If you want to get in better physical shape, what do you do?

If you want to get in better physical shape, what do you do?

You take proactive steps and carve out time to work out and eat better.

Improving your financial health is no different in the sense that it takes action to see results.

All that is needed to improve your personal finances is dedication, time, and an understanding of the steps to take.

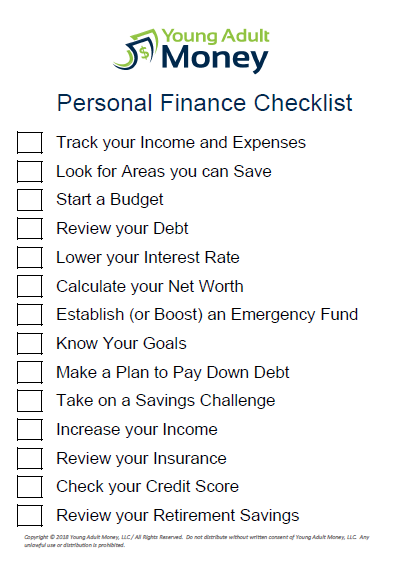

That’s why we put together the ultimate personal finance checklist.

This checklist goes through a variety of steps you can take to improve your finances. Many of these steps are centered around understanding your finances, making a plan of action, and then executing on the plan.

Are you ready to get started on your path to better money management? Scroll to the bottom to download the checklist in a PDF format, or dive right into the post!

Track your Income and Expenses

You’ve probably heard the advice that starting a budget is the first step to improving your finances. I think starting a budget is a positive action you can take, but I don’t think it’s the first step. I think the first step is tracking your income and expenses.

Think about it – how can you establish a budget without knowing how much you already spend? Or how much your take-home pay is each month?

I’ve been tracking my income and expenses for over five years now, and I can tell you there is nothing that can help you understand your finances more than having income and expense data. Having even one, two, or three months of this data can show you how much you spend based on broad categories like restaurants, groceries, and gas.

I’m a big fan of spreadsheets so I always recommend Tiller if you are trying to easily pull your income and expenses. Tiller pulls in data from all your different bank and credit card accounts and aggregates it into one uniform format. I used to do this manually each month and it took over an hour, and that was with a system that I spent hours and hours setting up. Tiller pulls it automatically.

I also created an automated budget spreadsheet in Excel that leverages Tiller to pull your data into nice reports and views. While it’s not necessary to use the Budget spreadsheet when using Tiller, you may find it useful.

Look for Areas you can Save and Cut Costs

After you have your spending data you can start looking for ways to save within your budget. If this was the first time you tracked your expenses, you may be surprised to find out you spend $500 a month on restaurants, for example. Or that your cable and internet bill is over $200.

Take some time and review each spending category. Decide which categories you want to focus on cutting costs in. Having specific areas you are focused on will make your chance of following through more likely. It’s more tangible than a generic goal of “spending less money.”

Read my post about how to find money in your budget to get started on this step, and check out some of the posts below that may be relevant to the specific categories you are looking to tackle:

Start a Budget

Once you’ve started to track your income and expenses as well as identified specific spending categories you want to save money on, it’s time to start a budget. Many people miss those two critical steps and jump right into starting a budget, which is why it’s not surprising that many struggle to stick to a budget.

I created an automated budget spreadsheet that you can download for free. Additionally you can use some of Tiller’s budget templates in Google Sheets as well.

For some people a spreadsheet budget isn’t ideal. If you want to explore other ways to budget consider reading this post on six different ways to budget your money.

The exact way you budget is not important as long as it works for you and keeps you accountable. At the end of the day a budget is supposed to help you spend your money in a way that is in-line with your goals and priorities.

Review your Debt

For many people debt is their number one financial challenge. Student loan debt alone is an incredibly difficult challenge for many individuals and couples, let alone all the other types of debt that people incur over time.

That being said, it’s important to regularly review the details of your debt. I know it can be a cringe-worthy experience, and my wife and I have gone through this experience many times when reviewing our debt (we did end our undergrad years with over $100k of student loan debt, after all).

Despite how painful this can be, it’s an important thing to do for a number of reasons. First, it shows you how high of interest you are paying on your debt and helps you prioritize paying off high-interest debt over low-interest debt. We’ll get into that more in the next checklist item.

But beyond that it also keeps you fully aware of your financial picture, and having full information is important for goal-setting and making decisions (big and small) that impact your finances. Finally it can motivate you to stretch yourself. I may have never started this blog or worked so hard at side hustles if I never got that full picture of my debt.

I created this spreadsheet to list out details of student loan debt, but it can be used to lay out all your debt. You don’t have to update this spreadsheet every month or even every quarter, but going through the process at least once a year can be helpful.

Lower the Interest Rate on your Debt

Not all debt is created equal. There is a big difference between a 3.25% fixed-rate 30 year mortgage and credit card debt with a 20%+ interest rate. Simply put, one is not a priority while the other is costing you tons of money.

