This post is the first post in our series 7 Weeks to Your Best Finances.

This post is the first post in our series 7 Weeks to Your Best Finances.

This series is meant to serve as a 7-week path to improving your finances. It will cover all the important topics like starting a budget, saving money, making money, investing, and more.

To find out more and see all the tips and ideas for improving your finances check out the dedicated 7 Weeks to Your Best Finances page.

Today I want to talk about a topic that most people avoid: how to connect your dreams to reality.

You see, it’s easy to dream. It’s easy to think of “what things could be like.”

For many people that’s a better job, a higher income, a business, a relationship, or any number of things that would make your life “better.”

For most people it’s a fleeting thought, even if it does show up (for some) on a daily basis. “Wow look at what _____ is doing. I could do that!” And then nothing. No action taken.

Thinking about dreams and goals can be particularly difficult for millennials, which seems backwards (millennials have their whole lives ahead of them, after all). In reality it’s not surprising.

Most millennials who have an office job are either bored, burnt out, or both. Many are underemployed and disillusioned. Most are, at minimum, frustrated with the lack of control they have over their income, work environment, and what they work on. Not to mention the crushing student debt many have taken on.

Every day more and more people give up on their dreams, whether it’s through negative thinking (that will never happen) or simply through getting content and going through the motions.

What I get excited about is helping people connect their dreams to reality. When you connect dreams to reality, which inevitably involves a hard look at your finances and your future, you leave with a renewed optimism and motivation to reach your goals.

Let’s get started.

What are your dreams?

When I give lunch and learns or work with someone on improving their finances, I like to kick it off by having them reflect on what their dreams are.

This accomplishes two things: it gives everyone their “why” and it frames up improving their finances in terms of their dreams.

You see, finances aren’t something most people want to think about. It can bring up a huge range of emotions from disappointment, to anger, to sadness. When people total up their student loans it usually isn’t pretty and can be downright depressing.

But when you think of your finances in the context of “this is the tool that allows me to make my dreams a reality” it’s exciting and optimistic, because it simplifies the path to your dreams. If you do x with your finances, you can get y (your dreams).

And who doesn’t want to make their dreams a reality?

Don’t gloss over the question. Really think about it for a few minutes. What do you want your life to look like in a few years? What do you want to accomplish?

Whatever your dreams may be, finances are a vital tool in making it a reality. And that’s an exciting thing!

While you might not be able to double your income overnight or rid yourself of student loan debt in the blink of an eye, finding motivation to reach those longer-term goals is a huge step in the right direction.

To give you a glimpse at my dreams, here’s what I would like to accomplish:

- Build up my businesses enough to justify leaving a well-paying corporate job to run them full time

- Have control over my work environment (anyone who works in a cubicle in an open office knows what I’m talking about – especially my fellow introverts!)

- Pay off all our debt

- Own a big house where my wife and I can host others often

Now those list of dreams are big and ambitious, but they truly are my dreams and what motivates me to constantly improve my finances, even if it’s just in small ways. It makes $100k in student loan debt a little less depressing when you know there is a path to overcoming it ;)

So you have your dreams written down, or in your mind, but how do you make those a reality? This is where I like to bring in the “financial bridge” strategy.

Why Corporate Finance “Bridges” are Great for Creating Personal Bridges

In corporate finance an important part of the forecast process is our financial “bridges.” They serve an important purpose: bridging from one time period to another.

For example, you may want to bridge the current year financials to next year’s forecasted financials. The bridge would show exactly how you’d go from $X in the current year to $Y next year.

These are useful because it forces businesses to reconcile their financial goals to reality. How exactly will you hit targets? What exactly needs to happen for these goals to come to fruition?

In the same way this bridging exercise can be helpful for turning your dreams into reality. Let’s run through a quick example.

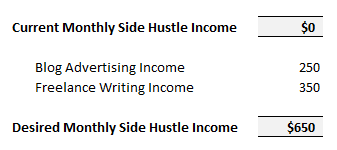

Let’s say your goal is to make an extra $650 in side hustle income each month. Let’s also say that you are pretty set on starting a blog as part of that income.

Their bridge might look something like this:

This bridge shows that they desire to go from a current state of $0 online side hustle income to $650 a month, ideally by the end of the year.

