The Biden administration recently announced a new proposed student loan repayment plan that, according to the Department of Education, will provide millions of borrowers with lower required monthly payments and increase the speed of student loan forgiveness.

Technically this proposal revises an existing plan, not an entirely new plan.

Let’s dive into what the details of the proposed new Biden student loan repayment plan.

Key Details of the New Biden Student Loan Repayment Plan

As I mentioned, the proposal does not create a new income-driven repayment plan, but changes an existing one, Revised Pay As You Earn (REPAYE). Including REPAYE, there are four income-driven repayment plans. You can see the details of each of the four plans here.

The revised edits to the REPAYE plan, which I am going to call “New REPAYE” from here on out, can be complicated at times.

Let’s start with the key points and then we’ll unpack each of them in more detail.

- The calculation for discretionary income will increase the federal poverty guideline factor from 150% to 225%

- Required payment will be 5% of discretionary income if debt is 100% undergrad (currently 10% or more for the four existing plans)

- Required payment will be between 5% and 10% of discretionary income if there is any grad school debt (we’ll walk through the calculation in a moment)

- Spousal income excluded when taxes are filed as married filing separately

- Interest will not accrue if a borrower’s monthly payment is so low that they it doesn’t cover the interest portion of the monthly payment

- Loan forgiveness will be between 10 and 20 years for undergrad only debt; if a borrower has any grad school debt, forgiveness will be after 25 years

- Parent PLUS loans will continue to be excluded as they were under existing REPAYE regulations; Parent PLUS borrowers will need to use the Income Contingent Repayment (ICR) plan instead

Now that we’ve covered the key points, let’s unpack them each a bit further.

Required payment calculation

There are a number of changes to how the required monthly payment is calculated.

