Anyone who has thought about passive income has asked themselves the question: how much money would I need to live off dividends?

Anyone who has thought about passive income has asked themselves the question: how much money would I need to live off dividends?

Not that dividend income is the only form of passive income, but few would disagree that dividend income the ultimate passive income – it requires little to no effort to maintain.

Many companies pay dividends, but the dividend yield can vary greatly from company-to-company, and some companies pay no dividends at all.

Living off dividends is a long-term goal of mine, though it wouldn’t be easy. It’s not realistic unless you have a large sum of money to invest in dividend-paying stocks, hence the reason it’s typically a longer-term goal of people versus something you can achieve in a short-period of time.

One thing you will notice when you start researching dividend-paying stocks is that the yield is usually relatively low. Companies are forced to decide whether to re-invest profits into their business or to give it to stock owners. Usually companies have a mixed approach and both re-invest and give stock owners profits in the form of a dividend, with a majority of profits being re-invested in the business.

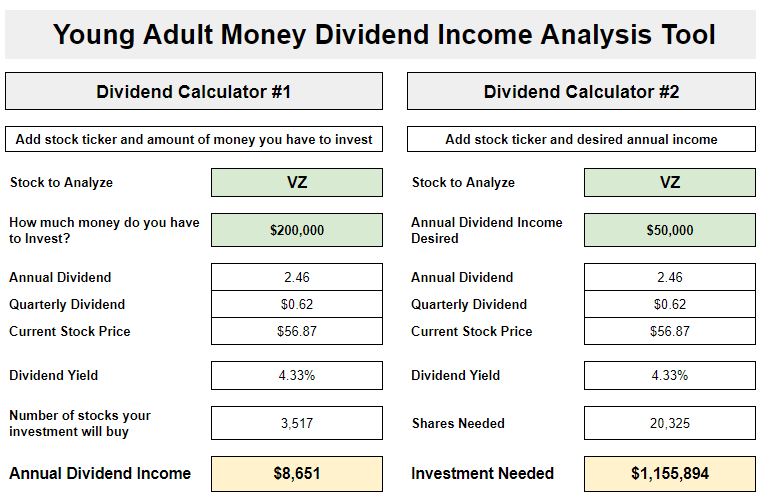

So how much money will you need to live off of dividend income? To answer that question I’ve created a dividend analysis tool.

How to use the Young Adult Money Dividend Income Analysis Tool

I created a dividend analysis tool in the past, but it wasn’t very practical. It didn’t automatically pull in stock data. This new dividend analysis tool automatically pulls in relevant information, and updates automatically if you enter a different stock ticker symbol.

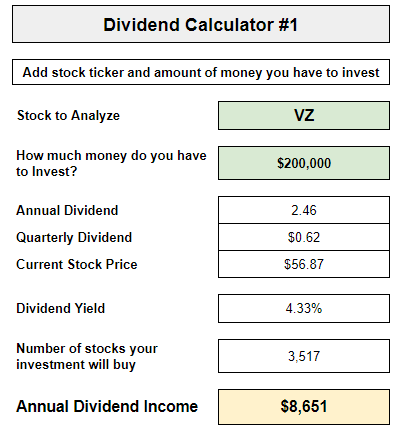

There are two different calculators in this tool. The first dividend calculator, shown below, will tell you how much income you can expect to receive from a certain stock’s dividend payments for a given amount invested.

The only cells you need to populate are the green highlighted cells. Google Spreadsheets does the rest of the work through formulas.

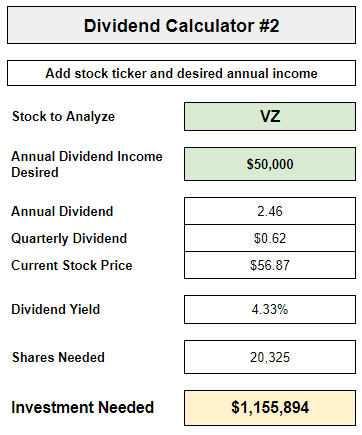

The second dividend calculator is my favorite one. You put in the stock ticker for a given company as well as how much income you want to receive from dividends.