They will accomplish this by starting a blog and leverage that to gain freelance writing opportunities. They will use the freelance writing opportunities of $35 a post for 10 posts a month to account for $350 of their side hustle income. They will also assume $250 a month in blog advertising income.

This bridge could go further as they could leverage their freelance writing opportunities to gain higher-paying ones, or negotiate current clients to a higher rate. Making $1,000 a month from freelance writing is realistic if they could get their rate to a higher price point or get a few higher-paying clients to complement their current clients.

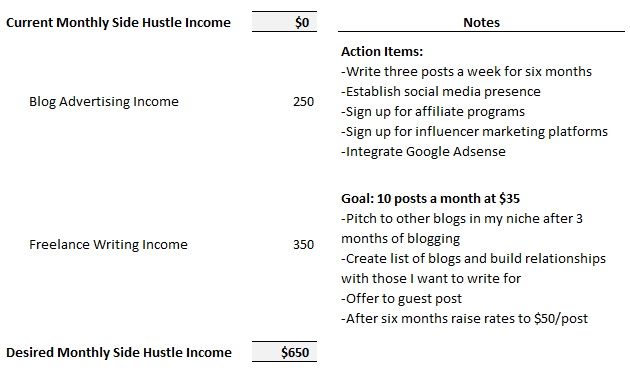

Now the story doesn’t stop with the bridge, though. A list of action items can be made for each financial target or goal. For example, how much time will be dedicated to the blog? What specific advertiser sources (i.e. AdSense, affiliate links, sponsored posts, etc.) will be leveraged to make $250 a month? What websites will freelance writing services be pitched to? When (exactly) will you start pitching your services?

The bridge gives you a high-level view of what needs to be done to reach a goal, but it should be broken down into further actionable steps.

The second pass at the bridge might look something like this:

Keep in mind that the $600/month in side hustle income displayed in this post may be part of a larger “bridge” towards a bigger goal, like paying down debt or saving for a home.

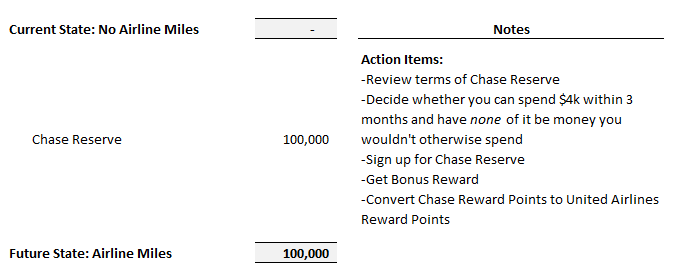

Let’s talk travel. A post I wrote recently outlines my strategy for flying to Europe for free. This is something most of you will be able to relate to.

Let’s say you want to fly to travel to Europe, but between the flight, hotel, and all the other expenses you just can’t justify it.

So let’s make our Europe vacation happen by making the flights free!

Yes this example is very simple, but at this point I simply want you to grasp the concept of bridging a dream to reality.

Some bridges will be very detailed and span years. For example, applying and achieving an MBA won’t happen overnight, but it can happen if you plan properly. Remember: no obstacle – especially financial obstacles – should stop you from achieving your dreams. Make a bridge for your dream and decide whether it’s worth the sacrifice or not.

These are just a few examples and this strategy can be used for all sorts of dreams and goals you have, regardless of how big or small those goals may seem.

If you have your dreams in mind it’s time to reconcile them to reality. Bust out a piece of paper or better yet, an Excel spreadsheet, and start bridging your goals. Your starting point is now and your end point is when your dream – or goal – is anticipated to become reality.

Keep in mind that, unlike corporate finance schedules, your bridge is not confined to a time frame. Meaning you aren’t confined to just comparing right now to a year from now. Perhaps it will take five years to make your dream a reality. What specifically do you need to accomplish each of the next five years to reach your goal?

The great benefit of this exercise is that you are forced to think through what exactly needs to be done, and whether you are willing to make the sacrifices and put in the work necessary.

How to “Stay the Course” with Pursuing your Dreams

One thing I rarely talk about is the fact that I nearly sold my blog a few months before a publisher reached out to me which led to my first book, Hustle Away Debt.

