If you’ve already heard about it – or perhaps already started the challenge – awesome! What I want to talk about today is an alternative way to do the challenge.

First, I should explain what the original version of the 52-week savings challenge is.

In the original version you save $1 the first week, then $2 the second week, $3 the third week, and so on for 52 weeks. At the end of the 52 weeks you will have a $1,378 saved. The purpose of the challenge is to prove that when it comes to saving money the ideal way to get started is with an attainable goal such as the first week’s $1 requirement.

An Alternative

Fellow Minnesota personal finance blogger Carrie Rocha of Pocket Your Dollars recently presented an alternative to the 52-week money challenge. She suggested doing the money challenge in reverse. Her reasoning was:

- You see an immediate impact – After just 4 weeks you will have $202 in the bank.

- Heavy lifting done early – If you started the money challenge early in the year, you will inevitably have all the big dollar amounts around the Holidays and year-end when people generally have additional expenditures. If you do the challenge in reverse (and assuming you start the challenge within the first few months of the new year) you will have smaller amounts to deposit around the Holidays.

I really like Carrie’s approach. Some people may find it hard to start the challenge in reverse because, well, the whole point of the challenge was to start small and show that you can progressively save more without it being a huge strain on your budget. Nevertheless, I think that doing the challenge in reverse is probably the better way to do it.

My Alternative to the Alternative

I have another alternative to the 52-week money challenge to share with you, and I think it’s the best approach. Instead of doing the challenge in order or in-reverse, I suggest doing the challenge where you pick and choose how much you save each week.

For example, let’s say you save $52 the first week and $51 the second week. Then, the third week you have a huge car repair bill. Maybe the third, fourth, and fifth week you deposit some smaller amounts. Alternatively, you could alternate between high deposit amounts and low deposit amounts.

No matter what you will still end up depositing $1 through $52, but this approach spreads out the amounts to be more in-line with the reality of your situation. I would still suggest starting with the larger amounts, but if you need to drop to the lower amounts you can.

Use our Spreadsheet and get Started

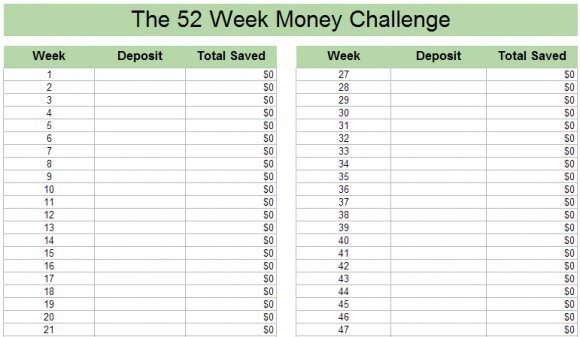

If you want to do the 52-week challenge, however you decide to do it, you can use our Google Spreadsheet and either track it in the spreadsheet or print it off and hang it up somewhere so you won’t forget about it.

There are two tabs in the spreadsheet. The first tab has a list of 52 weeks. Each week you should add what amount you saved. The ‘Balance’ column is a running total that calculates automatically.

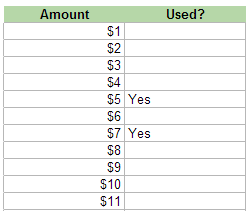

The second tab has a list of $1 through $52. This can be used to track what amounts you already deposited. You can add ‘Yes’ to the second column when you’ve deposited each amount.

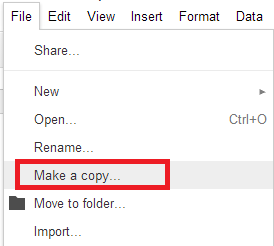

Be sure to make your own copy of the file – you won’t be able to edit the official file.

Whether you currently save or not, $1,378 is an amount I think any of us would be happy to see that in our saving’s account.

If you decide to take on the challenge, good luck!

Download the 52-Week Money Challenge Spreadsheet by entering your email below.

Join our Online Community to Receive your FREE 52 Week Money Challenge Spreadsheet

Are you serious about saving money? Here’s some articles that will help you save as much money as possible:

Have you ever tried a saving challenge? What could you use an extra $1,378 for?

Personally, I would rather pick a single amount and set up an automated transaction so I don’t have to think about it every day. The less brainpower necessary the better in my opinion.

Matt @ Mom and Dad Money That’s fair, and if it works for you great! This is a good challenge for someone just getting started or for someone looking to add an additional layer of savings (like me) who already have automatic transactions. You definitely would not need to think about this every day, but I think it can be a fun ‘challenge’ to get people going on savings.

