Every day there are millions of people who use spreadsheets at their job or business.

Every day there are millions of people who use spreadsheets at their job or business.

Even if you have only a basic understanding of Excel or Google Sheets, you probably realize how powerful they can be for things like planning and tracking.

While there are thousands of personal finance tools and apps out there today, it’s tough to beat the simplicity and power of a spreadsheet to level up your money.

Having worked in corporate finance and accounting for nearly a decade, I’ve spent most of that time working in spreadsheets. I’ve created a number of personal finance spreadsheets that I give away for free.

This post lists out some of those free personal finance spreadsheets you can use to level up your money.

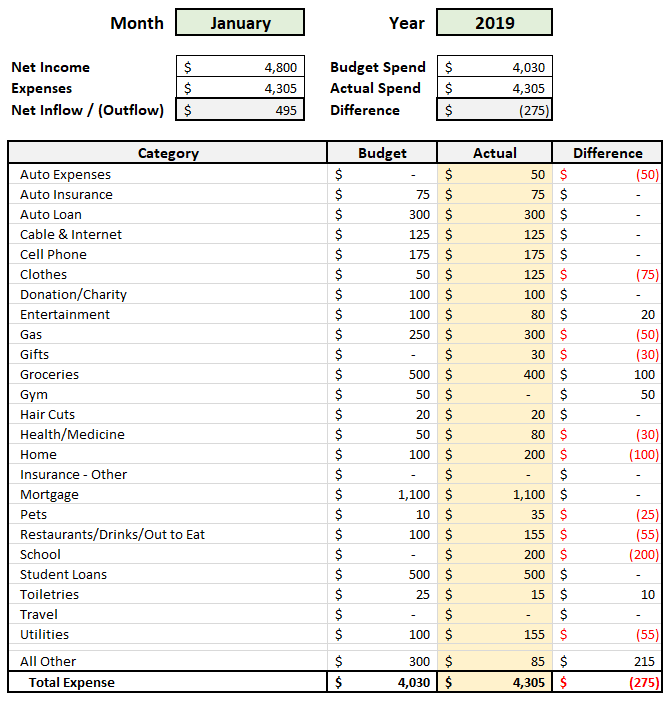

Let’s start with the most popular spreadsheet I’ve made: an automated budget spreadsheet.

Automated Budget Spreadsheet

For years my process of tracking our income and expenses looked like this: pull data from various credit card and other accounts, reformat so it’s all in the same format, and then consolidate it all into a spreadsheet.

I was so happy when Tiller came out because it allowed me to finally share an automated budget spreadsheet. Tiller is a software that pulls all your transactions from your various financial accounts and puts it in a uniform format. Anyone who does this manually each month knows that it’s a big time-saver.

You can download the automated budget spreadsheet by filling in your email below or you can read more about it here.

Join our Online Community to Receive your FREE Automated Budget Spreadsheet in Excel

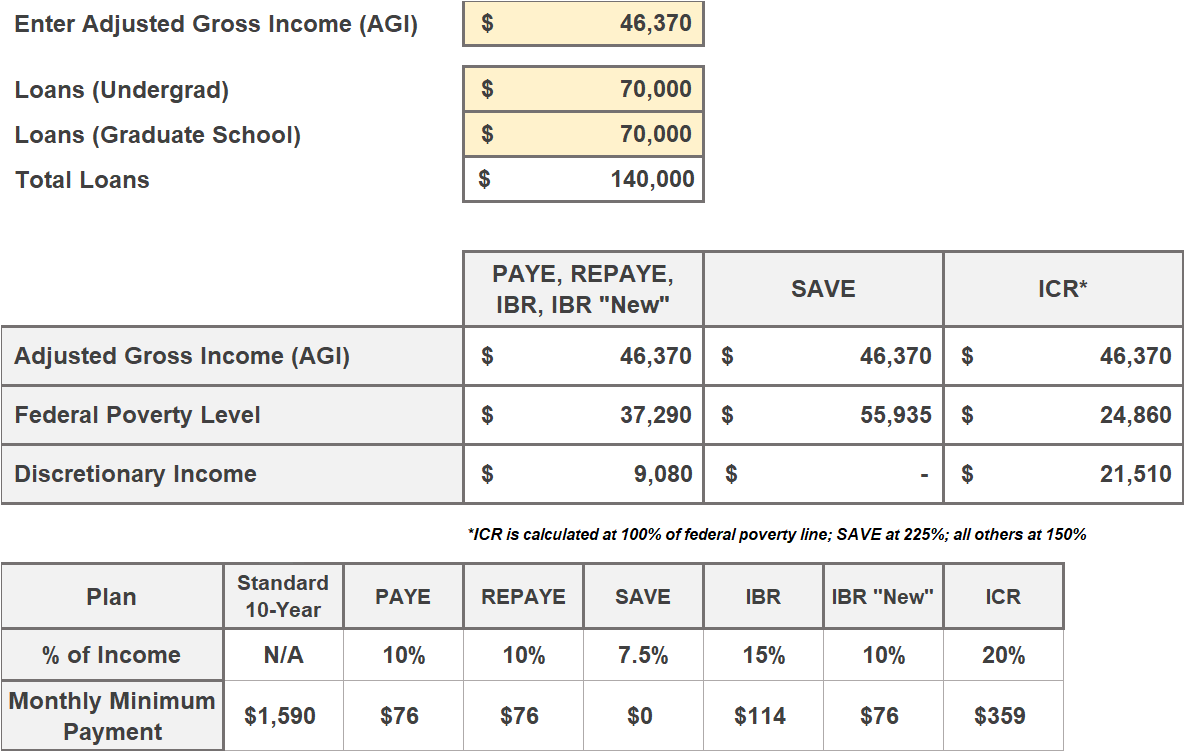

Student Loan Spreadsheet

I’ve had some form of a student loan spreadsheet on the site for a few years now, but it wasn’t until I wrote my book Student Loan Solution that I really blew out the spreadsheet with a ton of features.

