The exact amount of private student loans isn’t known, but recent estimates peg it at about $100 Billion.

The exact amount of private student loans isn’t known, but recent estimates peg it at about $100 Billion.

The increase in the amount of private student loans isn’t surprising, as there are a couple of major drivers in the trend.

First, the cost of college keeps increasing. This includes the cost of living, which many students take loans out for. As the cost of college increases, the amount of debt students need to take on increases as well. That drives many students to private student loans.

There has also been a big uptick in advertising related to private student loans. Both startups and banks have started to offer student loan refinancing as a product. This has naturally led many students to refinance federal student loans, which then turn into private student loans.

Refinancing federal student loans isn’t always a bad thing, but federal student loans have some major differences compared to private ones. We’ll kick off this private student loans guide by talking about how they differ from federal loans, then go into options for dealing with private student loans, and finally get into how you can potentially save thousands on your private student loans.

Let’s get to it!

Federal Student Loans vs. Private Student Loans

Federal student loans are owned by the federal government while private student loans are owned by a private company. Federal student loans come with a number of benefits including.

- Interest Benefit During Deferment – Subsidized federal student loans (not unsubsidized federal loans) do not accrue interest when they are in an eligible deferment period such as while you are in school at least half-time and during your grace period (the first six months after you leave school).

Not having interest accrue can result in big savings, which is why direct subsidized federal student loans are the best option. Unsubsidized federal student loans do not come with this benefit, nor do private student loans.

- Income-Driven Loan Repayment Options – Borrowers have the option of moving federal loans onto an income-driven repayment plan, which essentially caps the required minimum monthly payment at 10%-20% of your discretionary income.

- Loan Forgiveness Opportunities – Federal student loans are eligible for Public Service Loan Forgiveness, or PSLF, which provides eligible borrowers tax-free loan forgiveness after 120 qualified monthly payments.

Another loan forgiveness option is income-driven loan forgiveness. When you go on one of the four income-driven repayment plans and make payments for 20-25 years, the remaining loan balance and accrued interest will be forgiven. With this option you will owe taxes on the forgiven amount, but it’s still much better than not getting your loans forgiven.

There are some other options for loan forgiveness with federal loans, but these are the two major ones. Private student loans do not have loan forgiveness opportunities.

Student loans are nearly impossible to discharge in bankruptcy, but federal student loans at least offer a path to forgiveness. They also offer the most flexibility in repayment.

These are just some of the reasons why I highly recommend prioritizing repaying private student loans over federal student loans.

But this brings up another important point: in general it makes sense to not refinance federal student loans. That’s not to say federal student loans should never be refinanced, but you will want to be very confident that it’s the right decision before refinancing. These post may be a bit repetitive, but I go deeper into federal student loan refinancing in this post.

Enough about federal loans, though, let’s shift the focus on private student loans. What options are available?

Options for Dealing With Private Student Loans

Private student loans need to be repaid, so the first question is whether you can afford your payment or not? If not, here are a couple of options:

Work with your current lender – See if your current lender is willing to restructure your loan, either with a lower interest rate, longer payback period, or both.

Refinance with another company – There are a growing number of banks offering student loan refinancing. If your current lender isn’t willing to work out a reasonable repayment plan, there are plenty of other banks competing for your business. Credible is a company that gives you free rate quotes from multiple companies. If you use my link and end up refinancing your student loans, you will get a $300 cash bonus if you refinance less than $100k and a $750 cash bonus if you refinance more than $100k. (All bonus payments are by gift card. See terms.)

Even if you can afford your private student loan payment, it makes sense to look at what refinancing offers are available to you. You can refinance your private student loans over and over again, so I recommend looking at what rates are offered to you every 6-12 months. Put it on your calendar (seriously).

Let’s look at a quick example of what sort of savings you could be looking at.

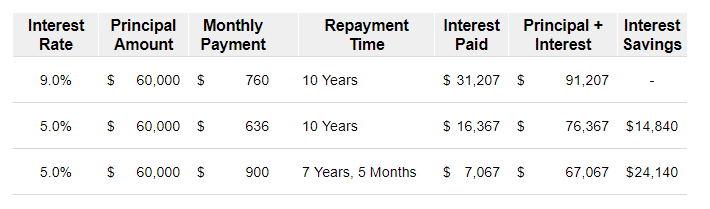

Jeff has $60,000 of private student loans at 9.0% interest rate. On the standard ten-year repayment plan he would pay $31,207 in interest.

If he refinanced at 5.0%, he would pay just $16,367 in interest. That’s a savings of $14,840.

It’s also worth pointing out Jeff increased his monthly cash flow by $124 a month by refinancing.

Let’s say Jeff wants to get rid of these loans even faster. He started a side hustle and he’s diverting some of his earnings towards his student loan debt. If he refinanced at 5.0% and voluntarily made a $900 monthly payment instead of the required $636.

The result is paying only $7,067 in interest, a savings of $24,410 compared to the original loan of 9.0%. He also eliminates his loans after seven years and five months instead of ten years.

Clearly refinancing student loans can be a powerful tool. It makes so much sense to refinance private student loans. You may have less options, but it also makes it clear what you should do if you are looking to save money on interest.

Your credit score is going to be key when it comes to getting access to the best rates. I recently wrote a post about a fellow blogger who raised their credit score by more than 150 points in eight months. In the post I share what worked for him as well as tips for improving your credit score.

A couple of additional notes:

- You can potentially free up cash flow to knock out your private student loans faster by moving your federal student loans onto an income-driven repayment plan. Whatever cash flow savings you have from making the switch can be diverted towards paying down your private student loans faster. This does not have to be a permanent move, you can move your loans back onto the standard ten-year repayment plan once you’ve eliminated your private student loans if it makes sense for your financial situation.

- If you are drowning in debt and none of these strategies are working for you, consider reaching out to Leslie Tayne. She’s a debt lawyer who has experience helping people with an overwhelming amount of student loans. I interviewed her in this post about the topic of what to expect when working with a debt lawyer?

Ready to get some refinance quotes for your private student loans? You can use Credible – you will get a $300 cash bonus if you refinance less than $100k and a $750 cash bonus if you refinance more than $100k. (All bonus payments are by gift card. See terms).