There are many ways to maximize your Health Savings Account, or HSA.

We list many of these in our Health Savings Account (HSA) Guide. This guide also provides a nice overview for those who are a newer to Health Savings Accounts.

They include things like:

- Shifting dollars from the savings portion of your HSA to the investment portion of your HSA, which allows your balance to grow tax-free (as long as you withdraw for elgibile medical expenses)

- Maxing out your HSA contributions each year

- Making sure you aren’t missing out on elibible expenses

While some of the more basic hacks to maximize your HSA are a good starting point, there are a couple of hacks that most people don’t know about.

And when I say hacks, let me be clear: these are all 100% legal ways to take full advantage of your Health Savings Account.

If you are ready to take your HSA game to the next level, here’s two things you can do:

Hack #1: Pay with a credit card, not with your HSA debit card

Similar to how a bank provides you a debit card that allows you to make purchases directly from your bank account, HSA providers also provide a debit card so that you can make purchases directly from your account.

The problem with an HSA debit card is that you miss out on credit card rewards, such as cash back and travel rewards.

There is no requirement to use an HSA debit card to use your HSA. You can use any form of payment, even cash, to make purchases. Then all you need to do is reimburse yourself.

It may feel like an extra step, but over time medical spend can really add up. Additionally, when you pay with a credit card it gets you in the practice of uploading a receipt when you go in and reimburse yourself. When you use an HSA debit card, it can be easy to not keep a copy of your receipt.

One other thing to think about is the fact that medical expenses can sometimes be quite material. We had our first kid in 2023 and we knew that the bill would be in the thousands, since we have a high deductible health plan.

So what we did was we signed up for a new credit card that required a certain amount of spend to receive their sign-up bonus (e.g. $2,000 within the first four months to get 50,000 points, which translated to a $500 statement credit). We easily put the required amount on the card when we paid the hospital bill.

To recap: pay with a credit card for the rewards, save the receipt, and go into your HSA servicer’s portal to reimburse yourself.

Hack #2: Track your qualified medical expenses, then reimburse them years down the road from investment gains

This second hack builds off of the first one.

Something that most people don’t realize with a Health Savings Account is that there is not a time limit for when you can reimburse yourself for a qualified medical expense.

Practically speaking, you could have a hospital bill of $1,500 in 2025 that you paid for with a credit card. As long as you save the receipt and keep a record of the expense, you can reimburse yourself 5, 10, 15, or even 40 years later.

One thing to keep in mind is that the eligible expense does need to occur when you have a high deductible health plan and an HSA. So if you had a bill in 2021 but didn’t have an HSA until 2025, you can’t go back and reimburse that 2021 bill.

This is a huge benefit for a few different reasons:

- You keep more cash in your HSA

With an HSA you can put money in pre-tax and take money out pre-tax (as long as it’s for an eligible medical expense). While that cash is in your HSA, you can also invest it.

What this means specifically for our example of a $1,500 hospital bill in 2025 is that you don’t have to take out $1,500 in 2025. You can let that $1,500 you would have taken out and let it grow via mutual fund investments in your HSA until 2025, in which case you can withdraw it. So instead of paying $1,500 with little investment gains in 2025, you can potentially take out $1,500 ten years later totally from investment gains.

- You Build up a Secondary Cash Emergency Fund

If you take this approach you can, at any time, reimburse yourself for your expenses. You don’t have to wait until years down the road.

Let’s say over the course of a couple years you have $2,000 of eligible medical expenses. That means any day you could log into your HSA servicer’s portal and reimburse yourself for $2,000 worth of expenses.

I often talk about an HSA being a medical emergency fund, which it is, but if you are able to hold off reimbursing yourself you can build up a cash reserve that can be tapped, tax-free, at any given time in the future. The longer you hold off on reimbursing yourself, the larger this fund will be.

- Future Medical Expenses May Be Massive

In general, I think the annual contribution limits for Health Savings ACcounts are relatively low.

For example, in 2025 the limits are $4,300 for an individual or $8,550 for a family. To be clear, I am not saying this is a small amount of money and there is certainly an argument to be made that there is an increasing divide of those who have well-funded HSAs and those who do not. But what I am saying is that health care expenses are becoming more and more material, especially for seniors. If you let your HSA grow while you are in your 20s, 30s, and 40s, you will have more tax-free assets to use later in life for expensive medical care such as long-term care in a facility or in-home care.

With this in mind, the more money you can keep within your HSA the more you can invest within your HSA and the larger your nest egg will be for future expenses.

And remember: in a pinch, as long as you tracked your expenses you can always get reimbursed from your HSA. Which is why this hack works so well.

Tracking Your Medical Expenses

The best way to track your medical expenses is in a spreadsheet. What I do is this:

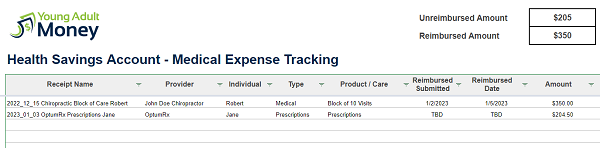

- Create a folder to store your receipts. Include the date and some sort of unique descriptor (e.g. 2022_12_15 Chiropractic Block of Care Robert).

- Add the expense to a tracking spreadsheet. In the first column, include the name of the receipt (e.g. 2022_12_15 Chiropractic Block of Care Robert). That way you can easily locate the receipt that aligns to the row. Remember, if you use the strategy of reimbursing yourself later on, you may need to go back years later – make it easy on yourself. Include other details in the spreadsheet such as what payment was used, the servicer/company you paid, cost, etc.

Instead of starting from scratch you can grab a copy of our free medical expense tracking spreadsheet. I included a couple examples in it to give you an idea of the type of details you may want to record. You can grab this spreadsheet for free by entering your email in the below form:

Join our Online Community to Receive your FREE HSA Medical Expense Tracking Spreadsheet

To recap:

Get yourself a solid rewards credit card instead of using the HSA servicer’s debit card.

Start tracking your medical expenses and saving your receipts.