I could have sold my blog for tens of thousands of dollars. It was an easy “out” for me as I had been working hard for three years and let’s be honest: side hustles can be draining, especially when you’ve been working at the same one for multiple years.

I didn’t sell my blog, and looking back it was the right choice. My blog has become a way for me to diversify my side hustles and get opportunities that would have been impossible otherwise.

I originally considered selling because I wanted a break from side hustles. After all, I had a new job in corporate finance and I could finally afford to take a break. I didn’t need the side hustle income per se.

After taking a long hard look at my dreams and what I wanted to accomplish, I realized my blog was an important piece of the puzzle. I knew that my dream was to run a business full-time, and my blog had exposed me to opportunities that simply wouldn’t have shown up if it wasn’t for my blog. It also taught me skills (like content marketing) that were important for reaching my dreams. So I stayed the course.

What is the secret to staying the course with your goals? Here’s a few tips:

If you work in corporate America you’ve probably seen at least one person who has a picture of a tropical location in their cubicle. The reason why is typically the same: it keeps them motivated.

The same concept can be applied to pursuing your dreams. What are you working towards?

Some of my dreams simply can’t be fulfilled by a 9-5 job. Starting and selling a business for over a million dollars, having enough money to make investments that will provide passive income, and being in full control of what work I take on simply do not go hand-in-hand with working a 9-5.

Anyone who side hustles knows that it can be a grind. Working a 9-5 is tiring enough! But for me I stay motivated because I stop and reflect on what I’m working towards, and the only way to bridge from where I am to where I want to be is working on side hustles. So I continue.

You will want to regularly review and reflect on where you are at in relation to your dreams. Have you made progress the past six months? Why or why not?

Are you truly willing to sacrifice what is needed to accomplish your dream?

If your answer is yes to that question you will be willing to hold yourself accountable and stay the course.

The reason I choose personal finance as my niche to blog about is because of how inter-connected it is to every aspect of our lives. It holds power in the sense that it can grant you freedom and – in many cases – allow you to fulfill your dreams.

That’s why I think it’s so essential to tie financial goals and benchmarks to your dreams. If you want to own four rental properties you need to calculate what it will take to get to that point. Once you’ve done that you need to regularly review your progress – and that means reviewing your finances.

Regularly reviewing your finances is not fun or sexy, but it’s incredibly empowering. Ignorance is not bliss for those who want to make their dreams a reality!

Tracking your expenses is key, as is starting budget. Here’s a step-by-step guide to get started budgeting, six different ways to budget your money, 8 books that help you manage your money, and some advice on how to stay motivated while on a budget.

If tracking your net worth is important for reaching your goal the best tool for that is Personal Capital. All you need to do is link your accounts and it will automatically calculate and update your net worth each time you log in.

Systems are an underrated and extremely powerful concept. Tim Ferriss’ book The 4 Hour Work Week is essentially focused on creating a system that doesn’t require you to be actively working for more than four hours. The entire focus of building a business or income stream hinges on the founder (yourself) not being actively involved but still making regular income.

The reason why so many diets fail is because they don’t stick. For many people cutting out all (fill in blank) out of their diet is not sustainable long-term. It’s not a good system because it doesn’t stick.

Systems that stick are systems that become a regular part of your life. Having started a blog over four years ago I’ve found the systems that stick that make it sustainable for me to continue to manage a blog in my spare time. I talk about some of these systems in my book Hustle Away DebtWhat systems do you need to implement in your life to reach your dreams? It usually involves some sort of sacrifice as well as an increased level of discipline.

If your dream is to be a bodybuilder, you are going to have to drop some activities out of your schedule to make time for training. You won’t be able to continue to eat all the same food and drinks you currently consume. Ultimately you will want to set up systems that work – times of the day where you regularly work out, weekly meal prep, and more.

The world is constantly changing, and those who can spot trends and adjust to change are the ones who are most likely to succeed. Remember Blockbuster? It was a household name. It was worth $5 Billion at one point. It had an extreme amount of resources that could be deployed and had every advantage possible.

