You’ve probably heard time and time again: the key to successful money management is budgeting.

You’ve probably heard time and time again: the key to successful money management is budgeting.

I tend to think that even just tracking your expenses alone can make a huge impact on your ability to manage your finances.

But the question this begs is “then what?” What are you supposed to do after you’ve started to track your expenses and budget?

I think the first thing to do once you’ve started a process of tracking your expenses is to find money in your budget.

So what does “find money in your budget” even mean? I think it boils down to looking at your spending and finding areas you could have reduced or eliminated spend. Then apply those findings to current and future spending.

At a high level it sounds simple, but let’s dive deeper by looking at some practical actions you can take to actually find money in your budget.

First: Track Your Spending!

An important disclaimer: if you don’t already track your spending and/or budget your money, get started! It’s very difficult to manage your money better when you don’t have data and information on your current spending habits.

Tracking your spending used to be a time-consuming process of pulling together information from various accounts, but Tiller has made it simple. You can even grab my free automated budget spreadsheet that has templates that make it easier than ever to track and review your spending.

Review Three to Six Months of Spend Data

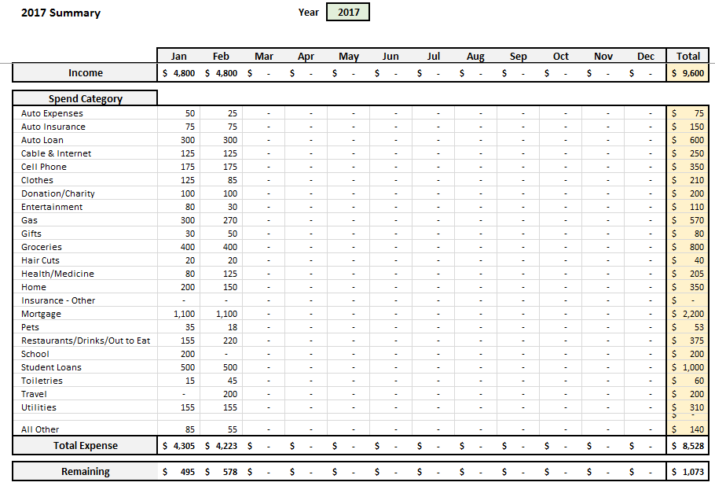

If you are using my automated budget spreadsheet the most valuable tab in the file is the annual tab that shows spend with months across the top and categories down the left-hand side. This view makes it very easy to track the spending trend.

Here’s an example of what this may look like using some mock data and categories:

Specifically you will want to focus on categories where you have room to impact them on a month-to-month basis. These include:

- Groceries

- Restaurants

- Alcohol

- Home-Related Expenditures

- Entertainment

- Travel

- Clothes

- Cell Phone

- Cable/Internet

There may be additional areas in your budget, but this list is a good place to start. While there is no guarantee that there is money to find in these categories in your budget, each presents a potential opportunity to find money.

I’ll go through a few categories and explain how to go about finding money in them.

Cable and Internet

Let’s start with an easy one. Everyone knows that cancelling cable or satellite can provide big savings.

My wife and I put this off for years but have enjoyed savings ever since cutting the cord.

Take a look at how much you’ve been paying for cable and/or internet. What have you been spending on a monthly rate? How much could you save if you cancelled cable?

I did this analysis and after paying back the one-time cost of an OTA DVR and other hardware we would save $67/month. That was savings even after a Netflix and Sling TV subscription. Take those two out and we would save $97/month, every month.

If this is an area where you would like to save money read my step-by-step guide to cutting cable.

Food and Drinks

We’re humans so we will always need food and drinks to survive. It’s an ongoing expenditure, indefinitely.

These type of costs present an opportunity, though, because if you can consistently lower the amount you spend on it, the more money you can find in your budget long-term.

Groceries and restaurant spend go hand-in-hand and I like to tackle both at the same time. There are many things you can do to save money on food (here’s 10 of them), but it starts with setting a baseline.

Over the past three to six months, how much on average have you spent on groceries, restaurants, and drinks? That will be your comparison point.

Now set a goal of how much you want to save. Do you want to cut your restaurant spend in half? Do you have a set amount you’d like to spend per person on groceries? It’s up to you how much you want to challenge yourself.

