This post is by our regular Wednesday contributor, Erin. Do you dream about the day you’ll be able to leave your working days behind and enjoy life to its fullest without any worries? Do you dream about having enough money to fund the life you want to live so you’re not chained down? Do you […]

Read More >>Is Roku the Key to Cutting Cable Forever?

I receive an email each day from the Wall Street Journal that covers stories and news related to the media & publishing industry. One topic that is covered on a near-daily basis is cord-cutting and how new media is slowly killing traditional cable offerings. One product that disrupted cable early on was Roku. Roku is […]

Read More >>Now is the time to get “Real” about your Finances

This post is part of the Financial Literacy Awareness Carnival. The carnival was coordinated by our good friend Shannon. Check out her post here. Be honest. Are you “real” about your finances? In other words, do you really understand your finances? Do you know where you currently sit financially and where you are going? If […]

Read More >>Why You Should Focus on Quality over Price

This post is from our regular contributor, Erin. Have you ever purchased something cheap for the sake of saving money, only to have it come back to bite you? It’s easy to fall into the trap of spending the least amount possible, especially if you’re still living like a broke college student, but it’s not […]

Read More >>What Would You Take if Your House Was on Fire?

This post is from our regular contributor, Erin. Imagine that you wake up in the middle of the night to the fire alarm blaring in your ears. You wake up in a panic. What’s the first thing you do? If you’re like any normal person, you might start freaking out just a bit. You’re likely going […]

Read More >>Why Parents Should Consider Their Financial Needs First

This post is from our regular contributor, Erin. As a parent, do you ever feel disappointed when you can’t give your child something they want? It’s understandable to want to give your child everything you couldn’t have when you were younger. There can be a lot of pressure to provide for them, both for necessities […]

Read More >>3 Moves to Make Before Considering a Personal Loan

This post is from our regular contributor, Erin. Have you ever considered getting a personal loan to go on vacation, fund part of your wedding, or to help with a home improvement project? How about to refinance your debt, or to consolidate it? These are all common uses for personal loans. Really, you can use […]

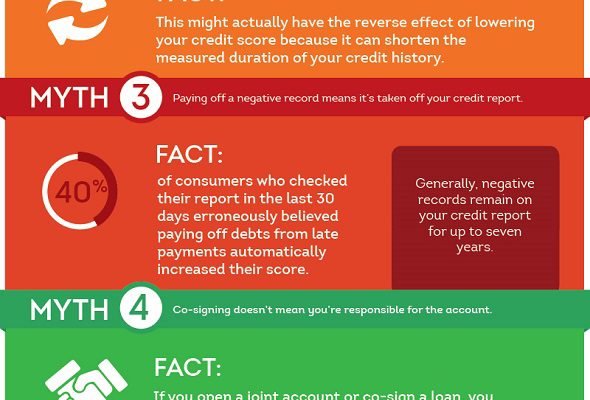

Read More >>Do you know what actually affects your credit score?

TransUnion has provided me with compensation for my time and efforts on this article. As always, all opinions are 100% my own. Everyone has a credit score, but does everyone know what actually affects their credit score? TransUnion recently conducted a survey that revealed that the majority of consumers have difficulty identifying what affects their […]

Read More >>Overwhelmed By Your Financial Situation? Start Small

This post is from our regular contributor, Erin. We talk a decent amount about establishing financial goals, and for good reason: goals are necessary to have! Without them, we wouldn’t have much motivation to improve our finances. However, getting started can be rough. If you’re in a good financial situation right now, that probably wasn’t […]

Read More >>What I Learned From Doing My Own Taxes

This post is part of the TaxACT #DIYtaxes blog tour which shares stories and tips about doing your own taxes and how it makes you smarter about the overall health of your finances. Do your own taxes today at TaxACT. You got this. For the past approximately five years I’ve done my taxes myself. I […]

Read More >>