We shop at Target all the time, and have for years. I find it to be much cleaner than Wal-Mart with a better atmosphere. Whenever I step into Wal-Mart I feel like I just entered a dimly-lit warehouse. It gives me a bad vibe. Target on the other hand seems a lot brighter and cleaner. Needless to say, I shop at Target much more frequently than I do at Wal-Mart.

When people miss out on easy savings it can be painful for me to watch. Target has one such savings opportunity that is simple to use. When you shop at Target with a Target REDcard, you get 5% off your purchase. It’s that simple.

The greatest benefit of the Target REDcard is you can get it as a credit card (which could be a good option if you have limited or no credit history) or you can get it as a debit card linked to your bank account. If you are worried about taking a credit hit from opening up a “store” credit card then use the debit option instead. The REDcard trumps pretty much every credit card you could use because you are not going to get 5% cash back on every purchase with any other credit card. 1% cash back is fairly standard for cash back credit cards, and you can get 5% by simply signing up for a debit card.

I could have easily called this post “How You Lose Money When You Shop At Target” and it would be just as accurate as the one I chose. When you don’t use a REDcard, you are essentially losing 5% on every single purchase.

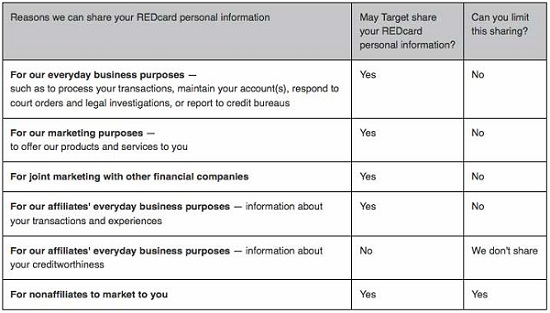

There is a negative that comes with using the REDcard. Target will use your information for various purposes, which are listed below. You can’t limit their use of this information, either.

Essentially whether you want to use the Target redCARD comes down to whether the savings is worth sacrificing your personal information. Each consumer will have to decide for themselves.

What do you think about savings programs like the REDcard? Is it fair to give discounts only to those who sign up for a store debit or credit card?

____________

Photo by Patrick Hoesly

Eesh. the 5% sounds sexy, but I’m not sure I want them to share my information. Thanks for highlighting all aspects of the card-a hallmark of an awesome, thorough writer :)

@Lbeemoneytree Yeah there are definitely pros and cons, though I have heard that the REDCard (as far as privacy) isn’t much different than most credit cards. And thanks!

I don’t shop at Target enough to be enticed by the REDcard. However, Lowes got me with their credit card because of the 5% off every time. That on top of always having a 10% off coupon is great. 15% off at Lowes every time is great especially since we are doing a lot of home improvements right now

@Em23 Wow that’s an incredible deal! I am hopefully purchasing a house before the end of the year, so I may have to look into Lowes. Any place you can get 15% off every time sounds good to me!

@DC @ Young Adult Money They have 10% off coupons in the change of address forms at the post office and you can usually find a printable one online somewhere

@Em23 Thanks for the tip!

I totally think it is fair to do it and I think it is a great tool for those who shop religiously at target. However I’ve only bought something maybe twice in the last year and their locations aren’t convenient to where I live. Congrats on saving 5% though, that is pretty huge!

@Money Life and More I hear you, I do shop there almost exclusively as I can’t stand WalMart. I feel bad for others who shop there as much as me (or more) who don’t get the 5% savings. It adds up and is essentially priced in to their products (imo).

I rarely read stuff that I didn’t know AT ALL about (many topics I’m a little unfamiliar with…but this is totally new). It seems like the debit option is a great way to go if you don’t want credit card debt but want to save. Great post.

@AverageJoeMoney Thanks! Yeah it used to be just a credit card and a few years ago they rolled out the debit card. You really can’t lose with the debit unless you don’t want Target to know your purchasing habits. If you use a credit card they are using the same data so I guess if you just pay straight up cash or debit you could argue for not using it.