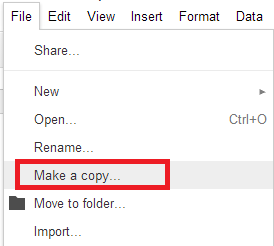

When you go to the tool, be sure to make your own copy.

Download the Dividend Analysis Tool by entering your email below.

Want to give your portfolio a boost? Sign up for SoFi Invest using our link and get a free $50 of your favorite stocks when you fund your account with at least $1,000.

Join our Online Community to Receive your FREE Dividend Analysis Tool

Please check your spam folder if you don't see the email from us.

Thoughts on the Amount of Money Needed to Live off Dividend Income

One thing you may have noticed is that it will take a lot of money to create an income you can live off of solely from dividends. It’s important to remember that companies are always trying to increase their income, and in turn, their stock price.

Instead of being discouraged by the amount of money needed to live off of dividends, use it as motivation to save more of your income and to increase your income.

For example, I might be able to make $2 million through my 9-5 job alone, but it will take me decades. Instead I focus on both increasing my income at my 9-5 and working my side hustles and I’m always looking to increase my monthly income. I also love the idea of building businesses I can sell for a lump sum later on, which can then be invested in dividend-paying stocks.

If your goal is to live off of dividend income, the best thing you can do is increase your income. That extra income can then be diverted towards dividend-paying stocks or mutual funds. You can do this at your 9-5 job or by increasing side hustle income. Your ability to increase your income at your 9-5 will depend on a number of things that you may or may not have control over: your specific job, the demand for your skills, the economy, and a number of other factors.

Making an extra $5,000 or $10,000 at your 9-5 job can be a lot easier than making an extra $5,000 or $10,000 through a side hustle. For example, you may get a promotion that nets you an extra $5,000 a year. In your new role, you may have more responsibilities but you may work the same number of hours. A side hustle, on the other hand, typically requires you using your free time to work.

The biggest benefit of side hustles, though, is that you have complete control over how much time you commit towards them and what you decide to pursue. Another benefit is that side hustle income is typically “extra” income that you don’t necessarily need and can easily be diverted towards things like investing in dividend-paying stocks.

Starting a blog is my go-to side hustle. I’m clearly biased because I’ve been blogging for nearly a decade, but this is my favorite side hustle.

There are countless benefits when it comes to blogging, from leveraging it to sell your own products and services, to using it to become an authority in your area of interest or expertise, to making money through affiliate links. For those who question whether blogging is saturated, I think there is always room for new and unique content. It’s not the easiest way to make side income, but if you stick with it there is definitely a path to making money off of blogging.

My wife and I have both done a number of side hustles, which I highlight in 10+ ways I’ve made side income.

If you’re interested in starting a side hustle, you may want to check out 50+ legitimate ways to make side hustle income online and at home.

Income is just one side of the equation. Cash flow is ultimately what matters. If you increase your cash flow you can direct those funds towards goals that improve your financial life. That can include investing to increase your dividend income over time.

Nice looking calculators DC! I do invest in some dividend payers, but also am focusing on index funds and some growth stocks now. Dividend stocks have had a good run the last few years in light of the rate market, so it’ll be interesting to see how many stick to them whenever the money stops pumping in to the market.

FrugalRules I personally don’t see myself focusing on dividend income for a few decades, but I like the idea of how passive of an income source it can be. I’m with you on the index funds and growth stocks.

