“You don’t budget? But don’t you talk about the benefits of budgeting all the time? What gives?”

“You don’t budget? But don’t you talk about the benefits of budgeting all the time? What gives?”

This is the general reaction I get when I tell people that my wife and I don’t budget, and we haven’t for years.

First off, I do think that keeping a budget is a key first step in managing your money. I also think that once you have a good sense of your monthly income, expenses, and cash flow, you can potentially get away without budgeting.

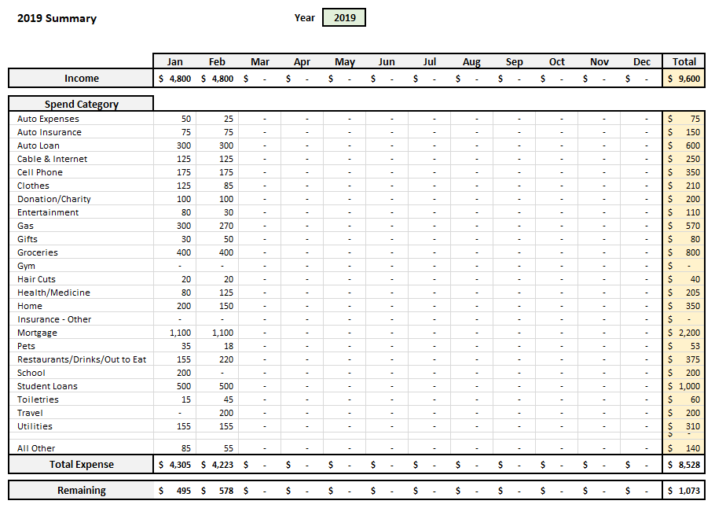

One of the most popular freebies on this site is our automated budget spreadsheet. This is a file I use myself, but I don’t use it to budget each month. I use it for the key first step in budgeting: tracking your income and expenses.

Tracking Your Income and Expenses

Tracking your income and expenses is a key first step when setting a budget. After all, if you don’t know how much money you spend on each budget category, such as restaurants, groceries, and utilities, how can you possibly set an accurate budget?

That’s why I always tell people to take a step back before setting their initial monthly budget. You first need to look at the past three months of spend, assign it to categories, and see what your average spend is by category. Only then can you set an accurate budget.

You can do this manually, by grabbing data from your credit card and bank accounts. Or you can do it automatically by using Tiller, which is the service I use and have integrated into our automated budget spreadsheet.

Tiller has been around for a few years now, and the company has a very simple value proposition: make spreadsheet budgeting easier. Once you connect an account, such as a credit card, all your transactions will be pulled in automatically, in a uniform format. I did this manually for years before Tiller existed and it has been a big time saver.

I set up our budget spreadsheet to have both monthly budget tabs where you can set a budget and track progress, but also a monthly trend tab, as can be seen below. It can be surprising how much you spend on certain things if you’ve never gone through the process of reviewing your spend data.

Why I Don’t Budget

My wife and I have done many things to save money, some of which we’ve made a habit of. A few examples include:

- Meal planning and prepping food on the weekend

- Taking full advantage of credit card rewards to save money on travel

- Limiting the amount of new clothes we buy and being really picky about what we keep

- Taking advantage of cash back websites and apps

Over time we got to a point where we felt comfortable with how much we were spending on each budget category. Amounts inevitably fluctuate – like when we are doing projects on our fixer-upper – but in general our trend has been somewhat consistent over the months and years.

So what we do instead of keeping a budget each month is tracking our income, expenses, and cash flow. We look at the trend and try to understand any outliers. It’s a good practice for any surprise expenses, like if our internet bill randomly increases or we get hit with an unexpected charge.

Should you forgo a budget and instead just stick to tracking your income and expenses? That will depend on your personality, financial situation, and goals. A few situations where I do think it makes sense to budget include:

- If you have a history of overspending – Some people are spenders instead of savers, and there is nothing wrong with that…unless it holds them back from hitting financial goals. If you are a spender and you struggle with running up a credit card, or simply never have money left over to save and invest, keeping a tight budget that you update daily or weekly could benefit you.

- If you are tackling credit card debt – Paying down credit card debt is right up there with building an emergency fund as a top financial priority. Because of how high the interest rate is on credit card debt, every additional dollar you can contribute towards your debt makes a material impact. Sticking to a bare-bones budget while paying down credit card debt could be very beneficial for your finances, both short- and long-term.

- You have a lower income – I won’t sugarcoat it: the lower your income, the more time and effort you need to put towards managing your money. There’s simply no denying it’s easier for someone making $100k a year to manage their money than someone making $30k. If you have a lower income, you need to make sure you are cash-flow positive (bringing in more than you are spending) and are making progress towards goals like an emergency fund, paying off debt, and investing. It can be tough, but with time and focus it can be done.

I will close this topic out by saying that even if you do need to keep a budget today, it doesn’t mean you have to forever. Eventually you may be able to get by with just tracking your income and expenses and doing an analysis of the trend each month, making adjustments as needed.

I have a budget but it is became flexible, so I have a % for determined category and seems works quiet well