This post is by our regular contributor, Erin.

This post is by our regular contributor, Erin.

Student loans are a burden that millions face.

Sadly, most choose not to face it, which has resulted in nearly 7 million Americans defaulting on their student loans.

Defaulting has some serious consequences.

As many of you probably know, you can’t get rid of student loans easily – sometimes, you can’t get rid of them at all, especially if you have private loans.

So what are you to do when facing an insurmountable, overwhelming pile of student loan debt?

Well, consolidating or refinancing may be an option to consider.

What Does it Mean to Consolidate or Refinance Student Loans?

Consolidating or refinancing your student loans are almost the same thing. The difference is the programs offered. You can consolidate your Federal student loans through the Department of Education via a Direct Consolidation Loan. You can refinance your loans (private or federal) through a private lender like SoFi, which offers free rate quotes.

Both processes allow you to take all your loans and roll them into one large loan. This is particularly useful if you’re paying 5 different lenders and losing track of what amounts are due when. When you consolidate or refinance, your old loans will be paid off, and you’ll continue making payments that go toward your new loan.

The difference between a Direct Consolidation Loan and refinancing through a private lender is that the Direct Consolidation Loan doesn’t allow you to save money on the interest of your student loans. That’s because your new interest rate is taken from the weighted average of your “old” loans, and rounded to the nearest one-eighth of one percent.

With a private lender, you can refinance to a different interest rate, just as you can on a mortgage. This makes it possible to save thousands of dollars over the life of your loan.

When Does Refinancing or Consolidating Make Sense?

As I mentioned, either can be helpful when your student loan situation is a mess. When my fiance was first paying his loans off, he owed three different loan servicers money every month. Now he’s down to one.

If you have undergraduate and graduate student loans, you might be paying different amounts to a number of lenders. That means you have to remember a number of usernames and passwords and websites. Simple tends to be better when managing your money, otherwise things can slip through the cracks.

Refinancing or consolidating allows you to make one payment to one lender. That’s it!

Another case where it makes sense to consider refinancing is when your student loan interest rates are through the roof. This applies more to older borrowers as recent interest rates on Federal loans have been fairly decent.

A Word of Warning: Beware of Your Federal Benefits

I can’t mention refinancing without highlighting the benefits that automatically come with Federal student loans. Why? Because you will lose access to them if you refinance.

Actually, you will lose access, although some private lenders are offering other repayment assistance solutions, such as forbearance. Unfortunately, they’re not guaranteed forever (they’re not regulated), so keep that in mind.

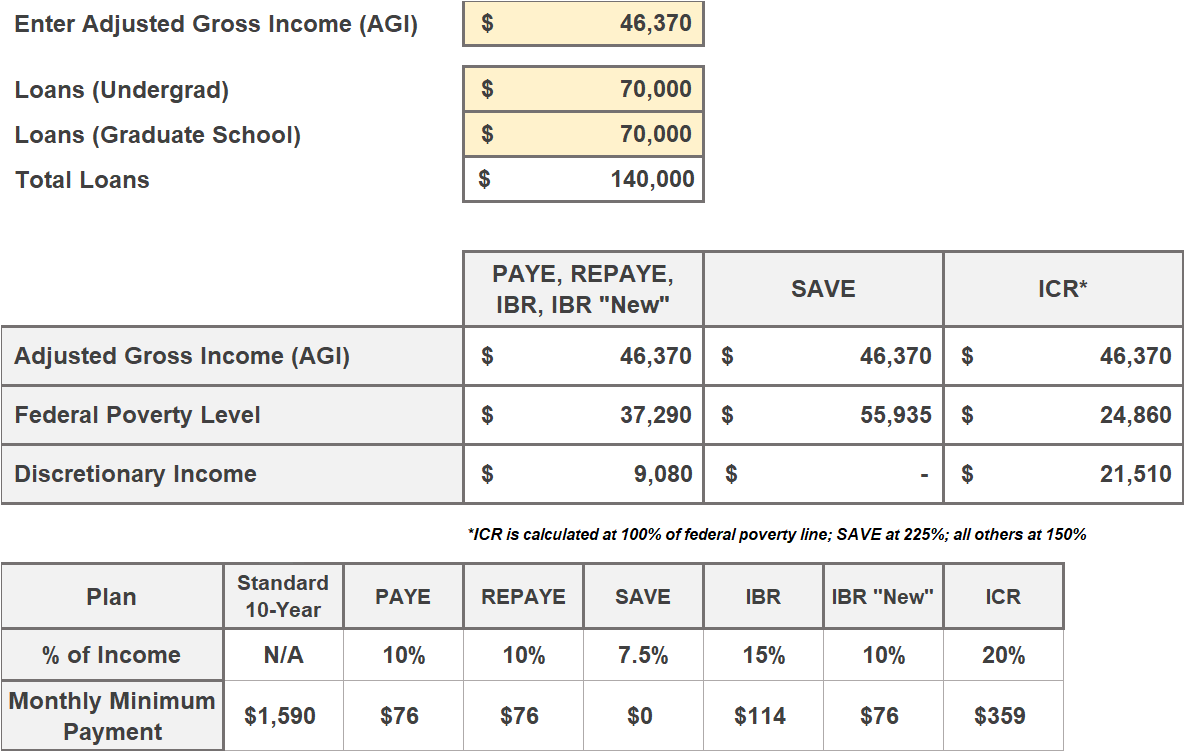

What benefits am I talking about? Things like Income-Driven Repayment plans, forbearance, deferment, and forgiveness, to name a few. Basically, any benefits that are designed to help you out should you experience trouble making payments.