If you went through the previous step and laid out all the details of your debt, you will have an understanding of what debt you need to prioritize. Depending on your debt, there’s a couple of things you should consider:

- High-Interest Credit Card Debt

If you have high-interest credit card debt you should consider a 0% transfer card. This gives you a 12-18 month grace period where you owe no interest on your debt. The benefits are obvious – you can focus on paying down the principle without getting hit with interest charges.

Another option is to refinance your credit card (or consumer debt) through SoFi. This could potentially save you thousands of dollars that otherwise would go towards interest. I’ve helped a few people go through this process and it can help you get on a solid plan for eliminating your high-interest debt.

- Student Loan Debt

If you have student loan debt one thing that is at least worth checking out is a SoFi student loan refinance. Especially if you have a very high amount of student loans and a number of years left on your repayment plan, the difference between refinancing and not refinancing could be thousands of dollars.

I think too many people overlook the gains they could have if they refinanced their debt. If you spend even a little time looking into it, though, you typically will find opportunities to save money on your debt which, in turn, will help you get out of debt faster.

Note: Take extra caution before refinancing federal student loans, as you will be giving up your right to income-driven repayment plans and potential student loan forgiveness. With that being said, if you are certain you are going to pay back your loans in ten years or less and are comfortable giving up the additional rights that come with federal student loans, refinancing with a private lender could save you money.

Establish an Emergency Fund (or Boost your Emergency Fund)

The day my wife and I decided to establish an emergency fund is one of the highlights of my personal finance journey. This one simple decision – and subsequent actions taken to make it happen – has had a profound impact on my finances and my life. Little can compare with the security of having money in a savings account in case an unexpected expense comes up.

And unexpected expenses do come up, and for many of us they come up far more often than we’d like. Whether it’s a pet getting sick or an expensive car repair, there is always something that could go wrong that requires money to fix. Cue the emergency fund.

If you don’t have an emergency fund it may be daunting to think about saving multiple months worth of expense. Instead of getting distracted by that large number, focus instead on simply getting started. Read about how to build a mini-emergency fund in just one month.

Calculate your Net Worth

When it comes to finances, and especially if we are talking about people in their 20s and 30s, I don’t put a lot of weight on net worth. I think it’s much more important to focus on increasing income and leveraging that income appropriately.

Nevertheless, similar to how it’s good to have an understanding of all your debt, it’s good to have an understanding of your net worth. I don’t recommend obsessing over this number or checking it regularly, but an annual update and review can be beneficial.

I recommend people use Personal Capital simply because it’s automated. You only have to set your account up once and then you can refresh the data whenever you’d like. With that being said you do have to update your passwords whenever you change them for your credit cards, debit cards, or any other account that is linked. If you would prefer going old school there is nothing wrong with calculating your net worth in a spreadsheet.

Know Your Goals

I typically talk about goals and dreams before talking about any specific actions you can or should take on your finances. But I put this a little further down the checklist because I think it’s important to have some basic understandings of your finances (i.e. how much debt you have, what your take-home income is, how much you spend each month, etc.) before you start setting goals.

You should have an idea of both short-term and long-term goals, but I’m a big fan of setting long-term goals and having those drive short-term goals. For example, I may want to be debt-free within ten years. That leads me to my short-term goals, which should fit with that long-term goal of eliminating debt. It may require me to increase my income, cut certain expenses out of my budget, or take other actions.

Goals don’t have to be static. For example one goal I had was getting my MBA. I even took the GMAT and applied to grad school. Heck, I even choose my classes for my first semester! This was just before I got my book deal. So I delayed my MBA by one semester. Then I delayed it again because a business opportunity came up that would require more of my time outside of work. Finally I decided that an MBA was not in-line with either my short-term or long-term goals, and I dropped it.

Make a Plan to Pay Down Debt

We’ve talked about budgeting, listing out the details of your debt, and lowering the interest rate on your debt. Now it’s time to make a plan to pay off your debt.

I want to again stress the importance of the interest rate of debt. The interest rate on my mortgage is 3.25%. It’s locked in for thirty years. My debt repayment plan with this is simple: make the minimum monthly payment each month. Thirty years from now the mortgage will be gone.

With other debt, though, you may want to be more aggressive. Credit card debt is a great example. You may have transferred your debt to a 0% transfer credit card and have a twelve month grace period where you pay no interest. Your debt repayment plan should be simple: pay off all your credit card debt within twelve months. How you do it will depend on your specific financial situation.

Or you may have refinanced your high-interest debt and are on a five-year plan to eliminate your debt. All you need to do is stick to the plan and your debt will be gone in five years.

Of course there will be situations where you are on a debt repayment plan but you want to pay off your debt faster. Let’s say you just started a ten-year repayment plan for your student loan debt, but you don’t want to take the full ten years. If you want to pay it off in five years, for example, you should figure out how much extra you will need to pay towards the principle each month to eliminate the debt within that five year time frame.

