

Student Loan Refinance: A Simple Value Proposition

One reason so many companies are getting into the student loan refinance business is because the value proposition is so simple. Borrowers benefit by saving money on interest, and banks benefit by increasing their assets.

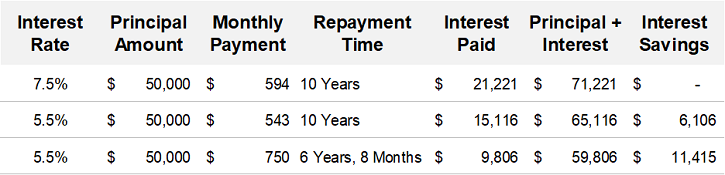

Let’s look at a simple example, Rob. Rob has $50,000 in student loans, with a weighted average interest rate of 7.5%.

As you can see from the above table, refinancing from 7.5% to 5.5% would save him approximately $6,000 over the course of ten years. He would receive $50 a month in additional cash flow that could be used to build an emergency fund, pay off high interest debt, or invest for retirement.

But what if Rob refinanced and and paid approximately $200 more than the minimum towards his loan each month? This would save him approximately $11,000 compared to his loans at 7.5% that were repaid over the course of ten years. But not only that, Rob would be done repaying his student loans in six years and eight months, compared to ten years.

As you can see, the value proposition is simple. But what are the drawbacks? And who should and shouldn’t refinance their student loans?

Get up to a $750* cash bonus when you refinance through a lender on Credible using our link.

Credible offers rate quotes from multiple lenders at once, including SoFi, Citizens Bank, College Ave, and more.

*$750 when you refinance > 100k, $300 below 100k; must not previously received quote from lender with your email to receive bonus

Who Should and Shouldn’t Refinance their Student Loans?

The most important thing to keep in mind with student loan refinancing is the fact that, regardless of whether you are refinancing private loans, federal loans, or a mix of both, you are creating a private student loan.

If you are refinancing federal student loans, you are going to lose access to the legal benefits that come with federal student loans. They include benefits such as:

- Access to loan forgiveness opportunities, such as income-driven loan forgiveness and Public Service Loan Forgiveness.

- Access to income-driven repayment plans.

- The ability to enter forbearance.

With that in mind, here is who shouldn’t refinance their student loans:

- Not comfortable or need access to federal student loan benefits – This is the biggest thing borrowers sacrifice when they refinance federal student loans. There is no undoing refinance once it’s happened, so you need to fully understand and be 100% comfortable forgoing those federal student loan benefits before you refinance.

- It’s a struggle to afford monthly student loan payments – You may be making on-time payments, but the payments could be a stretch for you. If you can’t easily afford your student loan payments, you shouldn’t use refinancing as a strategy to free up cash flow through a lower payment. Instead consider looking into moving on to an income-driven repayment plan.

- No emergency fund – As I discuss in Student Loan Solution, it’s super important for student loan borrowers to have an emergency fund fund (in fact we call it a F*** Off Fund in the book – yes there is more to that story!). Student loan borrowers need to have access to cash to protect themselves in situations where they may be in a bad job, relationship, or other situation where they feel stuck because they have their student loan payments hanging over their head.

This isn’t a comprehensive list of reasons to not refinance, but it hits on the important reasons that will apply to borrowers.

Now that we covered who shouldn’t refinance, let’s talk about who should consider refinancing their loans:

- Private student loans(!) – Private student loans are very comparable, and already lack the benefits of federal student loans. If you can get a lower interest rate on your student loans, it usually makes sense to refinance. In fact, I encourage those with private student loans to get rate quotes every six to twelve months to see if there are better options available to them.

- Can easily afford monthly student loan payments – If you are refinancing federal student loans, you should be able to easily afford your current minimum monthly payments. What I mean by that is it shouldn’t be a struggle to pay them each month, and the payments are a reasonable amount of your monthly take home (i.e. less than 15-20%).

- Emergency fund – You should build up an emergency fund before refinancing your federal student loans. If not, spend time building an emergency fund before refinancing.

- Comfortable forgoing federal student loan benefits – This should come as no surprise, but if you are considering refinancing federal student loans, you should feel 100% comfortable giving up the benefits that come with them.

The key word here is “consider” refinancing student loans. It’s impossible to know whether it makes sense without having a comprehensive overview of your unique financial situation. With that being said, if you fall into these buckets it may make sense to refinance. At the very leas you could check out what rate quotes are available to you and what the savings look like.

Get up to a $750* cash bonus when you refinance through a lender on Credible using our link.

Credible offers rate quotes from multiple lenders at once, including SoFi, Citizens Bank, College Ave, and more.

*$750 when you refinance > 100k, $300 below 100k; must not previously received quote from lender with your email to receive bonus