If you have a Health Savings Account, or HSA, and aren’t using it to pay for medical epenxes, you are missing out on tax benefits.

As we explain in our Health Savings Account Guide, HSAs have a triple-tax advantage:

- Put Money in Pre-Tax – Contributions put into an HSA are not taxed. Meaning, your adjusted gross income on your taxes will decrease by the amount you deposit.

- Interest and Investment Gains are Not Taxed – Once your cash balance hits a certain threshold (i.e. $1,000, $2,000, etc.) you can shift any money above the threshold into an investment account. The investment gains are not taxed.

- Withdraw Money Tax-Free – When you withdraw money to cover a qualified medical expense you are not taxed on the withdrawal. In general a qualified medical expense is defined as an expense that pays for healthcare services, medications, or equipment. Clear-cut examples include a prescription you get at a pharmacy or a bill from a doctor visit.

At a minimum, it makes sense to deposit money into your HSA and reimburse yourself for qualified expenses so that you are paying with before-tax dollars.

So how much can you contribute to an HSA? For 2023 the IRS has set contribution limits for HSAs to $4,300 for an individual or $8,550 for a family. For those over the age of 55 there is an opportunity to contribute an additional $1,000.

Besides contributing to your HSA and reimbursing yourself for qualified medical expenses, there are a couple of other ways to optimize your HSA. You can read a more detailed explanation in our post 2 Hacks to Maximize your HSA Health Savings Account, but at a high level they are:

- Pay with a credit card, not with your HSA debit card – When you pay with your HSA debit card, you don’t receive any rewards like cash back or points. Use a rewards credit card that either provides you with travel rewards or cash back. You can view all the latest credit card sign-up offers here.

- Track your qualified medical expenses, then reimburse them years down the road from investment gains – What most people don’t realize is there is no time limit for reimbursing your expenses from your HSA. Meaning, if you incur a qualified expense in 2023, for example, you can reimburse it at any point in the future, even years down the road (you must have had an HSA when the expense was incurred for it to be eligible for reimbursement).

The benefit of tracking your medical expenses and reimbursing later on is that you can keep more cash in your HSA, which allows you to invest more money. Remember, the investment gains are not taxed, so you can keep building your investments tax-free.

Think of the alternative. If you reimburse yourself for a medical expense immediately from your HSA, that cash exits your tax-sheltered HSA account, and you miss out on all the tax-free investment gains.

HSA Medical Expense Tracking Spreadsheet

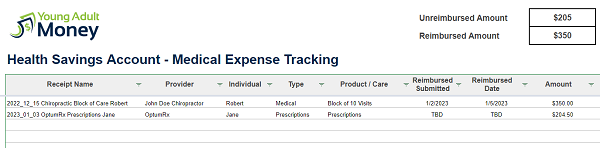

The best way to track your medical expenses is in a spreadsheet. That way you have a record of what expenses you’ve paid for but haven’t reimbursed from your HSA. Then at any point in the future you can reimburse yourself for some or all of the expenses in your spreadsheet.

Here’s my approach:

- Create a folder to store your receipts.

Include the date and some sort of unique descriptor (e.g. 2022_12_15 Chiropractic Block of Care Robert).

- Add the expense to a tracking spreadsheet.

In the first column, include the name of the receipt (e.g. 2022_12_15 Chiropractic Block of Care Robert). That way you can easily locate the receipt that aligns to the row. Remember, if you use the strategy of reimbursing yourself later on, you may need to go back years later – make it easy on yourself. Include other details in the spreadsheet such as what payment was used, the servicer/company you paid, cost, etc.

Instead of starting from scratch you can grab a copy of our free HSA medical expense tracking spreadsheet.

I included a couple examples in it to give you an idea of the type of details you may want to record. You can grab this spreadsheet for free by entering your email in the below form:

Join our Online Community to Receive your FREE HSA Medical Expense Tracking Spreadsheet