When you think about all the things getting married impacts, student loans likely aren’t one of the first things you would think of.

When you think about all the things getting married impacts, student loans likely aren’t one of the first things you would think of.

Believe it or not, for some borrowers marriage can have a big impact on their student loans.

In some cases making certain decisions on how you repay your student loans during marriage can cost you thousands or even tens of thousands of dollars.

Conversely, in some situations you can save tens of thousands of dollars by getting strategic about how you repay your student loan debt.

Later I’ll walk you through an example where this is the case, but first let’s establish exactly why this is the case.

When Being Married Impacts your Student Loans

Some student loan borrowers are not impacted by getting married. A good example is if you and/or your spouse both are on the standard ten-year repayment plan. Getting married doesn’t impact your payment – you will continue to make your standard payment, just like you did before getting married.

The same is true of private student loans. See our private student loan repayment guide for tips on how to save money.

If you or your spouse are on an income-driven repayment plan it’s a different story: being married impacts your payment calculation.

Income-driven repayment plans calculate a payment based on your discretionary income. Discretionary income is calculated as Adjusted Gross Income, AGI, less additional deductions related to family size and the federal poverty level.

AGI is a number on your tax return. The way it is calculated is Gross Income less certain allowed deductions. These deductions include, among other things, contributions to a tax-deferred retirement account like a 401k, 403b, or standard IRA. Contributions to a Health Savings Account, or HSA, is another good example.

Income-Driven Loan Repayment Example

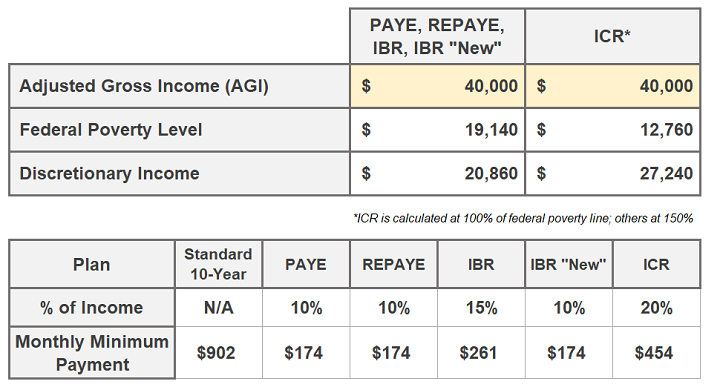

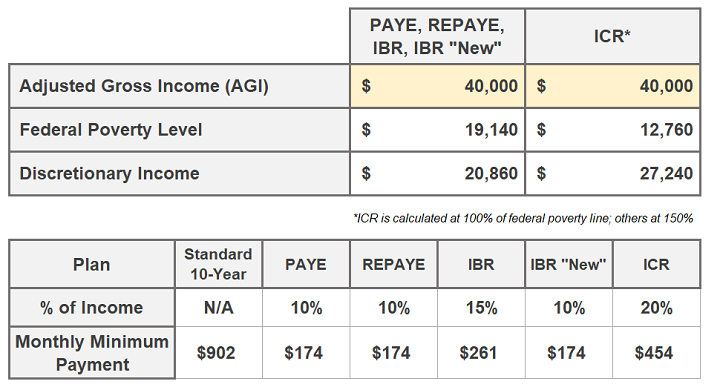

Below is an example from our student loan spreadsheet, which you can download for free and plug in the numbers relevant to your situation.

In this example we are using an individual – let’s call him Ted – with a household size of 1 who lives in Delaware. His AGI is $40k, and she has $85k of federal student loans at a 5.0% interest rate.

By switching to an income-driven repayment plan, his minimum monthly required payment drops dramatically from what it was under a standard ten-year repayment plan:

Clearly being on an income-driven repayment plan can be helpful for borrowers with a significant amount of student loan debt relative to their income.

If Ted was eligible for Public Service Loan Forgiveness (PSLF), where he would get his eligible loans forgiven tax-free after 120 eligible monthly payments, he would have a huge incentive to minimize how much he pays towards his student loans. It’s time for Ted to switch plans.

But what if Ted was ineligible for PSLF based on his employer being a for-profit? In that case as long as he expected his income to stay relatively close to what it is and not see a huge spike in the future, it likely makes sense for him to start working down the path of income-driven loan forgiveness. This loan forgiveness only happens after 20- to 25-years, and the forgiven amount is treated as taxable income, but it could still result in Ted saving tens of thousands of dollars that he otherwise would have put towards his student loans.