This is really cool! I am definitely going to enjoy playing around with this – thanks for sharing, DC :)

CSMillennial No problem, let me know if you can think of any improvements. I hope you find it useful or at the very least, fun ;)

Dividends are great but I don’t personally focus just on dividends. I think it can cause people to be undiversified and to miss out on other opportunities. One of the reasons I like broad, total market index funds so much is that you get the benefit of both dividends and capital gains, and since it’s all income no matter where it’s coming from I’ll take the diversification benefits of getting the best of both worlds.

Matt @ Mom and Dad MoneyMost stocks that have a dividend seem to be more focused on growth as it is, so I see where you are coming from when you mention total market funds. Overall I think plugging in stocks in my tool might at least motivate some people to hustle to reach the point where they can live off their investments.

Only advice I would give on picking dividend stocks is that don’t look for just yield. Look for high quality companies with an ability to raise dividends over time.

Thanks for sharing this awesome tool!

moneyconeThat’s a great piece of advice! I noticed that Century Link, which has a relatively high dividend yield, actually paid out so much that their EPS was negative last quarter. It’s a stock like Century Link that makes you pause and look at all aspects of the stock instead of just the yield.

DC @ Young Adult Money moneycone Great example! I actually own that stock! Not my best purchase!

moneyconeDC @ Young Adult MoneyHaha well the only thing I know about that stock is that the dividend yield is VERY high compared to other stocks. I can’t blame you for purchasing, though I know almost nothing about the company/stock.

Interesting post, DC! We are absolutely interested in dividend income as a long-term investment source. We won’t put everything there, but we will be putting a good chunk of cash into a dividend fund eventually.

Laurie TheFrugalFarmerI’m with you on that. I’m mainly undecided about WHEN to start buying dividend stocks. Should I buy them sooner and re-invest the dividends? Or should I focus on growth stocks and total market index funds and make dividend-paying stocks a bigger allocation when I’m nearing retirement? No easy answer.

Great calculators! I’m focused on index funds at the moment, but I have always been interested in generating dividend income and may make some changes to my strategy in the future.

CashvilleSkySame here. I hope to make a material amount off of dividends a few decades from now.

This calculator is awesome! I love dividend paying stocks, but there are no guarantees on dividends because companies can easily take them away if they have a few bad earning years. So I say pick your dividend payers well (i.e. large cash cows) or mix in high grade bonds that pay the same interest regularly.

blonde_financeGreat advice! Yes there area number that have consistently paid a dividend (and slowly increased) that I think I would stick with. The nice thing is that even when stocks pay a dividend, it usually isn’t a huge yield so you also are able to capitalize on rising stock prices too.

Great tool, David! I would love to have enough dividend income to retire on =)

Holly at ClubThriftyGreat minds think alike ;)

Nice tool David. One of the things to consider is that good quality companies raise dividends over time which will help.

Charles@gettingarichlifeGreat point, Charles. I noticed this in my own research as well.

I like dividend income stocks. I have some in my portfolio but like you said, it takes a while to live off the income. But just have to keep putting the money in little by little.

Raquel@Practical CentsIf your goal is to live off dividends, it definitely has to be long-term, especially once you start plugging in numbers into a calculator like the one I created. Nothing worthwhile comes quick, though.

Nice work DC. I love calculators in Google Docs. I have a few ones that auto pull in data.

DebtRoundUpThanks Grayson! I remember you saying you are a bit of a spreadsheet geek as well. I’m having fun learning how to use Google Docs on a smaller scale after getting frustrated when I tried to do too much with it initially.

DC @ Young Adult Money Yes sir I am! It is what I do for my day job, or at least part of it. Google docs can be powerful, but there are some tricky things that don’t match up with Excel.

DebtRoundUpDC @ Young Adult Money I don’t know if I mentioned it in a post or not, but I tried to put a whole bunch of reporting wants/requests from a small biz into Google Docs. Google Docs was NOT made to do anything overly complex or even for a business with more than one or two employees. Small tools are ideal. You really can’t beat Excel, it has so much more functionality and power than Google Docs. I spent about a year hating Google Docs after doing that freelance work but now I’m more open to making little tools in it.

