I did something I vowed to never do: I invested in a penny stock.

I did something I vowed to never do: I invested in a penny stock.

Anyone who knows me and my opinions on investing knows I am a relatively conservative investor. I don’t typically invest in individual stocks outside of my company’s employee stock purchase plan.

For whatever reason, though, I felt compelled to invest in a penny stock.

Anyone who has dabbled in penny stocks knows it typically doesn’t end well. These stocks have low market capitalization for a reason: they typically are either more of a start-up in nature or are a business on the decline.

Because investing in a penny stock is not something I typically do (or advise others to do) I feel compelled to explain myself. I’ll share a few reasons why I made the investment and why I think it could be a big winner long-term.

Mandatory Full Disclosure: I own shares of IZEA. These opinions are my own. Everyone should do their own research before investing in IZEA or any other investment.

The company I invested in is IZEA. IZEA is an advertising company that focuses on social sponsorship. In other words, they match up publishers with advertisers. If you’ve ever seen a “sponsored tweet,” IZEA likely brokered the deal. They broker blog posts and other forms of social media as well. Here’s an example of a post on this blog that was brokered by IZEA.

At the time of this writing IZEA trades for less than $0.50, giving them a market cap of approximately $25M. They had $8.3M of revenue in 2015.

Now, before you jump to the comments to berate me for making a poor investment, allow me to defend myself by sharing a few reasons I think IZEA is undervalued.

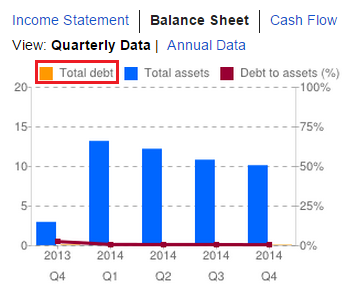

1) They have no debt

This point is pretty straight-forward: they literally have no debt on their balance sheet. No creditors whatsoever.

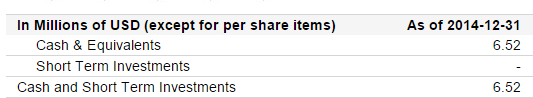

2) They have $6M in cash

Even if IZEA somehow completely collapsed tomorrow, they would have $6M that investors could divvy up. This is assuming they get $0 from selling off other assets.

3) Positioned in a growth industry

One of the most promising things about IZEA is the fact that they are in a growth industry. The billions a year spent on advertising by companies is slowly shifting to digital. IZEA is positioned to profit off of this transition, especially as more and more companies give social sponsorship a chance.

It’s important to note that IZEA isn’t just working with small or mid-size businesses. They continue to bring on huge clients like Nike that are household names – and that have huge advertising budgets.

4) A platform that can capitalize on volume

IZEA has a relatively new platform that allows for linking of Twitter accounts, blogs, instagram accounts, and virtually any social media platform out there (even Vine). This platform is an automated “match-making” engine that can profit off of higher volumes. It’s not like a traditional sale where you need a live person brokering each and every sale. For the most part, the manpower IZEA needs to coordinate a 100 sponsored tweet campaign is the same as the manpower they would need to coordinate a 10,000 sponsored tweet campaign.

I personally think the platform – which has hundreds of thousands of publishers using it – is a huge asset in and of itself that is not currently reflected in the stock price. Which leads me to my next point…

5) IZEA is an acquisition target

IZEA is an acquisition target because of the unique brand, platform, and business they’ve created. Huge tech companies are constantly looking for new revenue streams and IZEA is clearly a strong candidate for acquisition.

The acquisition may not happen this year, next year, or even within the next few years, but it’s hard to argue that the brand and business they are building isn’t desirable for a bigger tech or advertising company.

6) Leadership Team

Ted Murphy is the CEO of IZEA and Ryan Schram is the COO. I’m a finance guy so I can’t help but point out they have a great CFO in LeAnn Hitchcock as well. Ted founded the company in 2006 and many would argue he is ahead of the curve. Sponsored content is becoming all the rage as you hear people speculate about how much sites like BuzzFeed can profit off of it. IZEA has been doing sponsored content long before it was sexy.

I’ve been following Ted on Twitter for a couple years now and after reading some of the earnings calls I have to say I’m 100% behind his vision for the company and where it can go. Ryan has a lot of talent in sales and operations and I’m confident he can take IZEA to the next level.

In short: they have a great leadership team and I honestly might not have invested if I didn’t buy into their vision for IZEA.

7) Low Market Cap

I invested in IZEA when it was trading around $0.31 and had a market cap of $17M. Something just felt off about that number. It seems like they have the potential to push their revenue into the $10-$30M range within the next two years. At $17M market cap they would only need $1.7M in net income to have a P/E ratio of 10 (which is a benchmark I typically use when running these sorts of analysis, though I admit it oversimplifies things).