Student Loans and Marriage

In our example Ted was single. But marriage impacts the calculation, and the impact can be traced back to how you pay your taxes. Two general guidelines to keep in mind:

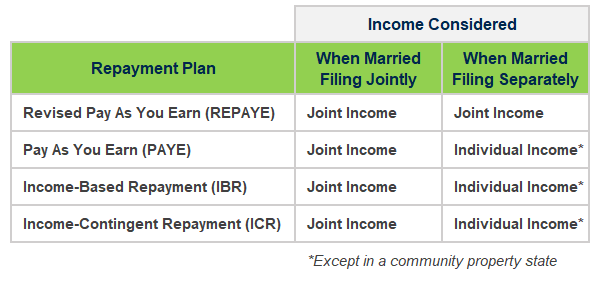

- When you file a joint federal income tax return, your student loan payment will be based on your joint income. In this situation, one thing that potentially helps ease the burden of having two incomes factored in is that student loans from both individuals are also factored into income-driven repayment calculations.

- In general, when you file your federal income tax return as “married, filing separately,” your student loan payment will be based on your individual income. Two notable exceptions: when you are on the REPAYE income-driven repayment plan or when you live in a community property state (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin).

Here is another way of looking at how your tax filing impacts your income-driven repayment calculation:

If you live in a community property state, we’ll go over the implications of that in a minute. But first let’s take a look at the impact on non-community property states.

When you look at the list above, you may wonder why people wouldn’t just switch out of REPAYE and file taxes separate? Well, for a couple reasons:

- You are only eligible for PAYE if you are a new borrower as of October 1, 2007, and you need to have borrowed a Direct Loan or a Direct Consolidation Loan after October 1, 2011.

- IBR considers 15% of your discretionary income instead of 10% like REPAYE, unless you were a new borrower on or after July 1, 2014, in which case you would get the “new” borrower rate of 10% of your discretionary income.

Not everyone is eligible for PAYE, or they likely would switch if filing taxes separately would benefit them. That means IBR is the default second choice, but many borrowers who switch to IBR from REPAYE will be paying 15% of their discretionary income.

Nevertheless, some borrowers will benefit in a huge way by having their income-driven repayment calculated solely on their income and not on their spouses. In these situations a borrower needs to seriously consider switching out of REPAYE.

Let’s look at an example.

In our earlier example Ted was benefiting greatly from being on an income-driven repayment plan. if Ted was pursuing PSLF he would likely end up having tens of thousands of dollars of student loans forgiven tax free, potentially cutting a year or more of work out of his life before he reached financial independence.

But what if Ted is married?

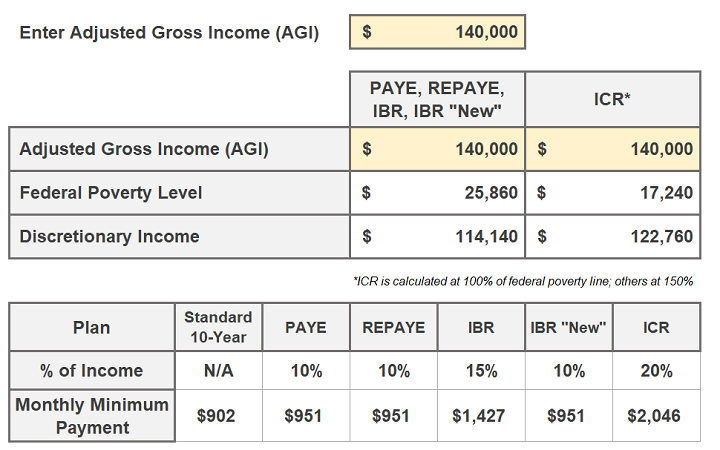

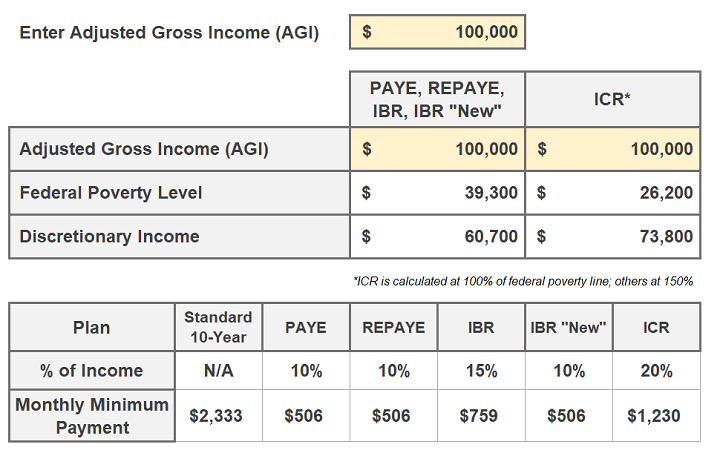

Let’s assume Ted’s wife, Angela, has an AGI of $100k. Let’s also assume she has no student loans.

Ted was previously on REPAYE, paying $174 a month towards his student loans.

Ted and his wife filed their taxes jointly, as most married couples do. For simplicity, let’s assumed their combined AGI is $140k.

Unfortunately Ted’s student loan costs go up significantly in this scenario.

