How would you like to have your student loans forgiven? Tax free?

How would you like to have your student loans forgiven? Tax free?

This is a silly question to ask. Anyone with student loans would like to have their forgiven tax free!

Many are becoming aware that there is a way to have your student loans forgiven through a process called Public Service Loan Forgiveness, or PSLF for short.

2018 was the first year that anyone would be eligible for student loan forgiveness through PSLF. Now that there are recorded cases of people having their existing loans forgiven, PSLF is getting more and more attention from the media.

But there are certain requirements. Not everyone is eligible for PSLF, but there are many who are. Let’s start by looking at the specific requirements for PSLF.

The Requirements of Public Service Loan Forgiveness

There are a few core requirements for PSLF. First, you must make 120 qualifying payments while on a qualified repayment plan while working for a qualifying employer. That means you can have your loans forgiven in as little as ten years (120 monthly payments = 10 years), though these payments do not have to be consecutive.

To re-iterate the core requirements, you must…

Easy enough, right? Just kidding. Let’s look at each of these requirements one-by-one.

Qualifying Repayment Plans

Not all repayment plans are qualifying repayment plans for PSLF. Notably, graduated and extended repayment plans are not. Thankfully these are falling out of favor for income-driven repayment plans, which are eligible.

Qualifying repayment plans for PSLF include:

- The Standard Ten-Year Repayment Plan

- All four income-driven repayment plans: PAYE, REPAYE, IBR, ICR

Note: I share detailed overviews of each of the income-driven repayment plans in my book Student Loan Solution.

A good rule of thumb is you will want to be in an income-driven repayment plan if you are pursuing PSLF. If you are on the standard ten-year repayment plan, you would theoretically pay off your loans after ten years, leaving nothing to be forgiven. So why is it a qualifying repayment plan? Is this some sort of trick?

No. One scenario where this would matter is for someone who worked for an eligible employer for a few years and did not know about income-driven repayment plans or PSLF. If they worked for an eligible employer, there is potential that the payments made on the standard ten-year repayment plan while working for that employer would count towards their 120. They could then switch to an income-driven repayment plan, lower their payment, and after they hit the 120 qualifying payments have their remaining eligible student loans forgiven.

Qualifying Loans

Now let’s talk about qualifying loans. Only federal loans are eligible for PSLF, meaning any loans issued by a State and any private loans (including loans that were created through refinancing) are ineligible.

If you have any private student loans or have already refinanced your federal loans, the best thing you can do is shop for a better rate. Here’s our student loan refinance guide. Shop the lenders listed here and see if any can give you better terms. If you have private student loans you have nothing to lose, compared to federal loans where you do lose access to programs like PSLF.

Here are the loans that qualify for PSLF:

- Direct Subsidized

- Direct Unsubsidized

- Direct Graduate PLUS

- Direct Parent PLUS (only if consolidated through a Direct Consolidation Loan)

- Direct Consolidation

Basically any Direct loan is eligible (other than Parent PLUS, which needs to be consolidated through a Direct Consolidation Loan. Note that ICR is the only income-driven repayment plan that Parent PLUS is eligible for, which is also the least advantageous. Make sure you fully understand the implications before EVER going through with a consolidation!).

This obviously leaves out FFEL loans, which people do still have (my wife and I both do). These can be eligible if you consolidate them into a Direct Consolidation loan. Again I stress the importance of understanding the implications of consolidation before going through it. I go into detail on this topic in Student Loan Solution.

Qualifying Employers

There are three “buckets” of qualifying employers:

An important caveat to this is that if you are a government contractor you may not qualify. For example, let’s say your for-profit employer provides services for a contract they have with the federal government. You are not directly employed by the government and, even if you are referred to as a “government contractor,” your employment is with a for-profit employer. In this case, you are not eligible for PSLF.

There are exceptions to this. Employment with a labor union or partisan political organization is not eligible employment for PSLF. PSLF eligibility may also be in jeopardy if you work for a religious organization, depending on the nature of your job. Any time spent on religious instruction, worship services, or proselytizing does not count as eligible hours towards PSLF. Because you need to work the equivalent of what your employer would define as full-time hours (typically forty hours) or thirty or more hours, whichever is greater, the government could have grounds for denying PSLF even if only a small portion of your weekly work is spent on religious instruction, worship services, or proselytizing.

The services these additional potential qualifying employers provide are laid out on the PSLF Employment Certification Form.

I do get a little nervous with this third bucket because it feels like a bit of a gray area. When you are talking about potentially having tens of thousands – or even six figures – of loans forgiven, it’s ideal to avoid any gray areas.

Additional Notes on Qualifying Payments

Here’s a few additional components that make up a “qualifying payment.” The payment mus have been made…

- after Oct. 1st, 2007

- under a qualifying repayment plan

- for the full amount due, as shown on your bill

- no later than 15 days after your due date

- while you were employed full-time by a qualifying employer

Let’s move on to an actual example of Public Service Loan Forgiveness.

Example of Public Service Loan Forgiveness

Let’s take a look at Freddie’s loan and financial situation and see if PSLF will benefit him.

Here’s Freddie’s details:

- $55,000 in Direct Subsidized student loans at 6.5%.

- $60,000 in Direct Unsubsidized student loans at 6.5%.

