Wouldn’t it be great to have enough money to be able to do whatever you want the rest of your life, never working another day unless you chose to?

Wouldn’t it be great to have enough money to be able to do whatever you want the rest of your life, never working another day unless you chose to?

That’s the driving force behind the FIRE movement that has gained in popularity the past decade.

FIRE stands for Financial Independence Retire Early.

Those who are intentionally pursuing FIRE are focused, sometimes obsessively so, on building up their investments to a point where they don’t have to work another day in their lives. This is the “Financial Independence” portion of FIRE.

Some who are pursuing FIRE also are focused on quitting their job and never working another day in their life, the “Retire Early” portion of FIRE.

What we are starting to see is more of a shift in focus towards the Financial Independence aspect of FIRE instead of the Retire Early component. Many people who pursue FIRE, or at least who you hear about, are relatively young (think late 30s, 40s, early 50s) and tend to continue working in some capacity even if they quit their 9-5.

Even if you enjoy your job and have no plans of leaving your employer any time in the foreseeable future, financial independence can be worth pursuing. Once you hit financial independence you have the financial ability to not put up with a workplace you aren’t happy at. Let’s say you are going to be moved to a manager who you despise. You don’t have to stick around for a single day because you don’t have to work. Or you may be put on an evening or weekend shift despite telling management that time is reserved for your family. They can comply with your request or lose you.

If you are just heading down the path of financial independence, it won’t be achieved overnight. But the endgame of having the option to not work can be motivating and drive you to save a higher percentage of your income, advocate for higher pay, or start a side hustle.

But we are getting ahead of ourselves. How do you know when you’ve achieved FIRE? How do you calculate a target?

How Do You Achieve FIRE?

An often-quoted figure for FIRE is 25x your expenses. This means once you have 25 times your annual expenses in investments, you have achieved FIRE.

Let’s say your household expenses are $5,000 a month, or $60,000 a year. Once you hit investments of $1.5M you have achieved FIRE.

Or let’s say your expenses are a bit less, $4,000 a month, or $48,000 a year. You would need $300k less to achieve FIRE, $1.2M to be exact.

But why is that the case? What is the logic behind 25x?

I reached out to author Tanja Hester, author of Work Optional: Retire Early the Non-Penny-Pinching Way, to get her input.

Hester said that the 25x factor is “based on a 4% safe withdrawal rate, which means that, according to some studies, you could withdraw 4% of your investments at the beginning of your retirement, and adjust that figure up slightly each year to account for inflation, and you’d have a very good chance of not running out of money.” The most famous study Hester is referring to is The Trinity Study, which is a 1998 paper from three professors at Trinity University.

The fact that the paper proposed a 4% withdrawal rate is why 25x is so widely cited. But is that too aggressive? Hester thinks so. “The logic is most likely sound for traditional retirees retiring today, who on average are retired for 30 year or less. But for early retirement, with a much longer timeline and so many more unknowns, I don’t believe 25x is quite safe enough.”

I tend to agree, and for one reason in particular: health care.

I’ve worked in health care for a decade and I project the costs increasing. There is waste in the health care system, no doubt, but removing that waste and realizing efficiencies won’t be enough to completely overcome the upward price pressure. People are going to live longer, largely due to advancements in technology and ground-breaking drugs and treatments. People with chronic illnesses will live longer, and sometimes living with and managing chronic illnesses can be expensive.

Employer-provided health coverage passed $20,000 for a family plan in 2019, with the employer paying nearly $15,000 of that burden. The cost of health care for a consumer naturally increases when you take the employer subsidy out of the equation.

So what do we do about health care costs? Here’s what Hester has to say:

The first step to prepare is to use the calculator at Healthcare.gov or on your state’s exchange to get a sense of what your health insurance would cost now, using some assumptions about what your income might be in early retirement. You’ll want to look at both the total premium costs and the out of pocket maximum, and remember that the OOP max doesn’t include the premiums, so you have to add them together to know the most you might have to pay. Then, assume those costs will go up about 10% a year to get a sense of what you’ll likely be paying down the road.

I would add that contributing as much as possible each year into a Health Savings Account can be beneficial.

