Here at Young Adult Money we really like to focus on increasing income. The problem is, you can increase your income all you want but if you aren’t consistently saving money you aren’t really making much progress from a financial standpoint.

Here at Young Adult Money we really like to focus on increasing income. The problem is, you can increase your income all you want but if you aren’t consistently saving money you aren’t really making much progress from a financial standpoint.

I’ve talked in the past about how my wife and I are planning on buying a car sometime in the near future. It’s hard enough to pay for gas these days, let alone put aside money for a new car that can range in the $2k – $25k range depending on what you’re looking for.

The more money you can put towards a car, the lower your monthly payment will be. That’s where savings comes in. But you don’t want to be stuck with no emergency fund, either. And what about a house? How about a wedding? Life’s expensive, needless to say.

That’s where BoostUp comes in.

What is BoostUp?

BoostUp is a company that helps you save money and has partnered with various companies to give you a “boost” if you reach savings goals. The below 1-minute video gives a great high-level description of their company:

If you watched the video – and even if you didn’t – the key takeaway is that BoostUp is all about helping people reach their savings goals.

Getting Started

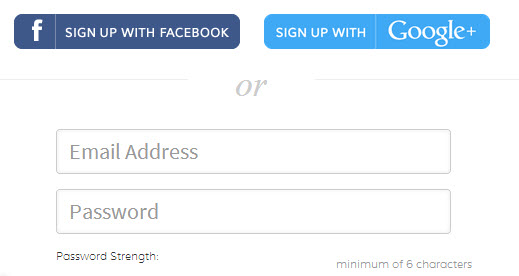

Getting started with BoostUp is easy. You can either login via Facebook, Google, or through your email.

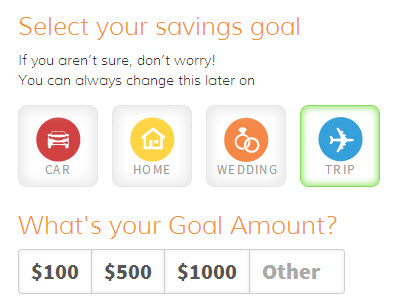

The final step in getting started is choosing a savings goal. I choose Trip because my wife and I are always looking to travel. Throughout this frigid winter in Minnesota I definitely have been dreaming of an all-inclusive resort getaway some place warm.

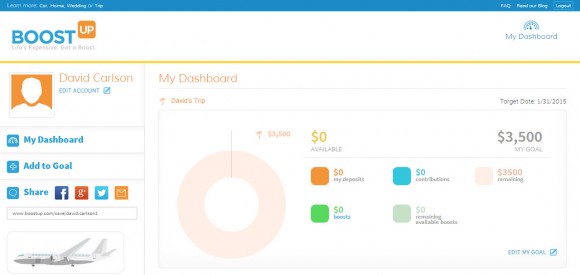

Once you have your account set up you can go to your Dashboard to monitor your progress towards your goal.

There are three basic ways to get money for your savings goal: automatic withdrawals from your checking account, family/friend contributions, and finally partner boosts.

I think the family/friend contribution is a unique idea. While I know many people have mixed feelings about whether or not you should ask wedding guests specifically to contribute money towards something instead of giving a gift, the friend/family contribution can be a great option for couples getting married. You could include in your invite something like “if you would like to contribute towards our BoostUp fund for our honeymoon as a gift, the link is …”

Setting up automatic savings

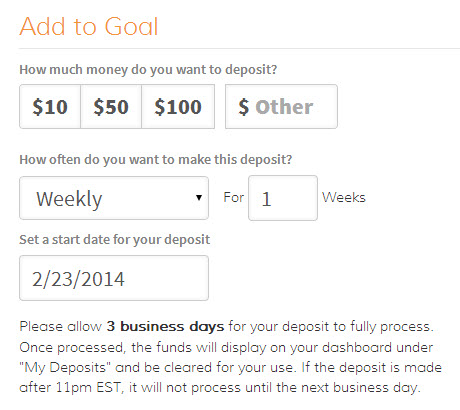

Setting up automatic savings is a key part of reaching big savings goals. Adding deposits and setting up automatic transfers is easy on BoostUp.

