I used to not give much attention to my net worth.

I used to not give much attention to my net worth.

That doesn’t mean I didn’t care about it. I was just more focused on increasing my income and lowering my expenses.

The way I see it, your net worth will continue to move in the right direction as long as you are consistently paying down debt, increasing your income (when possible), and keeping expenses at a reasonable level.

One thing changed where I focused my attention: COVID.

Since COVID took a hold in the United States, I’ve created a net worth spreadsheet – which you will be able to download for free later on – that I update almost every day.

Why do I do this? It gives me a sense of control.

I’m not alone. When there is uncertainty in the economy it is a natural tendency to look at your options. This is especially true if you are unemployed due to COVID but is also true even if you remain employed. We don’t know how the COVID story ends, so it makes sense to understand what cash you have available, what other assets you have at your disposal, and what debt is on your books.

Regardless of the reason you want to track your net worth, the good news is that it’s really easy to create a net worth spreadsheet. It doesn’t have to be complicated. It may require you to log into a bunch of accounts, but I think that’s a good thing.

I’m a big spreadsheet nerd and I like the control it offers. It’s worth mentioning that there is a more automated way to track your net worth.

Personal Capital is a tool that allows you to connect your bank and credit card accounts, among other things (student loans, car loans, mortgage) to automatically calculate your net worth. They use bank-grade security. It’s free and worth checking out. I use Personal Capital but since COVID have been using my spreadsheet since I want a bit more control.

For those who think like me…the way they make their money is through their Certified Financial Planner (CFP) services. They sent me regular communications until I emailed them a couple years ago and said I don’t want to be contacted by my assigned CFP. I haven’t been bothered by them since.

Let’s dive into the steps in creating a net worth spreadsheet.

How to Create a Net Worth Spreadsheet

Let’s get started creating our net worth spreadsheet. You can follow these steps or click here to jump to the bottom of the page where you can download a free template.

First, open a blank spreadsheet (thank you captain obvious).

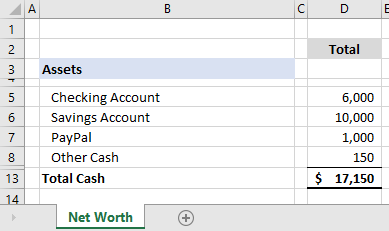

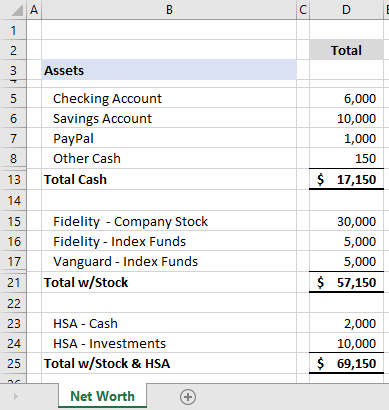

The way I like to view my net worth is a tiered approach. We’ll start with cash. This is money in a checking or savings account.

Since COVID I have become a proponent of the jumbo emergency fund which is what I call a 12-month emergency fund. Having your cash in a separate section will make it easy to understand exactly how much you have in case of an emergency.

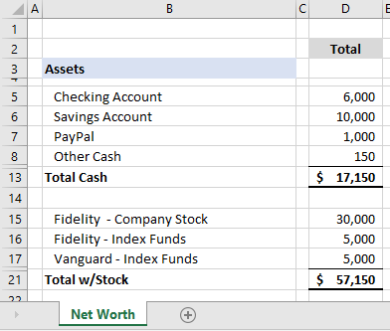

Next I recommend adding any non-retirement investments you may have. This could be any stocks, mutual funds, or vested employee stock.

The reason why I like adding this next is because if you become unemployed there’s a chance you will eventually exhaust your cash savings. While it’s not ideal to have little control over when you sell these investments, they are an additional safety net that can help you avoid going into debt while you are out of work.

