Side hustle income can be a great boost to your finances.

Side hustle income can be a great boost to your finances.

Whether your goal is paying down student loan debt or other debt, building an emergency fund, funding travel, or something else, side hustle income may be just what you need to reach your goal.

Side hustle income is great, but most people who start making side hustle income have never had to deal with the sometimes confusing tax implications of extra income.

I’ve had a number of issues with side hustle income and taxes, including:

- A friend telling me I was going to get hit with fees for not paying quarterly estimated taxes throughout the year – which is only partially true

- Having to pay in over $8k in taxes one year

- The IRS losing one of my quarterly estimated tax payments, which meant hours and hours of phone calls with the IRS

Through the process of figuring out how to best deal with side hustle taxes I’ve learned a lot about the topic. In fact, tax hacks have been one of my favorite personal finance topics the past couple of years because of how overlooked they are.

In this post I’ll explain how to pay taxes for side hustle and extra income. It’s a confusing topic for many, but only because they’ve never had a reason to learn about it.

Let’s kick it off by talking about what quarterly estimated taxes are.

Quarterly Estimated Taxes Explained

Quarterly estimated taxes are payments that need to be made to the IRS on certain dates throughout the year if you make income that is not subject to withholding. If you work a 9-5 where taxes are taken out of your paycheck, quarterly estimated taxes are not necessary.

Most side hustles and extra income activities are not subject to withholding. That means there is no employer taking money out of your compensation for tax purposes. Taxes are 100% your responsibility.

The government doesn’t want to wait potentially over a year to get your tax money, so they set up quarterly estimated taxes for income that is not subject to withholding. That way they get a portion of your potential tax bill early on and can use that for current expenditures, to collect interest, etc.

Quarterly estimated taxes are due on the following 2016 dates (2017 dates to be added when available):

- Jan. 15, 2017

In theory you would pay your expected – or “estimated” – tax bill on these dates for the previous three months.

How to Pay Quarterly Estimated Taxes

Paying quarterly estimated taxes is relatively easy. You can either print out paper forms and mail them in, or you can pay online.

I highly recommend paying online partially because the year I paid with paper forms was the year that one of my payments got credited to someone else’s account and I spent approximately 6-8 hours on the phone with the IRS correcting the issue.

Paying Online

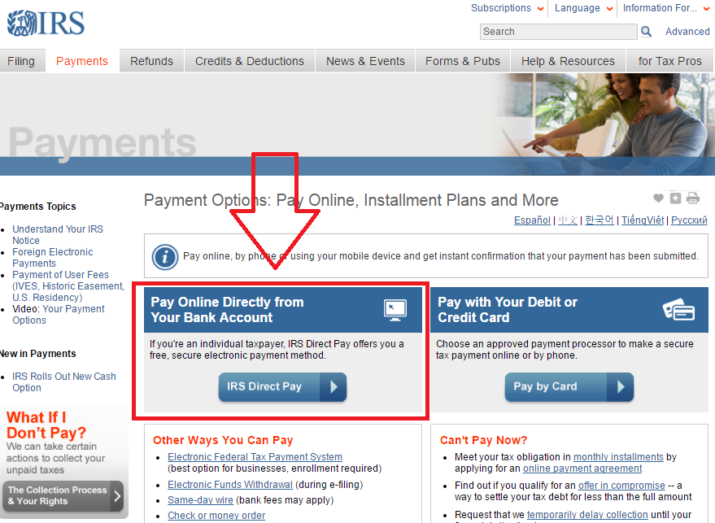

Paying your quarterly estimated taxes online is easy. Go to the IRS Payments Page and choose IRS Direct Pay (click for larger image).

The steps are relatively straightforward once you choose “Estimated Tax” as your reason for payment.

You can also pay with a debit card or credit card. Paying with a debit card costs a flat fee of a few dollars. Paying with a credit card is another option, but it will run you a fee ranging from 1.87% to 2.25% depending on the payment processor.

Why would anyone pay this fee? Well…quarterly estimated taxes can be a great time to churn credit cards for signup bonuses.

For example, let’s say you signed up for a credit card that required $3,000 in spend within the first 90 days. When you do that you get, say, $400 in a cash credit.

To make things simple, let’s say you are making a $3,000 quarterly estimated tax payment. At 1.87% that comes out to ~$56 in fees. That $56 is a small fee to pay if you are getting a $400 cash credit in return for the churned credit card.

