Do you make a side income on top of your full-time job through a side hustle or small business? If so, it’s essential to plan for taxes and make sure that you are paying in and setting aside enough money to cover your tax obligations.

Do you make a side income on top of your full-time job through a side hustle or small business? If so, it’s essential to plan for taxes and make sure that you are paying in and setting aside enough money to cover your tax obligations.

When you are making side income or are self-employed you need to pay quarterly estimated taxes. Quarterly estimated taxes are made four times a year and make up for the fact that you do not have taxes taken out of paychecks. If you don’t pay enough in quarterly taxes you may be stuck with a big tax bill at the end of the year.

Quarterly estimated taxes can be a complicated topic. In this post I try to make it as simple as possible to understand and calculate your quarterly estimated taxes. The sooner you can get your taxes figured out the sooner you can get back to doing more productive things, like earning more side income.

When are Quarterly estimated taxes due?

Below are the due dates for quarterly estimated taxes for 2018:

- April 16, 2018

- June 15, 2018

- Sept. 17, 2018

- Jan. 15, 2019

The April 15th due date for your first quarterly payment comes up quick, so be sure to get your quarterly payments figured out by this date. If you miss any of the dates, don’t panic: just make the missed payment ASAP to show you had good intentions.

How do I calculate estimated quarterly taxes?

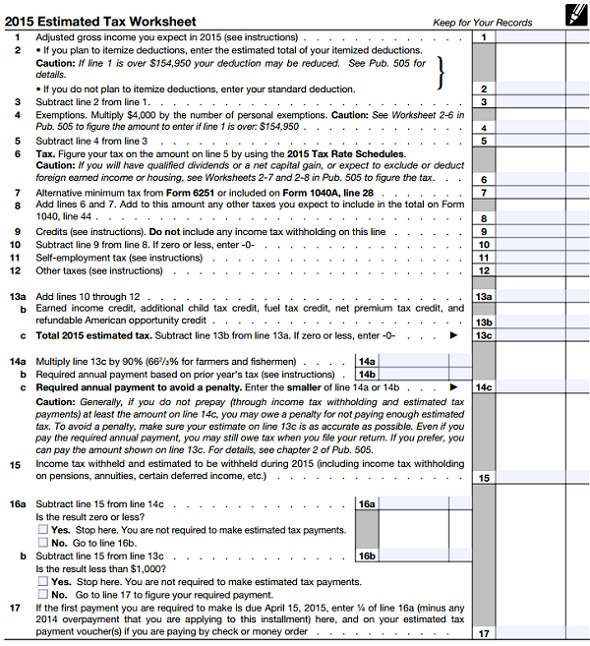

The IRS has a complicated schedule to calculate your quarterly estimated taxes in IRS Form 1040-ES. The schedule is actually way more complicated than I think is necessary, but there is one important thing that comes out of it: the minimum amount you have to pay to avoid penalties. This amount is found on line 14c:

If you’re really worried about being penalized I would recommend you see a tax professional who can help you figure out what your quarterly taxes should be.

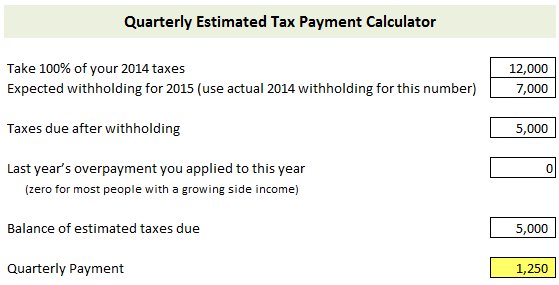

If you use a tax software like TurboTax you might notice that they take a far more simplified approach that is similar to the below example:

Download the Quarterly Estimated Tax Calculator if you want to plug in numbers yourself.

