There are a ton of budgeting apps out there, but many people end up using some sort of a spreadsheet for their budget.

Spreadsheets offer control and flexibility to users, and allows them to look closer at the transactions going through their accounts.

I have nothing against apps. Many people find them useful, and there’s no denying that there are a ton of good ones out there.

But I personally have used a budget spreadsheet for years and have found it useful. The more people I talk to about budgeting, the more I hear that people desire a spreadsheet-based budget without all the manual work that comes with it.

Today we finally have a budget spreadsheet in Excel that is automated and easy to update. But first let me tell you a bit about the budgeting process I’ve used in the past.

My Budgeting Process

I’m an Excel nerd so using a spreadsheet to budget was a no-brainer for me. I’ve had the same spreadsheet for over four years now. But why haven’t I shared it?

When I share spreadsheets and tools I want them to be as easy to use as possible. The biggest issue with spreadsheet budgeting is getting all the data in the proper format.

I have a number of credit cards due to credit card churning, plus throw in a bank account and you can see why it would take quite a bit of time to reformat everything. No two financial institutions seem to export data in the same format. So there’s a lot of work on the backend.

I didn’t want to share a budgeting spreadsheet until I solved this key piece of the puzzle. Fast forward four years and I still haven’t shared a spreadsheet.

That all changed when I discovered Tiller.

Join our Online Community to Receive your FREE Automated Budget Spreadsheet in Excel

Tiller – The Key to Automation

Tiller is what I have been waiting for: it automates the process of pulling in your financial data into a clean, uniform format.

Tiller is what I have been waiting for: it automates the process of pulling in your financial data into a clean, uniform format.

Now there are a ton of apps out there that link to your accounts. But they don’t allow you to dump your data into a spreadsheet because they either haven’t built a tool that can do that or they have a huge incentive to not allow their users to dump data into a spreadsheet.

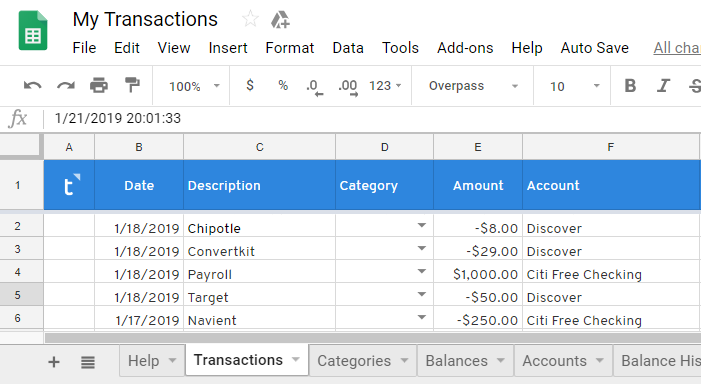

Once you sign up for Tiller you simply have to connect your accounts and your financial transactions will be dumped into a Google Spreadsheet each day. They will come through in a uniform format that looks something like this:

Tiller does cost money. You can use my link for a free 30 day trial, but after that it’s $79/year. If you’re like me and spend an hour or more getting your data into a uniform format or have avoided budgeting because you don’t want to take the time to mess with your data, $79/year is well worth what you are getting in return for Tiller’s service. (Don’t worry they have a 60-day money-back guarantee as well).

Tiller has bank-grade security and has partnered with a company that works with some of the biggest banks in North America to ensure it’s up to the same high standards banks are held to. What was even more reassuring to me was hearing that their employees can’t even see your financial data. You can read more about their security and other features of their service on their website.

I’m all for Google Sheets, and Tiller absolutely can work simply using Google Sheets, but Excel is where it’s at if you want a clean and good-looking budget spreadsheet.

So I took it a step further and created an automated budget spreadsheet in Excel.

An Automated Budget Spreadsheet in Excel

Tiller is a great start, but my automated budget spreadsheet in Excel is where people will feel most “at home.” Excel is widely used and I’ve created a spreadsheet that someone with limited experience can use.

The spreadsheet has a directions tab that guides you through the process of updating the spreadsheet with your data. It also points out best practices that will help you not “break” the file.

