This post is by our regular Wednesday contributor, Erin. Do you ever think the hype around paying off your student loan debt is a bit, well, unnecessary? Or are you in the camp of getting rid of them ASAP so you can move on to bigger and better things? A few weeks ago, I wrote […]

Read More >>3 Moves to Make Before Considering a Personal Loan

This post is from our regular contributor, Erin. Have you ever considered getting a personal loan to go on vacation, fund part of your wedding, or to help with a home improvement project? How about to refinance your debt, or to consolidate it? These are all common uses for personal loans. Really, you can use […]

Read More >>7 Actions You Can Take to Pay Off Your Debt

This post is by our regular contributor, Erin. Have you ever found yourself overwhelmed by the amount of debt you have? So much so, you have no idea what to do about it, and would rather bury your head in the sand? Trying to run away from your debt isn’t going to solve anything, which […]

Read More >>How to take Full Advantage of Employer Tuition Reimbursement

Over the course of the past few years I debated whether or not to get an MBA. After going back and forth for years I finally decided to get my MBA. What ultimately convinced me to get my MBA? Three words: employer tuition reimbursement. For those who are not familiar with employer tuition reimbursement, there […]

Read More >>What To Do If You Are In Credit Card Debt

As much as we talk about investing, increasing income, and even travel hacking on the blog, it’s important to recognize the fact that many people’s finances revolve around one thing: credit card debt. Millions of Americans are in some form of debt. Debt can have a huge impact on quality of life, and is the […]

Read More >>How to Balance Debt Repayment and Saving

This post is from our regular contributor, Erin. Have you ever wondered which you should be focusing more on: debt repayment, or saving? Chances are, if you’re like many millennials who graduated with student loan debt, you’ve wrestled with this thought at one point or another. Knowing which to prioritize can be overwhelming at times. […]

Read More >>3 Ways the Government Can Provide Student Loan Debt Relief

$1.2 trillion. As of June 2014, the overall student loan debt in the United States exceeded $1.2 trillion dollars with over 7 million debtors in default. Even if you personally have no student loan debt, it touches all areas of the United State’s economy. That trillion dollars of student loans means that students are paying […]

Read More >>How Far Would You Go to Pay Off Debt?

Today’s post is from our regular Wednesday contributor, Cat. I was recently thinking about how some people go to extremes with weight loss. They go on 60 day juice fasts and count calories and try all sorts of other things in order to lose weight fast. So, I was thinking, how far would people go […]

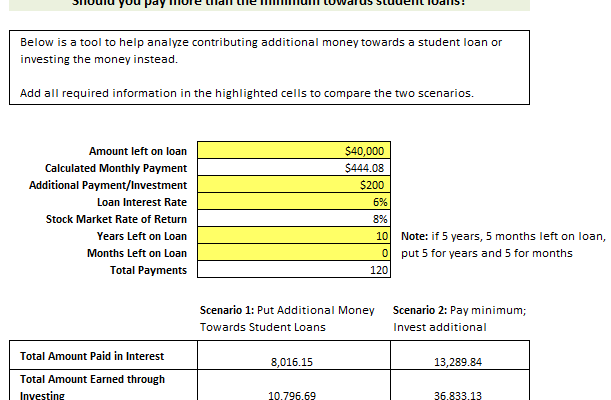

Read More >>Why You Should Pay the Minimum on Student Loans

I think that in almost every situation it makes sense to pay the minimum on student loans. Hear me out before you start firing off a comment about what terrible advice this is. If the goal is to build wealth – and I don’t know many people who don’t have that as a goal – […]

Read More >>Should you cash out your 401k to pay off debt? [Free Calculator Download]

You have thousands of dollars of debt. You have thousands of dollars in your 401k. I think you know where I’m going with this. The questions is: Should you ever cash out your 401k to pay off debt?

Read More >>

![Should you cash out your 401k to pay off debt? [Free Calculator Download]](https://www.youngadultmoney.com/wp-content/uploads/2014/06/Cash-from-401k-to-Pay-off-Debt-720x400.jpg)