Simply put how much you would like to transfer, how often, and for how many weeks or months. Add your bank account information and you are all set.

The beauty of automated transfers like this is that you can “set it and forget it.” As you can see I set my vacation goal as $3,500. This is a large amount, no doubt, but if I transferred $100 every week I would reach my goal in 35 weeks. 35 weeks might seem like a long time, but when you have automated savings set up like this you typically get used to the withdrawals and before you know it you’ve reached your goal.

Partner ‘Boosts’

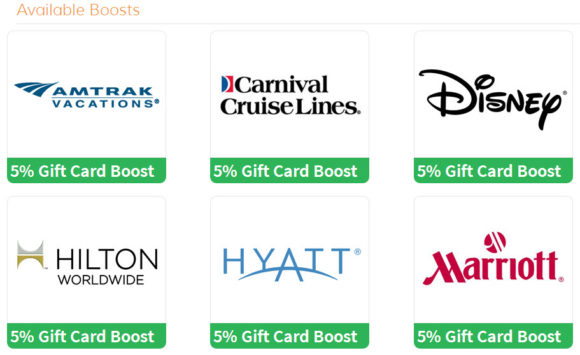

On your Dashboard you will see various partner boosts. Mine was populated with travel-related boosts because I choose a trip as my savings goal.

You can click on each Boost opportunity to view details. Most of the travel ones I looked at offered a 5% match on your first $500.

Pros and Cons to BoostUp

With any service there are pros and cons. Some of the positives of BoostUp are:

- Encourages Saving Money – I like that BoostUp is totally centered on saving up for large purchases. Most large purchases are daunting. Saving up for my wedding was a big challenge and it would have helped to have something that was automatically taking money out of my account for that specific purpose.

- Partner Boosts – Probably the biggest benefit of BoostUp is partner ‘Boosts.’ I think this is where the real value comes into play. For example, Hyundai offers dollar-for-dollar matching up to $500. That means you essentially get a “free” $500 when you buy a car from a Hyundai dealership (be sure to check restrictions on this). That can be a huge ‘boost’ for 20- and 30-somethings who may have trouble coming up with money for a car.

- Wedding/Honeymoon Fund – Let’s face it: it’s awkward (and some argue, wrong) to ask for cash instead of gifts from your wedding guests. I think BoostUp offers a great alternative with the friends/family contribution option.

On their wedding invitations couples usually put where they registered at. If you wanted to provide people an alternative to giving you gifts, you could simply add the BoostUp option to your wedding invite and people could easily contribute towards your bigger saving goals.

There are some things I didn’t like about BoostUp:

- Multiple Savings Accounts? – My wife and I already have automatic transfers each month from our checking to savings account. If it weren’t for the partner boosts you could argue that BoostUp is not much different than a savings account.

- Difficulty Withdrawing – If you want to withdraw your funds without making a specific purchase, you get hit with some restrictions. Below is from the FAQ page:

A check will be sent to the address you provide. Please allow 10-15 business days to receive your check in the mail. We reserve the right to charge a shipping & handling closing fee of $25 that will be deducted from your account balance greater than $25 or if your account balance is greater than $2,500, we reserve the right to charge a 2.5% shipping & handling closing fee that will be deducted from your account balance, prior to the check being mailed.

While I admittedly haven’t gone through the withdraw process, I personally don’t understand why they don’t make it as simple as withdrawing or transferring funds from a savings account.

- Call to Load Boosts – When I was viewing the travel partner boosts it said you had to call a certain number to redeem your boost. There was no option online redemption. I personally do not like having to call to redeem anything. I prefer to do it all online.

I was told that there are some boosts where you do not have to call, such as the Hyundai boost. This boost can be done entirely online.

Overall I think BoostUp can be a good tool, especially if you plan on using the partner boosts. It’s hard to say too many negative things about a tool that is entirely focused on helping people save money.

BONUS: If you register for an account before April 30th, 2014, you are automatically entered to win a 2-year lease on a 2014 Hyundai Elantra or $5,000 cash!