- He works full-time as a therapist at a 501(c)(3) nonprofit.

- His adjusted gross income is $30,000 a year.

- His is single and lives in Texas.

- He foresees himself working for a 501(c)(3) or the government for the next ten years, if not his entire career.

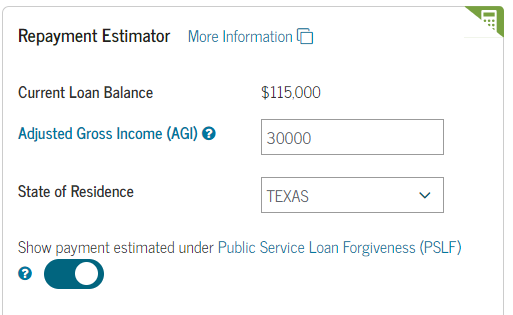

The calculations for Public Service Loan Forgiveness are relatively complicated, so we will leverage the Department of Education’s website to calculate Freddie’s potential loan forgiveness. With that being said, our free student loan spreadsheet includes a ton of calculators and resources to help you manage your student loans, including a calculator that estimates your payment under the income-driven repayment plans.

Our first step is to go to https://studentloans.gov/myDirectLoan/repaymentEstimator.action and plug in Freddie’s information.

We plug in all his information and select the “Show payment estimated under Public Service Loan Forgiveness (PSLF)” button.

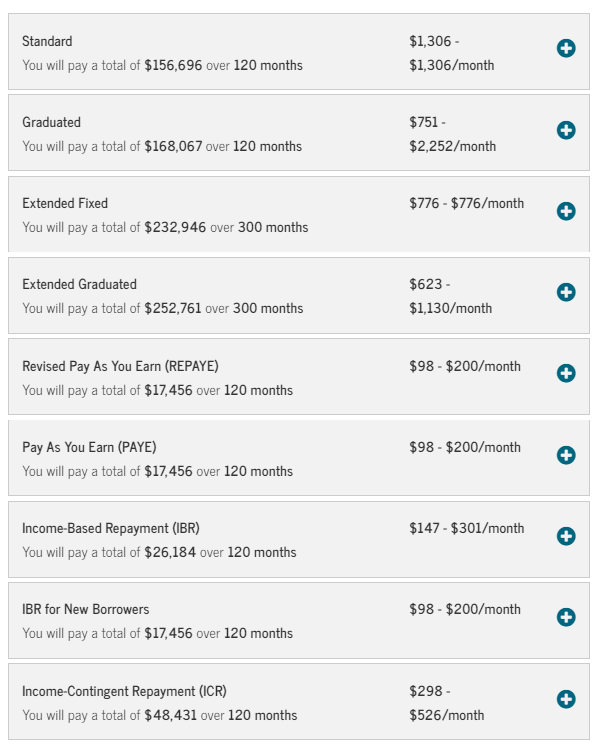

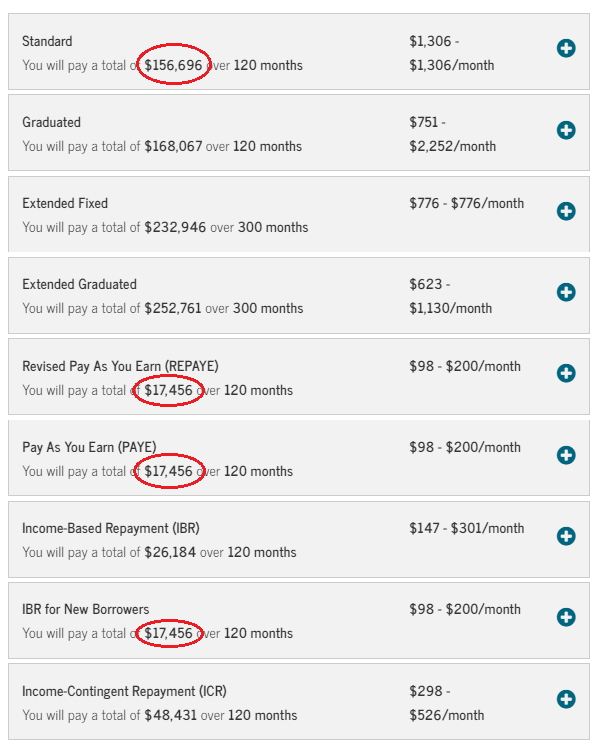

We then see Freddie’s results:

What this means is that under the standard ten year repayment plan Freddie would pay $156,696.

Conversely, under three of the income-driven repayment plans Freddie would pay just $17,456.

That’s a savings of approximately $139,000!

This is a bit of an extreme example, but there are certainly some borrowers out there who are in a similar debt and income situation. PSLF could be a game-changer for many people.

Note that the Federal government’s repayment calculator does factor in an increase to adjusted gross income of 3% each year to account for inflation.

Public Service Loan Forgiveness can be beneficial for those who qualify. Ten years may feel like a long time, but to put it in perspective to get loans forgiven on a more “traditional” route you need to make either 20- or 25-years worth of payments on an income-driven repayment plans. And the amount forgiven is taxed (commonly referred to as a “tax bomb” because of how big the tax bill potentially can be). In short: PSLF is the best loan forgiveness program available today.

interesting!!!