We’re actually going to do the challenge the way you are, DC. For instance, this month was SUPER tight due to a propane fill we had to do, so we will be doing the smallest amounts this month. I love this method b/c it can be done even if you’re on a super tight budget like we are.

Laurie TheFrugalFarmer Awesome! My wife and I will be doing this challenge and I think it will be a great way to get an additional $1,300+ in our savings. I love how it allows you to be flexible in your savings.

I definitely like the idea of this savings challenge, and I love all the variations people come up with! I think most of them end up being better than the original :)

CSMillennial I agree! I think the original way of doing this challenge is logical and I can see where they are coming from, but I like my variation much better.

I have never done the 52-week challenge but it does seem like a great idea! Why not? Maybe one of these years I will try it out.

Holly at ClubThrifty I plan on doing it to add an additional layer of savings. It’ll be $1,300+ that we didn’t plan on saving and will be a nice amount to have socked away in a ‘secondary’ emergency fund.

I’ve never tried saving in this manner but I think it’s a great method to follow. I can see how this picks up steam and really keeps a person motivated throughout the course of the year.

Brian @ Luke1428 I like the flexibility aspect of it where you can knock out the higher amounts when you have a little extra cash or knock out the lower amounts if you are having a tight month.

No matter how you do it, if you making saving a habit, it is worth it!

moneycone I agree 100%. Perhaps my idea doesn’t work for some people, and that’s fine! Finding a savings plan and sticking to it is the most important thing you can do.

That is like playing Who wants to be a Millionaire. Now they have a step up of money that you can win, but one you answer a question, you have no idea what you will get. As long as you keep track, you will still get there.

DebtRoundUp For sure. The main reason I created the spreadsheet is because I think it’s so easy to keep track of and only requires checking once a week for a minute and throwing some cash in a jar or transferring funds from a checking account to a saving’s account.

I like any kind of challenge to help save money….but for me I like to have everything constant and the same. I’d rather just have a fixed amount of money come out of each paycheck for saving. But hey, whatever works for someone else looking to jump start their savings…go for it!

DebtChronicles I already have a fixed amount going to savings with each paycheck, but I plan on using this challenge as a way to save an additional $1,300+ over the course of the next year.

I get the point of the challenge, but I’d rather just stick to my consistent contributions to my 401(k) and savings account. Plus, I’m already in a tight financial situation so it’s unrealistic to alter my budget this drastically by the later weeks. I do think it’s a good jumping off point for people who haven’t started saving or have trouble getting started.

BrokeMillennial Haha I’m not sure you saw what my alternative was to the challenge? I offered up an alternative BECAUSE I think it’s unreasonable to alter your budget so drastically the last few weeks. But automatic savings are great! I plan on using this as an additional savings challenge to start building a secondary emergency fund.

It’s great to have different ways that you can do this challenge. I’m going with a set amount each week of $25 which equals to $1300 at the end of the year.

Raquel@Practical Cents That’s another way to do it, maybe you should write a post? ;)

DC @ Young Adult Money Ha! Good idea. I think I will.

I like the flexibility of being able to tick off any dollar amount at any time. As long as people have the motivation to try to tackle the bigger ones toward the beginning, when you still have time on your side to ensure that they all happen.

Ugifter Good point. I think it would be best to mix it up so that you can get some of the bigger amounts out of the way.

I’ve thought about doing the fifty two week challenge. I like the reverse option the best though. I’d rather get the heavy lifting done first. And, also by saving the largest amounts first you may just get used to save that $40-$50 bucks a week and continue at that pace therefore saving more than the $1,378 ;)

SingleMomIncome That’s a good point! If you can get used to saving higher amounts consistently and stick with it for the long haul, you may be much better off. I plan on using this challenge to set up a secondary emergency fund, which may sound a bit funny since I haven’t really built a full first emergency fund : )

I like the idea and tried doing this last year but didn’t finish it. I think for me it didn’t work because I already have money allocated for several other various savings buckets. I could cheat and call it the 52-week savings challenge though. lol! I do think it’s easy to get sidetracked as the weeks go on so maybe that’s why the current model doesn’t work. I like what you’ve done because life is full of unexpected expenses.

Beachbudget I think it’s very easy to forget about the savings challenge and simply stop doing it. I think to make it work you have to set aside the money at a specific time on a specific day of the week. If only Google Docs allowed automated email reminders!