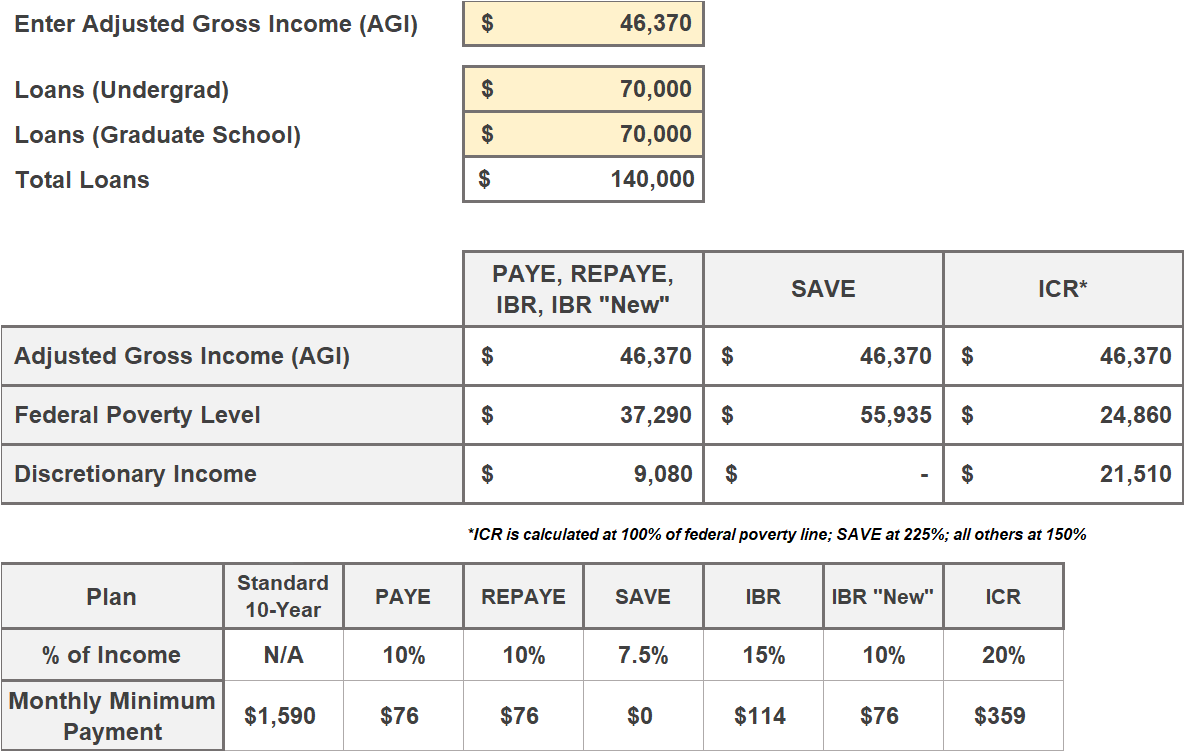

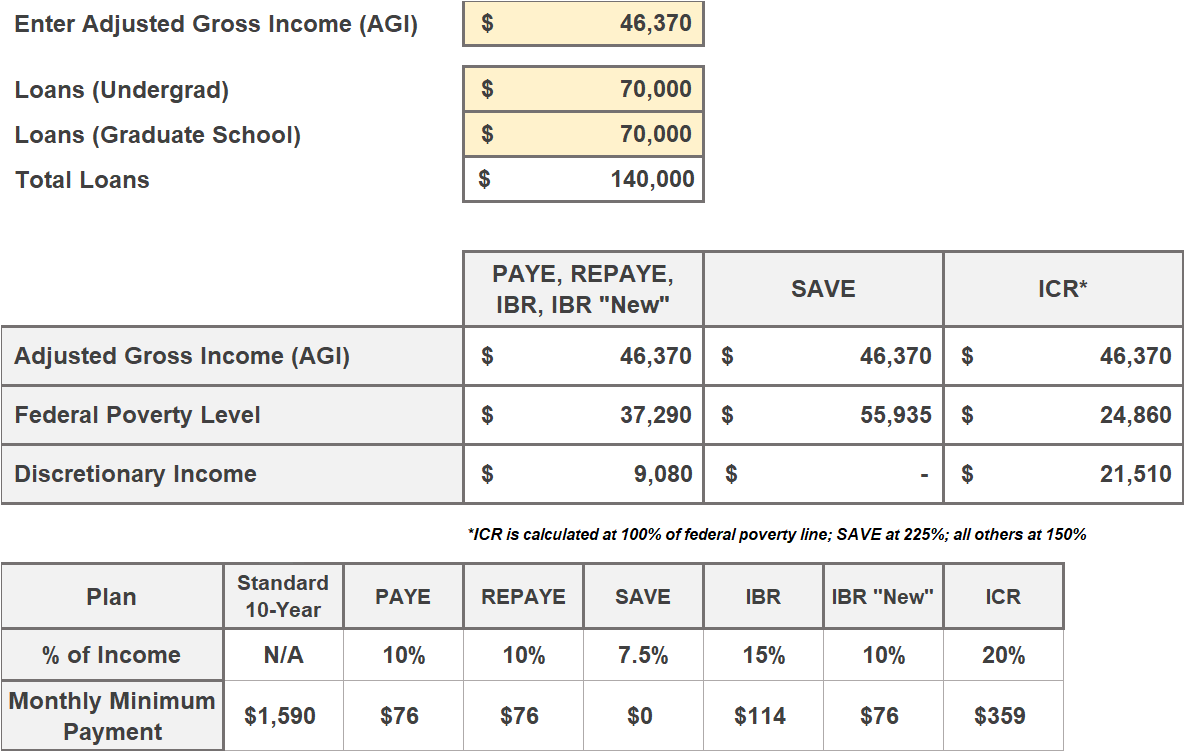

The first one is the change from 150% to 225% of the federal poverty guideline factor when calculating discretionary income. Discretionary income is a key variable, since income-driven repayment plans use a percentage of discretionary income (currently 10% to 20% depending on the plan) to calculate the required monthly payment.

The discretionary income calculation is:

Adjusted Gross Income – federal poverty guideline factor = discretionary income

Let’s walk through an example.

A single individual living in Delaware who has no dependents would have a monthly federal poverty of $14,580. This is at 100% of the guideline. Currently REPAYE uses 150%, or $21,870. New REPAYE would use a factor of 225%, or in this case $32,805.

This individual has an Adjusted Gross Income, or AGI, of $50,000. (Note: AGI can be found on your tax return and excludes things like 401k or 403b contributions).

Under the current REPAYE plan their discretionary income is $28,130 ($50,000 less $21,870).

Under the New REPAYE plan their discretionary income is $17,195 ($50,000 less $32,805).

Now let’s assume that this individual only has undergrad student loans. Under REPAYE they would be required to pay 10% of their discretionary income, but under New REPAYE they would be required to pay 5%.

Under the New REPAYE plan their required monthly payment would be $72 ($17,195 * 0.05 / 12)

Under the New REPAYE plan their required monthly payment would be $234 ($28,130 * 0.10 / 12)

Needless to say, that’s a big difference. The combination of the higher federal poverty guideline factor plus the percentage of discretionary income being cut in half leads to this individual’s student loan payment going down to less than $100 a month.

Want to plug in your own numbers? Download our income-driven repayment calculator by entering your email below. We just updated it with New REPAYE in addition to the existing income-driven repayment plans.

Join our Online Community to Receive your Student Loan Income-Driven Repayment Calculator

What about grad school loans?

The above example was an individual with only undergrad loans. But what happens if someone has grad school loans?

