Shannon’s regular Tuesday post will be published Thursday this week, so be sure to stop back then!

Shannon’s regular Tuesday post will be published Thursday this week, so be sure to stop back then!

You may have heard of virtual doctor visits, virtual interviews, and virtual classrooms, but what about virtual financial planning?

iQuantifi is “the virtual financial advisor to help you achieve all your goals.” iQuantifi is an alternative to expensive personal finance advisors and requires no phone calls or appointments. All it requires is an internet connection.

One of the things I liked about iQuantifi right off the bat was that it focuses on “trigger events” such as having a baby, needing a new car, etc. Trigger events are the things that have a big impact on a family or individual’s personal finances and are often the hardest things to get a handle on.

Today I will give a review of iQuantifi including what it does, what some of the features are, and what I think the major benefits of iQuantifi are.

To get started here is a short 1:30 clip that explains iQuantifi at a high level: Can’t watch the video? No worries – I’ll go over the content of the video in the rest of the post

How does iQuantifi work?

Registering with iQuantifi is really easy. All you have to enter is an email and password to get started.

iQuantifi does cost money, but you can temporarily get started for free if you share a status update on your Twitter or Facebook account. See more at the bottom of this post.

Getting started was as easy as inputting the following information:

- Family Profile

- Income and Expenses

- Account Balances

That’s all there is to it. They did not request personal information such as account numbers, in case you are concerned about security.

Once all my information was inputted into the system, iQuantifi ran it’s algorithm and told me such things as how much money I should put in my retirement account each month, when my debt would be paid down, and more. This was all put on an interactive timeline that makes it easy to tweak things like how much money you want to put towards debt.

You can also easily add additional goals and debts to your profile and, in turn, your timeline. These include things like vacations, a new family member, and travel:

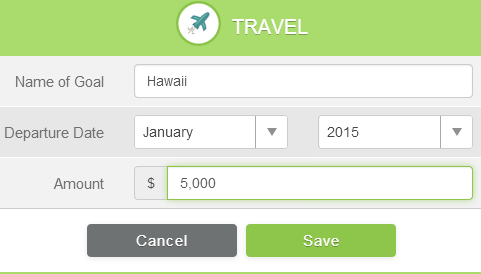

Let’s say I want to go on a vacation to Hawaii with my wife that will cost $5,000. I simply add the departure date and amount of the trip to get it added to my timeline. I choose January because I live in Minnesota!

Once it’s on my timeline I can click it to view details related to this goal, including what my “next action” should be. You can add as many goals or events as you want and iQuantifi will guide you through what you need to do to make the goal a reality.

For example, let’s say you want to take a $5,000 European vacation, but you only have $2,000 in your savings account. If you set the date of the trip only a few months from now, iQuantifi will show that you do not have enough funds to make this possible. It will also show you how much money you would need to come up with to make it a reality. You can move goals around on your timeline and iQuantifi will help you spot what timelines are realistic and which ones are not.

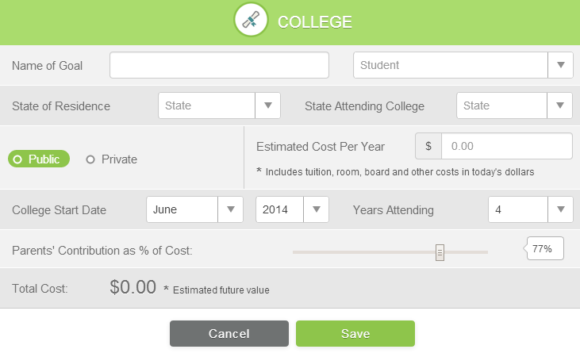

A feature that parents will find particularly useful is the college planning model (see pic below – click to enlarge). You plug in various data such as college start date, estimated cost per year, and percentage that parents plan on contributing. It will then calculate various actions that need to be taken, such as how much you need to save per month.

One of the great features of iQuantifi is being able to view different scenarios and see how they impact your finances. For example, let’s use saving for a college education as an example. Perhaps you estimate that your children’s college education will cost $200,000, which is not unrealistic 10+ years down the road!

Let’s say you plugged in 50% as the amount you would like to contribute and your child will be going to college 12 years from now. iQuantifi will tell you how much you need to contribute per month to make this a reality. Even if you are comfortable with this savings goal, perhaps you want to see how contributing 100% or 10% will impact your finances. This scenario analysis allows you to instantly see what altering certain goals will do to your finances, as well as help you determine which scenario is best.

