This post is sponsored by our friends at Progressive.

A couple days ago I used a new food delivery service for the first time. It was extremely easy to do and was done entirely online.

It made me think of just how much can be done from our computer or smart phone. I’ve compared and purchased life insurance online, signed up for credit cards online, and even make most of my income from the work I do on a computer. You can do almost anything these days from the comfort of your home, and I think that’s a (really) good thing.

Today I want to talk about something that many homeowners have, but not everyone has shopped around for: home insurance. There are tools out there to compare rates on hotels and life insurance, but until recently there has been no easy way to compare and buy homeowner’s insurance online.

First let’s talk about the value of shopping for lower rates on services, and why saving money on an expense like home insurance is a great way to improve your finances.

The Value in Shopping for Lower Rates on Services

Despite all of the content I’ve published focused on making extra money and increasing income, I’m still someone who thinks tracking your finances closely and cutting unnecessary or excess expenses is extremely valuable for your personal finances. In fact, when it comes to improving finances, I usually tell people to start by reviewing their expenses and figuring out where they can cut back or save.

When I finally got rid of cable I started to save a considerable amount of money each month. And the savings happen again and again and again. On an annual basis I’m saving the equivalent of a plane ticket abroad, simply by cutting one service cost out!

You don’t have to cancel services to save money, though. If you can save even $30 a month on a recurring expense you are still saving a considerable amount of money over time.

Insurance is a necessary expense. It is also a recurring expense, whether it’s on a monthly, semi-annual, or annual basis. Saving money on recurring costs is ideal because you save money over and over again.

So how do you save money on recurring expenses, like home insurance? You need to shop around and compare rates to be sure you’re getting the best coverage and rates for your home. Many recommend performing an audit of your homeowner’s policy annually. Shopping around for home insurance can be quite a time consuming process—many websites, calling agents, visiting brick and mortar locations.

Enter Progressive Insurance’s HomeQuote Explorer. I took a look at their new quoting experience that allows you to compare and buy home insurance online, which is exactly what you want to do if you are trying to save money.

Comparing Home Insurance Online

Progressive’s new tool, HomeQuote Explorer, allows you to receive multiple homeowner’s insurance quotes online. As someone who prefers the efficiency of shopping for services online, I was intrigued at the prospect of simply plugging in some information and seeing what sort of rates I could get.

When you start the process at the HomeQuote Explorer home page you first enter your home address. The really cool thing about this quoting experience is that it will pre-populate information based on public records, much in the same way that Zillow aggregates home data for their website.

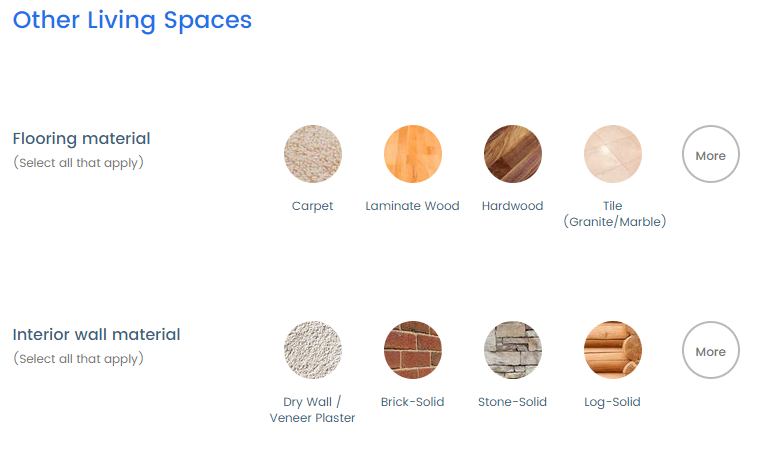

Then the tool asks you a series of questions about your home. If some of the pre-populated information is not accurate, you can edit it. After all, public records will not show what type of countertops you have (or what you changed them to), how much of the basement is finished, or any other number of specific pieces of information that are needed for an insurance quote.

Besides pre-populating as much data as possible, Progressive included a few unique aspects to the questionnaire that make it easy to fill out. For example for flooring, wall material, and other questions there are pictures that make it quick and easy to identify which options you should select.

It took me less than 10 minutes to go through the questionnaire, which was great considering the fact I’m a millennial who is short on patience ;)

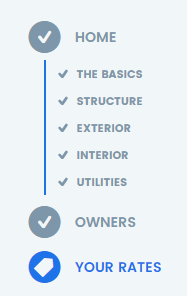

Below are the categories of questions you go through to get to your quotes:

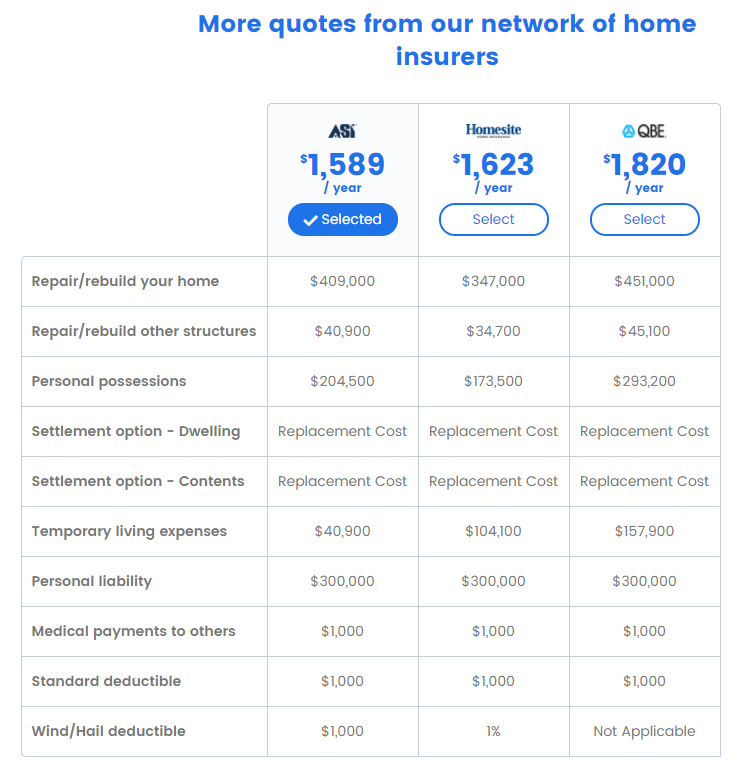

Here’s a view of what I saw when I got to “more quotes from our network of home insurers” (note: not based on my current address for privacy purposes):

Currently Progressive is the only major insurer that lets you instantly compare home insurance rates and coverage from multiple companies side-by-side. This is a feature that I think is valuable for anyone shopping around for home insurance. The lower the rate you can get for similar coverage, the better off you will be financially.

Get a quote from HomeQuote Explorer to see how the rate you get from Progressive stacks up to your current coverage.

Have you ever shopped around for home insurance? What do you think of Progressive’s HomeQuote Explorer?

What services have you compared or shopped for online that resulted in saving money?

I love being able to check rates on progressive! I think it’s kind of cool that they offer that feature (even if you ultimately decide not to use them).

Agreed! It makes you wonder why other companies don’t offer something similar…do they not think their rates are competitive? Who knows.

I always suggest to read well all the terms and conditions, also if some insurance seems better at first sight maybe don’t include a lot of things so read well terms and condition before to choose the real better option for you and your house!