One reason the rich get richer is because of passive income.

One reason the rich get richer is because of passive income.

Simply by having money that can be used to purchase shares of companies allows the rich to make money even if all they are doing is sitting on the couch all day.

You don’t have to be rich to have passive income, though.

You can slowly funnel your income into the stock market and see the stock price grow.

More established companies will pay a regular dividend that sends some of the profits back to shareholders.

Dividend income isn’t the only form of passive income, though. Many people cite things such as blogging, books, courses, rental income, and other forms of income that can be (at times) put on auto-pilot.

When you compare dividend income to any of the other forms of supposedly passive income, though, it becomes clear that there is nothing quite like dividend income.

Literally all you need to do is purchase a share of a company or dividend-paying mutual fund/ETF to receive the dividend. It doesn’t require your attention, and could – in theory – never require your attention.

Look at real estate, though. It technically can be made passive if you purchase a rental property and hire a management company. That way you don’t have to address any problems or repairs with the property, nor do you have to find and manage tenants.

What many smaller investors end up doing, though, is seeing how expensive management costs are and end up managing the property themselves. They may not be performing repairs, but they are calling contractors and signing off on repairs. You end up having to be “on call” in case something goes wrong at the property.

Same thing with blogging. While I am a big fan of blogging as a way to make money either on the side or full-time, it does require constant time and energy.

You can hire out various aspects of your blog, from content creation to graphics to accounting, but at the end of the day it’s going to take at least some time on your part to make sure the blog maintains it’s profitability.

Ultimately everyone who looks at passive income streams ends up recognizing just how powerful dividends are.

The problem though, is that dividends do require that you have money to invest. There’s no getting around it.

It can be difficult for people to wrap their heads around how much money they will need to earn passive dividend income. And a lot of people are curious how much money they will need to get enough dividend income to live off of, which is really the ideal financial position (though as you will see, can be unrealistic for many).

To give perspective I thought it would be helpful to show how much money you would need to make $1,000 of dividend income a year.

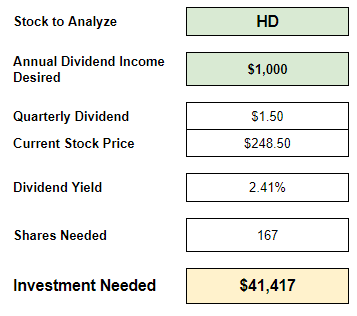

I created a dividend analysis tool in Google Sheets that will help us easily calculate this (you can get a free copy of the spreadsheet emailed to you by filling out the form at the bottom of the post).

Let’s look at Home Depot. They have a dividend yield of 2.41%, which means you will need to purchase 167 shares to get $1,000 in annual dividend income. That will require you to invest $41,417 in Home Depot stock.

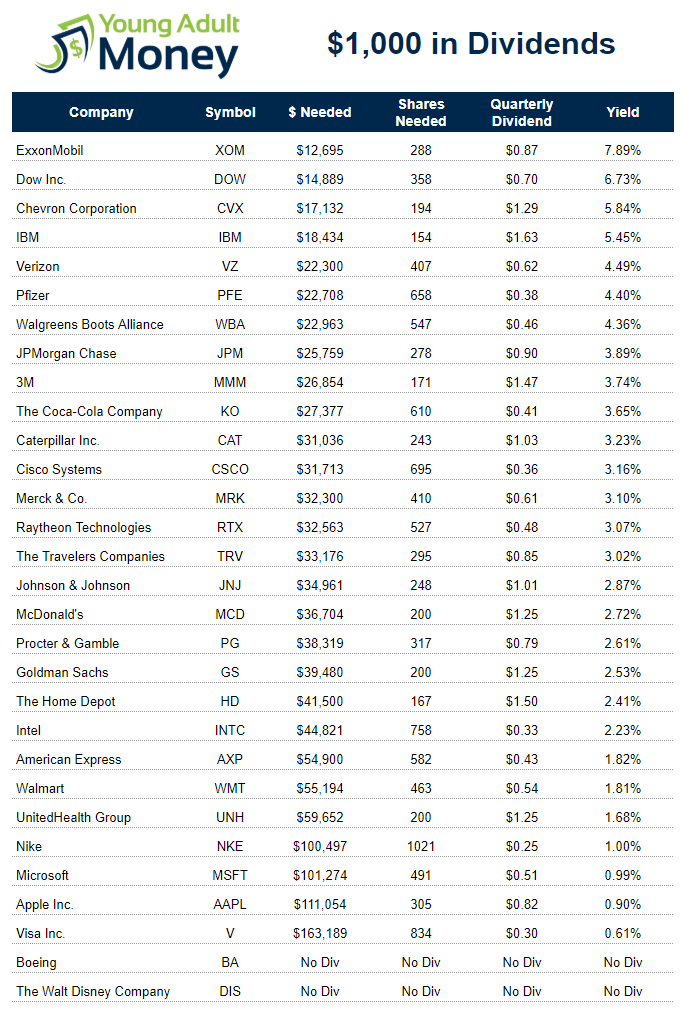

Let’s run this analysis on all 30 stocks that make up the Dow Jones Industrial Average.

Keep in mind that these are well-established companies and aren’t necessarily reflective of what you’d see for a small or mid-size company. And some large companies pay no dividends at all.

Special Offer: If you open and fund your free SoFi Invest account with $1,000 to start you will receive $50 of your favorite stock as a welcome offer. Use our link to get the offer.

Here’s the breakdown of the 30 stocks. Keep in mind this is at a point in time and this calculation will change on a daily basis.

Want to see a live version of this spreadsheet? You can view it here

As you can see, the amount you would need varies widely, but for the Dow Jones Industrial Average stocks you would, at minimum, need to invest about $13,000 in ExxonMobil to achieve $1,000 in dividend income.

If these amounts seem like a lot, remember that most people do not rely on dividends for income. Instead, they sell their stocks over time to fund their retirement. Stocks – including those that pay dividends – generally increase in value over time.

But it can be exciting to think of the possibilities that passive dividend income create. Some (including me) use this as motivation to improve their finances. The ability to invest more money – and create more dividend income – motivates me to side hustle and increase the amount of cash I can use to purchase investments.

I wrote the post 5 ways to find cash to invest in the stock market to help people identify opportunities to increase their investments (and speed up financial independence).

It’s worth noting that many stocks do not pay dividends, especially early stage companies that are focused on growing as quickly as possible. Instead of sending dividends to shareholders, they use their cash to reinvest in the company.

Dividend yields are generally relatively low, and for good reason. When a company pays a dividend, they are only paying out a portion of their profits. They are also keeping some of their profits to reinvest in the company for future growth (that theoretically will show up in a rising stock price).

If you want to play around with different stocks you can get the free dividend analysis tool by signing up below. If you don’t see the email from us please check your spam folder.

There is another tool within this file that allows you to run scenarios based on how much annual income you want from dividends. For example, if you wanted to know how much money you would need to get $50,000 in dividend income from a given stock, all you need to do is plug in the stock ticker and $50,000 desired income to get your answer.

You can get a free $50 in your favorite stocks when you sign up for a free SoFi Invest account and fund it with at least $1,000. Get this offer by using our link.

Join our Online Community to Receive your FREE Dividend Analysis Tool

Please check your spam folder if you don't see the email from us.