While leadership admits that it’s staffing up for the foreseeable future to create the capacity to handle a higher and higher level of bookings and clients, I think it’s clear that the revenue growth will eventually result in some sizable income figures.

I see IZEA as eventually hitting the $100M revenue and $10M income mark. Of course, considering the business they are in and the infrastructure they have created to handle high volumes, I don’t think it’s unrealistic to expect a profit margin higher than 10%.

While IZEA is no longer sitting at a $17M market cap, I still find them an attractive long-term play. They may be a penny stock, but if you invest and stick with the company long-term it could be a really profitable play. After all, if they ever hit an annual income of $10M it would justify a market cap of at least $100M, if not more.

____________

So there you have it: I invested in a penny stock and lived to tell about it. This investment won’t make sense for a lot of people out there, but for someone who wants to add a bit of risk to their portfolio with an opportunity for potential big gains, I think IZEA could make a lot of sense.

Do you think I’m crazy for investing in a penny stock? Have you ever invested in a penny stock or would you ever invest in a penny stock?

____________

Photo by frankieleon

It looks like you’ve done your research, so you’ve made an informed decision. No matter if the stock is a blue chip or a penny stock, that’s all you can do. Now, I hope you make fat stacks! Good luck.

I’ve never invested in a penny stock, but if you’ve done your homework. Good luck.

I love the title of this post – I laughed because I can imagine myself saying the exact same thing! However, I’m nowhere near that place in my investing. Like you, typically conservative (mostly ETFs for me). I am kind of excited to see where this takes you down the road though…

WGatWealthGospel Thanks! It’ll be interesting to see where the stock goes this year and the next 5 years (assuming I continue to hold).

DebtDiscipline Thanks! I definitely did some pretty extensive research into the stock and have known about the company for years now. I didn’t list out the risks that come with the stock in this post, but there are always market and company-specific risks that come with buying stock in a small company.

Financegirl I’m still a bit surprised that I followed through with it! I also am a relatively conservative investor and typically investing to me means putting more money into my 401k or HSA account, which is made up almost entirely of mutual funds.

Nice! I have never invested in a penny stock. There are a few exceptions, but we mostly just invest in index funds.

Nothing wrong with your strategy, though!

Holly at ClubThrifty Thanks Holly! I’m still surprised that I actually invested in a penny stock, and it wasn’t just a few hundred dollars of “fun” money it’s something that I actually would like to get a return on. Let’s hope it pans out ;)

Ha ha, I love the question of if you’re crazy or not! I’ve never invested in a penny stock and probably never will – truth be told I spoke to too many who just threw money away on them so I’d probably feel conflicted about it anyway. That said, it definitely sounds like you’ve done your homework on it, which is the main key. I’m fairly boring when it comes to our investing – mainly ETFs and some blue chip stocks.

FrugalRules Haha I had to ask the question because I wouldn’t be surprised if some thought I was crazy. I’ve been a boring investor for most of my life and this sort of investment is not something I’d typically make. The opportunity just seemed perfect so I couldn’t help but go for it.

I’ve invested in penny stocks before…I understand the allure because you want to hit a home run. Generally I’ve been burned, but there were instances when it worked out well. I wouldn’t put a large amount of money into a penny stock investment…it’s almost like gambling. But I have to admit the times that I invested in penny stocks, I probably didn’t do as much due diligence and research either. I’m an index investor, but even now, I understand the allure of penny stocks and if you’ve done your research and it’s not an amount you can’t afford to lose…I don’t think you’re crazy.

Absolutely not crazy. No stock is 100% safe, but you can’t make any money hiding money under your mattress. You did your homework and made a choice based on fact rather than emotion. I think it’s smart to take on a few more risky investments as long as the bulk of your money is in something more secure.

We haven’t invested in a penny stock but it sounds interesting! I will have to ask the in house investment guru if he would be up for it;0)

I think that money used in this manner gets closer to the gamble of investing rather than the long-term approach. It’s not something I would recommend to a close friend, but it’s like talking about playing poker we all know it’s a risk. It’s interesting none the less, did your investment platform have it and did you have any complications/fees to go along with that, I had something come up with OTC and stock less than a certain amount, did this occur with you?

Andrew LivingRichCheaply I’m glad you don’t think I’m crazy haha. I’m also primarily an index fund investor and I never thought I’d invest in a penny stock. The investment and business story just made too much sense to not invest. The question now becomes when I should divest from it.

Eyesonthedollar Thanks for sharing your thoughts, Kim. This is pretty much the same mindset I had when I invested in IZEA. Almost all my investments are conservative and being in my 20s it makes sense to take some “shots” at riskier investments. I certainly have time to recover if I lose my shirt, plus it’s a small percentage of my overall portfolio.