TurboTax will also populate printable quarterly estimated tax payment forms for you, which I used last year. I wouldn’t necessarily suggest using their calculation, though. Side income can vary greatly year-to-year. My side income was 15x higher in 2013 than in 2012. Needless to say, the quarterly payments I made in 2013 were far too low. If my income dramatically changed again in 2014 I may end up over-paying or under-paying by a significant amount.

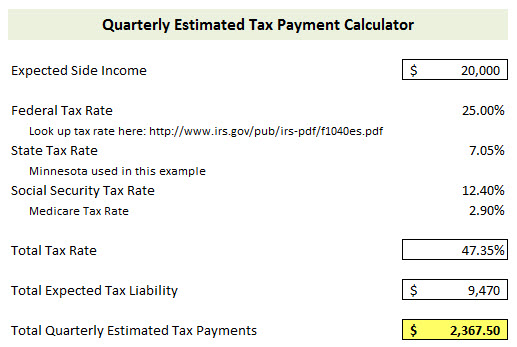

While you don’t want to pay less than the amount that TurboTax populates, you might want to pay more. An alternative formula you could use is:

This calculator is also available for download – Quarterly Estimated Tax Calculator.

Note: If you do decide to estimate your quarterly payments through this alternative method, be sure to make sure that the calculated amounts are at least as much as the ‘TurboTax’ method. Again, if you are worried about paying less than the minimum, you should consider talking to a tax professional.

You can print out your own quarterly estimated tax forms by going to IRS Form 1040-ES. These forms are blank and you can fill out whatever amount you want. Be sure that your quarterly payments are a consistent amount each quarter, though you can typically increase the amounts in later quarters if your income projection was too low.

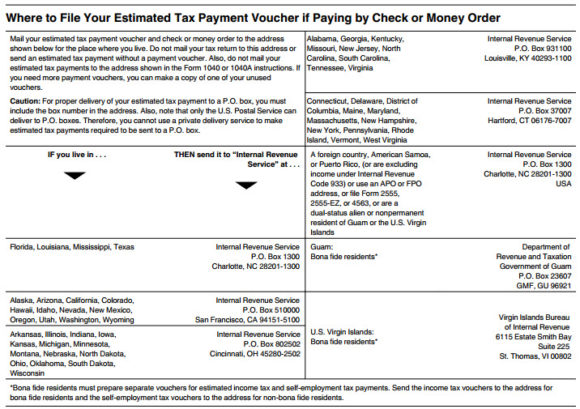

Where do you send your quarterly estimated taxes? That information is (not surprisingly) found in IRS Form 1040-ES (click for larger image):

State Income Taxes

If you live in a state that has an income tax (or in other words, a majority of states), you will also need to make quarterly estimated taxes to your State. You can use the same formula above to estimate how much you will owe, but simply allocate between Federal/State.

For example, let’s say I calculated that I will make approximately $20,000 in income next year. As it shows in the calculator above, I will need to pay in $2,367.50 per quarter. But that includes both Federal and State income taxes. How do you determine the amount to pay each quarter to the Feds and the amount to pay each quarter to the State?

For simplicity’s sake I will take the $20,000 in estimated income and multiply by the 7.05% Minnesota income tax rate. That brings me to $1,410, or $352.50 per quarter. To calculate the Federal estimated quarterly tax, simply subtract $352.50 from the $2,367.50 we calculated earlier. That brings us to $2,015, which is how much should be paid to the Federal government each quarter.

You will have to Google and search for your specific state’s quarterly estimated tax forms, but if you live in Minnesota you can find yours here.

Have you had to pay quarterly estimated taxes? What are your thoughts/questions/advice on the topic? Please share in the comments!

____________

DISCLAIMER: I’m not a tax professional. I’m just a guy who makes side income and has found quarterly estimated tax payments to be overly complicated. I hope you find this article useful but please realize I do not guarantee this information is 100% correct. Taxes are complicated and you should always consult a tax professional on these topics.

