A popular topic in personal finance is passive income.

Income that doesn’t require you to trade your time for money is “the dream” for many people.

There are many different forms of passive income, but the ultimate passive income is dividend income.

Dividend income comes from owning dividend-paying stocks. Not every company pays dividends. If a company is focused 100% on growth, they are going to use all their earnings to continue to grow their business.

With that being said there are many large companies that are focused on growth that pay a dividend. In fact it would almost be silly for a publicly traded company to not have a growth strategy.

Many of the large blue chip companies pay dividends, though their dividend yield (Amount paid out in dividends annually divided by current stock price) can vary. For example, Best Buy has a relatively high dividend yield of 4.18%, while Visa has a modest 0.80% dividend yield.

Even if you have other financial priorities that take precedence, learning and being aware of the opportunities that come with dividend income can motivate people to save more money, pay off debt faster, and make more money so that they can take advantage of all the benefits that come from dividend income.

With that in mind, let’s get to the real question here: how much can you make in dividend income?

How Much Can You Make in Dividend Income?

The first thing I need to say before answering this question is this: it’s not easy to make a sizable amount of dividend income. If it was easy no one would work and everyone would simply live off of their passive dividend income.

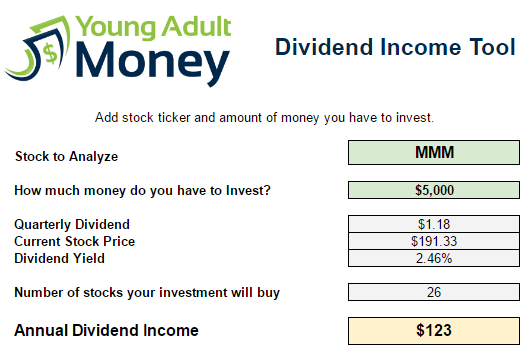

Using the spreadsheet I created, let’s look at what you would be able to make annually from dividends if you invested $5,000 in 3M stocks:

Join our Community to Receive your FREE Dividend Income Spreadsheet

Okay so you’d only make $123 each year. Now that may not feel like much, but remember it’s also reasonable to expect 3M’s stock to appreciate over time. Also, don’t forget how great dividend income is: you are getting $123 by simply owning $5,000 worth of 3M stock! No effort required.

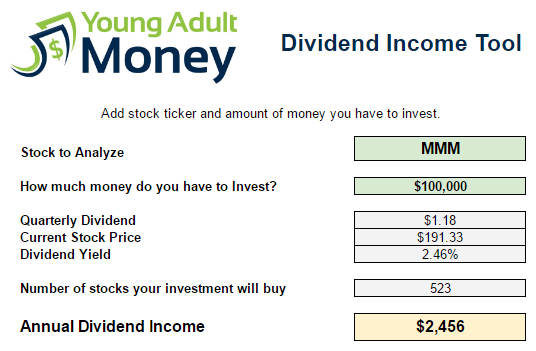

Let’s take a look at a higher investment amount: $100,000.

Nearly $2,500 a year – not too bad! You can see why dividend income is so attractive, especially to those looking to retire early or who don’t want to spend down their assets in retirement.

Quick math shows that owning $1 million of 3M stock would yield $25,000 a year in entirely passive income. Do you have $2 million to invest? double it up to $50,000 a year.

I don’t know about you, but this sort of scenario analysis is incredibly motivating to me.

I spend most of my free time working on side hustles to increase my income, and while paying off debt is the primary goal right now, long-term I would love to regularly funnel “extra” side hustle income into dividend-paying stocks.

If you are an entrepreneur or want to be an entrepreneur, dividend income just might give you the motivation needed to put in the long hours and hard work to build your business. After all, if you are able to sell for a couple million dollars – or more – you very well could live off of passive dividend income the rest of your life.

Want to try out some scenarios in the dividend income tool?

Get the spreadsheet below and find out how much you can make in dividend income with your current and future investments.

Join our Community to Receive your FREE Dividend Income Spreadsheet

I have just become more serious about dividend investing in the last year or two. Previously I was more focused on the actual share price & selling when it raised x%.

If I buy direct company stock, I make sure it pays a dividend. I have even added to my portfolio dividend mutual funds and ETFs.

I think the spreadsheet is a huge help because brokerages only tend to focus on the dividend yield & the hypothetical return of a $10,000 investment of up to the past 10 years which might not include reinvested dividends in the calculations.

Very cool to hear, Josh. I think right now there is a huge number of people who are really focused on just getting started investing (i.e. contributing to a 401k) and paying down debt, but long-term I think looking at dividend income can be really motivating. I’ve found that even having a small amount of dividend income can motivate me to try to earn more.

Cool spreadsheet! I think dividend income is a great way to bring in some additional income/another income stream. Like Josh said, many brokerages only provide the tools to see things like yield and return on higher amounts. While still helpful, it doesn’t serve a lot of investors – especially those starting out.

We do some dividend investing, and just have it reinvested into the ETFs we’re using, but will likely rely on dividend income in later years.

Good to hear about the dividend investing, John. I think reinvesting dividends is the way to go, and I do the same thing with the dividends I receive from the company stock I own. Ideally you can push off using or living on dividend income as long as possible, but I can also see the appeal of starting to use it early on. After all, it feels pretty great to know the money you just spent was from completely passive income!

I have a few dividend paying stocks and I can see why it’s enticing to have consistent passive income. There are also a lot of blogs that focus on dividend growth stock investing. I’m mostly in index funds but for the individual stocks that I do invest in, I’m more focused on growth rather than having them pay dividends as those companies are generally more stable. Dividends are cool but I think I’d prefer a company that has more growth and appreciation.

“Dividends are cool” – can’t disagree with that! I also am focused on growth stocks at this time, but I think it would be great to have consistent dividend income down the road to live off of.

Dividend is the easiest form of passive income one can think of. Honestly, I don’t know of any other passive income that take less work.

To insulate yourself from the misfortune of a single company stock, you could invest in a dividend ETF, for example, SCHD, that seeks to track the performance of the U.S. Dow Jones 100 Dividend Index. With an expense ratio of 0.07%, it makes dividend investing super inexpensive and easy.

I am long SCHD and plan to accumulate slowly and steadily.

Great tip about SCHD. A great way to go if you want to stay diversified.

I also love dividend payments. They always feel like “you have something secure from your stocks”. Anyway, I always try to reinvest the dividends directly. This helps you over the long run to grow even more of them and to live a richer life when you retire. I like stocks that reinvest the dividends for you directly.

Reinvesting dividends is a great idea for those who are looking to continue to bolster their holdings. Especially considering how long it can take to build up your dividend income, reinvesting is the way to go until you really need to start using the dividend income for daily life (i.e. in retirement!).