Do you live with roommates, family, or your significant other?

Do you live with roommates, family, or your significant other?

Do you find yourself wishing there was an easier way to pay for rent every month that didn’t involve nagging people to pay, or making 3 different arrangements to try and pay each other?

We all know that living with roommates after graduating is one of the easiest ways to cut the cost of your living expenses. But dealing with splitting the bill can be one of the worst parts of that arrangement.

When my fiancé and I were living together in our last apartment, I set up an automatic transfer from my bank account to his, and then he would write the check (as I didn’t have any – they weren’t free!).

That was a pain. Thankfully, we can pay online at our current apartment, but I know not everyone has that option, especially if you rent from a private owner.

If you want to make splitting the rent with roommates easier, you should check out RadPad.

What Does RadPad Do?

What is RadPad? It’s a mobile rental marketplace, and the company also offers a more convenient way to pay rent.

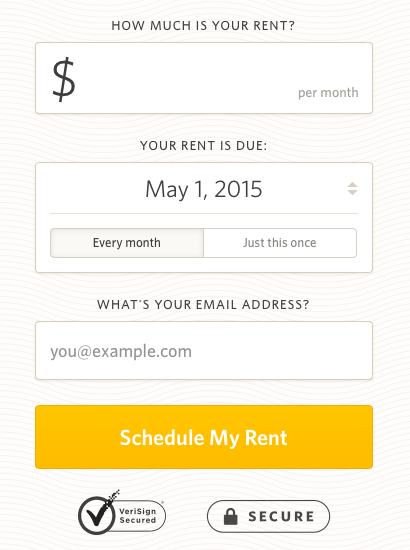

You sign up with RadPad, and you can pay your rent online by debit or credit card.

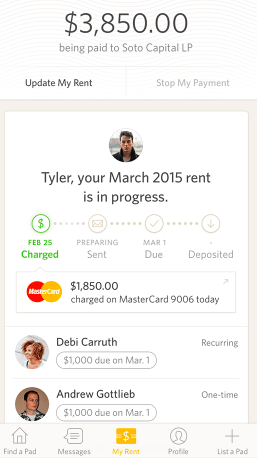

Living with roommates? Have them sign up and then link your accounts together. This allows you to see what each of you owes and when the payment is due. It’s an easy way to keep track of payments.

RadPad offers this service on the web, or you can download the app for iOS or Android.

That means you can make rent payments in advance if you travel often, or if you go on vacation.

It also means you can say goodbye to having to write checks – and personally, I hate writing them!

How Does RadPad Work?

It’s very simple – your landlord doesn’t even need to be signed up with RadPad.

When you sign up and schedule your rent payment, RadPad sends a check to your landlord. The check will have your name on it (along with anyone else who paid), so your landlord will know it’s from you.

You can choose to set up recurring payments, or make one payment at a time.

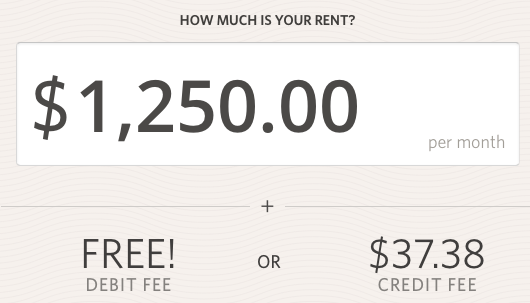

The only downside is that RadPad charges 2.99% of your monthly rent as a fee for using your credit card to pay rent. This is due to the interchange and processor fees paid by RadPad.

The company states that fees will never go up, and they’re working to get them down further.

RadPad accepts VISA, MasterCard, AmEx, Discover, and Apple Pay.

If you want to pay with your debit card, anything under $5,000 is completely free. If your rent is higher than that, you’ll be charged a flat fee of $9.95.

Once you’ve scheduled your payment, RadPad will notify you, confirming everything is good to go.

Worried about reliability? If for some reason your payment isn’t received on time, RadPad has a 100% guarantee that they’ll cover any late fees you might incur.

If your rent payment isn’t received at all, RadPad will cover that month’s rent, refund your payment, and pay any late fees.

You can also check the status of your payment from your account.

Why Make Rent Payments With Your Credit Card?

What I love about RadPad’s site is they give a little detailed breakdown of why you should consider using your credit card to make a rent payment.

This is something that needs to be addressed, as charging a large amount each month can be risky. We’re all about using credit cards responsibly, so let’s review this briefly.

RadPad lists the following reasons why you should consider using a credit card:

- Rack up rewards points – This we can definitely get behind, as Young Adult Money is all about finding ways to travel hack your next trip.

- Get credit card sign up bonuses – I’ve been staying away from some of the fancier rewards cards because I can’t meet the sign up bonus requirement of spending $3,000+ in 3 months. However, if I were to charge my rent, I would easily meet it! Plus, RadPad states payments are not classified as cash advances.

- You need more cash flow – The flexibility is nice in case there’s ever a problem with payroll, and your paycheck doesn’t go through on time, or if you get paid after your rent is due. However, you absolutely should pay off your credit card each and every month. You shouldn’t abuse this flexibility. Don’t keep charging your rent and neglect to pay it. The interest will kill you, and RadPad mentions this on their list.

- You want to build your credit history – If you don’t use your credit card for much else, then paying your rent on it is a good way to make sure you’re using it each month and building up your credit history. Again, just make sure you’re paying it off every month!

It goes without saying you should be renting a place that’s within your budget. Rent is a fixed expense you need to account for every month – it shouldn’t come as a surprise!

However, it’s also one of our largest expenses, and if you hit a temporary rough spot, being able to charge your rent and pay it off in a week or two when you have the money can be a good option to have. (That’s also why emergency funds are good to have!)

____________

Overall, if paying splitting the rent payment with roommates is a hassle, or if you need more flexibility with your payment (and can use your credit card responsibly), give RadPad a try!

How do you pay your rent every month? How do you split it between roommates?

I’m glad the landlord doesn’t have to signup. It’s always awkward asking older people to signup for new technology.

firstqfinance Haha, yes, and then you have to walk them through the process and troubleshoot any issues. =P Though, of course, not all landlords are older, but it does make it easier for everyone involved.