With hundreds, if not thousands, of banks, credit unions, stock brokers, and finance-related apps, how do you pick which ones to use?

With hundreds, if not thousands, of banks, credit unions, stock brokers, and finance-related apps, how do you pick which ones to use?

There are plenty of lists online for the best savings accounts, credit cards, and finance apps.

What I’ve found useful, though, is to hear what other people are actually using. For example, I could list out five different budgeting and tracking apps you can choose from, but it may be more helpful to hear what I actually use.

So today I am going to share my “money tool box.” From what service I use to invest, to what credit cards are my go to, I’ll go through all the different apps and tools that I use to track and manage my money.

Let’s start by talking about my favorite app, the one I use to track my income and expenses.

Budgeting and Tracking My Income and Expenses

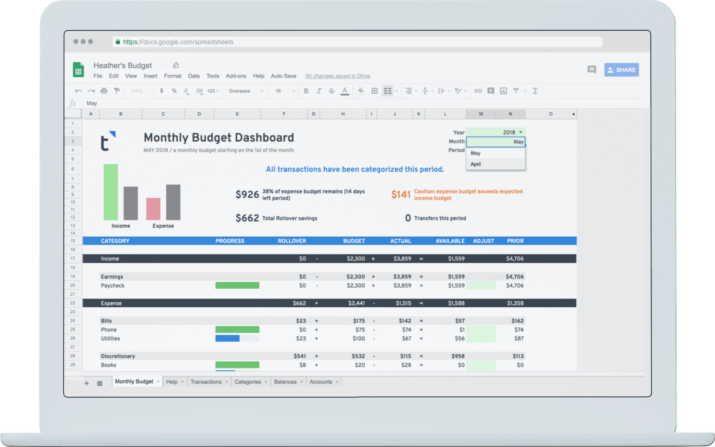

I don’t budget, but I do track my income and expenses (I explained in this post why I don’t budget). What I use to track my income and expenses also functions as a budgeting app. Tiller aggregates all your income and expense activity from your various accounts and puts it in a uniform format. It’s based in Google Sheets but can be used with Excel as well. They have a variety of budgeting templates in Google Sheets that make it easy to use.

When I use Tiller, I use it along with an automated budget spreadsheet I created that you can download for free.

Prior to Tiller I used to manually take the data from my various credit cards and bank account and put it in a spreadsheet in Excel. It was a very manual and I was excited when I came across Tiller, since it takes that manual step out of the process. If you’re interested in trying out Tiller for free for 30 days (about $5/month after that), you can try it out here.

Checking and Savings Account

Here’s how I approach checking and savings accounts: have a checking account at the bank or credit union that is most convenient, and a savings account at a bank that gives you a high interest rate, or APY, on your money.

This has two benefits. First, many people have a checking and savings account at the same bank or credit union because it’s convenient and easy. I did this for years and years, until I realized I was getting almost no interest from having my emergency fund parked in a savings account at that bank. It may not sound like much, but since my wife and I had already built up an emergency fund this ended up being a $500 a year mistake.

The second benefit is that when you have a savings account elsewhere, it takes a couple days to transfer money between accounts. The benefit of this is that you likely will only tap into the funds when you actually need them. Compare that to having a checking and savings account at the same bank where you can make transfers nearly instantaneously.

My checking account is at a regional bank here in Minnesota, and my savings account is with CIT Bank, which offers 0.55% APY, one of the highest interest rates available on the market (and way higher than the 0.01% I was receiving at my bank!).

Credit Cards

Before I talk about credit cards, I want to call attention to the fact that credit card debt is a big problem in the United States. Many people who have struggled with credit card debt are better off sticking to a bank account instead of using credit cards. But if don’t spend money you otherwise wouldn’t spend and pay off your balance in full each month, it makes sense to shift your spending to credit cards instead of using a debit card or cash. Why? Because of the rewards you can get.

Many credit cards offer solid rewards. I have been taking full advantage of a variety of credit cards the past few years. The points and miles I’ve gained have helped make our trips – including international trips to places like St. Martin and Aruba – more affordable.

I’ve used a lot of different credit cards because there have been so many good ones come on the market the past five years or so. The rewards credit card I recommend others open first is the Chase Sapphire Preferred, which offers you 60,000 bonus points when you spend $4,000 within the first three months of card opening. Because of how many destinations they fly to and the perks of the card, I also use the United Explorer Card regularly.

If you are looking for a cash back credit card, here are my picks. You can compare all of these cards with other credit cards here.

Net Worth Tracking

I will be honest, I don’t think it makes sense to obsess over your net worth. Especially for those in their 20s and 30s who have a lot of debt to pay down and may be at the lower end from a salary perspective, it can be downright depressing to look at your net worth.

Over time, though, net worth becomes more important. And in general, you should see your net worth improving, even if it is going from negative $50k to negative $30k.

I check my net worth every three to six months, and to do this I use Personal Capital, which is a free app. Personal Capital pulls in your bank account or accounts, credit card balances, investment balances, retirement accounts, cash and more.

Investing

In many situations people make the easy choice. They go to a college that is close to home, or one that their parents or siblings went to. They open a bank account where their parent’s bank. They see a financial adviser because their friends see that same financial adviser.

This was the case with me and Fidelity. I started to use Fidelity because it’s what my company uses for their 401k and employee stock purchase program. Again, because it was easy to have all the accounts in one place, I also opened an IRA with Fidelity.

Like banks and credit unions, I think most investment providers are similar. There isn’t a ton of differentiation in the market, or even opportunity for businesses to differentiate themselves.

Health Savings Account

Similar to Fidelity, I use Optum Bank for my Health Savings Account, or HSA, because it’s the default tool that is used with my health insurance. I use their website regularly for a couple of reasons: 1) to reimburse myself for prescriptions and 2) to shift dollars into the investment portion of my HSA.

You can use your Optum Bank debit card for eligible transactions, but the reason I go into their site to reimburse myself for expenses is simple: I want the credit card rewards! By using my credit card and reimbursing myself through the website, I can have those transactions contribute towards my credit card rewards.

One thing people don’t typically realize is that you can put your HSA funds into investment accounts like mutual funds. Once your HSA account exceeds a certain value, say $2,000, you can shift anything additional to the investment portion of the account. Each month I check to see if my account has exceeded the minimum required cash amount and shift anything extra to the investment portion.

There are other apps and tools I use, such as life insurance, car insurance, mortgage, etc., but I’ll end the list here. Bottom line is there are tons of apps and tools out there and you need to use the ones that work best for you.