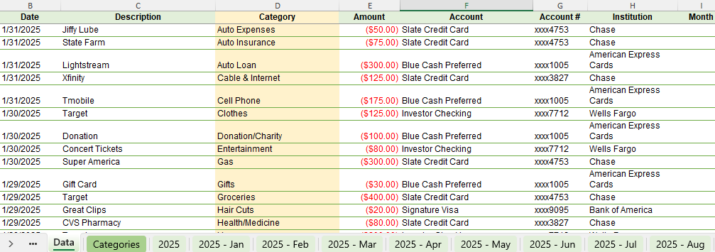

The data tab is where you will want to paste your Tiller data. The data will then become part of a table that uses formulas to automatically populate the monthly summary tabs and the annual summary tabs.

Note that Tiller does not automatically populate the category for each transaction. Having the user populate the category allows the user to assign relevant categories and look at the transactions at a lower level of detail than they would if category was auto-filled.

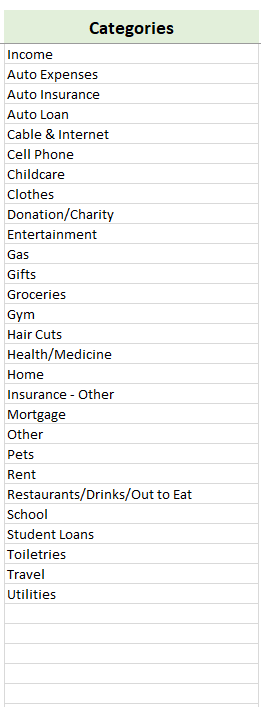

On the categories tab you can add or delete categories as you see fit.

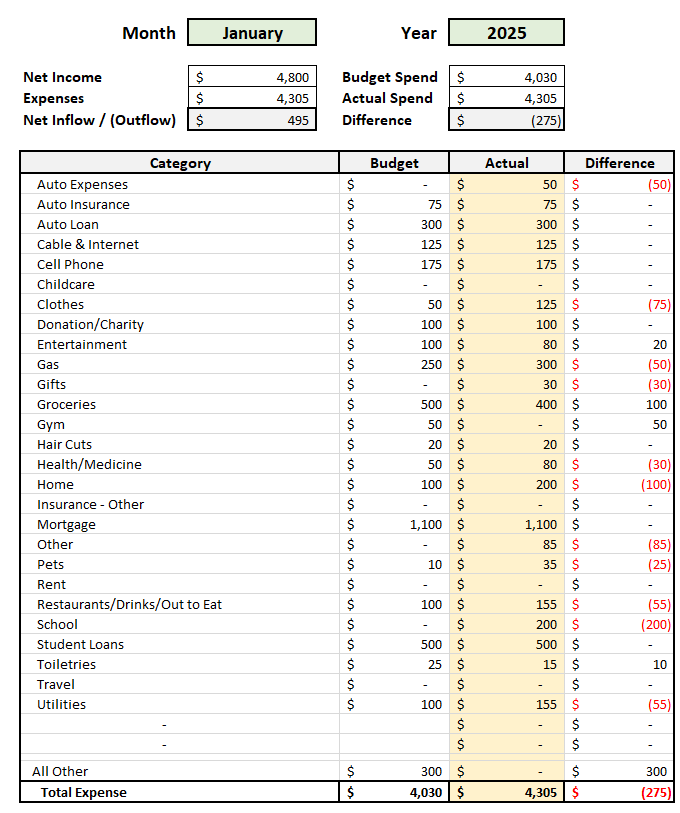

On the monthly summary tabs, everything is automated except for the budget column and the categories. You can add and delete categories as you see fit. You can unhide the hidden rows towards the bottom if you need to add more categories.

Everything is formula-driven, making it easy to see a snapshot for the month. While tabs have already been created for each month in 2025, you can easily make a copy of any of the months tab and choose a different month and year drop-down as you see fit. Everything will update automatically for whatever month you choose.