We should collaborate on some spreadsheet tool sometime.

DC @ Young Adult Money I feel ya. I actually have a few macro enabled spreadsheets that pull data from a shared Google doc when it opens. It is easier to have multiple people changing the Google Doc and then just bringing that data into Excel. Tends not to have as many things break.

I am game for some collaboration.

DebtRoundUpDC @ Young Adult MoneyI would be interested in seeing those macro enabled spreadsheets that pull from shared Google doc Files! Now that code would be useful.

DC @ Young Adult Money I wish I could show you those DC, but they have confidential client information that I would be in a lot of trouble if I shared.

I am intrigued by dividend stock investors, even though I’ll likely always be just a straight index fund investor. I’ll get some of the benefit from dividends, but not in the way that people who specifically invest in certain stocks will, and that’s okay. Many roads to Rome, right?

Nice work on that tool, too: you’ve got skills, David. :)

DonebyFortyThanks for the kind words, my skills didn’t come overnight but instead over the course of the last few years. Nothing worthwhile comes quickly! I will consider going more heavily into dividends later on but for now I just need to keep throwing money into index funds.

This is so nifty! I love this!

fitisthenewpoorThanks, I’m glad you like it!

This is cool David. It certainly provides some inspiration to get to the point of being able live off dividend income. I am going to play around with this tool later today.

Kyle JamesGreat, let me know how you like it or if you can think of anything else you would add.

I get dividends from my Whole Foods stock but I don’t think they come out to more than a dollar or two. Guess I won’t be living off of that any time soon ;)

brokeandbeauHaha maybe one day!

Very cool tool DC! I used to prepare tax returns for some very wealthy individuals. Many of these individuals essentially lived off of their investment income every year. I don’t know how most of them accumulated their fortune but it was pretty amazing to watch them earn 7-figures of passive income.

BudgetforMoreYeah I don’t know how I would react to those type of tax returns haha. I think it would make me jealous versus motivate me : ) If I could acquire enough wealth it would be absolutely incredible to have 6 or 7 figures in passive income!

Great tools, DC! Dividends are definitely wonderful passive income. The hard part, as with investing as a whole, there are no guarantees. As much as I enjoy receiving them, I’m not sure I would want to be fully reliant on them but it’s important to understand the potential they offer. And to look at which companies have historically and consistently paid out dividends and make them a part (but I still can’t recommend all) of your portfolio. You are definitely a superstar with excel, DC!

ShannonRyan I’m with Shannon on this one! And about the superstar excel spreadsheet guy too!

BeachbudgetShannonRyanHaha thanks!

ShannonRyan I think it would be pretty awesome to have a decent dividend income ON TOP of other assets (index funds, real estate, etc.). Long-term goals : ) Thanks for the kind words about my spreadsheet skills, I definitely am enjoying working on them.

I’m certainly no where near living off income from dividends, but it is fun to watch that money grow over time, especially if you reinvest it. Great spreadsheet.

EyesonthedollarThanks Kim! You are a lot closer than some of us : )

Great tool, thanks for sharing!

Mrs Snarkfinance No problem!

Well that looks both fun and depressing to play with! I know that I would need a seven figure portfolio to live the way that I want to, off of dividends. A girl can dream! Dividends are taxed favourably here, are they also tax advantageous in the US?

Ugifter Yes dividend is taxed advantageously in the US as well. But I’d need a seven figure portfolio as well!

I find I can get better returns with real estate. Sure, there’s more risk when you’re starting out, but it’s also something you can slowly get better at over time. I’m planning to use dividends to diversify my income, though. There are many roads that lead to passive income!

NomadWalletI don’t disagree with you about real estate, but it’s also usually not quite as passive. I rent out half our basement and there are a lot of little things that come with it. My wife and I both want to own a rental home/unit (or two) but if you have enough equity to put into stocks you could have a more passive income stream. I personally will probably pursue real estate earlier in life and dividends later.