I always like starting with the hardest part first. I think the 52 week challenge might be a good baby step for people who have no savings and have never tried, but realistically, you need much more than $1300 for emergencies in my opinion.

Eyesonthedollar You gotta start somewhere, Kim!

I think when people make decisions to save or diet in the new year they want to lose weight or have a big amount saved early. While that plan is great it can get depressing after a few weeks. And the reverse you suggest is good, but like starving, it can be too drastic for beginners to then keep with it. Still it is a good way to get started.

RFIndependence I think you misunderstood my proposal. I didn’t propose doing it the reverse way, but instead a flexible way where you adjust it based on realities of your life. If you just sunk $500 into a car repair, you could do some of the smaller amounts for a few weeks. If everything is going great or you got a bonus at work, consider doing the larger amounts.

This is awesome David! My issue with some clients is that they do not live “linear” lives that fit into the traditional 52 week challenge. Your spreadsheet gives them flexibility. Love it!

blonde_finance Thanks for the kind words! Easily the most positive comment I have received so far : ) The traditional 52 week challenge doesn’t take into consideration the reality of life, as you pointed out, and that finances are not always (or, hardly ever) 100% consistent week-after-week or month-after-month.

I have never tried this challenge. But I think your idea makes sense because some months you might not have enough money so if you had a smaller amount to contribute to the challenge, things would still continue rolling unlike if you are at the $50’s and some how things come up and you are unable to make the contribution.

BorrowedCents I think the original plan would make for a stressful December/January because people typically spend more during those months than the rest of the year. Consistency is important when it comes to savings, but flexibility also has to be part of the equation.

How interesting. I haven’t heard about this. I prefer to save at least $1000 a month if possible but I think this is a very clever idea as well. Its amazing how much you can save when you put in just a little effort.

DebtandtheGirl I think a lot of people would prefer to save $1,000 a month : ) I agree, this is a great example of how little actions, over time, can amount to some big savings.

I like the idea of crossing out whichever number you feel you can most contribute that week. I’m not wild about the 52 week money challenge though, $1,378 is really not enough money to save or invest or whatever in 52 weeks time. Guess you could always work in multiples, (double or triple), but I prefer a percentage of income.

brokeandbeau I already save a percentage of my income, but I plan on doing this as a “secondary” savings challenge, so while it’s only $1,378, it’s still a sizable amount to save considering how little you have to contribute each week.

I like the idea of the 52 week challenge, but I prefer my automatic paycheck withdrawal going into my savings account!

MoiAndMoney As I just said to Stefanie, I have an automatic savings plan set up but I plan on doing this as an additional challenge.

When I did it last year I essentially did your alternative. Depending on how much cash I had on hand (since I never have cash) and the expenses of that week, I deposited amounts in random order and just crossed the amount off the list as I went along!

For those that like to have funds automatically transferred into savings, you could set up the challenge to work that way instead of in cash!

SimplySave Great point! There’s really no reason you couldn’t schedule automatic transfers from one account to the other over the course of the 52 weeks. Hmmm I just might do that!

I think all of these are great options to get people to start saving. My priority this year is more toward debt as I’ve saved up a comfortable amount for my EF, but if I was doing the challenge, I’d probably choose the backwards method. I love seeing the bigger numbers show up first!

JourneytoSaving Best of luck in paying down your debt! I’m still trying to build up a large enough EF to tackle some of my debt, but for now I’m focused on building my savings and investing in my side hustles.

I love it. It’s like those survival football pools at work: you make the safe picks when you have to, and make the risky ones after picking your spots. Great twist on the idea, David.

Has anyone suggested just saving $26 every week?

DonebyForty They have! I personally already have an automatic withdrawal set up, but I plan on doing this on top of those withdrawals. Sort of a ‘secondary’ emergency fund.

Great idea.. I also think it would be smart to do it in reverse because that way you will have a little bit of extra money to spend around Christmas time!

I automated my savings each paycheck. If I weren’t so intent on paying down high interest student loan debt, I probably could save more. I like this idea but I actually prefer a steady stream of savings as opposed to varying amounts. I suppose if this was an additional savings plan, it would be fun though.

Nice, that’s a great idea! I’ve never done the 52 week challenge, but I do need to rebuild my e-fund. I’ll try this :)

I love this. Easy rules. A definite amount saved. And I really like your version of it since it accounts for the variables of life. Perfect!

Erin My Alternate Life Hope it went well for you!

kay ~ lifestylevoices.com Glad you liked it, Kay!