The money you deposit in your HSA is tax-free and stays with you forever, and you can invest in low-cost mutual funds (index funds). Whatever you withdraw for qualified medical expenses (which includes things like prescriptions, provider bills, etc.) is taken out tax-free. That includes any gains on investments. You can see how a $50k HSA at age 35 could really grow over time if you don’t have many withdrawals over the next ten, twenty, or thirty years. You can read more in our 2020 guide to Health Savings Accounts.

Having a more conservative withdrawal rate than the 4% that aligns to 25x is one way to combat this. Hester recommend everyone save at least 30x, with 33x to 35x being preferable. At 30x your annual withdrawal rate would be 3.3%, and at 35x it would be 2.9%. Hester’s reasoning is that the 4% rule assumes all expenses will rise with inflation. But health care costs have been increasing faster than inflation, and Hester also points out that the impact of climate change will lead to higher costs over time, but at an unknown rate.

Another way Hester recommends factoring in conservatism to your FIRE calculation is to not count Social Security into your traditional retirement budget. Instead this should be thought of as a health care buffer. The rationale, according to Hester is that, “a huge portion of Social Security benefits being paid out to retirees go to cover medical costs above and beyond what Medicare covers, and it’s only expected to get worse.

Considering all of this, it makes sense to run a few different FIRE scenarios. Your scenarios should range from a withdrawal rate of 2.9% (35x expected annual expenses in retirement) to 4.0% (25x).

Let’s move on to strategies to achieve FIRE, including what you should actively be doing to make sure you are on the path to FIRE.

An Example of FIRE

Your savings rate is crucial to achieving retirement, early or otherwise. The higher your savings rate, the faster you will achieve FIRE.

But that’s just one side of the equation. If your costs stay flat and your income doubles, you could keep your savings rate the same and reach FIRE faster. Alternatively if your income increases and you increase your savings rate, you will speed up your FIRE date.

Let’s walk through a simple example.

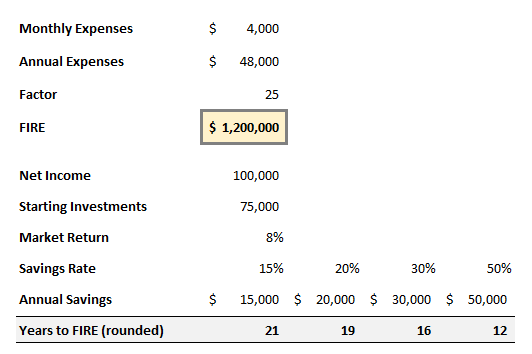

Doug and Kelsey estimate they will have $4,000 in monthly expenses in retirement, or $48,000 a year. Using the 4% safe withdrawal rate as our benchmark they will need to have 25x their annual expenses invested to achieve FIRE. This equates to $1,200,000.

Let’s also assume they have a net income of $100,000 that can be used for savings or investing. They already have $75,000 of investments and expect an average return of 8% for the market.

Here’s how the numbers work out:

If they have a 50% savings rate and all the assumptions hold they could achieve FIRE in 12 years. If they only saved 15% of their income each year, though, they wouldn’t reach FIRE for 21 years.

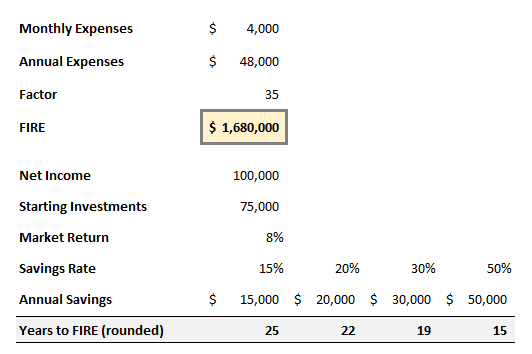

Remember, 25x is may be too conservative of a factor. Let’s try 35x annual expenses and see how it changes the expected FIRE date.

That changes things. Now Doug and Kelsey need nearly $1.7M to achieve FIRE, and the quickest they could reach it is within 15 years. I might add that 15 years can pass way quicker than most of us realize and if Doug and Kelsey were 35 years old they would still hit FIRE way earlier than most of the American population.