Do Federal or Private Borrowers Benefit More?

Hands-down, borrowers with private loans have an easier time making a decision when it comes to refinancing because they don’t have a loss of federal benefits to worry about. They might also have higher interest rates, or a variable rate they want to refinance to a fixed rate.

The benefits you have access to with Federal loans can’t be overlooked. If you’re struggling to pay back your loans, one of the first things you should do is call your student loan servicer to see what options are available. Defaulting on your student loans will increase the amount you owe due to penalties.

When Should You Refinance?

If you’re looking to save money by refinancing to a lower interest rate, you’ll save more by refinancing earlier. If you’re questioning your sanity because you’re not sure if you paid one loan and not another, then refinancing or consolidating now can help relieve stress.

As with any major financial decision, you should run the numbers for your particular situation. Most private lenders have estimated repayment calculators on their website, and some allow you to get a quote with a soft credit inquiry (meaning your credit won’t take a hit). You can get a free rate quote at SoFi to see what sort of savings you’d be looking at.

How Can You Consolidate or Refinance?

I want to reiterate this isn’t a decision you should take lightly. Once you consolidate or refinance your student loans, you can’t go back. Your old loans are gone for good. Once you’re ready, you can take the following steps.

- To apply for a Direct Consolidation Loan through the Department of Education, you can fill out this form online. It only takes about 30 minutes. It’s completely free, and there’s no credit check required. Remember, this is for Federal loans only.

- If you want to refinance your student loans with a private lender instead, we recommend trying SoFi first. It has been one of the leading companies to offer student loan refinancing and its interest rates are hard to beat.

A hard credit inquiry is used if you decide to move forward with the terms offered, but filling out the initial application only requires a soft credit pull. There’s nothing to lose considering the application only takes about 5 minutes.

It’s also worth noting most online private lenders don’t charge origination, application, or prepayment fees, but it doesn’t hurt to check beforehand. Traditional banks are more likely to charge these fees.

A majority of the time, private lenders allow you to refinance your private and Federal loans together, but you don’t need to refinance all your loans if you don’t want to.

______________________

Overall, refinancing or consolidating student loan debt can be a good idea if you’re in the first few years of repaying your loans, or if refinancing to a lower interest rate will help you save money in interest. Just remember that if you have Federal student loans, refinancing causes you to lose out on the repayment assistance options offered through the government.

Need to get organized? Download our free student loan spreadsheet below.

Join our Online Community to Receive your FREE Student Loan Spreadsheet

Have you consolidated or refinanced your student loans? Have you been thinking about it? Do you think it’s worthwhile for borrowers to save money? Have you taken advantage of the benefits that come with Federal student loans?

Oh gosh, I need to figure this out soon. My first loan payment is due in late January.

Wow, I didn’t realize SoFi rates were so low — I’ll have to check them out first. Thanks for the tip! :)

I am happy to report that we have been student loan free for a long time. However, I would definitely refinance if it made sense to do so.

Thankfully, we’re student loan free – though I consolidated most of mine when I was paying them off. Only having one bill as opposed to 3-4 each month alone was worth it. That being said, if it saves you money and you don’t lose any potential benefits I think it definitely behooves you to take a look at your options.

Before we paid off our student loans, we used consolidation to make the payments easier. I wish we’d not done it so we could have just paid the suckers off and not inflated our lifestyle. I can certainly see the benefit of consolidating for a lower rate, I’d just remind people not to use lower payments and a ticket to spend more on other stuff.

theYachtless It’s definitely worth a shot considering you can receive a quote for free (and with a soft credit pull). The only thing I’d caution against is going for variable rates. They’re much lower to start, but they can obviously increase. I’d only do it if you know you can pay your loans off quickly. I wouldn’t rush the decision, either – you have tons of time! You can refinance any time after your loans become due.

Holly at ClubThrifty Same here. I don’t have too much left on my loans, so it’s not worth it, but it’s a good solution for those that can save money from it!

FrugalRules Consolidating can be nice, especially when you’re dealing with multiple loan servicers (who are a pain to deal with). I’m glad I’ve only had one, but they’re enough of a pain!

Eyesonthedollar Yes, that’s definitely true. You should only consolidate if you absolutely need the money for other necessities, not so you can free up money for “fun” things! You still have to be responsible.

This is helpful information Erin. I’m looking at consolidating right now and I just need to plunge in and do the work to figure out which plan is best of me. I’m not keen on losing the federal options though so I’ll need to consider that as well.

Thank you for the information. Much to consider :)

Laura Beth @ How To Get Rich Slowly It’s definitely not an easy decision, and there are certainly some lenders more willing to work with borrowers than others. Hopefully you’ll find the right solution for your situation!