DC @ Young Adult Money NomadWallet That’s true. I have property managers so it’s as passive as possible after the initial purchasing and rehab — which is a lot of work. But then again, I don’t mind a bit of work in exchange for a higher ROI, so I guess it’s about how passive you want it to be. And you’re right, age does come into play. We’re still young, so we’re focused on growth right now, but will probably want less work in the future.

Nice tool you have there, David.

I’ve always thought that dividend income was more of a supplement than something that you can truly live off of. It would certainly take a ton of upfront investment for me to be able to maintain my current quality of life.

seedebtrunI agree, you would need quite a bit of equity to fully replace your income, but I don’t think it’s impossible. Whenever I retire I would like to draw a sizable income from dividends.

Excellent DC. Many thanks. I should have thought to do this a long time ago, as I’m a big fan of Siegel and love calculating dividends and the like. Thanks again for sharing.

Living off dividend income is absolutely one of my long-term goals. We’re currently invested in Realty Income (known as the “Monthly dividend paying stock”), Starbucks and Walmart. It’s not much, and for right now anything we do make off of dividends will just be reinvested. I would love to be able to solely live off of dividend income – what a dream come true!!

Thanks for that calculator – excited to play around with it!

Dividend income is my favorite too. I would like to build other streams like blogging and rental properties, but dividends are my foundation. It can be discouraging though because it takes so long to build a portfolio especially if you don’t make much income.

This year our dividend income actually surpassed our retirement income (pension, IRA, SS).

Every week, my husband comes our of his office and tells me how much money just dropped into our account through dividends or bond interest. It is pretty sweet just sitting here and getting that money, but it did take us over 30 years to reach this level of income. We never buy a stock unless it pays a dividend and actually didn’t buy Apple until it started paying one.

This is our long-term goal as well. We’ve realized we don’t need as much as we once thought because we want to keep our expenses low. I don’t feel the need to work longer and save more just so I can live a luxury lifestyle that I don’t need or want now. And obviously lower expenses now helps us save more. But we’ve still got a ways to go.

HI, a really nice calculator, and I can even add Swedish stocks :) (I do live in Sweden) However, it seems most stocks here pay dividend once a year and not quarterly. Which cell or cells should I edit and how to make that work?

I guess maybe cell D20 [ =D18*(D13*4) ] and just remove the ‘*4’ in the paranthesis? Or is it more complicated than that?

regards B.Fant

barbafant Hi B. Fant. Thanks for checking out the dividend calculator tool and leaving your question. You are correct, you would just have to remove the 4 or change it to 1. I tested it out with the stock ERIC and it looks like it shows the correct information.

DC @ Young Adult Money barbafant

I appreciate you answer, thank you very much!

barbafant Just adding an option. You could also purchase stock on the NYSE or NASDAQ. The would allow you to take advantage of compounding if you wanted to reinvest the dividends to diversify in something else.

There are easier ways to estimate this, but are less accurate. Calculate current quarterly or annual dividend payments. Estimate how much i need to live off (including dividend taxes). Divide target income by current annual dividends. Multiply your current holdings by the resulting number, and that’s roughly how much you need. Example: Current returns average $400 per year, or $100 per quarter. Target income from dividends is $80,000. $80,000 / $400 = 200. Multiply my current holdings by 200 before i can live off it. Possibly less if I move a larger portion of my investments to dividend payment funds (currently equally split between growth & income).

Really interesting, I’m into savvy Mood and I love read/Discover new ways and how to earn extra income

Thanks David

I have have always been interested in earning dividends

I got some dividends from my employer but I sold them all. From the start I did not think they were good for it and turns out I was correct.

Which are your top 5 companies for investing dividends in long term?

Hi Carl – I do not give individual investing advice (and legally cannot) so I can’t help you with your question. I recommend reaching out to a Certified Financial Planner with your question.