Whether it’s student loans, credit cards, a mortgage, or some combination, most of us have debt.

Whether it’s student loans, credit cards, a mortgage, or some combination, most of us have debt.

Regardless of how much debt you have, it likely makes it difficult to work towards your larger financial goals like saving for a house, building an emergency fund, or investing for retirement.

As someone who took on significant student loan debt, I have seen firsthand the drag debt can be on your financial life. It’s one reason I tend to focus on the issue of debt on this blog and in other writings.

Today I want to focus on estimating how long it will take to pay off debt. For example. if you paid an extra $50 a month towards your credit card debt, how much faster will it be paid off? $100? $500?

Before we get to the scenario analysis, I would first like to touch on a few important debt-related topics.

Look at ALL Options

There are tons of personal finance “experts” who push a one-size fits all approach to debt. It goes like this: If you can’t afford your debt, you need to make more, spend less, or both. You need to keep downsizing your life and working more until you have enough cash flow to make progress on your debt.

I, for one, am not an advocate of this oversimplification of eliminating debt. I think you are doing a disservice if you do not consider all your options with your debt.

For example, I have read multiple books on student loans that either do not mention Public Service Loan Forgiveness at all or try to scare readers away from pursuing it. But for a therapist making $40k a year working at a nonprofit, who has $150k of student loan debt, Public Service Loan Forgiveness could literally mean six figures of debt erased tax-free after ten years. It’s irresponsible for someone in personal finance to not explain the benefits of this.

This is just one example where someone should consider all options of addressing their debt and not simply “make more and spend less.”

Which leads me to my next point: seek help if you need it.

Seek Help if You Need It

There are many who have debt that is so high that it’s nearly impossible for them to make progress on paying it down. Or, it may just be at such a level that it’s causing you to be depressed and hopeless. When debt is this big of a burden on your life, it’s time to seek help.

Seeking help from a certified credit counselor, such as one at National Foundation for Credit Counseling. It also can make sense to discuss your situation with a debt lawyer such as Tayne Law Group.

Depending on your situation, a debt lawyer can potentially renegotiate your debt. This includes credit card debt, private student loans, and other debt. This typically results in making one affordable monthly payment. Through this process you can potentially have your debt renegotiated to a much lower balance.

This is just another reason why I think it makes sense to consider all your options. If you can have your private student loans renegotiated from $100k to $50k by a debt lawyer, think about the cash flow that this would free up.

How to Estimate How Long It Will Take to Pay Off Debt

The most common debt-related question people have is how long will it take to pay off my debt?

Let’s answer that question.

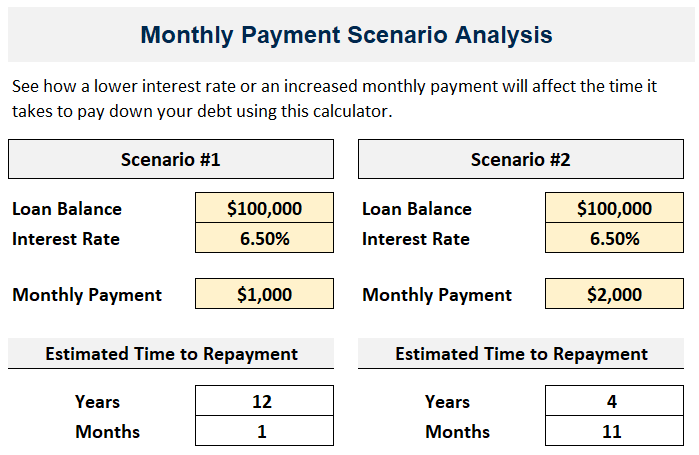

I’ve created two calculators that will help us. First, you can compare how a different monthly payment or interest rate will impact the projected date that you will pay down your debt.

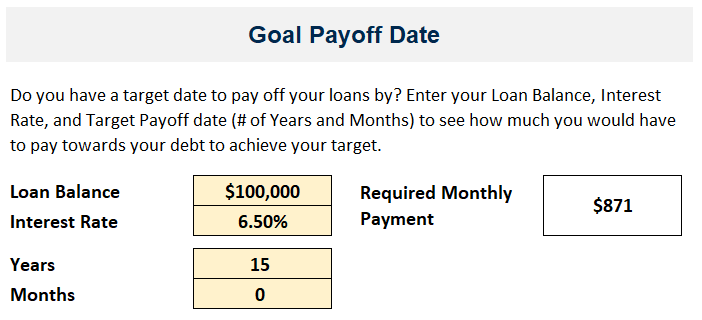

The second calculator will tell you how much in payments you need to make each month to hit a target debt payoff date.

You can get your free debt payoff calculators sent to your inbox by entering your email address below.

Join our Online Community to Receive your FREE Debt Payoff Calculators

I underestimated my payoff date last year and failed big time. I changed up and decided not to set a date. Instead, I’m focusing on increasing income.