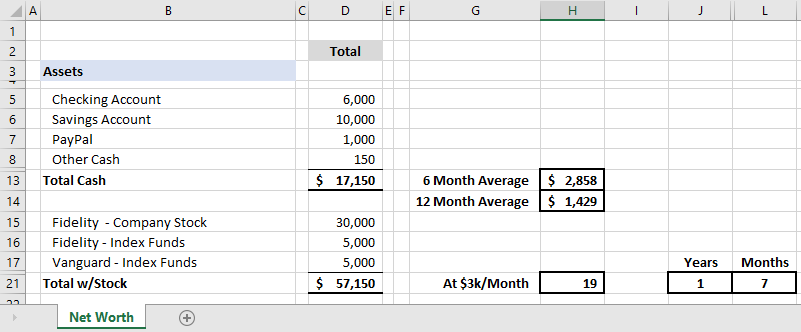

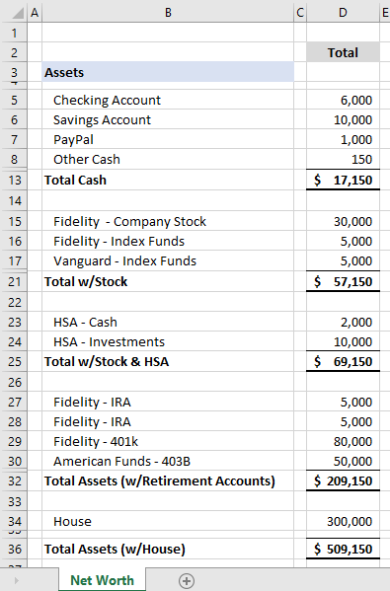

One thing I do in my net worth spreadsheet is calculate how long my cash and investments will last me. In this example the $17k of cash would amount to approximately $3k/month if it was stretched across six months and $1.4k/month for twelve months.

But let’s include the non-retirement investments as well. If you group the cash and the non-retirement investments together and assume $3k/month of expenses, these assets would last you one year and seven months.

As I mentioned, since COVID I have changed my thinking on emergency funds. I now target twelve months worth of expenses for my emergency fund. In addition I have targeted an additional twelve months worth of expenses in no-retirement accounts.

The next thing I like to add in is a Health Savings Account, or HSA. If you don’t know what an HSA is read our HSA Guide. If you have one and haven’t been contributing, now is a good time to evaluate whether or not that’s the right decision. I’m a big fan of Health Savings Accounts, especially for those in their 20s and 30s.

I list this as a third category because it’s an additional emergency fund, but it’s specific to medical costs. It’s still a great security blanket but it’s not quite as liquid as cash or non-retirement investments.

Finally I add the estimated value of my house in the equation. This clearly leaves off things like vehicles and alternative investments like gold and bitcoin, and anything that you could potentially sell to create cash flow.

You can certainly include these assets in your calculation. I chose to leave our vehicles off because of how unpredictable things are with COVID.

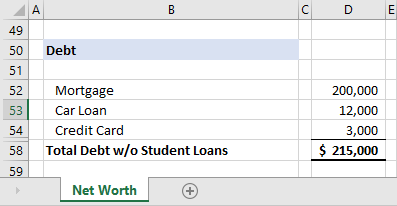

Next we will move on to debt. In the first section I recommend including things like credit card debt, personal loans, auto loans, and a mortgage if you have one.

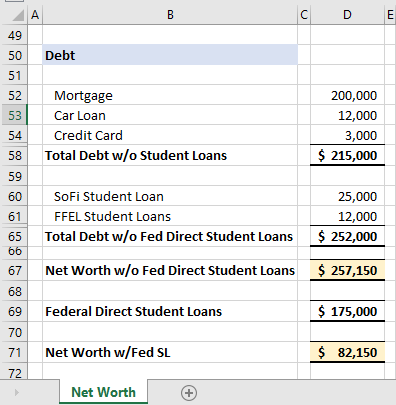

Where this gets interesting is with student loan debt.

If you are pursuing student loan forgiveness, either through Public Service Loan Forgiveness (PSLF) or Income-Driven Loan Forgiveness, I think it can be extremely motivating to carve out that debt separately.

After all, if you are going for PSLF the debt should, in theory, be forgiven tax-free. While it hasn’t happened yet, you should be using that future state of your finances as motivation to stick with the plan of achieving loan forgiveness.

And that’s all there is to it! You can download a copy of the net worth spreadsheet for free below.

You may also want to check out how to create a budget in a spreadsheet as well as my automated budget spreadsheet (free to download).

Join our Online Community to Receive your FREE Net Worth Spreadsheet