Major Benefits of iQuantifi

There are many things I like about iQuantifi. They include:

- Cheaper than a financial advisor – I’ve read countless blog posts about whether financial advisors are worth the money. One particular blogger wrote that they were upset about the experience because so much time was spent sitting down with the advisor and rattling off information that the advisor was then inputting into software.

iQuantifi is clearly a (much) cheaper alternative. While you might not get the personal aspect that comes with having a live financial advisor in front of you, you also save money – and time – by using a virtual tool like iQuantifi.

- Focuses on the big things that affect your finances – A lot of focus in personal finance is put on little things, like saving money on groceries or finding new ways to make some money on the side. Don’t get me wrong, these things are important, but it’s even more important to have the big things under control, like having a baby and saving for retirement.

iQuantifi focuses on these big events and helps people plan for them.

- Second Opinion – Even if you already have a plan in place iQuantifi can give you a “second opinion” of sorts. As I explained earlier, you can try out different scenarios and see how they impact your finances. What if you buy a house in two years instead of this year? Or what if you save half as much as you planned for your child’s college fund? Plugging in these scenarios can potentially help you find a better plan.

- It tells you when your goals don’t align with reality – Let’s say you want to take a $10,000 blow-out European vacation, but you only have $2,000 in your savings account. If you set the date of the trip one month from now, iQuantifi will show that you do not have enough funds to make this possible, as well as how much money you’d have to come up with outside of your regular income to make it possible. Try .

iQuantifi is FREE (for now)

iQuantifi typically has a $9.95 per month fee, but if you sign up and share on your Facebook or Twitter account the fee is waived. This is a temporary offer so I would highly recommend heading on over to iQuantifi and checking it out while it’s still free!

How have you handled ‘trigger events’ in the past? Do you have any coming up in the future (such as having a baby, going to grad school, or buying a home)?

____________________________________

This post is brought to you by iQuantifi and I received compensation. All opinions are my own.

I actually didn’t know what iQuantifi did, so this is really helpful. It sounds like a great and affordable tool for financial planning. I think the best thing that financial planners do for clients is help them realize goals and figure out the probability of achieving them, so this sounds like a great option for those who cannot afford a traditional planner. Thanks for the review!

blonde_finance I’m glad you enjoyed the review, Shannon! iQuantifi definitely built a great tool that can give people guidance right from their computer, so it can be a great option for people who feel as though they can’t afford – or justify – going to a financial adviser in person.

Sweet, D.C.! I have never heard of this before but I like it! =)

Nice review DC. I had heard of iQuantifi before, but didn’t know exactly what they did. That said, it sounds like a decent tool for those that may not want to deal with a “live” financial planner or are restricted due to the cost.

This is new for me, but being the anti-social person that I am, it sounds really neat!

Holly at ClubThrifty I’m glad I could introduce you to it!

FrugalRules I think it really is “in line” with how people do business and conduct their lives these days. People want quality tools that do not require human interaction (as sad as that might sound on paper haha). This is a tool that delivers for that purpose.

RetiredBy40 I’m also an introvert and to protect my time I like to avoid meeting in person for stuff like this as much as possible. It’s great to see there’s an app out there that is making it easy – and affordable – to plan your finances.

It sounds like a neat tool, especially because you can play around with the settings. If something happens and you want to change your goals, it’s probably easier to login to your account than to set up an appointment with an advisor.

JourneytoSaving I think it would also be more difficult to run different scenarios by a “live” adviser. They obviously bill for your time so you would be limited as to the number of scenarios you could run past them – unless you have enough money to pay for extended time with them. The tool they built is truly a “21st century” tool imo.

That video is pretty awesome. I did a spit take when the guy said “BAM”.

Do you think you’d pay the $120 annual fee for a service like this?

DonebyForty Haha it’s a good video for sure. I think that’s a good question. I think if you are at the point where you really want to plan out your finances for the future and feel a need to either go to a financial adviser or do something along those lines, it can’t hurt to give it a try. I find it hard to stomach the idea of meeting with a financial adviser and spending hours paying him to type in all our data, and then eventually having him push various products on me. I’d rather do it for less, on my own time, etc. I wasn’t pushed any products in the iQuantifi app, but if there was affiliate links at least I would be able to quickly bypass them or spend time on my own comparing them to other options.