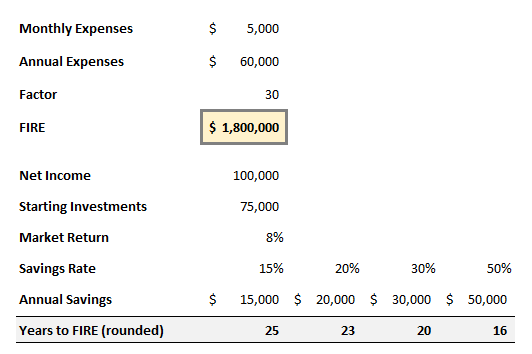

Let’s do one additional view. Let’s assume that $4k a month is simply too low for retirement income. Let’s go with $5k. And let’s drop the factor down to 30x. Here’s where we are at:

This brings us to a FIRE number of $1.8M. Depending on savings rates Doug and Kelsey will hit FIRE in between 16 and 25 years.

Again, 16 to 25 years can fly by. These examples are clearly way oversimplified. For example, we didn’t adjust Kelsey and Doug’s income at all over the years.

What I wanted to highlight, though, was the impact of savings rate and income. It’s going to be difficult, though not impossible, to achieve FIRE on a household income of $25k. The higher the income the easier it is to have a higher savings rate.

Lifestyle inflation comes into play here, too. Lifestyle inflation essentially means that as your cash flow increases the cost of your lifestyle does as well. For example, bigger houses with bigger mortgages can suck dollars away from the investments needed to hit FIRE. If your housing cost can stay consistent even as your income increases you can achieve FIRE quicker.

Strategies for Achieving FIRE

Spending less than you make, and then diverting those funds towards investments, is key to achieving FIRE.

One reason why we haven’t written about this topic that often on Young Adult Money is because other financial goals must come first. Many are working through building an emergency fund, paying off credit card debt, creating a student loan strategy, and understanding their income and expenses.

The good news is that the strategies for achieving goals like building an emergency fund are similar strategies for achieving FIRE. Increasing cash flow is typically how financial goals are hit.

Here’s a few key strategies for achieving FIRE:

Look for Opportunities to Spend Less

Depending on what you spend your money on, cutting expenses can be the easiest way to increase cash flow. If you don’t already, use an app like Tiller to analyze your income and expenses. Review at least three months, and look at the average spend by category (i.e. groceries, restaurants, auto expenses, etc.). I recommend making it a habit of reviewing your spending regularly so that you have a longer history to look at.

You don’t have to cut your spending ruthlessly, but perhaps you are spending too much on things you simply don’t care about. If you like your daily Starbucks drink, don’t cut it out. Instead you may want to cut back your restaurant spend by half. If you really love your apartment, perhaps selling your expensive car and getting a cheaper used one makes sense. Finding ways to save money is personal.

One thing my wife and I have done is spend a lot of time looking at ways to save money on travel. We have been able to take some amazing trips the past five years while paying for almost no flights thanks to travel hacking. We’ve also minimized the food we waste by planning meals each week before going to the grocery store.

Increase Income at your 9-5 or through a Side Hustle

FIRE wasn’t the driving force behind me focusing on increasing my income at my 9-5 or starting side hustles, student loans were. We had a lot of student loan debt coming out of undergrad ($100k+) and no emergency fund.

You can only cut so many expenses before you have nothing else that can be cut out. It’s true that cutting costs can be much easier than increasing your income, but at some point if you want to increase your cash flow it makes sense to take a good hard look at your income.

Some corporate jobs there is always opportunity to increase your income, either through promotions or through jumping ship to another company that is willing to pay you more. In other professions the pay is relatively capped, such as a teacher’s salary, and will increase as seniority increases. Doing salary research can help give you the information and data you need to have salary conversations with your manager. Making more money at your 9-5 can be much easier than making money at a side hustle, so this is a good place to start.

Side hustles are the other opportunity. I know a couple who, in addition to working full-time jobs, served at a restaurant on weekends for over a year to help pay for their wedding in cash. Getting a second job in retail or the service industry is the easiest way to make extra money, but it’s not the only way. To give you some ideas and examples, I shared the more than ten ways I’ve made side income. I also put together this monster post of 50+ ways to make extra money through online and at-home side hustles. Finally there are options like pet sitting and tutoring that have become popular (my wife is watching a couple dogs as I type this post up).