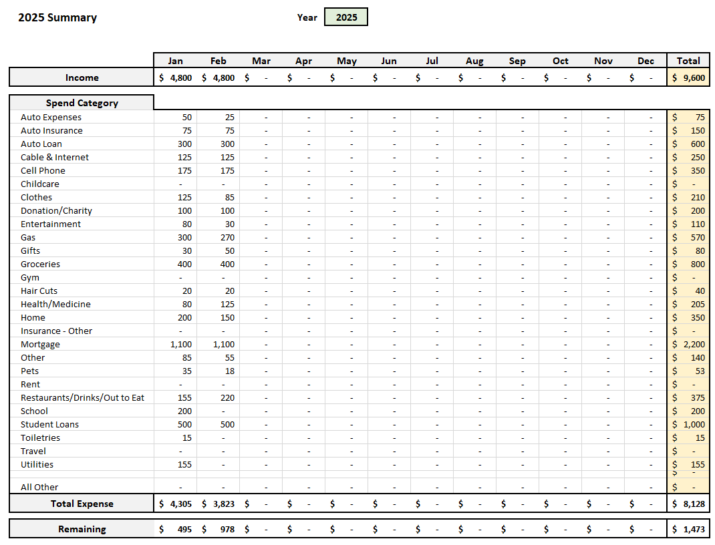

One additional thing included in this file is the annual summary. If you go to the 2025 tab you can see an annual summary of your income and expenses by month. This is automatically populated and you can easily make a summary for future years by choosing a different year from the drop-down.

This spreadsheet takes a lot of the manual work out of the budgeting process and gives you nice clean views of your financials, both budgeted versus actual as well as net inflow and outflow of cash.

My hope is that this easier process of importing and tagging data will encourage others to start budgeting. After all, using this process you can easily update your budget in less than 30 minute a month, perhaps even less than 10 minutes depending on how many transactions you need to tag.

Join our Online Community to Receive your FREE Automated Budget Spreadsheet in Excel

Your spreadsheet looks very thorough but simple to input & use. I’m not a big fan of the preformatted budgets Excel has, good idea, but still too much tweaking for what it is.

I do like the idea of Tiller because it saves so much time & helps ensure you don’t overlook any expenses.

This is awesome, thanks for the review! We use an extensive Excel spreadsheet but our expenses and investments are not automated. I just heard about Tiller last week and it seems like a great way to automate! Thanks!

Very cool DC! I’m a fellow Excel nerd myself and have a pretty extensive spreadsheet that includes a good number of things, but it’s not automated. I’ve seen Tiller popping up around the PF sphere a fair bit so I guess I should check them out. :)

I’m the world’s biggest tiller fan right now! I haven’t even finished my spreadsheet (because Visual Basic and the Google programming language are not as similar as they should be!)

interesting, thanks for sharing!

This sounds like a great tool! Sadly, I’m living in Europe. Anyway, I have optimized the process of manually adding the data for me. I do this on every Sunday. I have one sheet for my investments, one for income vs. outcome of the month and the last one for budget vs. expenses. The last one is awesome because it takes into account that there are several yearly payments which need to be converted to monthly payments.

I also use an App for tracking everything again with the possibility to export to Excel. It takes about half an hour to update everything but I’ve got the feeling that this also keeps me ahead of my finances and what’s going on.

I just visited your site for the first time and am impressed. I downloaded your automated budget spreadsheet in excel and like what I see. In the categories can I make sub-categories? If not, is the categories section unlimited? Just wondering.

Thanks for the spreadsheet and all the information on your site.

Hi Tom – Glad to hear you like the spreadsheet, and thank you for the kind words. I’ve tried to keep the spreadsheet as simple as possible, so there is no explicit sub-category column to populate. With that being said, I use personally use the “Note” column as a sub-category section, at times. For example, I have various Income sources. The category for that is “Income”, but the “Note” column as a sub-category to identify what the income source was. Granted to fully leverage this you need to pivot off the “Data” tab, which I’m assuming 90% or more of users know how to do.

Nice spreadsheet I’ll try out. I’m thinking of trying to add a tab(s) that will track account balances along with the transaction list. Do you think this is possible?

Is there a way to expand this budget into a two week view (bi-weekly) view rather than monthly?

Thank you, David!