2025 may be your first year with a Health Savings Account, or HSA, and you are looking to understand how it works. Or, perhaps you may have had an HSA for years but haven’t used it. It sounds weird, but I love writing and talking about Health Savings Accounts. I don’t think enough people know […]

Read More >>2 Hacks to Maximize your HSA Health Savings Account

There are many ways to maximize your Health Savings Account, or HSA. We list many of these in our Health Savings Account (HSA) Guide. This guide also provides a nice overview for those who are a newer to Health Savings Accounts. They include things like: Shifting dollars from the savings portion of your HSA to […]

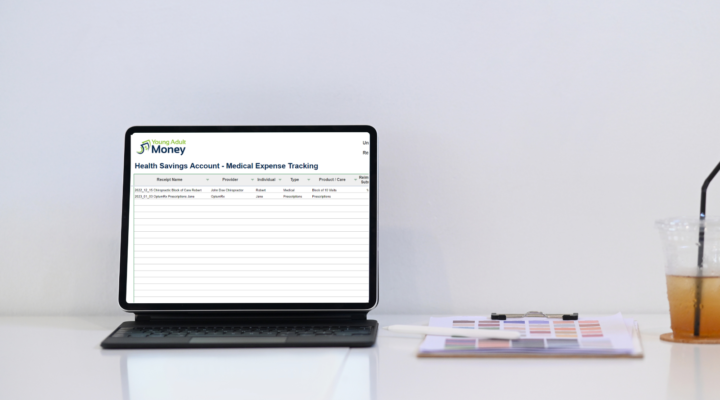

Read More >>HSA Medical Expense Tracking Spreadsheet

If you have a Health Savings Account, or HSA, and aren’t using it to pay for medical epenxes, you are missing out on tax benefits. As we explain in our Health Savings Account Guide, HSAs have a triple-tax advantage: Put Money in Pre-Tax – Contributions put into an HSA are not taxed. Meaning, your adjusted […]

Read More >>Why an HSA is the Absolute Best Retirement Account

I’m making a bold statement today: An HSA is the absolute best retirement account. Not taking full advantage of an HSA – or Health Savings Account – can be a costly mistake for those who are in the financial position to contribute to one. There is a general lack of information about the advantages that […]

Read More >>The Problem with Health Sharing Ministries

Health care in the United States can be summed up in two words: complicated and expensive. For those that can access and afford health care in the United States, many would argue that the US health care system is the best in the world. But what about those who can’t access care? Or can’t […]

Read More >>The $100k Health Savings Account

At some point I become obsessed with the idea of having $100k in a Health Savings Account. Obsessed may be the wrong word because it’s something I have very little control over. But I still think it would be pretty cool to have $100k in an HSA. For 2019 the maximum HSA contribution for […]

Read More >>13 Employee Benefits You Should Take Advantage Of

Last November, thanks to a not so gentle nudge from a round of layoffs, I left the world of full-time employment to start my own business. As much as I love building something that is all my own, there is one thing from my old job that I miss dearly. No, it isn’t the paycheck […]

Read More >>5 Types of Insurance That Millennials Should Have

When it comes to the world of insurance, many millennials feel one of two ways: they’re too young to need it or it’s overwhelming to deal with. In addition, the very idea of insurance is viewed as an extra expense that doesn’t offer immediate benefits and usually gets put on the financial needs back burner. […]

Read More >>Why You Should Contribute to an HSA When You Are Young

There are many benefits of contributing to a Health Savings Account (HSA) and at Young Adult Money, we are big supporters of contributing as much as you can, even maxing it out each year if you are in a position to do so. HSAs have been around since 2003 and are intended to help Americans […]

Read More >>