If you’re interested in bettering your finances, chances are, you’ve attempted quite a few different types of systems to keep track of your money. With all of the trackers, apps, and other financial tools, it’s hard to know where to start.

If you’re interested in bettering your finances, chances are, you’ve attempted quite a few different types of systems to keep track of your money. With all of the trackers, apps, and other financial tools, it’s hard to know where to start.

Most people have tested out spreadsheets a time or two as a means to stay on top of their finances . And hey, there’s nothing wrong with using a good, old spreadsheet!

Many people rely on spreadsheets because they are easy to set up and customize to your needs. Plus, they are easy to update regularly and can automatically calculate your finances for you.

But if you’re looking to modernize your love of spreadsheets and take it to the next level, then Tiller might be the tool for you. We tested Tiller out to provide a full-review. Here are our findings.

What is Tiller?

Tiller is a fairly unique platform in the financial tech world – it’s the only known personal finance service that syncs your accounts with Google Sheets, which you can customize entirely.

Tiller is a fairly unique platform in the financial tech world – it’s the only known personal finance service that syncs your accounts with Google Sheets, which you can customize entirely.

Tiller allows you to synchronize your bank, savings, and debt-related accounts, all onto one platform. You can then use Tiller’s pre-made Google spreadsheets, which will automatically upload your personal information. The spreadsheets then can be kept in your Google Drive account, and are accessible and editable at any time. Information, such as spending, will automatically feed from your bank accounts into your Tiller spreadsheets, so you don’t have to worry about updating it frequently.

Because of this, Tiller is ideal for anyone who likes to track each dollar, but has a hard time with the reporting features of their current bank account. With Tiller, you can sync every account into unique spreadsheets, allowing you to essentially create any type of financial report you would like.

How Does Tiller Work?

Many financial apps and websites allow you to link your bank accounts to them. So what really makes Tiller different?

Tiller essentially removes the need for you to do any data entry. For instance, if you are looking to set up a spreadsheet to track all of your expenses, Tiller can automatically gather your data, export it to a Google sheet, and will populate your own information. You don’t even have to worry about formulas or formatting – Tiller does it all for you. While Tiller provides a large selection of pre-made templates, you also have the ability to make your own spreadsheets.

Tiller also helps to keep you in the loop with your finances. They will send you daily summaries of your financial transactions, so you can always check your accounts easily and in one place.

Furthermore, Tiller can easily link to a wide array of banks, lending, and other financial institutions – over 10,000 to be exact. It doesn’t take more than a few minutes to securely link your bank accounts.

In order to get started with Tiller, you do need to have a Gmail account, since it utilizes Google sheets. If you do not have a Gmail account, you can set one up for free.

How Much Does Tiller Cost?

Tiller allows you to try it out for free for 30 days using this link. After the 30 day trial, Tiller will bill you just $6.58 per month to continue using their services.

Review of Tiller

As part of this review, I tested out Tiller for a month to see the truth behind the hype.

The first thing I noticed is that it is extremely easy to setup, especially if you already have a Gmail account. It took me less than 5 minutes to sign up on Tiller.

Once I signed up for an account, it was pretty straightforward to figure out. I linked my bank accounts, which also only took a few minutes. I could even find my student loan provider listed, so I was able to sync my student loans into a separate spreadsheet to calculate my debt snowball.

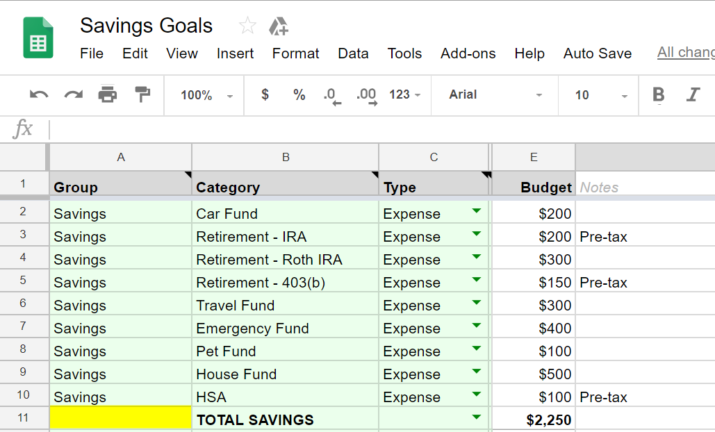

They do have a number of pre-made spreadsheets, such as the debt snowball spreadsheet and a few budgeting spreadsheets. I really wanted to create a savings goal spreadsheet, so while that wasn’t listed, I was able to create a custom report, as seen below.

Overall, I was really impressed by how easy-to-use Tiller was. As someone who tests out various financial apps and websites on the regular, one of my biggest complaints is that many other platforms take a long time to set up and aren’t very easy to customize. Tiller was the opposite – it is extremely fast and simple to customize.

And, if you’re like me and you love spreadsheets, Tiller truly makes it easy. I love that I can create a spreadsheet in just a few minutes, save it in my Google drive, and refer back to it on the regular basis.

Should You Try Tiller?

Of course, it’s natural to wonder if Tiller is really worth the investment. Before you go spending your hard-earned cash, you should know whether Tiller would really be worthwhile for you.

Tiller might be for you if:

- You prefer spreadsheets over apps

- You want an affordable financial tracking system

- You like a snapshot of your entire financial situation all in one place

- You like platforms you can customize

Of course, Tiller isn’t for everyone. It might not be the best fit if:

- You aren’t data-driven

- You aren’t interested in tracking every aspect of your financial situation

- You prefer the navigation and platform of an app

Try out Tiller for yourself and see if it’s a worthwhile investment in the long-run. Sign up here for your 30-day free trial.

Have you used Tiller? If not, have you tried other financial planning apps? What other methods do you use to keep track of your finances?