Criticisms of the FIRE Movement

The FIRE movement has faced a lot of criticism, some of it warranted. Let’s address a few of these criticisms.

What if you like your job? Why would you want to retire early?

The whole “retire early” aspect of FIRE can be really off-putting. After all, many of us love what we do for a living and leaving our job years, or even decades, before a traditional retirement age doesn’t make any sense.

I already mentioned this at the beginning of the post, but in this case and perhaps most cases the focus should be on the “Financial Independence” aspect of FIRE. When I think of the corporation I work for, there are many employees who are highly compensated. Assuming they have saved and invested significant amounts over the years, they could retire tomorrow. But they keep working year after year. The benefit for them is they are working by choice and have more leverage if they are pushed to do something they don’t want to do.

Besides having “f you” money, there is always a chance you will have to stop working earlier than expected due to an illness or physical limitation. It’s not something bright and cheery to think about, but you never know what life will look like in ten, twenty, or thirty years. You may also need to dedicate more or all your time to care-taking of a family member.

Don’t focus on the retire early aspect of FIRE. Focus on financial independence.

What about Kids? Isn’t it difficult to achieve FIRE with kids?

A common criticism of FIRE is that it is difficult to achieve when you have children.

I personally think this criticism has some validity. I’m 31 and my wife is 30, and we have no children. I often think about how having children will change our lives. In the context of FIRE, it’s much easier to save and invest with our DINK (dual-income no kids) household, not to mention avoid lifestyle inflation, than if we had children.

It’s been proven that when you have kids your household spend goes up from your child-free household. Parents feel the need to buy larger homes with more bedrooms and bigger vehicles. They naturally need to spend more money on clothes, food, activities, health care, and virtually every budget category.

I asked Hester about this and she said “realistically, you’ll need to work longer if your goal is full early retirement, because you won’t be able to save quite as fast as those without kids, and you’ll probably want to save more to account for kids’ education expenses or other ways you may wish to help them out.” She also offered another option, which she called a “career intermission,” or semi-retirement, which allows you to temporarily take a break from working to spend more time with your kids as they are growing up. She talks more about the math behind FIRE with kids and the option of a career intermission in her book Work Optional

Don’t people who pursue FIRE go to ridiculous lengths to save make and save money?

Probably the biggest criticism of FIRE is that those pursuing it take crazy measures to minimize the amount of money they spend. Another way of saying it is that those pursuing FIRE are happy to live a miserable life for five, ten, ore more years if it means they can retire early.

This is another criticism that has some truth to it. I started writing about personal finance before FIRE become a more mainstream concept, but I have seen historically those pursuing it be extremely critical of almost every sort of spend. It was off-putting to hear so many personal attacks on people for doing things as simple as commuting to work in a car instead of biking, or taking multiple trips in their car on the weekend to run errands (you can see why this movement can be so off-putting…).

There have been articles critical of FIRE because there seems to be so many single men who are the torchbearers, who are overly critical of anyone who spends money on things they find frivolous.

Thankfully over the years there have been more people, like Hester, who show more empathy. Not everyone wants to cut costs as much as possible and avoid social outings that cost money. Sometimes taking as simple of steps as purchasing an $8,000 used car instead of a $25,000 new car, or living in a house that is sufficient but not brand spanking new can make a massive impact on your ability to achieve FIRE.

My final takeaway for you is to not be discouraged if you aren’t in a spot to think seriously about FIRE. Millions of people would benefit from focusing on goals such as building an emergency fund or eliminating credit card debt, and FIRE is something that they can look into later on.

If you are in a position where FIRE seems like something you want to work towards, that’s great. You can start by looking for ways to increase your cash flow and, in turn, increase the amount you are putting in investments. If you want a more comprehensive overview you can check out Hester’s book Work Optional.

Howdy from Oz Down Under, really resonated with this post! I agree, I think 4% is wayyyy too high a figure, in our household MrsFrugalSamurai and myself use 2.5%… too conservative you think?