Dividend income is the ultimate passive income.

Dividend income is the ultimate passive income.

As long as you own a share of a company that pays dividends, you receive a fully passive income.

There is no income stream quite like it.

You could argue that there is some work involved, such as making sure the company is performing well and the dividend will continue to be sustainable. But if this is the only work involved, it’s not much!

Compare this to something like renting out real estate. While you can hand off the responsibilities to a property manager, many people who pursue income from renting real estate typically manage the property themselves. Being a landlord can be a lot of work.

But how much money would you actually need to live off of dividend income? I’ve created a tool that will show us the answer.

Dividend Income Analysis Tool – Live Off of Dividend Income

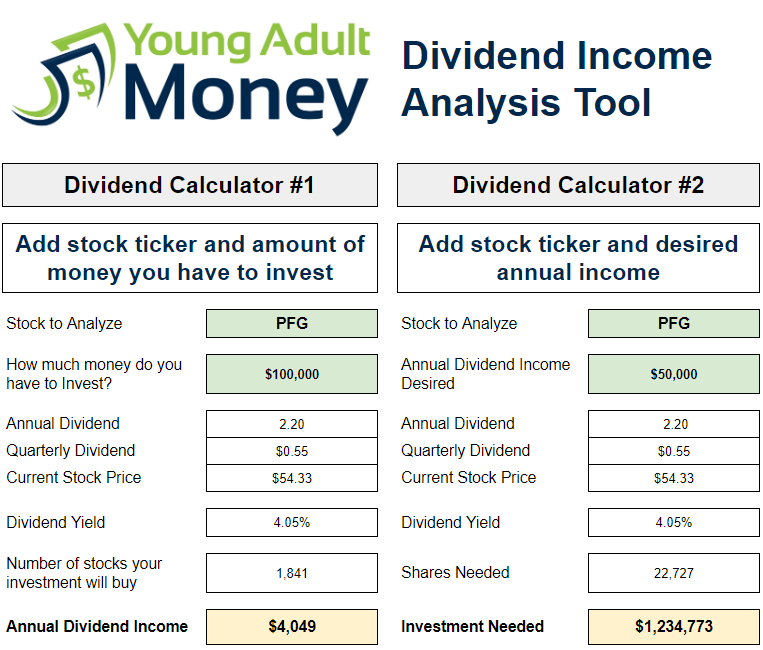

Below is a screenshot of our dividend analysis tool. In this example we are evaluating Principal Financial Group. At the time of this writing, PFG had a $2.20 annual dividend which translated to an approximately 4.0% dividend yield.

The first calculator tells you how much dividend income you could get based on how much money you have to invest. If you have $100,000 to invest you would receive approximately $4,000 in annual dividend income.

Not bad, but it’s pretty much impossible to live off of $4,000 a year. How about $50,000?

If your goal is to receive $50,000 in passive dividend income, you would need to invest approximately $1.25M in PFG stock.

Using this tool you can plug in any stock you want (though it will only work for stocks that pay a quarterly dividend). If you want to plug in different stocks, amounts you have to invest, and desired annual income (maybe you want $100k a year instead of $50k), you can grab a free copy of the tool by scrolling down to the bottom of the post.

$1.25M may sound like a lot of money, so how can you fast forward your path to financial independence?

Well, there are a few steps to work through, including:

- Understanding Your Income and Expenses – You don’t necessarily have to budget (I don’t), but you should at least track your income and expenses to get a good feel of what your cash flow is.

- Building an Emergency Fund – Whether you are starting from scratch (read this) or already have a healthy emergency fund (I highly recommend parking it here if that’s the case), having an emergency fund is an important step on the path to financial independence.

- Eliminating Debt – Eliminating your debt is a key step in building dividend income. After all, if you have high interest debt it’s better to pay it down than to invest..

- Growing Your Income – If you’re like me, you aren’t going to patiently wait for financial independence. I have been blogging as a side hustle for more than seven years and have taken steps to increase my income at my 9-5 job. While it doesn’t always play out this way, if you can increase your income but keep your expenses consistent, that is extra cash flow that can be used to build an emergency fund, pay down debt, or invest.

- Diverting Income to Investments – Most financial advisors will tell you to not overly focus on dividend income, so this post definitely oversimplifies how to best approach investing, but nevertheless extra cash flow should be diverted towards investments. The more investments you have, the more exposure you have to stock growth, dividend income, and the benefits of having access to liquid assets.

If your goal is financial independence, or more specifically to live off of dividend income, it can be a long road. The moral of the story here, though, is to take action! Even taking that simple first step of understanding your income and expenses can be a step towards being financially independent.

Download the Dividend Income Analysis Tool

You can download your own copy of the dividend income analysis tool by entering your email below. Have fun plugging in different numbers and seeing what different scenarios look like. Even $10k a year in dividend income can make a big difference in your life.

Join our Online Community to Receive your FREE Dividend Income Analysis Tool

Please check your spam folder if you don't see the email in your inbox.