A good starting point is this: in New REPAYE, a borrower with grad school loans will not need to pay more than 10% of their discretionary income towards their loans.

Well, this is no different than REPAYE, so is there any benefit for grad school borrowers?

The answer is yes, because of the increase in the federal poverty guideline factor, which doesn’t change depending on whether the borrower has undergrad loans, grad loans, or a mix of both.

They also will benefit in the sense that they will pay between 5% and 10% depending on the mix of undergrad and grad school loans.

Let’s say that a borrower has $50,000 in undergrad and $100,000 in grad school loans.

That means that 2/3, or 66.67% of their loans are grad loans.

You would take (33.33% x 5%) + (66.67% x 10%) to get to 8.3% as the percent of discretionary income that they will be required to pay towards their loans each month.

Spousal income excluded when taxes are filed as married filing separately

Currently on REPAYE, a spouse’s income is included in the calculation for monthly student loan payments even if you file your taxes as married filing separately.

This has caused some borrowers to switch to the IBR plan (Income Based Repayment) despite it requiring 15% of discretionary income instead of 10%.

New REPAYE changes this. With New REPAYE you are able to exclude your spouse’s income from the calculation as long as you file your taxes as married filing separately.

Interest will not accrue if a borrower’s monthly payment is so low that they it doesn’t cover the interest portion of the monthly payment

One of the biggest complaints about the current student loan repayment system is that borrowers can see their balance increase even after years and years of making payments.

Why this happens is because on income-driven repayment plans the required monthly payment may not cover all the interest, let along make a dent in the principal of the loan or loans. For example a borrower may be required to pay $1,050 a month on a standard ten-year repayment plan but on an income-driven repayment plan be required to pay $200. That $200 likely won’t cover the full interest portion of the $1,050 payment. If the interest portion was, say, $400, then $200 of interest ($400 – $200 = $200) would accrue and eventually be added back to the principal.

The New REPAYE fixes this problem. In the above example, the additional $200 of interest not covered by the $200 payment would not accrue.

Loan Forgiveness Implications

Changes to loan forgiveness timelines under New REPAYE will be impactful for some but minimal, if not entirely unchanged, for others.

- Loan forgiveness will be between 10 and 20 years for undergrad only debt; if a borrower has any grad school debt, forgiveness will be after 25 years

The easy aspect of this to get out of the way is anyone who has taken out any grad school loans. Their path to loan forgiveness will remain at 25 years, as it is under REPAYE.

For those with undergrad loans only, it’s a bit different. Here’s how it works:

- If a borrower took out $12,000 or less in loans, they will receieve loan forgiveness after making the equivalent of 10 years of payments.

- For each additional $1,000 borrowed above $12,000, the borrower would require one additional year of payments to receive forgiveness.

- No one who borrows only undergrad loans will need to make more than 20 years of payments to receive forgiveness.

With these rules in mind, an individual who took out $13,000 would need to make 11 years of payments, $14,000 would need to make 12 years of payments, and so on until you hit 20 years in which case that is the maximum number of years.

To be clear, this is for income-driven loan forgiveness. Public Service Loan Forgiveness, or PSLF, would still be on a 10-year timeline for all borrowers. Read more about PSLF here.

What else is in the proposal?

I focused on the key points here, but there are some other aspects of the proposal I haven’t touched on.

There are some changes to access to income-driven repayment plans for those who are in a delinquient or default status. The proposals here are all positive and move in the right direction. Because of the complexity of student loans many borrowers aren’t aware of all their options and could benefit greatly from moving into an income-driven repaymetn plan. That’s challenging for a borrower when they don’t even know income-driven plans exist.

There are a few proposed changes around what counts as an eligible payment, specifically focused on forbearance and deferment.

And perhaps the most notable thing I haven’t shared yet is that the administration would plan on phasing out new borrowers entering PAYE and ICR income-driven repayment plans, and make it difficult for a borrower to move from New REPAYE to IBR. IBR is written into law and therefore the administration is unable to fully limit access to it.

If you want to plug in your loans or a friend or family member’s loans to see what the paymennt would be under the New REPAYE plan, you can grab a copy of our calculator.

Join our Online Community to Receive your Student Loan Income-Driven Repayment Calculator

What’s next with the new Biden student loan forgiveness plan in 2023?

At this point the New REPAYE proposal is just that, a proposal. The Department of Education “expects to finalize the rules later this year and aims to start implementing some provisions later this year, subject to any changes made based on public comments.”

We will be closely watching this, the upcoming Supreme Court case on loan forgiveness, the ending of the COVID emergency order, and everything else impacting the student loan space. Subscribe to our email newsletter to stay up to date.