Blockbuster may be an extreme example, but I think it also gives hope to “the little guy.” Most established companies are terrible at innovating. If someone says to you “your idea has been done before” don’t let it get to you. There are thousands of examples where people succeeded in spaces where others saw no opportunity.

To bring this down to a smaller scale, don’t let setbacks stop you from pursuing your dreams. An unexpected $5,000 home repair can be devastating, but in the grand scheme of things it is a small bump in the road. Perhaps it wiped out your emergency fund and delayed your ability to pay off debt, but you’ll bounce back.

I can be a cynical person (just ask my wife!) but I do think there is power in staying positive regardless of the circumstances. It’s easy to become upset about changing circumstances, especially if it has a seemingly negative impact on what you’ve been working towards, but with change also comes opportunity. The question is whether you are willing to adjust as well?

Do you tend to think about your dreams but not lay out a plan that connects them to reality? What is one proactive thing you will do to bring your dreams closer to reality?

loving this post, I’m going to have a cash diet to save a little bit more still having good social life…I’m already planning and working ahead on my blog and on other personal plans…working in progress fingers crossed!!!

Awesome love seeing you channel your motivation this year to improve your finances! I think a cash diet is a great idea and I look forward to reading about how it goes for you.

Wow, DC, what an inspiring AND practical post! So much good advice in here about bridging from dreams to actionable goals and steps. I think the hardest part is knowing what your dreams are! At least that can be hard for me. I can think of lots of good directions to go in, and sometimes it takes time to discern which is best. But there are common steps I can take that will facilitate a number of those dreams.

Thanks for the kind words! I’ve had this post in mind for a while now but thought the beginning of the new year would be an ideal time to post it.

I agree that for some people it’s more obvious what their dreams are. I think they can change, too, depending on circumstances. Having children seems to be a big one that changes what people are working towards and what they want to accomplish.

Doing nothing. I’m guilty of it. It’s real easy to look at others and say “Wow, it must be nice to be them.”

I like the example of building bridges. I have never thought of it that way before and I like that you mentioned it might take 5 years to accomplish a goal. We all want instant gratification, but, most good things require work and patience.

Yes it’s so easy to do that! Some people do “get lucky” by inheriting or being born into money, a business, etc. but everyone else has had to work and sacrifice to be where they are.

Wow! FANTASTIC article, DC! I love the concept of building financial “bridges” to accomplish dreams. Taking your dreams and then working backwards to figure out exactly “how’ they can be accomplished is a great way to get where you want to be.

I have a dream of FI asap…not to retire, per se, but to ditch Alan’s 9-5 to enable us to work on projects we want to work on – together. We are attacking it from a few different angles…blogging, side hustling and investing in real estate.

I for the longest time had difficulty putting action to the words that I spoke. Too often I talked a good game but never executed. In 2016 it was the first time that I felt like everything that I said I was going to do finally came to fruition. I finally started writing, exercising and spending more time with my family. While it hasn’t always been easy I’m glad that I’ve done it. Thanks for sharing such an inspiring post and I’m definitely going to incorporate your lunch and learn sessions into my life :)

Wow thanks for the kind words! And it sounds like 2016 was a big year for you! I’ve also noticed how freaking quick time passes, so it’s easy to kind of “wait and see” and not take action, but then all of a sudden five years have past. You have to take action if you want to reach your dreams!

Holy moly, this post is so good! It’s both inspirational and informational/actionable. Thank you for not selling your blog. I started mine for a similar underlying reason of getting better at content writing and website management!

Thanks Colin! This is a post I had planned for a while and I’m very proud of it so I appreciate the positive feedback!

I didn’t realize that you had an opportunity to sell your blog. Glad you didn’t! I actually started a study abroad blog back in 2012 and I regret letting it go since I worked hard on it for years. Some other company has since bought the domain name. Also, love the Chase Sapphire Reserve too. The online sign up is ending on January 12th though. Luckily my husband and I already signed up!

Yes it was a good opportunity, too, based on all the metrics I had, but obviously I’m glad I didn’t do it! I think many people can relate to your experience. I think more and more in the future people will realize they can at least cash out SOMETHING for their blog, because the domain name, the age of the site, the content, etc. all has value even if the blog goes dormant for a while.