Motif Investing is perfect for both beginner and advanced investors. It allows you to invest in the industries and companies you want to invest in.

If you are a fan of Exchange Traded Funds, or ETFs, you will absolutely love Motif Investing. With Motif Investing you can pick pre-made “motifs”, or portfolios focused on specific company types or industries, or create a custom portfolio.

The ability to invest in specific industries – and set the exact companies within those industries you want exposure to – is a huge advantage of motif investing. No other company gives investors this much freedom nor makes it this easy to gain diversified exposure to specific industries and groups of companies.

If you’re wondering how Motif Investing works you’ve come to the right place. I’ll give a quick explanation of how to put together a custom motif as well as how to find pre-made motifs that fit your investing ideas.

I think it will quickly become obvious why I think you’ll love Motif Investing.

How Motif Investing Works

Motif Investing allows people to select custom “motifs” made up of up to 30 stocks. Not only that, but you can choose the percentage of the motif that is made up of each company. You can spread the percentage equally among the stocks in the motif or assign custom weights to each stock.

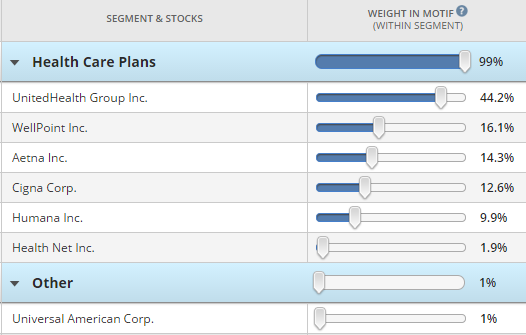

For example, if you want to create a health insurance motif you could create a motif made up of the following:

- UnitedHealth Group (UNH)

- WellPoint (WLP)

- Health Net (HNT)

- Aetna (AET)

- Humana (HUM)

- CIGNA (CI)

After choosing the stocks in your motif, you can choose the weight that each stock has in the portfolio. This level of customization is pretty incredible because it allows you to both spread risk across a number of companies but also give greater weight to companies you expect to out-perform other members of the motif.

I gave each company a percentage weight based on their overall market cap.

It’s as easy as that! You can also add an image to your motif to make it look a little better to other people who may use your motif.

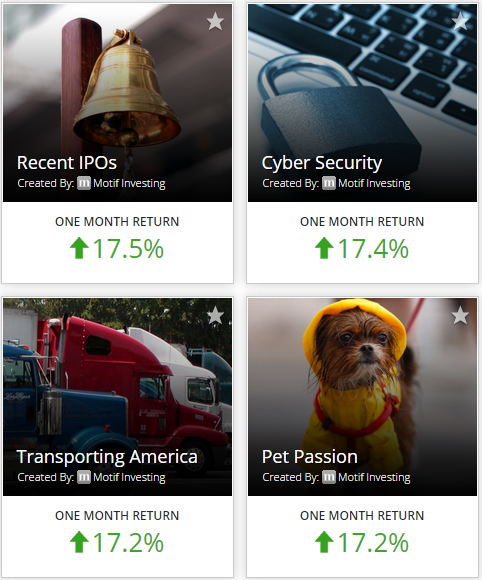

Motif Investing also offers over 100 pre-made Motifs that you can invest in. If you go to the “explore motifs” tab on their website you can view these pre-made motifs. Here’s an example of four of them:

When you explore motifs there are quite a few filters you can use to find motifs that fit your specific criteria, such as one-month return, one-year return, industry type, and more. If you want to view my Health Insurance Company Motif, click here.

Motif Investing allows people to do something pretty complicated – create a custom portfolios – but they make the actual service incredibly simple for users. I’m really impressed with the user interface and love how quickly and easily users can create motifs.

Benefits of Motif Investing

Motif Investing is offering something that other brokerages have yet to offer: the ability to create custom portfolios and diversify risk across very specific industries.

The biggest benefit that I see in Motif Investing is that you can purchase your entire motif for the cost of one trade: $9.95. That means you could theoretically purchase up to 30 stocks for only $9.95. This would be much more expensive if you were going to buy all 30 stocks individually. You also would not have the ability to control the makeup (percentage of exposure to each company) nearly as easily as you do with Motif Investing.

Other benefits of Motif Investing include:

- Diversification across multiple securities

- A Fully customizable investment

- Direct ownership of up to 30 stocks reflecting one idea

- Intraday pricing

- Marginability

- Greater control over capital gains

I’ve already mentioned why I think motifs are better than ETFs, but I would go as far as saying that motifs are superior to index funds. With index funds you have exposure to every industry. The issue with that is there may be certain industries that are more likely to increase in value while others are less likely to increase, depending on where the economy is headed. You can purchase a number of motifs to gain exposure to only the industries you expect to increase.