Paying Using Paper Forms

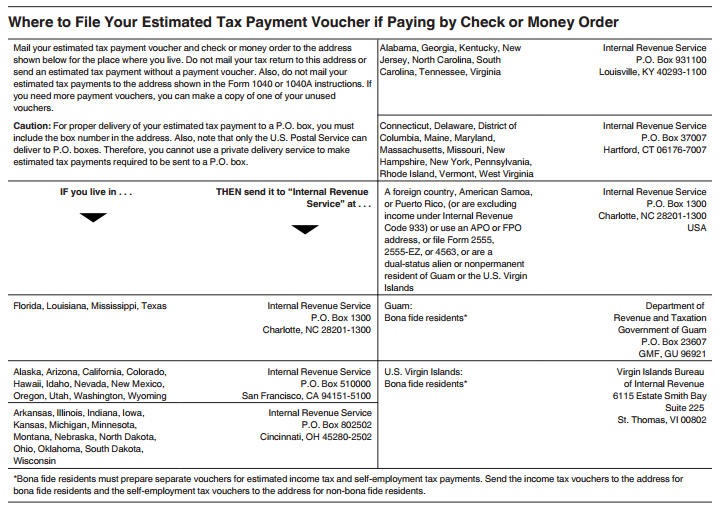

You can print out your own quarterly estimated tax forms by going to IRS Form 1040-ES. These forms are blank and you can fill out whatever amount you want.

Where do you send these paper tax forms? That information is (not surprisingly) found in IRS Form 1040-ES:

State Estimated Tax Payments

State quarterly estimated tax payments work in a similar way. Keep in mind that a select few states have no income tax, in which case this would not be applicable. More likely than not, though, you live in a state that does require quarterly estimated tax payments.

While I could list out every single state and link to their payments website, you likely have a good idea of what you need to do for your state payments if you have a handle on your federal payments. Simply googling “[state name] quarterly estimated tax payment” should get you to where you need to go.

How to Calculate Quarterly Estimated Taxes

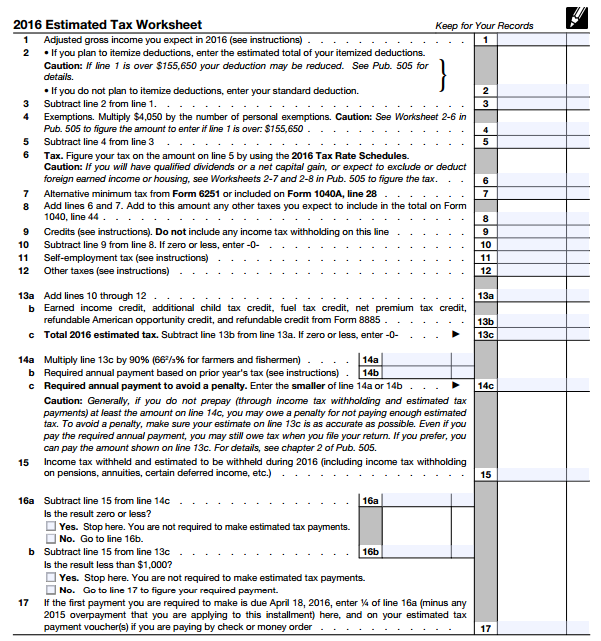

Quarterly estimated taxes aren’t always easy to calculate. The IRS has a complicated schedule to calculate your quarterly estimated taxes in IRS Form 1040-ES.

The schedule is way more complicated than I think is necessary, but there is one important thing that comes out of it: the minimum amount you have to pay to avoid penalties. This amount is found on line 14c:

While the safest bet would be to go through all the steps to calculate your quarterly estimated tax payments – or even pay a tax professional to do this for you – there is a simpler way to calculate your quarterly estimated tax payments.

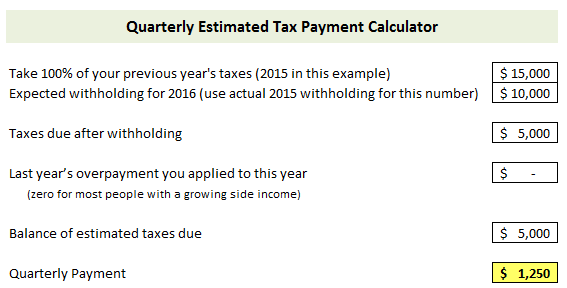

In general, making quarterly estimated tax payments that equal at least as much as you owed last year will help you avoid the penalty for underpayment. But if you are reading this you most likely haven’t paid quarterly estimated taxes before, so read on.

If you use a tax software like TurboTax you might notice that they take a far more simplified approach that is similar to the below example:

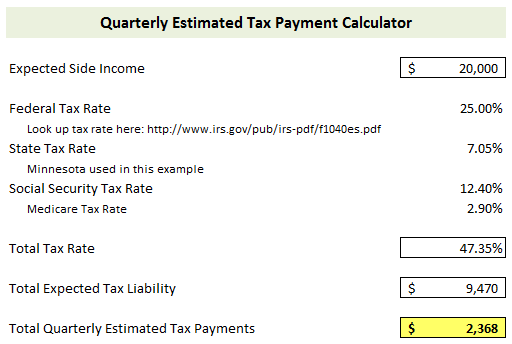

While you don’t want to pay less than the amount that TurboTax populates, you may want to pay more. An alternative formula you could use is:

I prefer method two, because it’s very likely more than you will need to pay in. It doesn’t factor in the possibility that you are withholding more than needed at your 9-5, nor does it factor in tax deductions or credits that will lower your overall taxable income.