In this scenario Ted is paying $777 more a month – or over $9,000 a year – than when he was single.

Ted is being penalized for being married.

Assuming Ted would get student loan forgiveness if his wife’s income wasn’t factored in, that’s a lot of cash flow to give up each year that could otherwise be going towards paying down debt, investing, or for a house down payment.

Especially if Ted is eligible for Public Service Loan Forgiveness, it makes sense for him to look for a better repayment strategy.

Remember, with REPAYE, it doesn’t matter if you file your federal taxes as “married filing separately,” both you and your spouse’s income is considered.

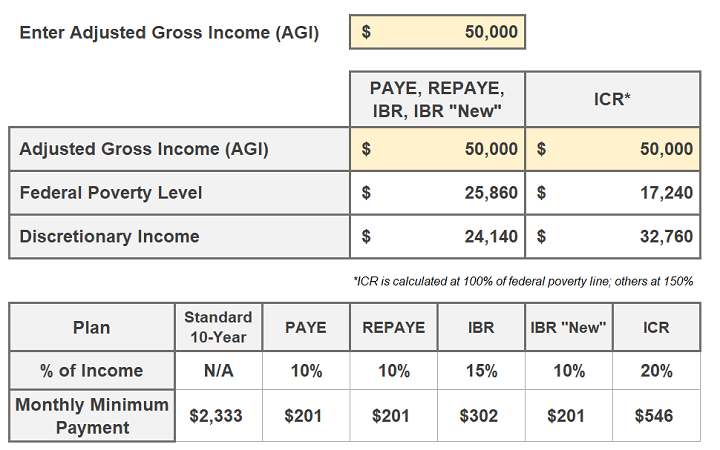

Let’s assume he’s one of those individuals – like my wife and I, and millions others – who is ineligible for PAYE. His next best option is IBR. Since he isn’t a “new” borrower, he has to pay 15% of his discretionary income.

If Ted files his taxes as married, filing separately, and switches to IBR, his required minimum student loan payment would $261 a month.

In this scenario, Ted would still save nearly $700 a month or over $8,000 a year on his student loans by making the switch.

There are some implications to married, filing separately. There is a tax hit that most people take when they go this approach.

Unfortunately the odds are that the average accountant doing tax returns has no idea how your tax filing impacts your student loans. You should still ask an accountant for advice, but take it with a grain of salt.

One way to see how much of a tax hit you would take is going through a tax software like TurboTax and running both married filing jointly and married, filing separately. Then compare the tax difference between the two.

For Ted and his wife, if the tax difference is less than $8,000 then it makes sense to file as married, filing separately.

But we haven’t yet hit on the fact that there are strategies for saving even more money on Ted’s student loan payments.

For example, is Ted putting away as much as possible in his standard IRA and 403b/401k? If not, increasing that contribution will lower his AGI, which in turn lowers his discretionary income, and ultimately his required monthly student loan payment. Read more about strategies for maximizing Public Service Loan Forgiveness (these strategies will be relevant for those pursuing income-driven loan forgiveness as well).

Community Property States and Student Loan Repayment

As if student loan repayment strategy wasn’t complex enough, community property states add another layer of complexity.

Community property states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

In these states, even if you file your income tax return as married, filing separately, each individual must report 50% of their spouses income.

Going back to the example of Ted, he and his wife would end up reporting the same income. I’m oversimplifying it, but essentially his AGI would be $70k and his wife’s would be $70k, instead of $40k and $100k, respectively.

This obviously makes it more difficult for Ted to maximize student loan forgiveness: it doesn’t matter who makes the income, they both need to report it.

There are some scenarios where this could create a unique opportunity, though.

Let’s use another example, Rachel and her husband Jeff. Rachel works at a nonprofit that is an eligible employer for Public Service Loan Forgiveness and her AGI comes to about $100k. She has $220k in student loan debt, all eligible loans for PSLF. They live in California, a community property state.

One key piece of information: Jeff doesn’t work. He stays home raising their two daughters.

Here’s what her payment would look like if they file as married, filing jointly:

In this scenario, Rachel would be paying approximately $6k a year in student loan payments. Since she is going for PSLF, it makes sense to minimize what she is paying. If she files married, filing separately. She could report $50k AGI instead of $100k, since her income would be split between her and her husband, and her husband doesn’t make an income.

She would now pay approximately $2.4k a year instead of $6k, a savings of approximately $3.6k.

Note that I am not a tax expert and I set her dependents at 2 in this example, assuming her and one daughter would be claimed on her tax return and the other daughter on her husband’s. I could be wrong about this – always discuss taxes with a qualified tax accountant.

But the point remains the same that in some situations a community property state could help people pay thousands less in student loans and maximize student loan forgiveness.

Student Loan Resources

Here are a few student loan resources to check out:

Student Loan Solution: 5 Steps to Take Control of your Student Loans and Financial Life