How Do The Jones Do It Do it! IZEA is one of the only penny stocks I’ve really looked into and analyzed, so I can’t speak for the other companies out there. I think there are some penny stocks that are exponentially riskier than IZEA.

EvenStevenMoney It’s true that I am taking on significant risk by investing in a small business instead of a blue chip, but at the same time people invest in much smaller businesses all the time. I think this is a safer investment than, say, investing in a website or blog. I used Fidelity for this trade and had no additional fees for purchasing an OTC stock. There is always some issues buying/selling penny stocks due to the low volume, but overall it went smoothly.

I have been thinking about adding more risk to my portfolio as right now I’m fairly average when it comes to risk. This is something I will have to look into!

I think as long as you didn’t invest your entire life savings in a penny stock that it’s fine. I would call this type of investment the “Vegas” type investment or investing with your fun money. I had clients who essentially built a home on penny stock investing but I have also seen clients lose thousands of dollars on penny stocks as well. As long as you invest the responsible amount, then I don’t think there’s anything wrong with it.

I’ve heard you mention IZEA a couple of times so it’s great to hear more detail about your rationale. I think ‘penny stocks’ have such a bad connotation because people just view them as lottery tickets, but I think you’ve approached this very differently, with some really well considered analysis and logic. No debt and a good amount of cash is a little more comforting too. I think it’s a great thing for someone your age to be looking at these type of investments alongside a broader portfolio, but you know I’m partial to a few ‘riskier’ investments on Speculative Island :)

Really look forward to hearing how this one plays out for you DC!

When it comes to investing, penny stocks or other – what matters is doing your due diligence, investing what you are comfortable losing and understanding how it fits into your overall portfolio, which it sounds like you did. Fingers crossed it pays off for you!

SenseofCents When you are in your 20s and 30s it’s prime time to take on risk. A lot of millennial investors are just too conservative.

blonde_finance I want to be one of those clients who built a house from a penny stock investment ;) Just kidding. I put in a decent amount of money but it’s still not such a large sum that it could turn into “house” money. I think whether it’s good or bad to invest in penny stocks has a lot to do with the percentage of your portfolio that you are putting into penny stocks, as you mentioned.

Jason@Islands of Investing Oh yes, gotta love Speculative Island! I think IZEA is one of those companies who – for better or for worse – dropped to below $1 and has struggled to get out of penny stock status ever since. If you look at what the company is actually doing and accomplishing it’s surprising their market valuation is so low.

I hope I have good news for you down the road with this stock!

ShannonRyan That’s the thing, I really feel like I have a good understanding of this company, their vision, their business, and their financials. Most penny stock investors – especially those who only invest in one penny stock – probably know little about the company they are investing in. I also think a lot of penny stocks are failing companies or companies that are basically non-operational but have some sort of hope of becoming something bigger and staging a turnaround.

DC @ Young Adult Money Andrew LivingRichCheaply That is always my problem. Sometimes I hold too long because I feel personally invested in it…if it drops, I believe it’ll go back up. And sometimes I sell too soon, I’ve done that before too…selling before the stock skyrocketed!

I do like IZEA a lot and I am familiar with the company, so I see where you’re coming from. I’ve dabbled in penny stocks for fun in the past. I lost a little and gained a little, but overall I usually view it differently than investing. You did your research with this company and you already knew about them before you investing.

Andrew LivingRichCheaply DC @ Young Adult Money Yeah it’s really tough (or impossible) to time the purchase/sale of a stock. I could sell today and already have a nice gain on the purchase of IZEA, but I truly do think they are positioned for long-term growth. I told myself before I bought it that I would hold it for at minimum 3 years, but ideally I would hold them “forever” or at least until they get bought out.

MoneyMiniBlog I view this particular trade as a “true” investment move and honestly they seem a lot different than the “penny stocks” out there. A lot of penny stocks seem to be companies on the decline or not even functioning. Either way I’m really happy with IZEA right now and plan on holding for at least a few years.

Very compelling case! This sounds like an interesting company in a brand new space. I’ll probably buy 1,000-2,000 shares just as an experiment. They had a nice earnings call yesterday:

http://seekingalpha.com/article/3185696-izeas-izea-ceo-ted-murphy-on-q1-2015-results-earnings-call-transcript

richmondsavers1 I was wearing my IZEA T-shirt in celebration of Q1 earnings haha. Just kidding. Maybe.

But yes they did have some good results. From everything I’m seeing they are a good long-term play. I could see them getting acquired in the 2-5 year time frame and we all know acquisitions mean a nice payday for investors.