Do you have a ton of student loans? You aren’t alone.

Do you have a ton of student loans? You aren’t alone.

According to Pew Research four-in-ten adults under the age of 30 and one-in-five adults age 30 to 44 have student loans.

The first thing you should do is this: Don’t Panic.

It’s okay to be overwhelmed by your student loan debt. For many graduates it seems like an insurmountable challenge to pay off their loans.

And I can relate.

My wife and I had student loans when we finished undergrad (a lot of them).

Add a masters in counseling on top of that and we certainly know what it’s like to be deep in student loan debt.

There have been plenty of days where we were simply overwhelmed by the amount. At the end of the day, though, panicking does not help.

I can’t guarantee you will ever feel “comfortable” with your student loan debt (and not being comfortable can actually be beneficial, but more on that later).

What I can say is that understanding your student loans will give you, at minimum, a sense of control. Having an action plan – and automating smart decisions – can help you deal with loans psychologically.

Here’s what I recommend doing if you graduate with a ton of student loans.

1) Put all your student loan data into a spreadsheet

Not all student loans are created equal. Simply knowing how much you owe in student loans is not enough.

You will want to understand exactly how much each loan is, what the interest rate is, and whether or not the interest rate is fixed or variable.

Additionally, understanding whether your student loans are federal student loans or private is important. Federal student loans offer you more repayment options and additional options like forbearance and deferment.

We’ve created a spreadsheet that can be updated as often as you’d like. I recommend updating at least once a year, if not every six months or quarterly.

![]()

If you want to use our free student loan tracking spreadsheet fill in your email address below and then go check your email. Otherwise you can find out more about the spreadsheet in this post.

Join our Online Community to Receive your FREE Student Loan Spreadsheet

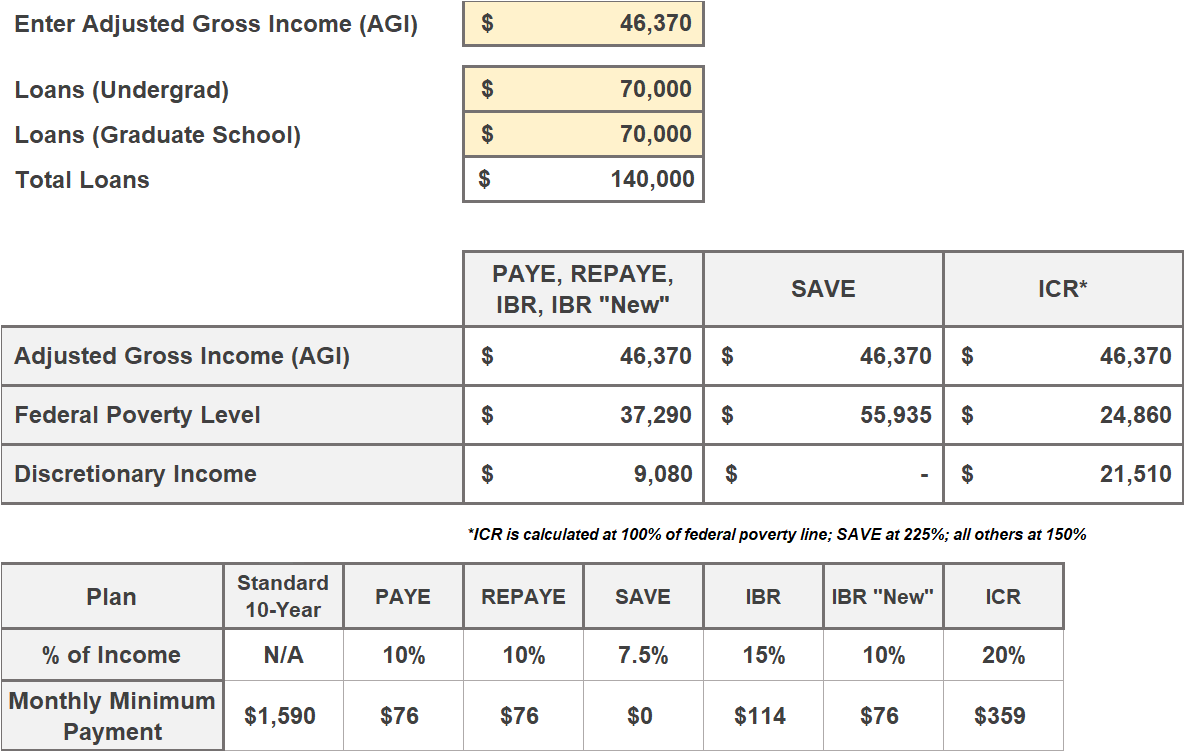

2) Understand your repayment options

Private student loan repayment is less flexible and has less options than federal student loans, which is why I oftentimes recommend that borrowers focus on knocking out the private student loans before putting anything additional towards their federal student loans.

The good news is that over 90% of student loans are federal student loans. Federal student loans offer a variety of payback options, including:

- Standard Repayment

- Graduated Repayment

- Extended Repayment

- Income-Based Repayment (IBR)

- Pay As You Earn Repayment

- Income-Sensitive Repayment

We have a post that goes into the details of each repayment option.