Photo by Lending Memo

Okay, I’ve got a question for you – when do I know I need to start paying estimated taxes? This is something I am so confused on. I didn’t owe any taxes on my side income for 2013, because I didn’t make enough to owe. However, I expect to owe in 2014.. so when do I start paying? And where on earth in Turbo Tax does it allow you to file for your estimated taxes, since you have to do that in the current year? When we did our taxes this year, I kept looking for it to pop up and I never saw anything about paying 2014 estimated taxes (and we got the home and business version).

CSMillennial Technically you don’t have to pay estimated taxes in 2014 because you didn’t make any side income in 2013. Turbo Tax won’t assume you will have side income in 2014 if you had none, so that’s why the box didn’t pop up. I actually found their calculation slightly misleading because they only have so much information and we know better than TurboTax how much we think we will make in 2014. I would suggest getting started in 2014 or have more taken out of your pay check this year (I did that towards the end of last year. This year I’m doing it ALL year just to have my bases covered).

At this point anything you put in for 2014 is totally voluntary and up to you. I would suggest guessing what your total income will be for 2014 and then plug it into the calculator to see what your estimated tax bill is. Print off the quarterly tax stubs at the IRS website and pay 1/4 of your estimated tax bill each quarter. You’ll thank yourself when tax season rolls around!

btw – I plan on paying about $700 more than TurboTax populated on the stubs and just printing my own and filing.

I did an awful job estimating my taxes this year, and we ended up with a $6,500 refund. We’ve rethought our strategy since and I’m going to do much better next year!!!

DC @ Young Adult Money Awesome, thanks so much for the information David! This was really helpful. I will plan on paying estimated for 2014 since I know I’ll make enough to owe more than $1000 in taxes this year. I do already have the max taken out of my paycheck, but like you I’d rather have all my bases covered here! Thanks again for the information and advice.

Holly at ClubThrifty Haha at least it wasn’t the other way around where you owed $6,500! We owed close to $6k :0 I kind of expected it, but thought it would be closer to $4k. Oh well, you live and you learn.

CSMillennial DC @ Young Adult MoneyNo problem! On my paycheck you can choose to have a certain amount taken out on top of what is regularly taken out. So each paycheck I have an extra $100 taken out for Federal and $50 for State. I will probably keep that even though I’m also going to pay a relatively large quarterly estimated tax as well. But yeah, whatever is easiest for you. It might be good to pay the quarterly taxes just to get in the habit and it feels good to type them in when you’re preparing your taxes and see your tax bill go down or your refund go up.

This is extremely helpful! While I do not technically need to pay this year, I plan on sending Uncle Sam something. I’ve been estimating 20% but I’m going to up that to 45% instead. YIKES!

fitisthenewpoor It’s a bit crazy how high the tax rate is. You only really think about it when you have to calculate the payment yourself!

Taxes do add up quickly. I think sometimes it is better to err on the side of caution and overpay a little bit vs. being stuck with underpayment penalty.

BudgetforMore This year I definitely plan on being much closer to $0 if not get some money back. Part of that plan is reviewing where I’m at when September comes around and whether I need to have more taken out of my paycheck the last quarter of 2014.

I believe you can pay online, can’t you? I thought I saw something about that. I am using the TurboTax calculation, but I changed it a bit to come up with a better number.

I felt really bad for you when you commented on my blog about tax issues, but happy for me, because I knew it would inspire a post like this that will help me with my tax situation. So thank you for figuring out for us and sharing! :-)

This will be my first time having to pay quarterly taxes and I’m definitely going to see a tax professional/accountant because it all seems too confusing for me.

So if you put all your side income into a SEP or solo 401k, you’d only need to send in Medicare and SS?

DebtRoundUp Yep there are online pay options. I also plan on paying more than the TurboTax numbers indicated.

blonde_financeHaha my Dad said the same thing when I was over at my parent’s house “well, it’ll be a good blog topic.”

debtperceptionI think the IRS worksheet (screenshot of it in this post) is way too complicated. I think most people can calculate income, and in turn taxes, somewhat reasonably with a few simple calculations. Divide by four and you’re done! Of course, if you make more money than expected you will want to set that aside in a bank account for when tax time comes around (I took this approach for 2013 taxes).

