My wife and I built an emergency fund a few years ago. It was one of the best money moves we made.

My wife and I built an emergency fund a few years ago. It was one of the best money moves we made.

It wasn’t easy.

As I’m sure you can relate to, there is a never-ending list of demands on your money.

But it was something we knew we had to do. Our finances were stressing us out (*cough* student loans), and we knew that one thing that would help relieve some of that stress was having a healthy emergency fund.

So we focused on building an emergency fund. We did whatever we could to increase our cash flow and divert it to our savings account. We saved money on groceries and restaurants through couponing. We were both working side hustles.

We built up a one month emergency fund, then over time built that up to three months. Finally we got to five months. My calculations are conservative, so this is a decent amount of money.

And where has this sat the past few years? The same bank I’ve used since my parents set me up with a savings account when I was a kid: TCF Bank.

So we set up a TCF Power Savings Account. And how much does this “power” savings account pay? 0.01% APY.

This is not a joke. This is not a test. This is not a drill.

We are talking zero. point. zero. one. percent. interest.

These dollars needed to get out of that account ASAP!

With that low of interest, it’s virtually no different than a checking account. The only benefit of having a savings account with that low of an interest rate is having a physical separation between your savings and your checking. It ensures you don’t spend your savings.

If you find yourself in a situation like this, realize that your bank or credit union is one of many banks and credit unions. There is no reason to stay with one that has an awful product (and 0.01% is awful).

Do this: if you have a savings account, go check what interest rate you are getting. If it’s not at minimum 0.55%, it’s time to move.

Deciding that your bank or credit union isn’t cutting it is the easy part. The difficult part is deciding where to move your money to.

Switching banks made us over $500 in gains a year.

It’s incredible to think that a simple move can make such a big impact. Here’s how it played out.

Why We Chose CIT Bank

CIT Bank is an online bank. Online banks have less costs than banks with physical branches. And because of those lower costs CIT Bank offers one of the highest savings account APY rates on the market: 0.55%.

Typically you need to have a fairly high balance to tap into a bank’s highest interest rate. While CIT Bank does require $25,000 to guarantee the 0.55% APY, it offers a practical alternative option: deposit $100 a month. You can open an account with just $100 a month and as long as you add $100 a month you will be given the high APY of 0.55%.

Typically you need to have a fairly high balance to tap into a bank’s highest interest rate. While CIT Bank does require $25,000 to guarantee the 0.55% APY, it offers a practical alternative option: deposit $100 a month. You can open an account with just $100 a month and as long as you add $100 a month you will be given the high APY of 0.55%.

If the whole “online bank” aspect of it turns you off, let me tell you why I came around. We are talking about a savings account here, not a checking account. If you use CIT Bank to either house your emergency fund or help you build one, you won’t be taking money out of it that often (hopefully). Most of the transactions will be transfers from your home bank’s checking account into your CIT Bank Savings account.

As far as security, your money is safe with CIT Bank just like it is with any physical bank. CIT Bank is a member of the FDIC, which means your deposit accounts are insured up to $250,000 per depositor, for each account ownership category.

Gains from CIT Bank

Sometimes it’s difficult to envision how rates actually translate to dollars. After all, we are talking about just 0.55% APY. What does that even look like?

Well, when you compare to a bank account that gives you virtually 0 percent interest, it makes a big impact.

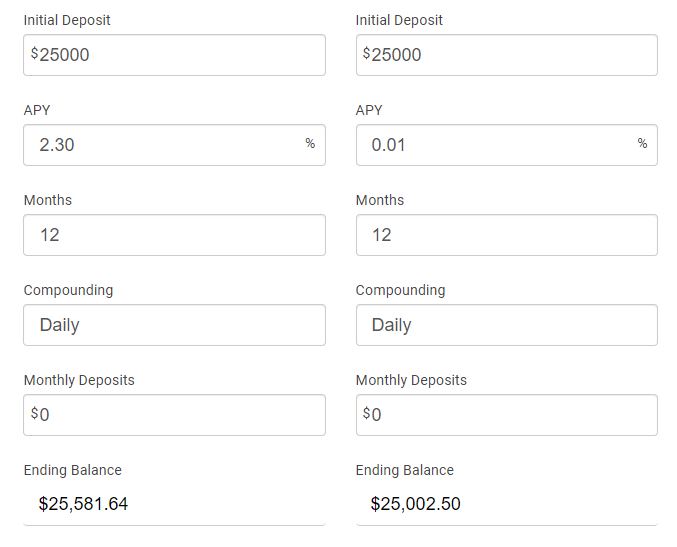

Below is a comparison between CIT Bank’s Savings Builder account and a bank account whose APY is 0.01%.

Note that this does use 2.30%, which is what CIT Bank was at prior to multiple interest rate cuts by the Federal Reserve and impacts of COVID and the resulting economic impacts. 0.55% and 2.30% are not going to give the same return, of course. Savers are getting hit really hard by the historically low interest rates. But 0.55% is still better than 0.01% – the only silver lining.

$581 in gains versus $2.50 in gains.

$580+ a year is a huge difference!

And this is over the course of just one year. Once you get to year two, your starting balance will be that much higher and interest will compound daily on the higher amount.

Yes, this example does use a $25,000 balance, but regardless of the amount you can see that the higher APY is going to benefit you.

Whether you have an established emergency fund or are just starting to build one, don’t settle for a low rate. If I had made the switch earlier I’d have made over a thousand by now.

I haven’t had savings in a traditional bank in years, choosing Capital One 360 for a long time at 1%. Way better than the brick and mortar banks, but I finally switched to Ally a few months ago for 2%. The difference is huge — especially since I happened to switch when it was offering a sign-up bonus of 1% for any funds transferred in October. So I’m getting a boost from that too! And I was just notified that the rate is going up to 2.2%.

I don’t have enough in any one account to qualify for CIT, but I’ll keep it in mind once I do.

Yes that’s great that you are up to 2.2%! If you look at the details of the 2.45%, though, you just have to deposit $100 a month to get the higher rate. Minimum opening balance is $100 to qualify. If you even have $1,300 in another savings account you can deposit $100 to start and set up auto transfers of $100 to CIT.

sometimes is necessary switch banks well I found a good deal keeping my old banks but renegotiating the annual cost of my bank account and I’ve saved a good amount:D

That’s good to hear! Unfortunately I don’t think my current bank would come up to anywhere near what CIT bank will give me. If they aren’t going to match their rate of 2.45% APY (as of this comment publishing) then there is no reason for me to keep my emergency fund parked there.

I’ve never heard of CIT Bank. I need to see what other options are out there. I need a better interest rate.

Would highly recommend. There MAY be some credit unions out there with higher rates, but with a $100 minimum opening deposit (with $100 monthly deposits going forward) I haven’t seen anything that comes close.

TCF actually now offers a savings account that offers 2.25% interest with $10k minimum deposit and keeping the balance above $10k.