Giving Motif Investing a try carries a low risk to investors. It’s not an “either or” scenario where you will either invest in ETFs and mutual funds or invest in motifs. You can still invest in your “regular” investments while also putting more and more money into your Motif Investing account. If you end up liking one more than the other you can adjust accordingly.

$150 Cash Back Special Offer

Motif Investing has a special offer running for new users. If you sign up using this link (or any link to Motif Investing on this page) you have the opportunity to gain up to $150 cash back, starting with $50 cash back on your very first trade.

If you’re ready to give Motif Investing a try, head to Motif Investing to get started!

What do you think of Motif Investing? What motif do you plan on making first?

I have never heard of Motif Investing, but it sounds awesome. I have had clients who have wanted to invest in specific areas (like tech or banking) and this is a great resource for those clients, especially because it’s not always clear how an ETF is structured.

blonde_finance I think Motif Investing is a great alternative to ETFs. You can actually include ETFs as part of your “motif” as well, which I thought was an interesting option.

Ha ha, I actually have a Motif review going up on Wise Dollar on Wednesday. I just opened an account with them as well and like what I’ve seen thus far. The one thing other may want to keep in mind with Motif is when you rebalance and it’s not in an IRA it will cause a taxable event. You’d be surprised as to how many that trips up.

Awesome! I have never heard of it. $150 is tempting =)

I invest in ETFs, so this sounds really interesting to me. This is the first I’m learning about Motif investing, so I appreciate you sharing the information. Since I’m mostly focusing on getting out of student loan debt, I hesitate to invest too much (which is why I chose the basic ETFs for now), but since this sounds similar, I may have to put that on my list of things to learn more about re investing. Thanks for the info!

I’m with Holly on this one! Great info, DC! :)

I have never heard of Motif, seems pretty straight forward and the $150 sign up is a nice start up offer.

This sounds interesting! Investing is pretty foreign to me, and it’s a little intimidating. My husband and I are both interested in learning more though, and I know we’re both looking forward to having the income to invest.

FrugalRules Thanks for pointing that out, John, as I must have missed that as well! It’s a good thing to keep in mind, especially for people who get used to rebalancing their 401k or IRA. I look forward to reading your review!

Holly at ClubThrifty Yes, free money is always tempting ;) I think that promotion ends this year unless they extend it into 2015.

kay ~ lifestylevoices.com Thanks! I hope you check it out. I’m a big fan of what they are doing and honestly haven’t found another business that offers a similar service.

DebtDiscipline It seems like a lot of fun for people who like to spread their investments across a given industry, or even a sub-section of an industry. I’ve had fun viewing all the motifs people have made.

BudgetandBees While I do work in finance full-time, I did not care much for individual investing until recently. I mean, if you don’t have income to invest it’s hard to get excited about it or motivated enough to actually look into it.

I have done almost all my non-tax deferred investing with Betterment, but Motif seems to be a strong contender in the DIY investing sphere. For $150, it’s very tempting.

Good timing with this info! I had just barely signed up last week!

I’ve been seeing a lot of info about Motif lately, and I think it’s a brilliant idea. Something I’d definitely look to invest in once I start diversifying away from my individual stock investments.

This is my first time hearing about motif investing, but it sounds pretty legit. I don’t think I will be ready to invest in a program like this until my debt is totally out of my life. I have to admit that investing has always been intimidating for me, so something like this would probably be good starting point when I’m ready.

I had heard of Motif investing before, but never saw any well written or comprehensive reviews about it. Definitely more interested in it now. Thanks DC!

Eyesonthedollar I haven’t looked into Betterment, but it’s another company I want to try out. The $150 bonus goes through the end of the month, unless they extend it into 2015.

Mark at Bare Budget Guy It actually looks like bad timing because I wish you could have used my affiliate link ;)

Jason@Islands of Investing It really is a great way to purchase a bunch of individual stocks for a low price. I think you’ll enjoy it.

Debtfreemartini I think you’re smart for waiting until you get rid of your debt. Once you do, this is a great way to buy a bunch of stocks for a low price.

sunburntsaver This just might be my favorite comment ever! Thanks so much for the kind words. I take pride in giving comprehensive reviews, so I’m glad you found it useful.

DC @ Young Adult Money Mark at Bare Budget Guy Ha! Don’t worry, I’ll get you next time buddy.