Sometimes the hardest part about getting “financially fit” (i.e. in a good financial place) is getting started. There are literally thousands of different things you can do to get your finances in order and improve your personal bottom line. The question is, where do you start? Today I share five steps you can take to getting started towards a better financial future.

1) Keep Track of all your Spending

The very first thing you can do to start getting your finances in order is to keep track of all your spending and put it in a spreadsheet. If you don’t know how much you are spending and what you are spending your money on, you can’t plan for the future or cut wasteful spending.

When you record your spending in a spreadsheet, split it up by categories. Here are examples of categories you can use:

- Athletics

- Auto Expenses

- Cable & Internet

- Cell Phone

- Clothes

- Entertainment

- Gas

- Gifts

- Groceries

- Health/Medicine

- Home

- Laundry

- Rent/Mortgage

- Restaurants/Drinks/Out to Eat

- School

- Student Loans

- Toiletries

- Travel

- Utilities

Tracking your spending by category makes it much clearer as to how much of your monthly spend is going towards variable costs like entertainment and eating out vs. fixed costs like rent/mortgage and student loans.

2) Create a Budget

Once you have tracked your spending for a few months you will have a better idea of where you are spending your money.

You may realize that you are spending $500/month on eating out. If you can cut the amount you spend on going out to eat you will free up cash flow.

Set a budget for each category and review how well you did each month. Adjust accordingly.

3) Start Paying Down High Interest Debt

If you have interest debt, such as a balance on a credit card, start paying it down and make it a goal to get the debt to zero. There is a chance that your debt is overwhelming, say in the tens of thousands. The whole theme of this post is “get started.” You don’t need to pay it off in just a couple months – it may take a couple years. The important part is to get started!

If you only have low interest debt, just keep making the payments on time (or start making the payments on time!). Inflation almost certainly will match or exceed your interest rate in the long-term (even on most student loans) so just keep making the payments on time.

4) Set aside Money for an Emergency Fund, Health Expenses, and Retirement

If you aren’t currently setting aside money for an emergency fund, health expenses, or retirement, I would highly recommend getting a high interest savings account started as soon as possible. Even if you can only put $100 towards each of these a month, it’s better to get started today than wait a year until you will theoretically “have higher income.” Start small and once you get used to not having that extra disposable income you can start contributing more.

5) Write Down Your Goals

While paying down debt, tracking spending, and budgeting is important for everyone, one of the most important things to do for your financial health is to write down your goals. Having goals written down, such as “$10,000 emergency fund” or “0 credit card balance” are much better than pursuing something ambiguous like “become wealthy.”

_____________

If you truly want to improve your financial situation, getting started is the key. It’s easy to get buried in the massive amount of information available on debt, investing, real estate, credit cards, etc. and get frustrated or overwhelmed. Instead, start with some of the steps listed above and small, achievable goals.

____________

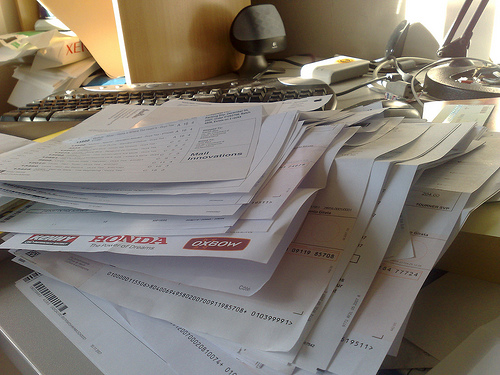

Photo by Joel Bez

Love it! I totally agree that getting started is the key. Having the feeling of needing to do something to get your financial house in order is great, but means nothing if not put into action. I also agree that goals are huge, they can really help when you’re struggling to get started.

@FrugalRules I personally think a lot of people are overwhelmed by all the information and advice out there. Finding a few things you can do TODAY (or within the next week or so) can really help.

Getting started is just as important as keeping your motivation along the way. If you break your goals into smaller goals, and celebrate the achievement of small goals (NOT by going to the mall, but having your favorite treat for every $500 of debt won’t break the bank and will keep you happy).

@RFIndependence I wrote a post on this a few weeks ago! Breaking big goals into small goals is absolutely key to success!

We do all of this besides tracking our spending. We do watch our cash flow though to see where and how much we have left.

@SenseofCents That’s great! I do find the tracking spending to be a bit burdensome, but in the end it only takes a couple hours a month to get everything in the spreadsheet. It’s interesting to see the trends month-over-month and how big-ticket items influence the trend. Okay I’m a geek : (

Great tips! I totally agree with all of these! Tracking spending is a biggie! Without doing that, you have no idea where all of your money is going. That was the single most important thing that we ever did.

@Holly at ClubThrifty It has benefited us a ton as well, though we haven’t adjusted much because of it. It ended up being about what we expect and most of our spend is on things that we need and either can’t adjust or would be incredibly difficult to adjust (i.e. student loan payments, rent, utilities, etc.).

Paying down high interest debt is extremely important. It’s the debt that will make you feel like you’re suffocating.

@OneSmartDollar I thankfully haven’t had to deal with it, but I have heard from many that it can be overwhelming and often make you want to just ignore finances altogether.

Solid advice David. Well done.

@James1844 Thanks James! Appreciate you stopping by and commenting. I just got a package from a DINKs giveaway I won. Good stuff!

Getting started is the hardest part. When you start to make an effort, it all gets easier after those first few baby steps.

@Eyesonthedollar Getting in the habit of doing things that benefit your finances is key I think. This isn’t something I listed, but I thought about pursuing side income for a long time. Until I actually started making solid plans and subsequently launching Y.A.M. I wasn’t doing much to pursue that goal. Now I am in the habit of committing about 20 hours a week to side income.

Creating a budget was extremely eye-opening for me. I realized that I did not make enough money to spend the way I was spending, even though it seemed pretty frugal, it was not enough.

@GillianatMAG I hear you there – tracking our spending showed that we have more expenses than we originally thought. While we could cover them, it made me think more about increasing our income and how even a little side income could benefit us greatly in the long-term.

Great advice. My wife is the driving force behind our financial fitness. I’m thankful she is because I hate doing some of the things you mentioned (i.e. tracking all spending). It’s very sound advice though.

@Jeremy Sarber Haha it is time-consuming, but definitely beneficial.

I really need to work on the concrete goals aspect for once we have enough to pay off my girlfriend’s student loans!

@Money Life and More I’m a huge fan of goal setting. Absolutely love doing it.

Lots of great tips here and many I’ve been doing since I was young and often share with my fans. A budget is a must and ever since implementing and following one to a ‘T” I don’t think we can imagine life with out it. Tracking our expenses really opened our eyes to where all our money was going. Mr.CBB

@CanadianBudgetB Nice! So far tracking our expenses has been great. It hasn’t revealed too much that we wouldn’t have expected, but after having three full months recorded it’s cool to see the trend.

When I tallied up our spending on food, it turns out we spent half on eating out. After cutting that down we’ve been able to reduce our food expenditure by 1/3rd. To be honest, I didn’t think that sort of trimming was possible with the food we were buying (I thought, there’s no way we can get rid of this!), but once we did get rid of it, never been missed ;)

For us I think one of the biggest points was actually just tracking where our money was going. When we found out just how much we were actually spending, and wasting, we were horrified. It helped to light the fire in order to stop the bleeding – and get us back on track.