Looking at your side hustle income taxes in isolation will allow you to set aside more than enough to cover your side hustle tax obligations, with upside that you will potentially get a nice tax return.

I put together an Excel spreadsheet with the two payment examples that you can use to help you estimate how much to pay. You can download the file below:

Join our Online Community to Receive your FREE Quarterly Estimated Tax Payment Calculator in Excel

A Few More Things to Keep In Mind

With side hustle taxes there are a couple more things that people tend to miss or forget about that I think are worth pointing out.

- Side hustle taxes are higher than 9-5 taxes

Those who have worked as full-time contractors or freelancers likely are well aware of the fact that side hustle taxes are higher than 9-5 jobs, but newer side hustlers who work in traditional 9-5 jobs may not realize it at first.

The reason for this is Social Security and Medicare taxes. In traditional employment situations the employer pays a portion of your Social Security and Medicare taxes. Not so when you are talking about a contract or freelance scenario – you are on the hook for 100% of the tax burden.

When you saw the second quarterly income tax calculation scenario above you likely noticed that the tax rate seems pretty high – nearly 50% in Minnesota. Again, this is taking side hustle taxes in a vacuum and not factoring in credits and deductions, but it’s true that you need to assume a higher tax burden for side hustle income due to the additional Social Security and Medicare tax burden.

- Withhold More at Your 9-5

Another strategy that some side hustlers take advantage of is having a higher rate withheld from their 9-5 paycheck. Having an extra $25, $50, or even $100 withheld from each paycheck can help layer in some conservatism into your tax planning that will help ensure you get a tax return.

While I pay quarterly estimated taxes each year, I also have a small amount voluntarily taken out of each paycheck at my 9-5 for both Federal and State income taxes.

- Keep Excellent Records

Side hustle taxes are already very “DIY” as far as quarterly estimated tax payments are concerned, but it all hinges on you taking action and keeping excellent records of income and expenses.

At the end of the day you need to have clear documented records of all of your financial transactions. This helps not only with making accurate quarterly estimated tax payments, but also with

While some people are spreadsheet nerds like me and have their own system set up, I know many who have started to use FreshBooks to keep track of their side hustle finances. It’s a web-based version of Quickbooks (created by the same company) and can take some of the guesswork out of managing your finances.

I know that was a lot of information to take in, but as someone who has paid quarterly estimated taxes for a number of years I can assure you that it gets easier over time. It can be confusing and stressful at first but eventually it will become an easy process to go through and will take only a small amount of your time.

Any questions that weren’t answered in this post? To those who have been making side income for a while now, what has your experience been like calculating and paying quarterly estimated taxes?

Another great tip about using extra withholding from your 9-5 is that the IRS counts it as being paid prorata throughout the year. So, if you get to the end of the year and realized you’ve significantly underpaid your quarterly estimates, you could put a huge chunk of money in as extra withholding in December to avoid penalties.

The first time setting up the calculation is tough, but after you know how the formula works, it’s a quick process. I do love a good excel spreadsheet-great resource. :)

Great tip Kathryn! I agree it can be painful and confusing the first time you go through the process, but if you start regularly making side or extra income it becomes easier over time.

Solid breakdown DC. We thankfully have a CPA & bookkeeper we use to keep us on track with our taxes now, but I still do all I can to stay on top of them so I know what’s going on. They let us know about half way through the year if we need to make any adjustments on our quarterly payments so we’re not completely out of whack come the end of the year.

That would be nice to hav ea bookkeeper! I have at least 8 hours – maybe 10 – of work to do to reconcile this year’s financials. It’s not fun but I’ve been through the process a few years now so I know what I’m getting myself into.

Really interesting post, thanks for sharing it!!!

Thanks! I’m glad you found it useful!

Very informative post David. Taxes are necessary and lots of people downplay the effect of taxes on your bottom line. I had a little tax rude awakening during my first year as a freelance writer.

Since most of my income is from my day job, I didn’t think I really needed to pay quarterly taxes. But when I accounted for my freelance income on my year end tax return, I went from a nice refund to slightly in the red! I didn’t have to pay a penalty thankfully but it was an unwelcome surprise nonetheless .

Like you mentioned I increased the withholding at my regular job to make up for it since the vast majority of my income is from my day job. Won’t make that mistake again!

Haha many of us have been there Syed, but I’m sorry to hear about your experience that first year! My wife was actually in tears the year we had to make a massive payment to the IRS! We were overly cautious the next year and got a similar sized return (instead of paying in – much preferred!).

My father in law is a physician so I have been helping him organize his paperwork for years. The amount of tax prep work needed to be done before even handing the accountant can be so overwhelming at times.

While I am definitely not a tax expert I have definitely become way more familiar with taxes and it’s amazing all the little nuances that people never think about.

Thanks for sharing!!!

That’s actually the main reason why I don’t hire a tax preparer – I’m already doing a TON of prep work so I might as well just enter it into TurboTax myself. I’ve learned a lot the past few years as I’ve ventured into side hustles, and I agree it’s crazy all the little things that can impact your taxes. You really don’t know about them until you have a reason to know about them.