If you are interested in checking out BoostUp for yourself, head over to their website.

Have you heard of BoostUp before? What are your thoughts on their service?

I have not heard about BoostUp before, but think this is interesting. I frequently advise my clients who like to travel to set up separate savings accounts for travel. The cons are definitely a challenge, but the partner boosts make it really interesting. Thanks for sharing!

blonde_finance No problem! I definitely plan on taking a closer look at the partner boosts and seeing which ones I would take advantage of.

DC @ Young Adult Money blonde_finance Be on the lookout for some more partners in the coming months. Stay tuned!

BoostUp DC @ Young Adult Money blonde_finance Looking forward to hearing about them! It would be nice to see some travel ones that are willing to go higher than 5% as well ;)

I’ve not heard of them before either, but they do sound interesting. We actually go the separate savings account route for a few things – like travel, new car, etc. It does take a little work to keep things straight, but it’s easier in the long run because we know exactly what we have for each item.

FrugalRules I’ve been considering setting up separate accounts for each thing like you do, but just haven’t gotten around to it. I think a travel fund would be ideal.

DC @ Young Adult Money FrugalRules We’ve even started piloting a Payroll Deduction program! This way, you never even feel the money leaving your account, and next thing you know, you’re ready to get a boost towards your big purchase!

I’ll have to check out their website as this is pretty intriguing. I wouldn’t mind getting a boost…the Hyundai dollar for dollar match sounds cool. I have a Hyundai but it might not apply to used cars. I think it sounds like it can be a helpful service when saving for set goals. Although it seems like you might be able to just save on your own and buy a discounted gift card. I’ll have to look into Boost more and read the details.

This is an interesting thing here. I’m going to head over to their website. We typically have a couple accounts, as I’m not inclined to keep up with a number of accounts for multiple goals, but if I can get a so-called boost to do so, I’m there.

I’ve never heard of them but sounds like an interesting concept. I agree with you that the withdrawal restrictions should be more simple.

Hmmm….It looks like it has potential, but their partners are few and far between. I own a Hyundai, but am not planning on buying another car anytime soon. While we are planning on buying a home soon, they only offer Quicken loans. I wouldn’t use it until they have a few more partners.

I’d recently heard about BoostUp, but would have to play around myself. I’m pretty on the fence about anything that makes it difficult for me to get my money out (other than a retirement fund of course!)

BrokeMillennial We’re working on making it SUPER easy to get your money out. We’ll be sure to update you when we announce the update!

BoostUp BrokeMillennial This is great news and I’m definitely excited to hear about this update!

Interesting, I hadn’t heard of BoostUp prior to this. I’m extremely saving oriented, so I don’t think this would be something for me. This might’ve been something my wife and I could’ve used when we got married (because we did ask guests for money contributions and got a ridiculous amount of small dollar checks which were a hassle to keep track of, endorse, etc.). I can see how this would could be beneficial for those who need encouragement/motivation to save up.

I am not familiar with Boost Up so thanks for bringing this to my attention. It looks like an interesting concept, although probably fairly new. I agree that it should be easier to get your money. Beyond the boost-up from the select providers they have, it’s really not that much different from a savings account where I can easily move money around. But I think it definitely has potential.

I haven’t heard of them, but it sounds like an interesting concept, especially for a wedding. The withdrawal fees seem like a pretty big disadvantage though.

JourneytoSaving don’t worry! We’re working on making the withdrawal process much better!

It seems like a good concept, but I’m not sure about the execution. It sounds like the company is nudging you towards buying from one of their partners. Which could be fine, but could also ultimately be a net loss, if your best choice is a competitor (or simply not making a purchase at all). The fees are also tough to swallow: they well exceed what you’d earn in interest in an online savings account.

Recently hear about this tool from one of my friend who lives in Chicago.He also told me that he is familiar with this tool since years ago. The app boost up is formerly known as Motozuma and my friend find it very useful. After reading this post I can understand that how it works. Now I also interested about Boost Up, despite of its disadvantages. Thanx for sharing DC.