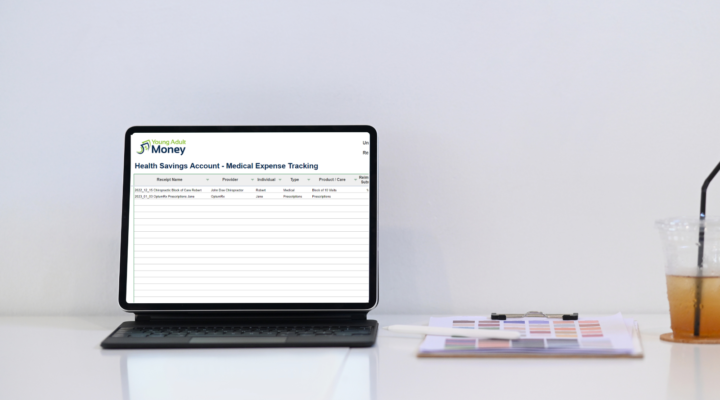

If you have a Health Savings Account, or HSA, and aren’t using it to pay for medical epenxes, you are missing out on tax benefits. As we explain in our Health Savings Account Guide, HSAs have a triple-tax advantage: Put Money in Pre-Tax – Contributions put into an HSA are not taxed. Meaning, your adjusted […]

Read More >>How to Pay Less in Taxes: Save Money on Taxes (Legally)

The tax code is complicated. A complicated tax code means filing taxes can be a headache, or for some of us a migraine. The one good thing about the complicated tax code is that it creates opportunities to pay less in taxes. Legal opportunities. In fact, the government has intentionally built in these opportunities […]

Read More >>The Ultimate Tax Checklist

Ready or not, tax season is here. It’s time to start compiling your tax information if you haven’t already. Whether you take your taxes to a professional or you complete them yourself, there is an ample amount of work to do in preparation of filing your taxes. Preparing yourself beforehand can save you time, money, […]

Read More >>What’s the Difference Between a Tax Deduction and a Tax Credit?

Taxes are one of the most complicated parts of being an adult. No one really teaches you how to do taxes – you’re just expected to know what you’re doing. You may hear certain tax terms thrown around, but do you know what they really mean? If not, that’s okay! Taxes are complicated, but that’s […]

Read More >>How to Make Sure You Get a Tax Refund Next Year

How to Make Sure You Get a Tax Refund Next Year Many people go into tax season having on idea whether they will end up owing taxes or will be getting a refund. And while many finance experts may say that it’s best to not receive a refund, many feel better when they do receive […]

Read More >>13 Employee Benefits You Should Take Advantage Of

Last November, thanks to a not so gentle nudge from a round of layoffs, I left the world of full-time employment to start my own business. As much as I love building something that is all my own, there is one thing from my old job that I miss dearly. No, it isn’t the paycheck […]

Read More >>How to Rollover Your 401(K) When You Leave a Job

The decision to leave a job isn’t always an easy one. There are many professional, personal, and financial decisions to consider. You might wonder if you will have more opportunity, be better able to pursue your career goals, or have a more professional work environment. If you participated in your company’s 401(K) plan, you may […]

Read More >>How to Earn Tax-Free Airbnb Income With the Masters Rule

Tax season is well underway. While some of us have had our taxes completed and filed for several weeks, there are those of us who will plan on getting to it every week until April 17th is here. Wanting to delay the hours worth of paperwork for as long as possible is understandable, especially if […]

Read More >>10 Smart Things to Do With Your Tax Refund

Do you have a tax refund check coming your way? With the average tax refund being around $3,000, it may be tempting to blow that money on something fun. But instead, why not consider using your tax refund to better your finances? Here are 10 smart things you can do with your tax refund. […]

Read More >>