Take on a Savings Challenge

When I have a specific challenge I tend to have a higher likelihood of accomplishing the task at hand. After all, who likes to fail? Beyond that I also have found that doing things in short spurts have yielded the best results.

Think about a home renovation. Yes, they sometimes can linger on forever. But most of the progress happens in short, dedicated periods of time where you are laser-focused on completing the task at hand. The same could be said about writing a paper in college or cleaning an apartment. The more focused you are and the more you see the task as a challenge to overcome, the more likely you are to succeed.

That’s why I advocate taking on a savings challenge. Savings challenges differ (here’s eight different savings challenges to choose from), but all have a common goal: save as much as possible in a given period of time. Conversely, some savings challenges focus on spending as little as possible for a given period of time.

Taking on a savings challenge is a great way to either establish an emergency fund or to add to one you already have.

Increase your Income

We’ve now made it to my absolute favorite thing on our personal finance checklist: making more money! My entire book Hustle Away Debt is focused on making extra income above and beyond your 9-5 job.

We can’t always control how much we make at our full-time job, but with technology today there is an unlimited number of opportunities to make money outside of your job. This extra income can help you pay off debt faster or reach other financial goals quicker.

Here’s some of the posts on our site that are focused on side hustles:

Side hustles aren’t the only way to increase your income. Increasing your take-home at your 9-5 job can potentially be an even bigger boost to your finances than a side hustle. Contrary to popular belief, higher-paid employees do not necessarily work longer hours than lower-paid employees. Look no further than an entry-level accountant working late into the evening to see an example of this in corporate America.

Researching salary data can help you know whether or not you are getting paid the same as others doing the same sort of work as you, or even those who have the same title as you at the same company. Here’s a guide on how to find and compare salary data.

Review your Insurance

Insurance is one of those things that you have to pay for but rarely (or never) end up needing. With how health insurance policy has played out in the United States the past decade I think we can all agree that insurance is an extremely important part of our financial health. It protects our finances in emergency or worst-case scenarios, and should be something that we review regularly.

There’s a number of insurance items we should review on a regular basis, including:

- Home or Rental Insurance

- Auto Insurance

- Life Insurance

- Health Insurance

- Disability Insurance

I err on the side of taking out more insurance than taking out less. I also am convinced that the cheapest insurance is usually not the best. There are countless examples of people who went with the cheapest home or auto insurance who ended up having too little coverage and terrible service from their insurance company when they actually needed them.

If you have a partner or children I would highly recommend taking out life insurance. You would only need it in a worst-case scenario, but if that scenario was to happen you have no idea how it would impact your partner. Having appropriate coverage ensures they are able to take the time necessary to process what happened without having to worry about financial stress.

You can explore your life insurance options through companies like Ethos and Policy Genius, both of whom offer online quotes. Ethos in particular has a majority of their life insurance enrollments completed entirely online.

Check your Credit Score

It’s easier than ever to check your credit score. Most credit cards now allow you to check your credit score free of charge.

Here is a general guide to how creditors will view your credit score:

- <500: Very bad

- 500-549: Bad

- 550-599: Poor

- 600-649: Average

- 650-699: Good

- 700-749: Very good

- >750: Excellent

If you have a bad credit score, don’t panic. Nearly a third of Americans in total and 43% of millennials have a bad credit score, which is defined as a credit score of 600 or below.

The most proactive and quick way to improve your credit score – or establish credit if you have no history – is through Self Lender. Self Lender has a credit boosting loan that is created specifically to boost your credit score. You can read my review of Self Lender or head to their website to learn more.

You are entitled to pull your credit reports once a year from annualcreditreport.com. When you go to the site you provide your name, social security number, address, and date of birth, and answer a couple of identifying questions. Then you choose which credit report you want to receive (there are three credit reporting bureaus and you can grab all three if you want), and they appear instantly.

Review your Retirement Savings

According to recent research by Wells Fargo, 41% of millennials have not started saving for retirement. Considering the variety of financial obligations such as student loans, as well as wage stagnation that has not kept up with the cost of living, this unfortunately isn’t surprising.

Whether you’ve started saving for retirement or not, it’s important that you regularly review how much you are contributing to retirement accounts and whether you should be contributing more. If you are behind on saving for retirement, here’s how to catch up.

One of the nice things about retirement savings is that they come with tax benefits for a majority of people. If you need to get up to speed on all the different retirement account options and how they can benefit you from a tax perspective, read our post about tax-advantaged accounts.

If you have a Health Savings Account did you know that it can double as a retirement account? Here’s why I think an HSA is the absolute best retirement account.

Download the Personal Finance Checklist by filling out your email address in the form below.

Join our Online Community to Receive your FREE Personal Finance Checklist

I tried SoFi to lower my student loan interest rate a few years ago but for some reason I was ineligible. I think it was due to my credit score. I’ve drastically improved my score since then, so I might try it again.