Then set up a plan of action. How exactly will you cut costs? Will you limit the number of restaurant meals you have? Will you brew coffee at home six days a week instead of no days? Will you meal plan, coupon, and stick to a strict grocery list?

Make a plan and stay motivated each month by comparing how much you saved against your baseline.

Clothes

For some, clothes don’t make up a big part of their monthly spend. For others it’s a big part of their spend.

If you already don’t spend much on clothes this spend category won’t be an opportunity for you to find money. But if you’re anything like my sister there is definitely an opportunity to find some money by cutting the amount you spend on clothes.

Similar to food and drink, set a baseline. How much have you spent per month, on average? And how much would you like to save?

As Erin describes in this post, one of the best ways to spend less on consumer goods like clothes is to force yourself to wait 24-48 hours before making the purchase.

I’ve done this with tablets and for years have been able to talk myself out of buying one. Simply going home and sleeping on the decision can work wonders and virtually forces you to spend less money.

Besides that it can help to identify why and when you are making purchases. Do you go to the mall just to look around and then end up leaving with $200 worth of clothes you didn’t plan on purchasing? Or is it online shopping that gets you?

Finally think about returns. If you buy clothes and don’t end up wearing them, are you in the habit of making returns and getting your money back?

Track and Review Progress

The only way to truly tell if you are finding money in your budget is if you are tracking and reviewing your progress. If you already track your expenses this should be an easy thing to tack on to your monthly process.

Additionally your target spend by category is essentially your budget, so you’ll want to track how close you are to that target as well as how much lower you are from your original baseline.

The more detailed your plan is the more likely it is to succeed. For example with groceries my wife and I consistently plan meals for the next two weeks, make a grocery list before going to the store, and check for coupons and deals that align to our grocery list. We’ve been doing this for years and it takes some time but building that level of detail into our process has really paid off.

Keep in mind your personal preferences when trying to save money. Personal finance bloggers and authors love to point out the daily $5 latte that people buy from Starbucks as an easy way to save money, but for some people that $5 latte is worth a lot more than, say, having a monthly cable subscription.

You have to keep in mind your preferences while also avoiding going down the road of making excuses to the point where you don’t pursue saving any money.

I Cut My Spending – Now What?

Ultimately if you go through the process of finding money in your budget, you will end up at a point where there is nothing else that you can cut or nothing else that you can cut without being miserable.

Once you reach this point you will be in one of two positions:

- Comfortable with the amount of money you have left over each month after expenses

- Still wanting or needing more money to hit savings, investing, and debt pay-down goals

If you are part of the second group – and I suspect many people are or will be – it’s time to look at the other side of the equation: income.

You can either increase the amount you make at your 9-5 or you can look for ways to make extra income above and beyond your 9-5.

We’ve put together a lot of great content over the past few years about how to start a side hustle and how to make extra money. Give these posts a read if you’re interested in increasing your income.

______________________________________________________

Finding money in your budget is possible for everyone. Every single person or family will have a unique budget with their own unique set of circumstances, so it’s important to take a personalized approach to finding money in your budget.

Again, if you don’t already budget or track your spending consider checking out my free automated budget spreadsheet. This will help you get started with the process and allow you to set benchmarks to track your progress against.

What have you done to find money in your budget? What areas do you think you could spend less money on if you really tried?

I agree completely – tracking your spending is the first and most important step for effectively managing your finances. I always used my own spreadsheet, but recently started using Tiller and LOVE it. Great tool that makes tracking so much easier.

I also have always used my own spreadsheet, and I still do to an extent. I created one that works with Tiller and it allows me to have the best of both worlds – automation AND Excel!

Tracking your spending is so important – it seems the obvious place to start but many people blindly cut expenses without knowing where the real drains on their wallet are!

Great point! It’s important to know what areas will make the most impact.

I am totally agree with this list, well I lived without cable and honestly is been a good life,about internet I found a good deal but I keep myself update with better deals…and when I was on debt repayment I tracked every single cent I’ve spent and I bought few clothes, honestly also now that I am debt free I tend to buy few new clothes and only if are on my shopping approved list:D