The student loan spreadsheet has all the following features:

- Instructions on Where to Find your Student Loans – Whether you have federal, private, or state student loans, there are instructions on how to find the details of your student loans.

- Tracking Tab to House all your Student Loan Details – The most important part of the spreadsheet. This will be where all your student loan detail is laid out in a nice snapshot.

- Student Loan Repayment Calculators – Three different student loan calculators that help you visualize what sort of impact putting additional dollars towards your loans will have.

- Weighted Average Interest Rate Calculation – Simplifies various calculations by giving you one interest rate that can be used in all your student loan repayment calculations.

- Income-Driven Repayment Calculator – Shows your estimated monthly payment under the various income-driven repayment plans.

- Federal Poverty Guidelines – Helps with calculating income-driven repayment.

- Principal vs. Interest – Curious how much of each individual payment is going towards interest versus principal? This tool will help you visualize it.

You can download the free student loan spreadsheet by filling in your email below or read more about it here.

Join our Online Community to Receive your FREE Student Loan Spreadsheet

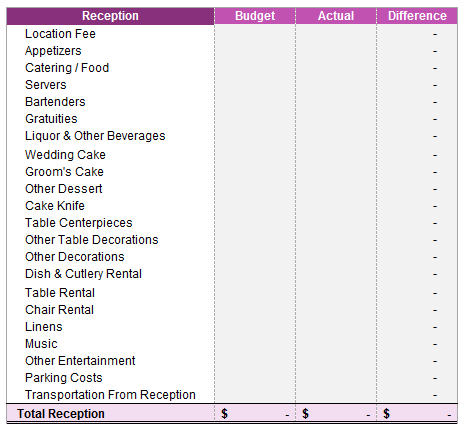

Wedding Budget Spreadsheet

Most people who plan weddings need to keep track of their budget and how much they spend along the way. There are definitely apps and tools out there that help with this, but it’s tough to beat the simplicity of a spreadsheet.

I created a wedding budget spreadsheet for a friend who was planning her wedding. I made it available for anyone else who was planning a wedding.

Enter your email address below to get the wedding budget spreadsheet sent to you, or read more about it here.

Join our Online Community to Receive your FREE Wedding Budget Spreadsheet

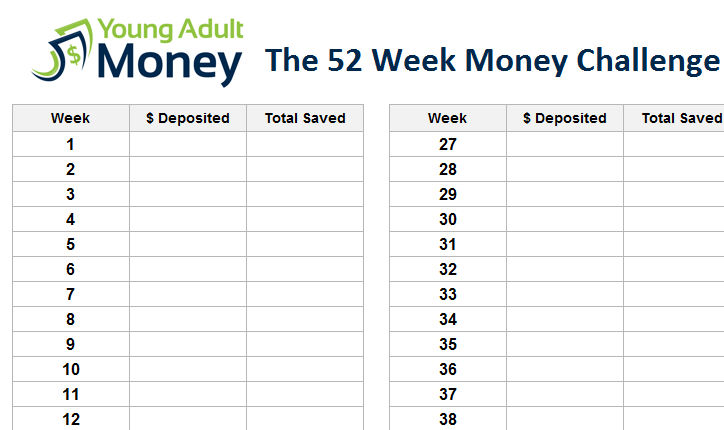

52 Week Money Challenge Spreadsheet

The 52 Week Money Challenge is simple. Over the course of 52 weeks, you make a deposit into your savings account once a week. The deposits range in value from $1 to $52.

One way people do this is deposit $1 the first week, $2 the second week, $3 the third week, and so on. At the end of 52 weeks the deposits total $1,378.

You can also do a modified version where you save more or less each week depending on how much extra cash you have. Did you have some unexpected bills this week? Save $1. Have some extra cash this week? Save $50.

Enter your email address below to get the 52 Week Money Challenge spreadsheet sent to you, or read more about it here.

Join our Online Community to Receive your FREE 52 Week Money Challenge Spreadsheet

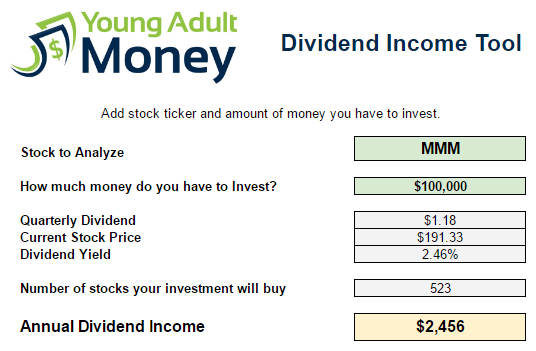

Dividend Income Analysis Spreadsheet

Dividend income is the ultimate source of passive income. If you can make $30k+ a year through passive dividend income, it makes it a lot easier to use your time how you want (especially if you can quit your full-time job!).

But how many stocks would you need to buy to actually make passive dividend income that you can live off of?

This spreadsheet has two calculators that will answer that question for you. One calculator allows you to plug in a stock and see what sort of passive income you would receive with various amounts of that stock. The second calculator allows you to plug in your desired dividend income and then tells you how much of a certain stock you would need to buy to achieve it.

Enter your email address below to get the Dividend Analysis spreadsheet sent to you, or read more about it here.

Join our Community to Receive your FREE Dividend Income Spreadsheet

Do you have an idea for a personal finance spreadsheet? I would love to hear your idea and possibly create it for the site! Share your ideas here.

helpful tool