EyesonthedollarI’m not 100% sure, Kim. I don’t know much about SEP or solo 401ks, but I would assume so?

Oh taxes are so much fun. Luckily, I feel like I’m getting much more organized this year!

DC @ Young Adult Money Eyesonthedollar I’m still learning too. That will make a great post when I figure it all out.

This is a really good explainer. My main freelance job takes out taxes just as a normal employee, so I’m grateful it’s not this complicated yet.

Good stuff there, David. Do you know if these quarterly payment requirements apply to rental income as well?

Since I still have a full time job, I can just increase my withholding. I can even do a larger amount at year end, rather than all throughout the year.

That’s a great way to do it if you still have a full time job. I claim 0, and take another $600 a month for the feds and $300 a month for the state.

BudgetBlonde Same here, Cat!

MichaelSaves Interesting that must be a pretty big freelance job then?

DonebyForty That’s a good question, and I’m honestly not sure. I do have some rental income from our basement studio but I didn’t think about whether you’d need to make quarterly estimated payments if it was your only ‘side’ income.

No Nonsense LandlordI did that towards the end of last year and will probably continue just because I’m sick of paying in and it would be nice to get a check in 2015. I am trying to have my side income as separate as possible from my ‘regular’ income so I will be making quarterly payments.

I know I’m supposed to, in fact I’ve been self employed for a few years and I haven’t done it. I always just wait and do the whole year at once. One of these days I’ll start doing it.

Miss Tightwad This is the year! It’s not nearly as complicated to get started as the IRS form makes it sound.

My accountant sets this up for me, but speaking from experience from last year and not paying quite enough each quarter and having to owe way to much at the end of the year, I plan on reevaluating things each quarter. The joys of self-employment!

Thanks for the guide DC. I’m not self employed yet, so no quarterly taxes for me, but I will keep this in mind for the future! And I thought the disclaimer was awesome, btw.

I went to a tax place this year thinking I would have to start paying quarterly taxes but she said I didn’t need to. I guess I don’t make enough? Taxes are so confusing and scare me. I’m curious to know how one would pay quarterly taxes when married and filing jointly.

debtperception You can just file them under your name and social security number. I file jointly but I just file them under my name and SS. You could add your spouse on the payment stub but honestly it doesn’t matter because when you file jointly it all combines anyway.

If you plan on making $2k or more I would definitely consider making the payments. The Q1 payment is due tomorrow (needs to be in the mail) but if you miss that you can always start with Q2. Trust me, it helps come tax time! I would just take about 40% of what you think you will make and pay that in quarterly taxes.

Taxes aren’t fun and it’s difficult when you don’t know enough about them (trust me, I didn’t know what a quarterly tax was a little over a year ago!) but once you start looking into it and understanding it more you realize it can be simplified a bit.

I am working on estimating taxes for an income that my wife has where she is a 1099 employee. We both also have incomes where we have witholding and receive W-2s. I like the simplicity of the worksheets you have here. I do have one question. When you enter “Expected Side Income” in the second worksheet, is this simply the gross income that you have received for the year for the work on the side, or is this adjusted in any way? I have to say the 1040-ES explanations from the IRS are very complex to me. I will likely get the advice of a tax professional as well, but thought I would ask someone who has been through this already.

patriot202 Sorry for the late reply – I don’t get email notifications for comments on this post anymore. When I think of “expected side income” I think of the overall profit I will make as an employee, not the top-line “revenue” figure. For example, I have writers for Young Adult Money so I subtract that from my earnings. I also had freelance writing income in 2014 but had zero expenses to offset it, so I put the total on my 1099 in the “expected side income” bucket.

Hope that helps!