3) See how much you can save from refinancing

Refinancing your student loans is a way to pay less on interest over time. For some it can equate to thousands in savings. Looking into refinancing is never a bad idea. Worst case scenario you don’t go through with it. At the very least you can see what sort of offer is available for you.

One of the most popular student loan refinancing companies is SoFi. You can get a free rate quote at their website and see what sort of savings you could get through refinancing.

There are some risks that come with student loan refinancing. Federal student loans have protections built in, such as deferment, forbearance, and income-based repayment options, which you lose when you refinance your loans with a private lender like SoFi. Here’s a comprehensive overview of student loan deferment and forbearance.

Take extra caution before refinancing federal student loans, as you will be giving up your right to income-driven repayment plans and potential student loan forgiveness. With that being said, if you are certain you are going to pay back your loans in ten years or less and are comfortable giving up the additional rights that come with federal student loans, refinancing with a private lender could save you money.

4) Do the basics to improve your personal finances

While it’s important to understand your student loans and repayment options, student loans shouldn’t be looked at in a vacuum. They should always be considered in context of your total financial situation.

Think about $50k in student loans. This amount means something different to someone making $40k a year than it does to someone making $200k a year.

With that in mind, if you haven’t started doing the “basics” to understand, organize, and ultimately improve your personal finances, now is as good a time as any.

A couple basic things you should be doing:

- Track your Expenses

When it comes to money, the first thing you will hear people say is “you need a budget.” But in reality there is another first step: tracking your spending.You likely have a good handle on your income, but few people know exactly how much they spend on things like gas, groceries, and other spend categories. You need to understand where your money is going before you start budgeting.

I created a free automated budget spreadsheet in Excel that will make it very easy to track your expenses each month.

- Create a Budget and Look for Savings

Now that you have your expenses laid out you can create a budget. If any categories look higher than they should be, create a budget that forces you to spend less in that area.For example you may spend $800 a month on groceries but really want to get that down to $500 a month. That extra $300 could be going towards student loans, an emergency fund, or any other number of things that will benefit your finances.

It may not be as easy as deciding to spend less. You may actually need to take action. I put off getting rid of cable for over two years and it wasn’t until I finally took the step of cancelling cable that I started to see ~$100/month of savings.

Pick areas that you want to save money on, make a plan for what needs to happen to realize the savings, and then follow through.

There are ton of other things you can do to improve your finances, but these are the first couple things I would look into. For a full list of 10+ things you can do to improve your finances, check out our Ultimate Personal Finance Checklist.

5) Focus on Increasing Income

We’ve gone through a number of things you should do if you have a ton of student loan debt, but if you want to be really proactive you should focus on increasing your income.

My general direction is to first take steps like cutting the interest rate on your debt, budgeting, and cutting expenses, but if you’ve already done that or there isn’t much opportunity in those areas, you naturally end up looking to increase your income.

You can only cut costs so much, which is why increasing income is such an opportunity, regardless of whether you accomplish it by increasing your income at work or through a side hustle.

My entire book Hustle Away Debt is focused on this idea that making money through side hustles, which is essentially any way you make money outside of your 9-5 can be a huge boost to your finances.

If you’re interested in exploring this option you can read Hustle Away Debt or check out How to Start a Side Hustle even if You are Busy or our monster post highlighting 50+ Ways to Make Extra Money At Home.

Related:

Student loan debt sucks! These are great tips. It is definitely possible to pay them off sooner, even on a low income. My lightbulb moment was putting all the loan amounts on a spreadsheet, and being depressed At the large number. It is definitely easier to ignore the debt when it is all spread out, and you don’t check it haha.

I can relate to your light bulb moment of putting everything on a spreadsheet – can be really difficult experience for many (most?) borrowers. I think it’s so important to understand what types of loans you have, how much you owe on each loan, the interest rate, etc. Can really help you optimize your repayment as well as get motivated to pay them off faster!

I always periodically look at the state of student loans and it crushes me every time. The student loan total amount has had a 250%+ increase since 2004, climbing to $1.4 trillion now. The class of 2016 (latest figure) graduated with an average of $37,000+. And 71%+ of college students use student loans to help finance their education.

My student loans always felt like a huge burden. I’m really glad I’ve finished paying them off. I feel for those with massive student debt amounts.

The statistics are pretty alarming nowadays, and there is a huge disconnect between the current generation and the older generation that did not experience the same amount of debt when they went to college.

This is exactly what I did. I put myself on a strict budget, moved to a super cheap place to lower my expenses, and started doing every side hustle I could think of so I could throw as much money to my student loans as possible. It worked, because they were paid off in 3 years (woo-hoo!)! It feels sooooo good to see that my sacrifices were well worth it, and now I get to save/invest that extra money!

Student loans are the majority of my debt. My interest rates for most of them are pretty low. I recently refinanced my federal loans. I was able to lower my interest rate by 1% and I lowered my payment by $28.

1% can make a big difference, good move Jason.